Uniqlo: How Asia’s Largest Fashion Retailer Actualizes Its American Dream

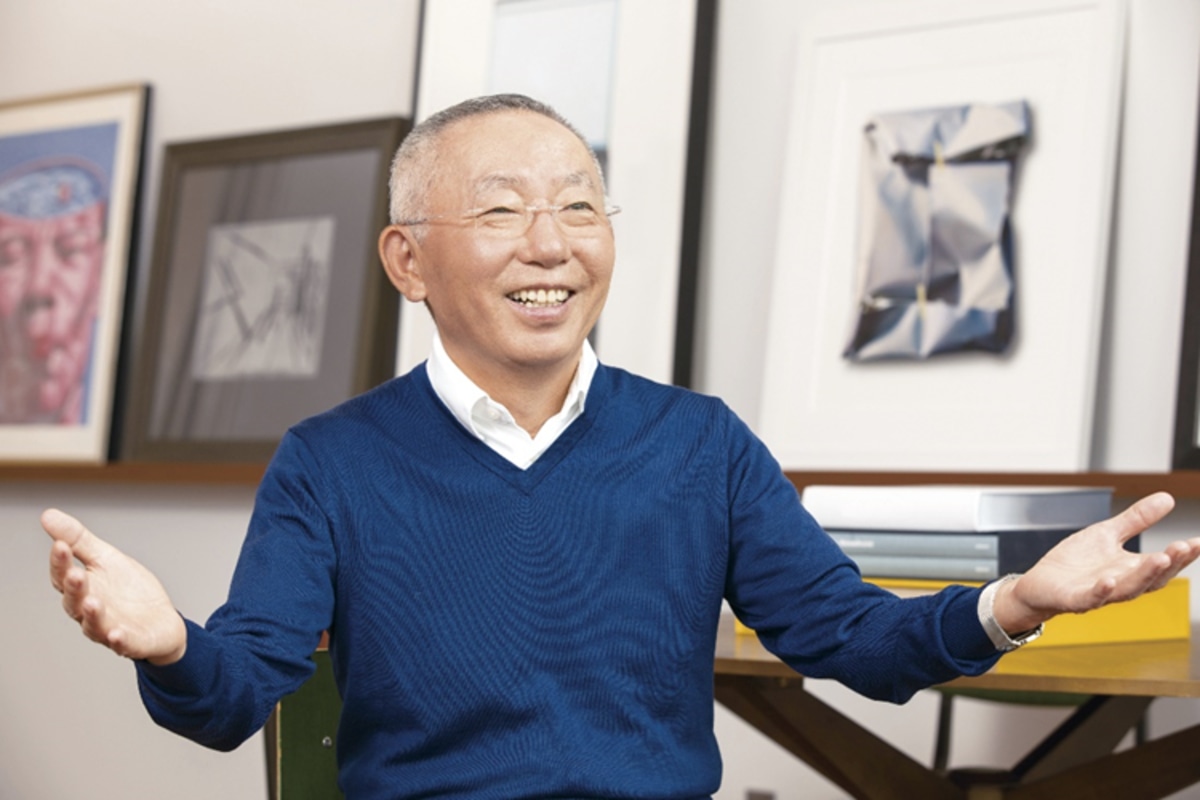

From humble beginnings nearly four decades ago, UNIQLO is now a global brand with over 2,000 stores around the world. Owned by an umbrella company called Fast Retailing, Uniqlo is a fashion retailer on the rise with over $20 billion in sales in 2020. 46% of Fast Retailing is owned by one man: Tadashi Yanai, making him the richest person in Japan. Tadashi got his start 34 years ago with one dilapidated men’s clothing store that he begrudgingly inherited from his father. Let’s read on to the rise this global retailer.

The Beginning of Tadashi Yanai

When Tadashi was handed his family’s menswear shop, he had designs to put his own spin on the store. One store wasn’t enough: he wanted to build an empire. Tadashi admired the work of American management expert Peter Drucker, business philosophy said that money and morality need not be mutually exclusive. He realized he could build his empire and become a very wealthy man without corrupting his soul. From Drucker’s teachings, he learned that it was best to think first about what customers want, rather than what the company (or owner) wants to sell. He added women’s clothing to his menswear store and rebranded the entire operation in 1984 as Unique Clothing Warehouse (which he later shortened to Uniqlo).

In the late 1980s, Tadashi Yanai sought out Mickey Drexler, then president of The Gap, during a time when Uniqlo was experiencing tremendous growth and market saturation. Tadashi invited Mickey to breakfast and set out to study his every move in order to perfectly replicate everything The Gap did. Immediately after meeting with Drexler, Uniqlo began copying The Gap’s business model of producing and exclusively selling all of its own clothing. Tadashi even had Gap-like commercials made for Uniqlo with celebrities dancing around in khakis.

Expansion in Tough Times

In the early 1990s, a recession in Japan helped put Uniqlo on the map. People wanted cheaper goods and Uniqlo delivered. In 1993, Tadashi made a move that was absolutely unprecedented for a Japanese company: He shifted all production to China. This allowed him to cut the cost of the clothing he sold and further increase profits. By 1994, 10 years after Tadashi took over his father’s clothing retailer and rebranded it as Uniqlo, there were 100 stores in Japan.

But there were some big stumbles along the way. By 2002, Tadashi was ready to expand globally. He opened 21 stores in and around London. A few years later, Uniqlo opened in three malls in New Jersey. This global expansion would prove to be a complete and utter failure that personally cost Tadashi tens of millions of dollars. One major mistake involved Uniqlo’s sizing metrics. Uniqlo’s standard sizing metrics were met with derision as the average Japanese man and women is usually much smaller than the average American adult. This led the company to sloppily upsize its clothing for the American market. In New Jersey, Uniqlo was bested by Abercrombie, The Gap, Express, and other American retailers that offered cheap clothes that fit American bodies. Within 18 months, Uniqlo closed 16 of its London stores and all three New Jersey locations.

This initial failure of Uniqlo’s overseas expansion taught Tadashi a very important lesson: Uniqlo had succeeded in Japan much like the Gap (and Starbucks) succeeded in the U.S. – by being ubiquitous. However, for Uniqlo to succeed in Europe and the U.S., it also had to have style. It had to be cool.

Making Uniqlo Cool

Tadashi once again studied the success of other businesses and set out with a new plan for Uniqlo’s overseas expansion. He cold-called a famous Japanese designer named Kashiwa Sato and asked him to lead a creative team that would set up flagship stores in cities across the world, starting with New York. Sato told Tadashi that the Uniqlo brand was the very epitome of uncool, and that if he wanted to succeed in New York, London, and other cosmopolitan Western cities he’d have to redo everything.

Tadashi gave him the green light.

Soto and his team brought in hip lines like Charlotte Ronson and Vena Cava. Tadashi’s wife suggested approaching Jil Sander with enough money to lure her out of retirement. This approach worked. Since the flagship Uniqlo store opened New York’s SoHo district, it has become one of the highest grossing locations in the world. The company’s collaboration with Jil Sander, branded +J, had customers lined up for blocks. And Uniqlo was prepared: there was more than enough inventory to go around.

During the economic downturn in 2008 and 2009, Tadashi went on an acquisition spree. He bought Theory and Helmut Lang, both higher-end designers of basic wardrobe components. All of the acquisitions now fall under the Fast Retailing umbrella corporation, of which Uniqlo is still the biggest asset.

Struggling in the U.S. Market

A long-held ambition for Tadashi Yanai is to build Japanese-born Uniqlo into the number one apparel brand in the world. For that to happen, the retailer needs to make a much greater impact in America. “Significant expansion in the US is key to achieving that goal,” acknowledges Daisuke Tsukagoshi, CEO of Uniqlo’s US business.

To win over American customers, Uniqlo US is leaning in on its well-established formula of functional, everyday clothing combined with localized stores and community engagement.

Of Uniqlo’s 2,200 stores globally, only 47 are in the US, the world’s biggest clothing and accessories market, which is expected to be worth $462 billion by 2025, according to GlobalData. Uniqlo makes an estimated $324 million in sales in the US, the research firm estimates, a fraction of the sales in Japan, China and South Korea, says Neil Saunders, managing director of GlobalData’s retail division. Fast Retailing does not explicitly break down the brand’s US performance.

The US and Europe were hard hit during Covid-19 lockdowns. With many of Uniqlo’s US stores located in shopping complexes, the retailer wasn’t able to maximize on the benefit of new shopping options such as curbside pickup, says Euromonitor’s Japan-based consultant Yuri Gorai. Many of Uniqlo’s stores are also in city centers and urban areas and lost sales as a result of the consumer retreat to the suburbs during lockdowns.

Uniqlo is under pressure to gain market share in the US, analysts say, requiring significant investment in more stores in strategic locations and increasing marketing to improve brand awareness. For a country the size of the US, Uniqlo’s store numbers are small, says GlobalData’s Saunders. “They’re by no means a national retailer and are not on-the-radar in the American market the way Gap or H&M are,” he says. “It currently only serves pockets of the market.”

Strategies to Take Over

Quality over Quantity

A priority for now is to raise brand awareness, Tsukagoshi says. “We need to tell the story of ourselves and who we are.”

While Uniqlo shares the fast-fashion label with H&M and Zara, it takes a very different approach to these other retailers. Rather than simply pumping out masses of clothing for immediate consumption to be quickly discarded for next week’s or next season’s styles, Uniqlo specializes in the basics that have a season-less appeal.

“We don’t chase trends. People mistakenly say that Uniqlo is a fast-fashion brand. We’re not. We are about clothing that’s made for everyone,” CEO Tadashi Yanai explained.

“Zara and H&M bring in a lot and bring it in frequently,” explains Kayla Marci, Edited’s market analyst. “Uniqlo is quite calculated and very consistent in its more moderate cadence. Given their moderation, I’d call Uniqlo a ‘diet’ fast-fashion brand.”

This restraint lends a greater stability in the buying cycle, with about one-third of Uniqlo items available between six and nine months, whereas 66% of Zara’s products are under three-months old.

Uniqlo’s relatively small inventory mix is a distinctive feature of the business, reducing the need for discounting. The retailer had 6,209 pieces for sale online in February 2021, while Zara had 9,198 and H&M 20,860, according to data from Edited. There are also fewer arrivals and stock stays on the shelf for longer.

Uniqlo has pushed the button effectively on collaboration over the years, says Marci. She points to the +J collection in partnership with Jil Sander; and collaborations with Christophe Lemaire (artistic director of Uniqlo U since 2016), JW Anderson, Undercover and Kaws. “Instead of flooding the market with weekly drops of trends that have a short shelf life, Uniqlo’s strategy has long-term benefits to both the planet and its profits by minimizing the number of products destined for landfill and avoiding overstock issues, protecting margins from steep discounts when products don’t sell,” says Marci.

Uniqlo isn’t completely trend avoidant, argues Masahiko Nakasuji, who joined Uniqlo as chief marketing officer for the US, from Procter & Gamble. “We are just not responding to smaller, shorter-term trends. We do pay attention to bigger shifts, such as a preference for oversized clothing.”

The oversized trend was boosted by the consumer preference for comfort during lockdown, prompting the brand to introduce more oversized styles. “That’s how we are responding to the market,” says Nakasuji. “We might not have a fashionable product, but we are meeting the demands of our customers, whether it’s improvements on color, functionality or fit.”

Leveraging Technology

Tadashi described Uniqlo as a “digital consumer retail company,” which sums up how it leverages technology from its factories through its supply chain and to the consumer. Since 2016 Uniqlo has invested more on e-commerce than physical retail in its home market and has focused on expanding online shopping in Japan, across China and Southeast Asia and in the U.S.

That investment is paying off as the number of visits to Uniqlo’s website rose 30% year-over-year in 2020, far faster than that of H&M (0.9%) and Zara (13%), reports Caroline Kim, lead retail industry consultant for SimilarWeb, a company that tracks online traffic.

The company has leveraged digital marketing to engage with customers through a multitude of campaigns and has heavily invested in the potential of E-commerce. Through these digital efforts, Uniqlo aims to capture a larger target market and bring more traffic to the website.

“Of the three players, Uniqlo over-indexes on desktop traffic, which bodes well for sales because desktop shoppers are highly engaged and more likely to convert,” Kim asserts. “H&M and Zara, on the other hand, have a higher percentage of mobile web users who are less engaged, stay on the site for a shorter amount of time and are more likely to bounce off the site.”

Over half (56%) of Uniqlo’s site visitors originate on desktops, compared with 34% for H&M and 40% for Zara.

But Uniqlo also leverages technology into the design and construction of its clothing, similar to the approach of sports and activewear companies but to a lesser extent in traditional fashion.

“The technical attributes used within garments really differentiates their products from other fashion brands, especially at such low prices,” Marci says, pointing to Uniqlo’s fabrications including HEATTECH to keep people warm and AIRism to keep wearers cool and dry. Branding these innovations gives the fashion retailer a unique edge against its competitors.

Each Uniqlo store is designed with a digital customer-first approach. The store is an experiential zone, inviting consumers to explore and learn about the tech behind creating fabrics. The huge LED screens, inviting interiors, bright lighting, and friendly store managers create a holistic and immersive customer experience, ensuring you come back every time!

“Technology is a big component that is at the core of Uniqlo. It’s used not to cut corners or speed up processes, but to improve the product for the customer,” she maintains.

Community Engagement

Uniqlo’s current US portfolio of 50 stores are located across key East and West Coast cities such as New York, New Jersey, Boston, San Francisco, Los Angeles and Seattle. Rather than open more stores in untapped parts of the US, the priority is to focus on existing stores and use the space more effectively to raise awareness about the brand’s core values. “It’s easy just to open more stores and expand more and more,” says Tsukagoshi. “The most important thing for us is how we contribute to society. That’s our reason for existing.”

Innovative marketing in New York shows the direction in which Uniqlo would like to develop. To celebrate 15 years since the opening of its Soho store, the retailer partnered with the Soho Memory Project to install a photo exhibition as well as with local businesses including florists and restaurants for exclusive in-store activations. Uniqlo also unveiled a campaign featuring individuals who have a rich connection with New York, such as art dealer Nicola Vassell and gallerist Jeffrey Deitch. Moving away from standardization in retail formats and marketing approaches, Uniqlo’s goal is to connect more intimately with local consumers, notes Nakasuji.

“We don’t want to invest in lots of mass marketing,” Nakasuji says. “We want to build a relationship with the community and we do that by establishing a rapport first.” Uniqlo’s marketing is controlled and focused, he insists. The priority is to enrich people’s everyday lives by activating local communities with cultural programming. Partnerships have included major cultural institutions, such as The Museum of Modern Art (MoMa) in New York and Tate Modern in London.

Uniqlo’s physical stores are also taking on new roles in response to the consumer shift to digital. This summer Uniqlo has been testing live-stream shopping, which is filmed in stores. The streams are hosted once or twice a month by influencers, such as Dylana and Natalie Lim Suarez, and shop staff who provide more detailed information on products. The streams, using technology provided by Bambuser, are broadcast on Instagram Live and Uniqlo’s website.

“Unlike fast fashion, we aren’t selling only looks, but there’s a story around the quality, texture and function of a garment,” says Nakasuji. The streams provide an additional opportunity for more intimate brand storytelling, he explains. And live streaming represents one more way in which Uniqlo can stand out in a crowded marketplace.”