Nurturing Seeds for Pivotal Changes – That’s How This Silent Backer Speaks to the World!

The dotcom bubble burst over 20 years ago, leading many tech businesses’ stocks to plummet. Whilst some companies, such as Amazon, recovered swiftly, many others were left in ruins. Technology has evolved in almost every single aspect in the two decades since the catastrophe.

We may believe that our technology is superior in a world where everything is digitalized. The internet, smartphones, and personal computers are all mature technologies that have been extensively accepted for ages. Emerging technologies, on the other hand, such as quantum computing, autonomous vehicles, and blockchain, are still in their early stages of development.

While some technologies may still have room for improvement and refinement, Four Cities Capital shows up to nurture those seeds that are still in their infancy. The company is a venture capital firm headquartered in Newton, Massachusetts. The firm attempts to make minority investments in seed-stage, early-stage, and later-stage software and technology companies.

Having been active for years as an investor, but this backer seems to not make any headlines. It’s reasonable because this capital firm wants to put 100% effort into nurturing talents. However, we can have a quick “getting to know” game with a little information published. First, let’s take a look at their team.

Four Pillars Cement a Strong Foundation

Leadership is essential to the success of any business because it sets the tone and leads the organization’s strategic direction. A good leader inspires and motivates their team, creates a great work environment, and promotes innovation and progress.

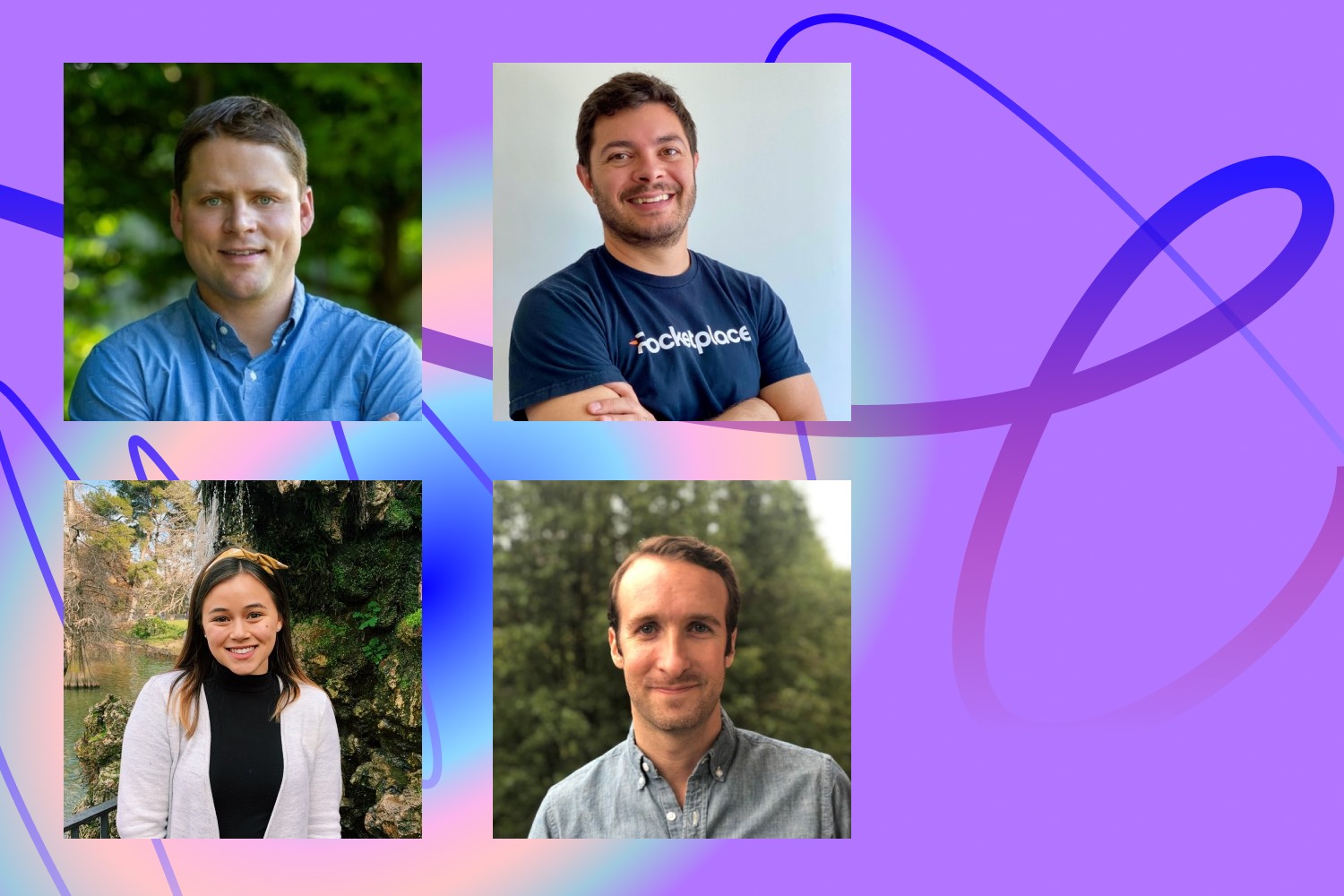

In the Four Cities Capital narrative, they have an incredible operating team that has kept the firm functioning smoothly for years.

Let’s start with Matthew McKnight. He is the Chief Commercial Officer of Ginkgo Bioworks in addition to his role at Four Cities Capital.

Prior to joining Ginkgo, he worked for IndUS Growth Partners for seven years and was the President and COO of Decision Resources Group, which specialized in health tech/data and the life sciences industry.

Matt has worked as a business development support specialist at Palantir Technologies and is an active seed stage venture investor. He began his career as an officer in the United States Marine Corps.

Matt graduated from Dartmouth College with a history degree and from the joint degree program at Harvard Business School and the Harvard Kennedy School of Government, where he was a Zuckerman Fellow.

Louis Beryl, the founder and CEO of Rocketplace, his third venture-backed firm, is up next.

Previously, he founded and served as CEO of Earnest, a data science-driven lending platform founded to improve the credit system in the United States. Earnest was purchased by Navient in 2017 for $155 million, and it is now one of the nation’s leading student loan refinancers. Louis is a mentor at First Round Capital and a part-time Partner at Y-Combinator.

Prior to Earnest, Louis was a Partner at Andreessen Horowitz and co-founded SolidEnergy, a battery technology company. Louis is a Princeton University graduate and a Baker Scholar in the joint degree program at Harvard Kennedy School of Government and Harvard Business School.

Furthermore, Mia Nguyen works as the firm’s Operating Principal.

As the only full-time employee at Four Cities, Mia keeps the machines running. She was previously the Chief of Staff at Underscore VC. She is also an All Raise volunteer and a WISE advisor – both of which focus on diversifying the tech industry. Mia earned a degree in finance and global social entrepreneurship from Northeastern University.

Finally, Ethan Bernstein, an Investor & Advisor at the flagship, should be mentioned.

He was previously the co-founder and CEO of Freebird, an insurtech that assisted travelers during flight delays. Four Cities participated in numerous rounds of funding for Freebird, including the inaugural seed round. Capital One purchased Freebird. Ethan formerly worked in corporate development, private equity, and financial services.

In addition to his job at Four Cities, Ethan serves as an advisor to many VC-backed CEOs and is (finally) finishing his degree at Harvard Business School after a 7-year hiatus.

These four individuals already have their name imprinted in the industry. What unites them is the gap between the idea that recent technology advance is mature and the reality that we are only at the start of profound changes in how our global system runs.

This viewpoint advantages long-term investors who are ready to invest across asset classes and look across cycles. This mindset also plays a main role in the way they invest, with most of the deals in Series A.

The Illusions on the Maturity of Technology

While many technologies have matured and become widely adopted over the years, there are still some areas where technology is not yet mature enough to meet all of our needs.

Major global industries and significant portions of humanity stay structurally unaffected by the digital revolution and the recent appearance of greatly disruptive technologies based in biology, new materials, and artificial intelligence/unmanned systems.

However, being at the pilot stage, these industries are facing several challenges.

Biotechnology is changing the way we think about health, medicine, and agriculture. Even without the impact of COVID-19, various biotech trends have accelerated innovation.

However, the biotech industry faces a number of challenges that are impeding its growth and widespread adoption. The high expense of biotech research and development is one of the most critical obstacles. Developing new medications and biotech solutions can take many years and cost an average of $1 billion.

Furthermore, 98% of biotech executives report revenue losses as a result of regulatory changes, with more regulations likely to be implemented in the future. This puts increasing pressure on medicine pricing and approval, limiting access to biotech options for many people.

The biotech business faces substantial regulatory challenges. Compliance with various rules is costly and time-consuming, and additional restrictions may increase pricing and drug approval pressure, limiting access to biotech solutions.

Following that comes new materials technology, which confronts a number of problems that restrict its growth and application. The high expense of research and development, as well as production, is a big challenge.

Another issue is the lack of new material standardization and norms. When new materials are developed, there is frequently a lack of established standards and regulations for their use and disposal.

As the demand for environmentally friendly materials grows, the industry must find innovative ways to develop sustainable and eco-friendly products. However, developing sustainable materials that meet performance requirements while staying cost effective remains a tough puzzle for the industry.

The Chat GPT has recently made news in every press release you can find. However, many people recognized that AI-empowered emerging technology is still in its infancy because it requires a significant amount of effort to complete.

AI algorithms are susceptible to a variety of flaws, including inapplicability outside of the training area, bias, and brittleness (the ability to be easily tricked).

One of the most serious risks of AI is techno-solutionism, the belief that AI is a panacea when it is only a tool. As AI progresses, the temptation to apply AI decision-making to all societal problems grows stronger. However, technology frequently creates larger problems while attempting to solve smaller ones.

These limitations above add to the immaturity of technology in our modern world. It looks cool and helps people in almost everything today. However, since holes are still on the fabric of the technological surface, Four Cities Capital has something to do.

There is a huge gap between the sense that our recent technological advance is mature and the fact that we are only at the start of profound changes in how our global system runs.

Four Cities Capital is willing to bridge that gap. And their method is becoming a global seed and series. A financier.

Series A funding is critical for startups since it provides the funds required to scale their operations and bring their product or service to market. This investment round is often held after a firm has completed its seed round and proven its concept by garnering momentum and user or customer validation.

The capital seems to be the professional in nurturing these talents and offering them enough instruments to translate their ideas into cash and value. Let’s look at some of their deals to see if their claim aligns with their actions.

The Backer Nurtures Disruptive Moonshot Ideas

One of the first deals of the firm could be named Pigeonly in 2014, a subscription-based platform that makes it easy for people to search, find, and communicate anywhere in the world.

They have a culture of collaboration based on hacking ideas, code, and business models. It creates technologies for the underserved and overlooked.

That’s meaningful and important. However, it is only the first step in Four Cities Capital’s grand plan to fix the world.

The capital is the typical example of who supports the minority. Four Cities Capital invested in Jopwell in 2015, a career platform that assists Black, Latino/Hispanic, and Native American students and professionals in unlocking chances for career progression not only when looking for a job but at all stages of their careers.

Apart from offering companies cash to provide more access to the undeserved community, the capital firm is also an active investor in the medical field.

Circle Medical, for example, provides primary care doctors in-person at your home or workplace. Or Thirty Madison, a family of specialist healthcare companies committed to achieving outstanding results for everybody.

Not to mention Dr. Treat, a pet health and wellness firm that delivers tailored pet care and is reinventing the approach to companion animal health and wellbeing.

Aside from healthtech, software and artificial intelligence (AI) are tenet targets in their investment philosophy.

The corporation invested in Kadence, a hybrid working software company that coordinates people, places, and projects, in 2022. It aspires to build a society in which everyone has the opportunity, resources, and atmosphere to accomplish their best work, no matter where they are.

Or Meez Culinary Solutions, a SaaS company that transforms recipe content including videos and pictures into an interactive database. Meez Culinary Solutions assists its users in the following areas: ideation, organization and search, collaboration, sharing, and execution.

The backer also has a stake in the payments business, having invested in Paytrix, a platform that provides payment and banking infrastructure to software companies.

Paytrix integrates a regulated curation layer into their network, allowing businesses to instantly expand their payments operations abroad.

Cushion, a venture backed FinTech business that is revolutionizing the way consumers pay their recurring expenses, is another example in this area.

And with their claim to invest in new materials and resources, they have backed several business stars, one remarkable name is Lygos, a company that provides biotechnology solutions for today’s renewable chemical challenges.

They engineer microbes to convert sugars into high-value, industrial chemicals, targeting compounds where biological production is cost-advantaged over petrochemical production.

Cryptocurrency is also the field that draws much attention from the backer. They have backed Cashmere, a safer crypto wallet that secures treasury. It transfers funds using the multi-signature signing feature, which combines the flexibility of hot wallets with the storage security of cold wallets.

When we mention this backer, its wide network cannot be excluded of the topic.

The FourCities network comprises Coatue, IT Modern Treasury, Ginkgo Bioworks, RES, Marqeta, Opendoor, Y Combinator, Greylock Partners, BOND, Khosla Ventures, Sequoia, 8VC, Fifth Wall, Accel, Hippo, Robinhood, Index Ventures, Andreessen Horowitz, Pie, Deel, Harvard Business School, Earnest, Founders Fund, SoftBank, Relativity, Benchmark, KPCB, NfX, Spark, Instagram, Felicis Ventures, and SpaceX.

Besides, Four Cities Capital presents a collection of high-growth companies that have been making waves in their respective industries.

In that list, we could name Airspace Intelligence, Boom, DG Deepgram, Human Interest, Just Appraised, Alpaca, Bubblehouse, Drip Capital, Jasper, Landed, Anchor, CareRev, Gecko Robotics, Jeeves, Mashgin, Aven, Deel, HomeLight, Joy, and Modern Treasury.

No Stones Left Unturned for Greater Goods

Four Cities Capital has made a total of 152 investments to date. Their investment portfolio spans across various sectors and industries, including technology, healthcare, and consumer goods.

Their most recent investment was made on January 1, 2023, when they invested $3.5M in Craftwork, a startup that specializes in creating handmade artisanal products. This investment is a testament to Four Cities Capital’s commitment to supporting innovative startups with promising growth potential.

In addition to their general investments, Four Cities Capital has also made a conscious effort to support diversity in the startup world. They have made a total of 23 diversity investments, which represents approximately 15% of their overall investment portfolio.

Their most recent diversity investment was made on October 20, 2021, when they invested $2.6M in Windsor.io, a startup that provides cloud-based HR and payroll management solutions. By investing in diverse startups, Four Cities Capital is helping to drive innovation and growth in underrepresented communities.

Over the years, Four Cities Capital has had 18 exits, which means that they have successfully sold their stakes in 18 of their portfolio companies. Some of their notable exits include Simple Habit, Lygos, and Circle Medical. Simple Habit is a meditation app that was acquired by Headspace in 2019, while Lygos is a synthetic biology company that went public in 2021.

Circle Medical, on the other hand, is a healthcare startup that was acquired by VillageMD in 2020. These successful exits demonstrate Four Cities Capital’s ability to identify and invest in startups with strong growth potential, ultimately resulting in successful outcomes for both the startups and the firm itself.

Bottom lines

As 2022 drew to a close, companies must forge a path in a market characterized by unprecedented challenges and unbridled opportunities brought about by technology.

Undoubtedly, the Covid-19 pandemic has reimagined the technological landscape, accelerating demand for digital innovation and challenging even the most advanced manufacturing facilities.

2023 brings a unique set of challenges to companies. Addressing challenges will distinguish the companies that survive – and thrive – from those that fall by the wayside. That’s always been the mission of Four Cities Capital. Since the world is still broken, there remain lots of things for this “superhero” to do.