Nikola Motors: The Ups & Downs of The So-Called “Tesla 2.0”

Another week, another rocketship rise in value for a newly founded car maker. Previously, it was Tesla outstripping the market values of car manufacturers with a century’s heritage. Now it’s the turn of Nikola Motors, a brand that takes its name from the same source as Tesla and has similar designs on changing the future of transport.

Similar but different. While Tesla started by making saloons and SUVs, and has only recently moved towards making hard-working vehicles such as pick-up trucks and lorries, Trevor Milton, Nikola founder and executive chairman, says trucks are the only way to go.

Nikola Pre-Scandal: A Big Rival Against Tesla

Founded in 2015 by Trevor Milton, Nikola Motors is one of several startups competing to find ways to accelerate the move to clean energy in the auto industry. Nikola has specifically targeted trucks, which have been more challenging because of the weight of batteries needed to power them. While Nikola plans to use batteries at first, Milton focused on the potential of hydrogen as a source of non-fossil-fuel energy for the trucks. Hydrogen hasn’t been tried in the auto industry in any real way because of its cost.

The name Nikola comes from Nikola Tesla, a Serbian-born scientist, largely forgotten in his day, but whose reputation has been revived and even partially deified in recent years. Of course, another company had already used the surname, but Elon Musk’s Tesla has so far focused entirely on battery power for its vehicles, eschewing – even being dismissive of – hydrogen power for vehicles. The hydrogen-versus-battery debate is likely to be the most significant one in car making for the next decade, at least.

Long story short, the electrification of transportation won’t stop with passenger cars. It will extend into commercial trucks, too. And that’s where Nikola is positioning itself to be a big winner as the mass electrification wave sweeps across the transportation sector over the next decade.

The company has created two market-leading, zero-emission commercial truck prototypes: a battery electric vehicle (BEV) truck and a hydrogen fuel cell (HFC) truck. Both trucks have wide-ranging benefits over traditional diesel commercial trucks.

They will be cheaper, with all-in costs of about 95 cents per mile (and falling), versus 97 cents per mile for diesel trucks. Their costs will be more certain, with limited reliance on volatile fuel prices. Not to mention, they will be clean, while diesel trucks account for 39% of the transportation sector’s greenhouse gas emissions.

Nikola’s trucks will also be modern (one look at the average diesel truck shows that those trucks are far from modern) and built on a software system that can seamlessly integrate autonomous technology.

In other words, Nikola’s trucks are light years better than what’s currently out there. They are trucks designed for the 2020s.

As a result, strong demand for these next-gen trucks are inevitable. Indeed, Nikola’s FCEV truck has racked up over 14,000 pre-orders totaling more than $10 billion from the world’s biggest trucking and fleet companies. And that’s just the tip of the iceberg. In North America, 400,000 commercial trucks are sold every year.

Over the next decade, Nikola will leverage its pioneering technology platform to increase adoption of its next-generation, zero-emission trucks in that huge market. As a result, its revenue and profits will soar.

Surge Before the Storm

For most of this year, Milton and Nikola were rolling along amazingly well, leaving a trail of dust as they shifted into high gear. Nikola became a public company, with shares trading on Nasdaq, after a reverse merger with a firm, VectoIQ, which had raised money with the purpose of completing an acquisition with a technologically advanced automotive partner. That helped catapult Milton to becoming one of the wealthiest people with direct business ties to Arizona.

Milton’s enthusiasm sometimes bordered on hyperbole. “Everyone else is now following Nikola,” he declared during the Phoenix unveiling two years ago at the Arizona Science Center. He cited Tesla and Daimler (which recently began an electric-truck venture with Knight-Swift Transportation Holdings of Phoenix).

In a company video filmed at the company’s new headquarters and research center in Phoenix, Milton described how he founded Nikola in his basement, like some of the best companies in the world:

“A company that came out of a basement built the most advanced semi-truck the world has ever seen in an environment that all the other manufacturers said could never be done, and we proved them wrong,” he said. The next four or five years for Nikola, Milton predicted on another occasion, “is going to be one of the greatest stories ever told.”

In a 2016 press release, he boasted that Nikola had engineered the “holy grail” of the trucking industry. “We are not aware of any zero-emission truck in the world that can haul 80,000 pounds more than 1,000 miles and do it without stopping.”

And, for flash, there was the 2019 purchase of the 2,600-acre Utah property, located on water, that featured eight bedrooms, 8.5 bathrooms, a gym, a tennis court, and a helicopter pad. He and his wife, Chelsey, also own a multimillion-dollar home in Phoenix.

Meanwhile, Nikola’s corporate facility on Broadway Road south of Sky Harbor International Airport features a “world-class gym” and “the largest hydrogen station in the Western World,” he declared, along with an organic-foods kitchen.

The Controversy Around Trevor Milton

September 2020 couldn’t have started better for the college-dropout visionary behind Nikola after the Phoenix-based truck manufacturer inked a landmark deal with General Motors (GM) to build zero-emission pickups and his personal net worth soared to around $6 billion.

But three weeks later, Trevor Milton was humbled, self-muzzled, out of a job, worth $4 billion less and facing an onslaught of legal threats — from federal investigations to sexual assault allegations.

Prior to launching Nikola, Milton, now 39, said he founded four other companies including a security/alarm business, an online used-car platform and a company that claimed to convert trucks to run on compressed natural gas. That business was sued by Phoenix-based Swift Transportation, now part of Knight-Swift Transportation Holdings, over allegations of lackluster product performance, insufficient deliveries, and other issues.

The Hindenburg Report Blows Up

Shortly after General Motors (GM) and Nikola announced their partnership to manufacture all-electric pickups, Hindenburg Research dropped a bombshell. The small New York investment firm, which has sought to profit from Nikola’s woes by shorting the company’s stock, alleged widespread duplicity involving the company, its vaunted technology and Milton.

In its report Sept. 10, just two days after the General Motors announcement, Hindenburg called Nikola “an intricate fraud built on dozens of lies” and claimed to have gathered extensive evidence including recorded phone calls, text messages, emails and photographs detailing dozens of what the firm said were false statements by Milton.

As one example, Hindenburg alleged that, amid questions about the functionality of the Nikola One big rig, the company staged a video showing a semi-truck cruising on a road. In reality, Hindenburg said, Nikola had the truck towed to the top of a remote hill and filmed it coasting down — footage that was included in the sleek promotional video shown at the Arizona Science Center two years ago.

Hindenburg said it located the road where the video was taken, describing it as a straight, little-used, two-mile stretch near Grantsville, Utah, with a 3% grade — “enough of a slope to get a motor-less truck rolling.”

Nikola countered that the report was “replete with misleading information and salacious accusations” directed at Milton but didn’t repudiate the video footage.

“As Nikola pivoted to the next generation of trucks, it ultimately decided not to invest additional resources into completing the process to make the Nikola One drive on its own propulsion,” the company said, though it insisted the prototype vehicle had functional parts.

According to media reports, Hindenburg’s allegations prompted the U.S. Securities and Exchange Commission and U.S. Department of Justice to investigate whether claims made by the company, and Milton in particular, might have misled investors. Nikola has acknowledged that its attorneys have briefed SEC investigators. The legal threats got worse for Milton on Sept. 29, when two sexual-abuse allegations surfaced.

What’s So Good of Nikola That It Isn’t Collapsing?

Now, with the executive chairman gone and shares of the electric truck maker down about 80% from their peak, the company must rely on the strength of its business model. That model attracted auto sector luminaries, big-name investors, and industry giants. But it depends on delivering “big technological advances” and “dramatic cost reductions.”

A new note from RBC Capital Markets explains why electric and hydrogen truck startup Nikola may be poised to succeed despite now-departed founder Trevor Milton’s allegedly false claims about its progress and tech.

“What made Nikola unique was the opportunity to sell ‘routes’ via fuel cell truck leases, and helping industry solve ‘chicken and egg’ problem associated with hydrogen infrastructure build-out.” Yet analysts say Nikola must “rebuild credibility” and the stock will remain in the “penalty box” while that happens.

“If they’re able to succeed, this could potentially create a first-mover advantage and a feedback loop allowing them to sell more trucks.”

Affordable Hydrogen Fuel Cells

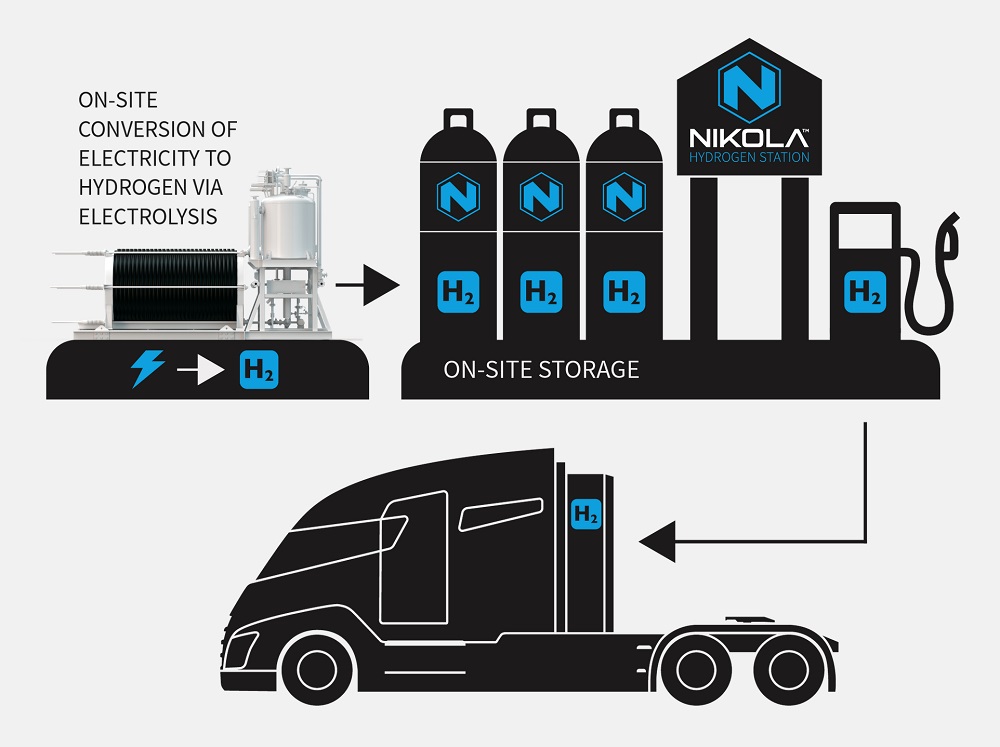

The company’s big insight was that hydrogen-powered vehicles could be economical if the same company that built them also sold the fuel to run them. The sale of the fuel would pay for the hydrogen station network needed to make hydrogen-powered trucks viable. That solved the ‘chicken and egg’ problem—no one would buy the trucks without a place to fuel them.

Ultimately, hydrogen costs have to come down for it to be a viable fuel source in the heavy-duty trucking and auto markets. Nikola believes it can get the cost of hydrogen down to $2 to $3 dollars per kilogram by standardizing equipment and buying electricity responsibly. Hydrogen can be made by separating the element from natural gas or from water. Nikola is taking the water path.

To make hydrogen from water, Nikola needs electricity. It takes, perhaps, 50 kWh of electricity to make a kilogram of hydrogen. (For comparison, this Barron’s household used about 900 kWh of electricity last month.) Nikola wants to pay low rates for electricity so the electricity feedstock could cost as little as $2 per kilogram of hydrogen. This is a rough approximation—Nikola didn’t comment on its hydrogen cost breakdown.

Making hydrogen from steam methane reforming, which is more common, is even cheaper than electricity. The feedstock, natural gas in this instance, is about 50 cents to $1 per kilogram of hydrogen. The money is in the storage and transportation of the hydrogen gas.

Nikola will have the hydrogen gas on site at its facilities. In addition to electricity, the company will have the capital, maintenance, compressor, and storage costs to consider. Going from $16 to between $2 and $3 is a big drop, but hydrogen for transportation is still new and not widely available. Scale could drive down costs significantly.

Water, of course, is the other feedstock, but it’s relatively cheap. Residential water prices in Connecticut, for instance, are roughly a penny per gallon. Water feedstock for hydrogen production via electrolysis, or methane reforming, works out to pennies per kilogram.

(In fact, water is, often times, priced for farmers by the acre-foot. That is an acre covered by a foot of water. It’s a lot of water—about 326,000 gallons.)

This is all a bit of fun with hydrogen numbers. But this math will matter for stock prices. If hydrogen prices get down to $2 to $3 a kilogram, they will be low enough to keep the hydrogen industry trucking. Prices aren’t there yet, but these numbers can help investors who are wondering if it’s possible.

A New Chapter for Nikola Corp After Milton’s Exit

Milton resigned Sept. 20, though he still retains a controlling interest in the company with a net worth, primarily consisting of Nikola shares of about $2 billion. The company’s stock closed September around $20 a share after briefly topping $54 the day of the GM announcement.

“Founding Nikola and growing it into a company that will change transportation for the better and help protect our world’s climate has been an incredible honor,” Milton said in a prepared statement announcing his resignation.

The company said it “remains committed to achieving” a set of milestones previously outlined despite Milton’s exit amid claims of fraud involving the company that have reportedly led to investigations by the Securities and Exchange Commission and Department of Justice.

“With support from our business partners and suppliers, we are focused on executing on our strategic initiatives and laying the groundwork to become a vertically integrated zero-emissions transportation solutions provider,” the company said in a press release.

Above all, the company needs to execute on its strategies and prove to naysayers that it can deliver high-quality, zero-emissions vehicles while building out an ambitious hydrogen fueling network.

Stephen Girsky, a VectoIQ managing partner and former General Motors vice chairman, was appointed Nikola’s chairman. The rest of the senior leadership team is intact, including Mark Russell as CEO and Kim Brady as chief financial officer.

“Trevor saw the possibility of creating an end-to-end zero-emission transportation system when the industry was still in its nascent stages and took action to build the Nikola of today, with world-class partnerships, groundbreaking R&D and a revolutionary business model,” he said in a prepared statement.

The company’s many partners and big customers have mostly stayed on board, including Phoenix-based Republic Services, which in August announced a deal to purchase 2,500 electric-battery garbage trucks and recently reiterated its goal of working with Nikola as it transitions to a zero-emissions fleet.

Ambitious Goals Ahead

Nikola, meanwhile, has laid out an execution timeline that includes the start of testing of its Nikola Tre snub-nosed cab before the end of this year.

The goals for 2021 are even more ambitious and include completion of a batch of test trucks and a manufacturing facility in Germany, breaking ground on a commercial hydrogen station, starting production of the Tre in Germany and finishing the first phase of Nikola’s plant in Coolidge, with expected completion in 2023.

The company also affirmed Nikola’s intention of continuing to bring together strategic business partners and suppliers to improve commercialization timelines, build long-term competitive advantages and more. Nikola’s big industrial partners are sticking with the embattled company, providing another sign it’s positioned to survive the tumult for now.

German industrial conglomerate Bosch, which is providing components for a planned hydrogen semitruck, is still on board. And Nikola’s top finance exec said at an investor event yesterday that Bosch and CNH Industrial — the European company slated to manufacture the Nikola Tre — remain partners.

Also, GM still plans to build Nikola’s Badger pickup and supply tech for its heavy trucks, and fleet owners that placed semi orders haven’t bailed. The multi-billion dollars deal could radically change the future of Nikola, allowing the smaller company access to GM’s considerable infrastructure and resources.

While Nikola has yet to generate any meaningful revenue, theoretically it could still, under new leadership, start producing and selling successful hydrogen vehicles in the years to come. Despite the company’s rocky start, that would be a good thing for a world in desperate need of low-carbon shipping. Currently, the Nikola story is one more piece of evidence that start-up founders aren’t the climate saviors they and their rich, gullible investors seem to think.