Transfix & Its Perspective to Address the Pressing Industry Challenges

If you’ve been in the world of Logistics and Supply chain management for a while, you must have heard about some acute concerns of the industry, typically the diminishing truck driver pool.

Whereas the American Transportation Institute projects approximately 175,000 open truck driver spots by 2026, the Millennials aren’t lining up to join the profession. In fact, there’s a large number of talks in the media as well as within the supply chain industry about such a massive driver shortage and its significant impact on shipping speeds and quality. But…what if the problem is more than meets the eye?

Let’s discover the perspective of Transfix, the leading digital freight marketplace, as to this growing shortage as well as some expert solutions it does offer to actually tackle the challenge!

Transfix: An Overview

Before diving into the particulars, it’s essential to first take a look over the Transfix – the FTL Freight Marketplace for Shippers and Carriers.

As the leading freight marketplace connecting shippers to a national network of reliable carriers, Transfix does provide trucking brokerage services with an application dedicatedly developed to enable shippers to access Transfix’s contracted carriers for freight transportation.

Fortune 500 companies such as Anheuser-Busch, Unilever, and Target partners with Transfix to handle their most important FTL freight needs. The company’s technology platform provides shippers with enhanced visibility, advanced tracking capability and real-time data access to vetted and quality carriers. With instant pricing tools, guaranteed capacity, data-driven insights, and reliable service, Transfix is changing the world of transportation one load at a time.

Furthermore, Transfix collaborates with leading companies to ensure that their freight is and delivered on time. Adopting the cutting-edge technology, Transfix can quote thousands of loads in under a minute and manage the entire process from beginning to deliver, saving Shippers hours each day. In 2018, Transfix was named one of Forbes’ “Next Billion-Dollar Company”.

With decades of freight experience and profound industry knowledge, coupled with future-facing technology, Transfix sets its heart on reimagining the freight industry of the U.S. “We’re not satisfied with the status quo, and we’re motivated to reduce the 65 billion empty miles in the US each year. We believe that shippers and carriers can use thousands of wasted hours to solve more interesting problems.”

Diminishing Truck Driver Pool: Transfix’s Perspective & Resolutions

There goes without saying that trucking has been the backbone of the American economy. Such a $700-billion industry moves nearly 70% of the country’s freight tonnage, which – from financial experts’ standpoint – a leading indicator of the country’s economic health. Actually, the baseline assumption has long been the same: If trucks are moving more freight, it indicates that companies are producing more goods, and consumers have stronger purchasing power, too.

There’s, nonetheless, another key economic concept at play – supply and demand fundamentals. With higher consumer expectations around shipping speeds, increased global competition, as well as the prevalence of omnichannel retailing, shippers nationwide face imposing challenges. Confounding this is a record-high shortage of current and prospective drivers, a top-of-mind problem for every single shipper since freight demand continues to surpass supply, and transportation costs unexpectedly rise in response.

1. Diminishing Truck Driver Pool & Its Impacts

When it comes to the truck drivers working within America, they are, on average, 55 years old, with most soon approaching retirement. Unfortunately, with given lifestyle and values concerns, few Millennials are in the pipeline for the profession.

To be more specific, in 2018, staggeringly 60,000 drivers were needed to meet robust demand for trucking services, which may already be a conservative estimate. The shortage could be upwards of 100,000 or more, told Kevin Sterling – Seaport Global Securities LLC analyst. Such driver shortage stems from several factors, which include an aging workforce, high driver turnover rates (above 90% at present), reduced capacity as a result of regulatory changes, increasing freight demand, inflationary pressures, and “lifestyle priorities” that make competing industries more attractive.

Taking these issues into consideration, industry experts fear the current shortage may nearly triple by the year 2026 – absent any meaningful changes – which is around 175,000 open spots according to the estimate of the American Transportation Research Institute.

As regards its impacts, tales of the direct impact the driver shortage has on shippers abound in the media: Companies like General Mills (Haagen-Dazs, Cheerios) attributed cutting 625 jobs by the end of 2019 to rising commodity and freight expenses. According to The Wall Street Journal and Fox Business, major food giants—Mondelez International (Cadbury, Nabisco, Trident), Hershey Co, Nestle SA, and CocaCola Co—all planned to hike 2019 North American prices, passing the burden of rising ingredient and transportation costs onto retailers and consumers.

Additionally, reliance on last-minute, higher-cost shipping has dramatically increased. Jeffrey Harmening, chairman and CEO of General Mills, said on the company’s Q3 FY2018 earnings call on March 21st that General Mills had to quadruple its reliance on the trucking spot market in that quarter.

“We called out increased freight costs that are up to CAGNY but the cost pressure we’re seeing is even higher than we thought at that time. We’re now having to go out to the spot market for close to 20% of our shipments versus the historic average of about 5%, and those spot market prices can be 30% to 60% higher than our contracted rates. In fact, North American freight spot prices were near 20-year highs in February. Higher freight costs are impacting our raw material prices as well as the cost to ship materials from our suppliers to our factories has risen significantly. And we’ve seen higher prices in some key commodities including grains, fruits, and nuts, further heightening the inflationary dynamic.”

2. Transfix’s Perspective: When Carriers Win, Shippers Win

Whilst the impact of the shortage is felt industry-wide, the problem is much more complicated than it may seem to be. From Transfix’s standpoint, adding more drivers is just one piece of the solution – it isn’t a long-term fix. It is the industry-wide inefficiency that remains the real root cause. Thus, it’s more than crucial to address the inefficiencies throughout the supply chain that impede the smart utilization of existing drivers and their trucks.

So, what are exactly these inefficiencies and how to solve them? Let’s go explore!

Offering Better Experiences and Data Access

Taking a deeper look, it’s clear that there’s more to the shortage than meets the eye. First of all, a rampant lifestyle, coupled with several work issues, significantly reduces drivers’ satisfaction, health, and productivity. Unless the concerns over the driver experience are properly addressed, adding more headcount won’t solve anything, especially for potential Millennial truckers, who do place a high premium on employee engagement and experience.

What’s more, from the shippers’ side, they don’t typically have access to the actionable data that would allow them to substantially enhance productivity and reduce costs, even with a shortage of drivers. Actually, low adoption of the right technology not only limits network visibility but also reduces efficiency at facilities. Also, it does stand in the way of solving common driver pain points.

Shippers are singularly poised to drive change in the marketplace, but without proper insights, several may fall short. In order to succeed in this competitive environment, shippers now have to take urgent courses of action to upgrade the driver experience and build trust, in turn improving their own performance.

After all, the answer lies in a combination of human and data-based insights, with new capabilities employed to improve this relationship on both sides. Always bear in mind: When drivers win, shippers share in the victory!

Truckers Talk: Hear Firsthand from Drivers

Truly listening to the direct experience of drivers is the first key to incisively tackling the current industry problems!

At Transfix, they are partnering with thousands of carriers and innovating to solve their most pressing concerns. Wasted miles is one issue that is particularly catastrophic for the industry. Too often, deliveries are made with no return consideration, leaving the driver with empty miles and no compensation for time, fuel, or vehicle wear and tear. The ATRI 2018 Study highlights that nearly 15 to 20% of miles are driven with empty trailers, or “dead-head” – which, according to Transfix, adds up to approximately 65 billion empty miles annually.

Also, there are other major challenges that drivers usually come up against:

- Reduced Income Potential: Average salary is 45,000 – 50% lower than they were in the 1970s when adjusted for inflation.

- Highway Congestion: On average, highway delays equate approximately 1.2 billion hours of lost productivity, which equates to 425,533 commercial truck drivers sitting idle for a working year.

- High Wait Times: In practice, 63% of drivers are detained three or more hours at shipper docks each time they arrive to load and unload.

- Lack of Accessible & Safe Parking: So often, the truck drivers are forced to park at unsafe locations, such as on the shoulder of the road, exit ramps, or vacant lots.

- Electronic Log Devices (ELDs): Whereas such technology has been designed to bring greater accountability to everyone working within Hours of Service compliance constraints, 7 out of 10 drivers saw a decrease in hours on the road, and 42% saw a decrease in privacy.

“When they started the ELD aspect, they looked at it from the driver’s perspective and assumed that all of that time would be spent actually driving. They didn’t consider all of the waiting that actually happens at the facility” shared Sterling, Sterling Lockett Trucking.

3. Transfix’s Proposed Practices

Drivers and Shippers: Partnered for Success

As already discussed,when carriers win, shippers win. The shippers who acknowledge where – and how – they can be a better partner to drivers will be the ultimate winners.

To take an example, the best-in-class shippers like Unilever has started to raise the bar, offering experience-enhancing amenities like break rooms and on-site parking. To implement these types of experience improvement involves thinking about truckers’ holistic journey: What obstacles do they face throughout the course of a shift? Which changes can be operationalized to ensure a real impact? Of course, these practices do require efforts, time as well as money; however, they bear fruits.

“My favorite two places in the world are church and Unilever’s Newville facility. Everybody is very friendly. You’re able to park your truck, use the bathroom… no one is looking at you or questioning you either.” Ramon, Elias Transport.

Would you like to create such a good end-to-end experience for your company’s carriers just like Unilever? Let’s go through some proposed practices and pick the one(s) best-suited your case.

- Educate Staff: To train staff to treat truckers as part of the team, and incorporate driver feedback into performance reviews

- Increase Amenities: To improve facilities with access to bathrooms, water/snacks, WIFI, list of nearby amenities such as rest stops, truck parking, hotels, restaurants, etc.

- Share Materials: To leverage purchasing power for truckers’ materials to help them secure or brace loads for transit (for instance, extra cardboard, blankets, bubble/shrink wrap)

- Offer Incentives: To gift some gas cards, meal coupons, calling cards, etc. Or, where relevant, let’s offer product samples, coupons, and branded merchandise.

- Pay Faster: To shorten the payment cycle – either directly or via a company like Transfix that offers carrier quick pay services.

Embrace the Transformative Power of Data and Technology

Again, the commitment to acknowledge and address day-to-day carrier challenges is the first step to eliminating any unnecessary delays and costs. To go to the next level, shippers should not only address specific concerns but also need to leverage data-driven insights that further illuminate broken areas – or black holes – in the transport segment of their supply chain.

In fact, digital freight companies like Transfix provide this much-needed transparency; hence, shippers can go even deeper in solving key challenges. With the aid of sophisticated technology, shippers can receive both quantitative and qualitative data points, allowing for a deeper level of analysis—and inherently more impactful outcomes.

Below are a few examples of how shippers could possibly adopt data-driven insights to handle with driver pain points:

| PROBLEMS | ACTIONABLE INSIGHT | INTELLIGENT ACTION |

| Long Wait (Detention) Times | Identify the areas causing delays by analyzing driver in-and-out times and tender lead-times | Focus on improving loading efficiencies at the warehouse |

| Inflexible Appointment Times | Evaluate accessorial spend as a function of preset vs. non-preset appointments and segmented vs. non-segmented customers | Adjust loading dock hours to better accommodate carrier schedules |

| Wasted Miles / Driver Backhaul | Apply advanced algorithms to anticipate when a driver will be empty | Match a driver to the best nearby load taking into consideration their routing, geography preferences and driving time |

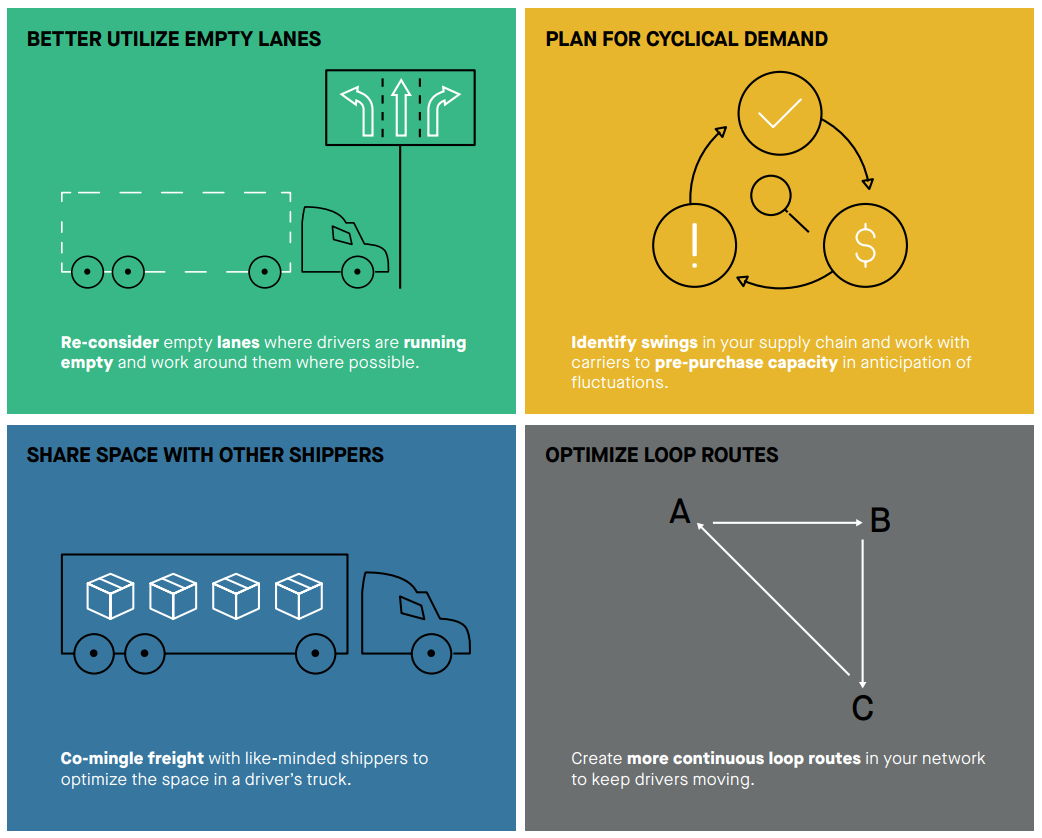

Also, technology “boasts” the ability to unlock opportunities for driver and shipper success. Let’s take a look over some typical problems that can be solved by adopting data-enabled insights and state-of-the-art technologies:

The Bottom Lines

As the leading digital freight marketplace, Transfix has actually inspired a better future for transportation in the $700 billion U.S. trucking industry, continuously fixing manual inefficiencies that lead to frustration and wasted time and money for shippers and carriers.

As the shortage of truck driver pool gets worse and worse, it’s a “should” that you, as a player within the game of the logistics and supply chain management, do embrace Transfix’s perspectives and practices to ease the specific problems of your business and ignite its profitability.

You May Also Like: