The Art of Investing: Jeff Horing’s Trailblazing Career as a Venture Capitalist

Whilst the venture capital world is full of talented and influential leaders, just a few stand out as eminent impact drivers. And the co-founder and Managing Director of Insight Partners – Jeff Horing – can’t be missed out in the list.

With a career spanning over 25 years, this VC leader has partly shaped the direction of the industry through his firm’s investments and his thought leadership. He is well pronounced for his philosophy of building sustainable, socially responsible businesses, and has championed ESG initiatives in the companies that Insight Partners supports.

He has been recognized by Forbes as one of the world’s top 100 venture capitalists and widely respected for his insights on entrepreneurship, investment strategy, and social impact.

But what makes this individual such an important figure in the landscape? Keep reading on.

From Electrical Engineering to Venture Capital: Jeff Horing’s Career Trajectory and Impact

Jeff Horing was born in the United States and grew up in a family of entrepreneurs. His father and grandfather both started and ran successful businesses, which helped to inspire Horing’s own entrepreneurial ambitions.

“My grandfather was an entrepreneur, and my father followed in his footsteps. I grew up in a family that valued entrepreneurship and the spirit of building and growing companies.” – Horing told Forbes.

His education in electrical engineering and business at Cornell University and Harvard Business School equipped him with technical and management skills that have proven valuable in his career as an investor.

In detail, he attended Cornell University, where he earned a degree in electrical engineering and developed a passion for technology and entrepreneurship. After graduation, Horing worked as a software engineer at Digital Equipment Corporation, where he gained experience working on large-scale software projects.

He later pursued an MBA at Harvard Business School, where he developed his business and management skills. Horing’s experience as a software engineer and consultant at the Boston Consulting Group gave him a unique perspective on the challenges facing startups, and he soon became interested in venture capital as a way to combine his interests in technology and entrepreneurship.

In 1995, he co-founded Insight Partners with Jerry Murdock, with a focus on providing more than just capital to early-stage technology companies. Under Horing’s leadership, Insight Partners has become one of the most respected and successful venture capital firms in the world, investing in over 400 companies and helping numerous startups to scale and succeed.

As Managing Director, Horing has been involved in the day-to-day operations of the firm, overseeing the management of the portfolio and guiding the overall direction of the firm. He has been actively involved in fundraising efforts, including the recent successful raise of $20 billion for Insight Partners XII.

Besides, Horing has served on the boards of various portfolio companies, providing valuable expertise and guidance to help them achieve their goals. He is known for his hands-on approach to working with portfolio companies and his commitment to providing long-term support for their success.

In a 2018 interview with CNBC, he stated: “We take a partnership approach with our portfolio companies. We work closely with management teams to provide strategic guidance and support for long-term success.”

In addition to his work at Insight Partners, Jeff Horing has been involved in various philanthropic efforts, including serving on the board of the Child Mind Institute, a non-profit organization dedicated to improving the mental health of children and adolescents.

Through his work in both the business and philanthropic worlds, Jeff Horing has demonstrated his commitment to creating lasting value and making a positive impact on the world.

Over the years, Jeff Horing has achieved a notable level of wealth through his success as a venture capitalist and investor. As of 2021, his estimated net worth is approximately $225.18 million, largely tied to his role as a director at Alteryx, Inc.

With ownership of around 914,226 units of Alteryx, Inc’s common stock, Horing has demonstrated his ability to identify and invest in companies with significant growth potential.

From Personal Investment to Blossoming Tech Backing: A Promise for Long-Term Value Creation

It’s worth noting that Jeff Horing and Jerry Murdock used their own money to launch Insight Partners, which stands as a testament to their confidence in their ability to identify and invest in successful tech companies. This also reflects their willingness to take risks and their commitment to building a successful venture capital firm.

In a 2019 interview with Forbes, Horing stated: “Jerry Murdock and I started the business in 1995 with personal investments of $10 million each.”

So with their initial seed funding of $20 million, Horing and Murdock were able to make early investments in companies include Qualtrics, an online survey company that was acquired by SAP for $8 billion in 2018, Alibaba, the Chinese e-commerce giant that had a highly successful initial public offering (IPO) in 2014, and Twitter, the social media platform with a market capitalization of over $50 billion, which all have since gone on to become highly successful and valuable companies.

Over the years, Insight Partners has continued to grow and expand, with a focus on providing more than just capital to their portfolio companies. They work closely with their portfolio companies to provide strategic guidance, access to resources and networks, and support for growth and scaling.

In addition to Qualtrics, Alibaba and Twitter as fore-mentioned, Insight Partners has invested in companies that have become household names, such as Shopify, the e-commerce platform with a market capitalization of over $150 billion, and DocuSign, the electronic signature company that had a highly successful IPO in 2018.

“We’ve been with Shopify since 2013. It’s been a great company to partner with, and it’s been an amazing ride. They’re doing a great job of helping businesses of all sizes to succeed online, and we’re proud to be part of that journey,” shared Jeff Horing in a 2018 interview with CNBC

Besides, the venture capital company has invested in Docker, a software company that has become a leading platform for containerization and DevOps. It highlights the firm’s ability to identify and invest in promising early-stage companies with innovative technologies and strong leadership teams.

Horing stated: “We’re excited about the potential for Docker to transform the way that developers build and deploy applications. We believe in the team and their vision, and we’re committed to supporting them as they scale and grow.”

Through their investment in Docker, as well as their work with other portfolio companies, Insight Partners has demonstrated their commitment to providing strategic guidance and support for long-term success.

A Hands-On Approach to Investing in Disruptive Technologies and Emerging Markets

To understand how Insight Partners has been able to identify and invest in high-potential technology companies, it’s important to take a closer look at the investment strategy developed by Jeff Horing.

The investor takes a hands-on approach with portfolio companies, working closely with them to provide strategic guidance and well-rounded access to resources and networks. He believes that this approach empowers portfolio companies to achieve long-term success.

Insight Partners takes a long-term view with their investments, seeking out companies that have the potential to generate significant value over the long term. They are committed to supporting their portfolio companies throughout their growth journeys, offering resources and expertise to help them achieve their goals.

“We invest with a long-term view and take a partnership approach with our portfolio companies. We are committed to providing the resources and expertise needed to help our portfolio companies achieve sustainable growth and long-term success.” – Horing stated.

His investment strategy does involve focusing on disruptive technologies and emerging markets. The venture capital company seeks out companies that are leveraging innovative technologies and business models to disrupt traditional industries and create new markets. They also look for companies that are expanding into emerging markets, where there is significant potential for growth.

“We look for companies that have a strong management team, a clear path to sustainable growth, and the potential to disrupt their respective industries. We also look for companies that are leveraging innovative technologies and business models to create new markets and opportunities.” – Horing stated.

In an interview with Business Insider in 2019, the venture capitalist once again emphasized the importance of investing in new stars that are leveraging these emerging technologies, stating “We’re interested in companies that are creating new categories, and we’re always on the lookout for emerging technologies that could disrupt existing industries.”

In August 2021, they announced an investment in Rimini Street, a provider of enterprise software support services. This investment is an example of Insight Partners’ focus on disruptive technologies and emerging markets, as Rimini Street is reimagining conventional enterprise software support services and expanding into new market.

The investor has also emphasized the importance of having a deep network of experts in the tech industry, which is a key part of Insight Partners’ investment strategy. According to Horing, having access to a diverse group of experts provides Insight Partners with the resources, expertise, and networks needed to support portfolio companies and help them achieve their goals.

He said: “We have a deep network of experts in the tech industry that we can draw upon for resources, expertise, and networks. This helps us to support our portfolio companies and help them achieve their goals.”

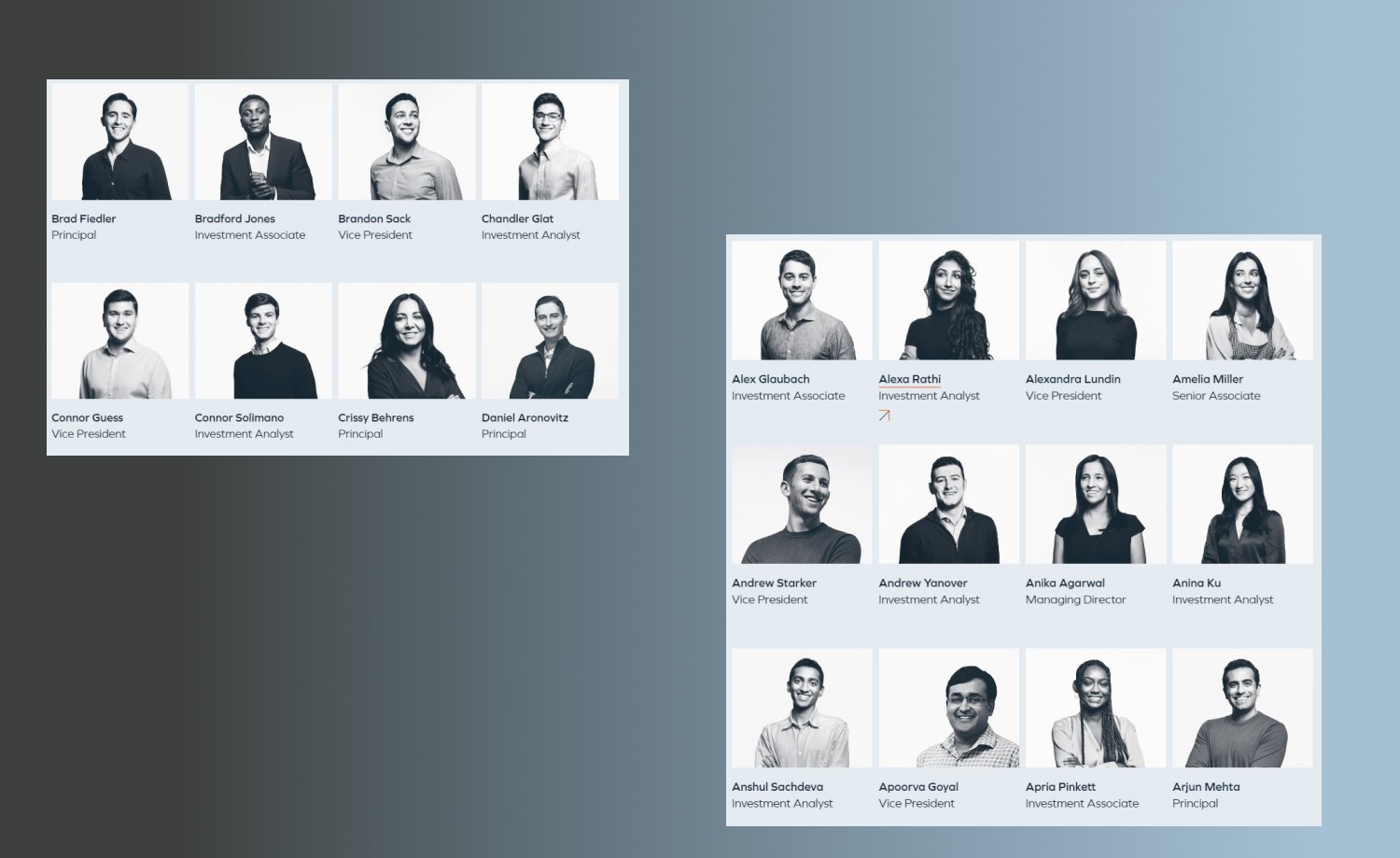

This network includes experts in various areas of technology, such as software engineering, data science, and cybersecurity, as well as professionals with expertise in areas such as marketing, sales, and finance. This broad range of expertise enables Insight Partners to provide portfolio companies with the guidance and support they need to succeed.

Investing in the Future of Technology and Beyond: Global Expansion

The company’s success in investing and supporting high performers is evident not only in their portfolio of successful investments but also in their ability to raise significant amounts of capital for future investments.

The latest example of this is their most recent fund, Insight Partners XII, which was announced on February 24, 2022, and raised a total of $20 billion. This brings the total amount of capital raised by Insight Partners to an impressive $46.1 billion across 11 funds.

More remarkably, Insight Partners, under the leadership of Jeff Horing, has been expanding its presence globally with a particular focus on Europe and Asia. The firm opened new offices in London and Tokyo, recognizing the significant potential for investment opportunities in these regions.

“We see tremendous opportunities in Europe and Asia, and we believe that having a physical presence in these regions will help us to identify and invest in promising startups and entrepreneurs. We’re excited to be opening new offices in London and Tokyo and to work with talented founders and management teams in these regions.” – he stated.

The expansion has allowed the firm to tap into the diverse talent and expertise available in these regions, and also to better serve their portfolio companies operating in these markets. With the London office, Insight Partners has been able to make strategic investments in European companies, while the Tokyo office has enabled the firm to identify and invest in promising technology startups in Japan and other parts of Asia.

“Having a global presence is essential for a modern venture capital firm. It allows us to identify promising investment opportunities in emerging markets and to provide portfolio companies with access to new resources and networks,” he proudly shared. “We’re committed to expanding our presence globally and to providing our portfolio companies with the support they need to succeed.”

The firm’s increased investment in emerging technologies and trends, such as artificial intelligence, cybersecurity, and cloud computing, reflects their focus on investing in innovative companies that are shaking up conventional industries and nurturing new markets. These technologies have been rapidly advancing in recent years and are expected to continue to be a driving force in the tech industry in the coming years.

Insight Partners has also been investing in companies that are focused on social and environmental impact, highlighting their commitment to investing in companies that align with their values. For example, the firm was an early investor in Pluralsight, an online learning platform that provides education and training opportunities for underserved communities.

“We believe in the transformative power of education and training to help underserved communities achieve their full potential. Pluralsight is a leader in this space, and we are excited to support their mission and growth.” – Horing stated.

Bottom Lines

“Investing is a long-term game. You need to have patience and discipline and be willing to ride out the ups and downs.” – Horing said.

Jeff Horing’s success as a venture capitalist and investor is not just attributed to his technical and management skills, but also his values and vision. His focus on building sustainable and socially responsible businesses, as well as his hands-on approach to supporting portfolio companies, has helped to set Insight Partners apart in the industry.

The future of Insight Partners looks bright as the firm continues to expand globally, invest in emerging technologies, and support sustainable businesses that have the potential for long-term growth and success.