This Backer’s Unstoppable Momentum Benefits Troubleshooters

During the dot-com bubble, which was a period of extreme growth in the technology sector in the late 1990s and early 2000s, many companies benefited from a surge in investor interest and capital inflows. The rapid rise in stock prices and market valuations during the dot-com era led to a frenzy of speculation and optimism among investors, which helped many companies raise large amounts of capital.

And it’s reasonable enough to see not only enterprises, but also the backers behind them, have experienced such enormous growth. IVP (Institutional Venture Partners) is one of those benefited from the burst.

Founded in 1980, IVP is one of the premier later-stage venture capital and growth equity firms in the United States. The capital firm is a backer that invests in high-growth technology and media companies.

Talking about IVP, we must pay tribute to its founder Reid Dennis, the legend who is considered as one of the pioneers of venture capital in Silicon Valley, and has played a significant role in shaping the technology investment landscape over the past several decades. Let’s read on.

The Legend that Architects a Legacy for His Descendants

“In the 50’s and early 60’s, they didn’t call it venture capital,” said Reid Dennis, the founder of Institutional Venture Partners. “They called it a special situation,” he joked.

Dennis began his venture capital career with Davis & Rock, one of Silicon Valley’s early venture capital firms, after briefly working as an engineer.

He made his first investment in Ampex, a business that manufactured an early version of a tape recorder, in October 1952. He is one of numerous venture capitalists and entrepreneurs interviewed in Something Ventured, a new documentary film that examines the roots of the venture capital sector.

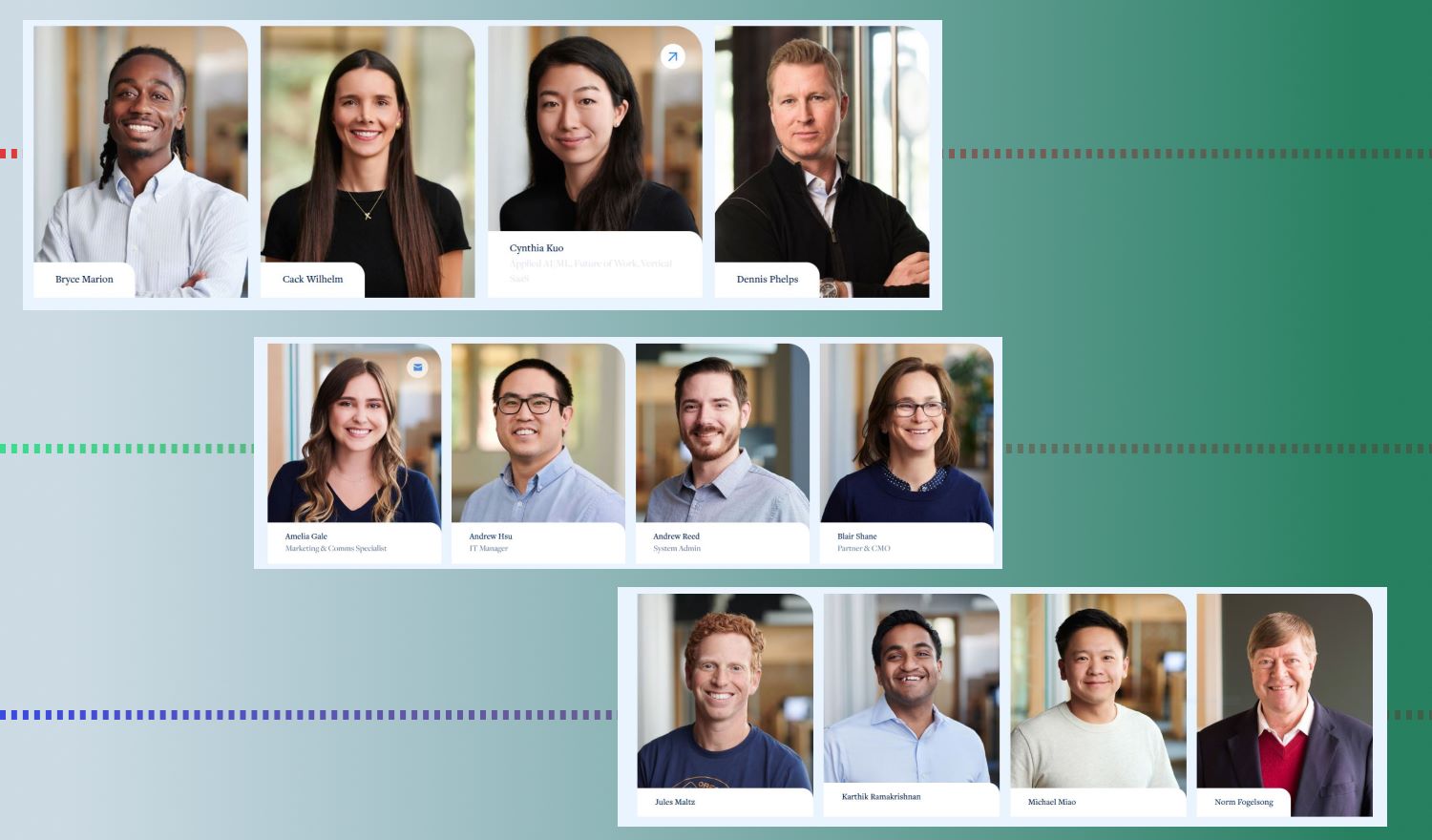

Having co-founded IVP in 1980 with Norm Fogelsong and Rick Melmon, Reid Dennis helped turn the business into a dominant player in the technology investment scene.

Reid Dennis, who has been in the game for a long time, looks back on the early days of venture capital with a distinct affection ‘for the good old days,’ which entailed a hand-to-hand approach of mentorship and loyalty. And he’s particularly critical of the present venture capital system, which relies on one or two huge ‘wins’ or ‘exits’ for each fund.

“In the early days, we had somewhere around 60-65 percent of companies that were successful,” he said. “Another 10-15 percent you might just get your money back. Today, there’s so many people in the industry that say, ‘If we can get two big hits out of 10, we can make money.’ I think that’s the wrong approach. That’s not an approach I’m comfortable with.”

Dennis, who is regarded as one of the founding fathers of the venture capital industry once said that “If one of us heard about a deal down here in the peninsula, we’d invite the entrepreneur to come up and have lunch with us in San Francisco.”

He added, “We’d sit and eat while he’d tell us his story. So among the five of us, we could come up with maybe $100,000, and we’d go back to our offices and call up our friends who invested with us before, and we’d say ‘Do you want to join us?’ And sometimes they’d reply, ‘Sure, I’ll be in for 15 or 20.’ And that’s the way we got started. It was an informal association of people that had full-time jobs doing something else.”

Venture capital has evolved dramatically since the early days of IVP, but one of the biggest changes, according to Dennis, is that many young people are now drawn to the industry because they believe it is a terrific way to make money.

And IVP is attracted to those young fellows, their businesses, because it was fascinating, beneficial and an interesting way to help individuals while interacting with people that they otherwise do not work with.

Ongoing Quest to Back World-Changing Entrepreneurs

“We specialize in helping address the unique needs of hyper-growth companies, including assistance with recruiting, strategy, product development, and scaling operations,” IVP said in a blog post.

The firm aspires to be the skilled and trusted advisor for CEOs as they grapple with critical decisions like equity financing, debt securing, reviewing M&A deals, and preparing for an IPO. They deliver on this and then get out of the way, proving that fundraising is just a step along the path, not the end aim.

Their attention is the most valuable asset. Every day, they wake up seeking the fastest growing technology firms that are industry leaders with strong management teams, and they’re willing to travel across the country, and in some cases, the world, to locate them.

There is no healthcare fund, no clean tech fund, no China fund, no India fund, and no Brazil fund.

They’re a team that meets face-to-face every day to hunt for the greatest firms in specific emphasis area; that attitude helps the capital to be extremely effective in selecting those companies, assisting them after they’ve invested, and eventually creating strong returns.

IVP is a venture capital firm that invests in high-growth technology firms in a variety of industries, including corporate software, consumer internet, digital media, and mobile.

They also make investments in healthcare and financial technology startups. Among these sectors, IVP seems to have an interest in software driven companies.

“I believe that software in the future is going to be bought not sold,” shared Jules Maltz, General Partner at IVP. “There will be classic companies that are product-focused companies with product-focused CEOs who build great software that spreads almost virally throughout an organization without the need for much active selling.”

He added, “I think Slack is an example of a company that we recently invested in that plays on that trend. It has the metrics of a consumer company in terms of how fast and viral it’s growing, but the monetization model of an enterprise business. It’s incredibly exciting to have the capacity and the ability for an enterprise company to scale just like Twitter or Facebook scaled. We’re looking for more of those.”

The backer believes that 10-15 companies will be founded each year that will earn the vast majority of returns in their industry. It is their responsibility to invest in as many of them as possible, therefore they hunt for companies that are experiencing “hypergrowth.”

This indicates that businesses are not just increasing at 100% or 150% year over year, but also at staggeringly 500% or 1,000% year over year. It means that something is working at an unprecedented level in their business, and IVP looks for market leaders in large markets with that type of growth rate.

The capital firm is looking for management teams who understand how to run these types of enterprises on a large scale. When all of these variables come together, the backer becomes ecstatic, and they mobilize as a group to do anything they can to find a way to invest in those companies, even if it takes all of them traveling to their offices or driving up to San Francisco.

IVP has extensive experience assisting firms in going public, completing M&A transactions, and hiring senior executives and board members. It’s a key component of how the backer helps their companies grow.

They have a very team-oriented attitude, and when they locate a firm that fits their criteria, they all work together to find a way to invest in it.

After they’ve invested, they work extremely hard to help the company grow, and they have a track record of doing so. Let’s take a look at their performance over the years.

Celebrating Four Decades of Accomplishments

It’s not an exaggeration to state IVP has made pivotal contributions to the technology industry from the perspective of a VC. Since its inception in 1980, the firm has made 372 investments in companies ranging from early-stage startups to established corporations.

With these investments, the giant has been able to build a diverse portfolio across a wide range of industries, including enterprise software, consumer technology, and fintech.

The capital is one of the industry’s top performers, with a 40-year internal rate of return (IRR) of 43.1%. IVP focuses on venture development investments, industry rollups, founder liquidity, and select public market investments.

One of IVP’s most recent investments was on February 27, 2023, when the drone manufacturer Skydio raised $230M in a Series F funding round. This investment highlights IVP’s focus on emerging technologies and its willingness to invest in innovative companies with promising futures.

IVP is also committed to promoting diversity and inclusion in the tech industry. To that end, the firm has made 66 diversity investments to date, supporting companies that are led by women, people of color, and members of other underrepresented groups.

IVP’s most recent diversity investment was on May 24, 2022, when Monte Carlo, a data observability platform, raised $135M in a Series C funding round.

In addition to its successful investments, IVP has had more than 120 IPOs and investments in over 400 companies since its founding including Attentive, Brex, Discord, Grammarly, HashiCorp, Hopin, Klarna, Lyra, MasterClass, Snap, Supercell, Twitter, Wise, and Zynga.

With the recent successful IPOs of Coinbase, Compass, CrowdStrike, Datadog, Hims & Hers, Sumo Logic, The Honest Company, and UiPath, top entrepreneurs recognize that the IVP team plays an instrumental role in their success.

During its lifetime, IVP has raised a total of $7.4B across 7 funds. The latest was in 2021, when the firm announced the closing of IVP XVII, a $1.8 billion later-stage venture capital and growth equity fund.

The new fund follows the recent success of IVP XVI, a $1.5 billion fund formed in 2018. IVP XVII is the largest fund raised in the firm’s 41-year history and brings the firm’s cumulative committed capital to $8.7 billion.

IVP has also made acquisitions, such as its purchase of Giphy on May 15, 2020. Giphy, a popular platform for sharing animated GIFs, was acquired by Facebook for $400M, and IVP played a critical role in helping Giphy grow and scale before its acquisition.

Having experienced such an enormous growth for years, however, the capital firm can’t stay away from the market that’s no longer appealing any more. In fact, the firm has pulled back in a cooling private market as the economy rides a rocky road to a possible recession.

When the Venture Capital Market Cools Down

When IVP entered 2022, it was similar to its venture brothers and sisters such as Accel, Sequoia Capital, and Andreessen Horowitz, having significantly slowed from the hot market of 2021.

According to Crunchbase data, IVP lowered its investment cadence in 2022 after participating in 26 fundraising deals in the second and third quarters of 2021, when the venture market reached record highs.

In reality, in the second quarter of 2022, the firm was involved in only one announced deal – a $65 million Series B to Paris-based business forecasting platform Pigment.

The value of the rounds IVP had invested in 2022 was drastically reduced as the deal count decreased. According to Crunchbase data, IVP’s more than two dozen rounds reached more than $5 billion in the second and third quarters of 2021. It spent less than $900 million on the eight rounds it participated in for the same two quarters of 2022.

During those same middle quarters of 2021, IVP led or co-led six rounds, according to Crunchbase. These rounds included a $130 million Series B round for TaxBit, a Utah-based bitcoin tax and accounting software platform, and a $100 million Series C round for Paper, a Montreal-based edtech business.

IVP led or co-led three rounds in the same quarters of 2022, including a $135 million Series D for San Francisco-based data reliability platform Monte Carlo, which valued the business at $1.6 billion.

In a new presentation in November 2022, the VC firm told startup leaders to batten down the hatches. The market is still months away from bottoming, and access to venture capital will remain limited. Insider has unique access to the company’s presentation, titled “Thriving in a Bear Market: A CFO’s Guide.”

One of the computer industry’s oldest and wealthiest venture capital firms has offered a pessimistic forecast: markets are still far from bottoming, and portfolio businesses must “surgically pare down expenses” while investing in growth to flourish.

The firm IVP cautions in a 10-page PowerPoint shared with Insider that the public markets collapse that has crushed tech companies over the last nine months will likely last another nine months.

This has ramifications for venture-backed, private enterprises that rely on outside funding to exist and develop. As the downturn continues, founders should expect lower valuations and increased investor scrutiny.

The new rule comes after a succession of similar memos from investors such as Andreessen Horowitz and Y Combinator.

After years of telling founders to grow at all costs, investors are suddenly advising them to cut expenditure and stretch their runways in order to “avoid a death spiral,” according to Sequoia Capital in a presentation to its founders.

Founders must be more cautious in their spending as the frenzied pace of venture dealmaking slows, according to Vashee and Miao. Based on a recent Silicon Valley Bank report, venture companies raised $83 billion in new money in the first half of 2022, the most in the industry over a six-month period.

The partners, however, believe that founders will have unequal access to those assets, with money flowing more readily into early-stage businesses and existing portfolio companies.

Bottom lines.

As almost half of 2023 has passed, many organizations and venture capital (VC) investors are experiencing down rounds for the first time in a decade or more. Because VC financing structures have a long history, we can look to previous downturns to identify investment terms and tools that are once again relevant.

Moving forward, the venture capital sector is likely to be more competitive than ever in 2023, with growing competition for funds and shifting investor objectives. Let’s see how IVP navigates the way to go onto through the ongoing gloomy setting.