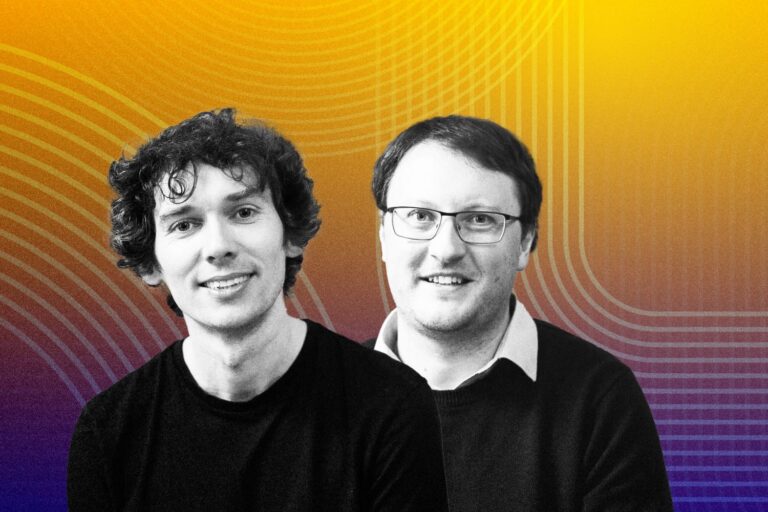

The “Purple Cow” Garry Tan & The Secret of “Being Different” in Your Tribe

As an early investor in cryptocurrency exchange Coinbase, grocery delivery service Instacart and supply chain software unicorn Flexport, Garry Tan has appeared on the Forbes Midas List for the past four years, most recently ranking at No. 28. He debuted at No. 4 on the inaugural Forbes Midas Seed List in 2022. Let’s dive in to see how he becomes such a ”household” name!

Started Off as an Engineer

He grew up in the San Francisco Bay Area, sort of in the shadow of Silicon Valley. “I don’t think that I ever thought I would become a venture capitalist.” He said in an interview hosted by GGV Colleague. “I just knew I wanted to code.”, he continued.

Tan started programming at 14 years old and found his very first job by cold-calling the Yellow Pages. He got paid $7 an hour for making web pages and the internet section of the website. At this time, this income was meaningful for him because that money helped his parents pay for their first down payment for their apartment. As a child of immigration, he didn’t grow up so well off. Tan supposed that “…computers have given me absolutely everything in my life.”

After graduating from American High School, a public secondary school located in Fremont, Tan entered Stanford University and studied Computer Systems Engineering which was the major he would do after graduating. At Stanford, Tan was a truly effective leader in his sphere of influence when taking on the responsibilities of the president of the Asia-Pacific Student Entrepreneurship Society (ASES). Besides, he also had an excellent academic performance that was the first-authored published research on cross-cultural effects on input modality preferences in CHI2003 in conjunction with Stanford Mass Communications department and NHK Japan. During high school and college, Garry Tan did a part-time job during school, and a full-time during breaks as Software Engineer Intern at Sapient and 2 other Tech companies.

A $200 Million Mistake at the Age of 23

Like other normal students, they graduate and then find a stable job, and so does Tan. At the age of 23, he graduated from Stanford and Computer Engineering and wanted to work at a startup. Unfortunately, it was a very tough time for him because there were very few startups. And then, Tan was offered to join Microsoft in the role of Program Manager for Windows Mobile.

“Being at Microsoft was the pinnacle” to him, “I have health insurance… Thank goodness for the affordable care act” Tan funny shared in That Creative Life series. And at that moment, he was happy that he had a great job and “got to go to the martini bar every Friday night”, he had a brand-new car. “It’s stable and really nice. So, there is nothing wrong with that”, he said.

And about that time, Tan’s friends were starting a company with Peter Thiel who wrote the $500,000 check to Facebook in 2004. And they flew him down to have dinner at their new French restaurant. “I remember the dinner was awful” he recalled the things. And at that dinner, Peter Thiel suggested Tan come and join them because he supposed that Tan’s doing at Microsoft was wasting the time. “We’re going to go change the world.” Then, Peter asked Tan “How much a year do you make at Microsoft?”. Tan told him it was $70,000, really the lowest of the low coming right out of college. “Cash this check, quit your job. This is a zero-risk opportunity for you,” Peter said and gave Tan $70,000 from his personal bank account.

However, Tan said, “Thank you very much, Mr. Thiel, but I might get promoted to Level 60 next year.” while he was in level 59, the lowest of the low in the organization. He said no to Peter Thiel because “They were working on something totally different that I had never heard about before”. And, of course, the company, that turned out to be Palantir and Palantir is now worth $20 billion or more.

A lesson learned from Garry Tan is that “There is an interesting realization that if you go by the thing that you read about, or see YouTube video about or whatever, you’re not going to create new stuff. You’re just going to like sort of chase what was happening like 9 months ago and then all the interesting stuff is basically a bunch of creators making something in a room that nobody else had ever made before.”

For the question of how to do it best, according to Tan, “Learn first, then earn” is the best strategy. “Learn” means learning about yourself and acquiring related skills until great at them. And “earn” means putting money in the pocket. If people try and do thing in reverse, they try to earn first, they will probably still learn but it maybe slowly and they don’t know what they are going to give up because it might come at a great cost. And as a result, they might also get trapped in that hedonic treadmill. “Always remember, if you’re not learning or earning, plot your exit to a place where you can” Tan suggested in a video on his YouTube Channel.

What if Garry Tan realized these things earlier and didn’t afraid of new things and received Peter Thiel’s offer?

Be a Purple Cow Like Seth Godin Says, and Be Different as Garry Tan Does

A year later, Tan came back for his friend’s wedding and visited the office where the software they were building was. He decided to quit Microsoft and join them as employee #10 at Palantir.

Though it may be a little bit later, it can be qualified as a sort of emblematic of how bewildering the early stage is, especially for those builders, engineers, designers, for product people who can ship, and then break out of the mindset of like first what did their parents think that it’s great to have health insurance. That is really a very Asian American way of thinking. “It’s safe. It’s tough to take risks.”, Tan emphasized in the interview with GGV Colleague, he said “And the only risk really in tech these days is if you don’t take risks”. Especially for people who really want to really accelerate what they’re doing. They can join the place that is working on problems that they believe in. And early-stage startups may be an ideal place for them to cut their teeth and maximize the difficulty level and maximize agency.

As Tan, he lost two years working for Microsoft which were prime coding years, “It’s tough, you don’t have a billion years in your career to really create and it’s very precious time.”. And more, the advice he wants to give to fresh graduates and people who were at that same moment that he was at Microsoft is “Don’t be afraid! Be bold, be different, be a purple cow like Seth Godin says.”. And he wishes he realized that a lot earlier actually. And especially in schools, even at Stanford so that he didn’t have to say sorry that “I knew I was gonna be an engineer, but I actually did Structured Liberal Education.”

This maybe the reason why Tan decided to invest in Coinbase when receiving a cold email from the address [email protected] while he was a partner at Y Combinator. And not long after that Tan invested $300k into the crypto exchange across Y Combinator and Initialized Capital. The combined stake of those investments is now worth $2B+… for a remarkable return of >6000x.

“It’s the best investment I’ve ever made,” Tan tells The Hustle. “One reason I invested in Coinbase when many others didn’t is because I was primed for the opportunity.” A key investing lesson from his experience is being primed. In other words, being primed means keeping an eye on the fringe.

In Tan’s situation, he used crypto trading exchange called Mt. Gox – a Tokyo-based cryptocurrency exchange, which later imploded in a major scandal. During that time, he realized that if crypto was going to go mainstream, it would have to have a much better interface. Therefore, “when I saw Bitbank (later Coinbase), I understood the opportunity.”, Tan said.

A Founder Becoming a Good Leader

When asked how to build a good leader, Tan said “It really does take polymath and great managers are not sort of born there,” he continued “They’re definitely taught and only through sort of the fire of going through just so many difficult things.” That means it’s difficult to take a great builder and teach them to be a great cult leader. And Tan views that as a positive shift when the founders make something innovative and bring in professional management which takes it to the next level.

He gave the reason why he thinks it’s happening now “we are all as a society, much more mindful of the plasticity of our brains”. In the other words, he supposed that “people can grow, and they can change, and the best founders can grow and change in the course of running their businesses.”

Obviously, Garry Tan started off as a tiny seed investor where he owned 1%. But he was first money in any way. Therefore, he would often support founders with the very first money into their seed extension. Until now, it has been operationalized for 10 years, and “every founder will get punched in the face so many times”. To Tan, this is sort of obvious which founders will make it. And of course, some individuals will stand up and pick themselves up. Then, they could realize what went wrong like the way they can own the failure.

Having been doing this job for 8 years, Tan identifies a founder as a self-aware person, who owns the problem and owns the mistake and then tries to fix it. He believes the actual founder will act like “It’s not someone else’s fault, it’s my fault.” whenever things go the other way or something is out of their control. And then, there will be “I’m gonna do to solve it”. And as an investor, he can help them only if they have an incredible amount of self-awareness.

Besides, Tan found that the other method that encourages founders to actually engage in mindfulness is meditation or executive coaching. As a result, if they are more mindful, they have abilities to have full ownership, then their organization would grow and change in a positive way.

The Biggest Return

In fact, beyond co-founding Initialized, Tan was also co-founder of the YC-backed blog platform Posterous, which was acquired by Twitter in 2012 for $20 million. Besides, he was a YC founder in the summer of 2008 and served as a partner there from December 2010. In November 2015, Tan left the firm, wishing to focus more on Initialized Capital, a venture capital firm he founded with Reddit co-founder Alexis Ohanian in 2012.

At Y Combinator, Tan helped compile a directory of “the best and the brightest interaction designers and visual designers” and wrote Coinbase’s first seed round check in 2012. While at Y Combinator, he and fellow Y Combinator partners raised $7 million in venture capital funding to support Y Combinator alumni companies, including Instacart and Coinbase.

By selecting Tan to lead YC, the accelerator board is bringing one of its most distinguished alumni back to the fold. Tan and Ohanian began investing in Initialized in 2011 while still partners at YC before moving to focus on the company. But Tan’s ties to the accelerator remain deep: The internal directory he created, cheekily called Bookface, remains a vital part of the network YC offers its entrepreneurs.

And now, Tan takes over the head at Y Combinator which means he will step away from a top job at Initialized Capital. Instead of thinking of the network and community as YC’s biggest challenge, he views this as the biggest strength for the development. He hopes that they can engage YC’s alumni community more of the institution in the near future although it’s unclear how that may materialize, whether through more events or if there’s a micro-community play to be seen.

However, when asked about complementary or competitive dynamics, Tan didn’t say how his future venture advisor position at Initialized and his new role at Y Combinator. He said, “You need a seed investor who’s going to be there for over the course of years, and Initialized remains that. The high level here is like I’m here to make the YC companies and the founders successful.”