Michael Kors – the Rise, the Fall, and the Alarming Changing Retail Ecosystem

While Michael Kors is a clothing brand that has been around for 40 years, its designer has a story that dates back to the 70s.

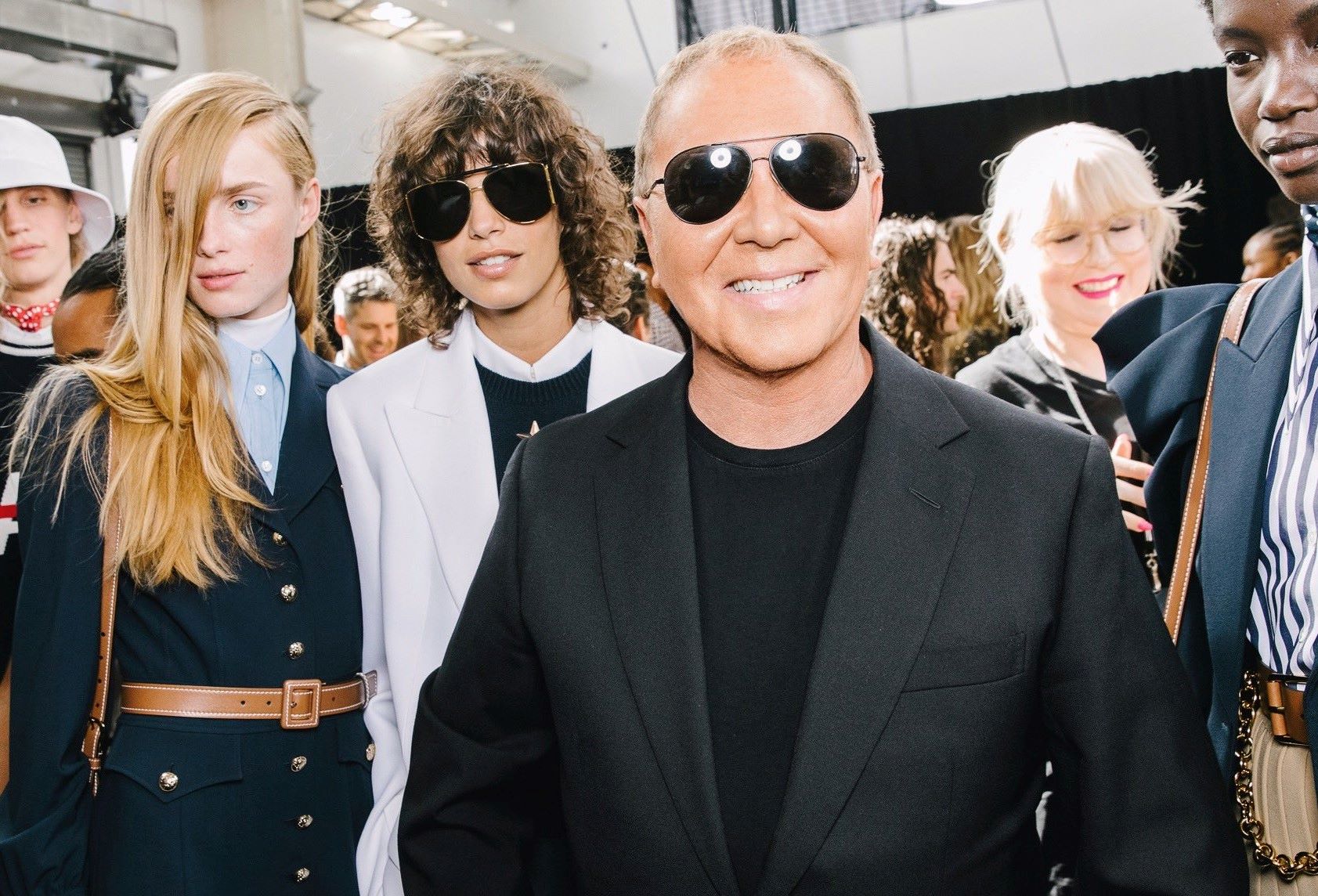

In 1977, he enrolled in New York’s Fashion Institute of Technology but dropped out soon after, to begin working at the Manhattan boutique Lothar’s. At Lothar’s Kors birthed his own line of design and it was such a hit that got pick up by Bergdorf Goodman. Shortly thereafter, Kors debuted his own label Michael Kors founded in 1981 at New York Fashion Week and developed his own fan base as celebrities like Barbara Walter, Demi Moore and Julia Roberts wore his. However, recession of the early 1990s forced the designer to seek bankruptcy protection. Even after that the designer still have faith in his dream. Kors began designing for the French brand Céline around 1997, and eventually became the brand’s first creative director. In 2003, Kors exited Céline to refocus full-time on his own brand, supported by an investment from Silas Chou and Lawrence Stroll.

The Designer’s Story from Bankruptcy to Billionaire Clubs

In 2004, Kors appeared as a regular judge on the newly debuted and massively popular reality television series Project Runway, making Michael Kors a household name across America thanks to his punchy humor and witty commentary. That, along with the brand’s strategic formula, combining a streamlined American “jet set” aesthetic with “affordably luxury” price points, has helped rocket the success of Michael Kors and his firm.

In 2006 the first Michael Kors “lifestyle” retail store was opened, after a long time hanging in apartment stores and malls.

In 2011, as Michael Kors was listed on the New York Stock Exchange, just later that year the company raised more than $900 million, which had valued the company at more than $3 billion, making it the largest fashion IPO in history.

Talk with Kors On His Designs

Like every industry, every clique and every club, there is a code. In the code of fashion, for something to be wearable or commercial, means it is appropriate for the mainstream but not always at the edge of fashion, not always pushing the envelope. It is a complaint often directed at Kors, who makes commercial clothes – cloths that we all want to wear, clothes that sell. “I think the stupidest thing that anyone talks about is that it’s a bad thing that what you do is wearable and commercial,” he says.

So, what is a jet-set lifestyle? Jet-setting is captured mostly in entrepreneurs, either they are on a work trip or vacation yacht, Michael Kors wants to address that high-class symbol of a modern person and make it the brand’s personal catch phrase. Which has made a grand branding success since luxury look at affordable price is what the public love most around the time.

Michael Kors – The Brand’s Story

Michael Kors is famous for its “jetset” lifestyle, where we can see the fashion mixture of elegance, style and casual. It covers a wide range of products including clothing, accessories, bags, and shoes, or even perfumes and beauty products. Luxury with accessibility is what shoppers know Michael Kors for.

The brand is divided into two main segments, included:

First, Michael Kors Collection – the luxury brand’s segment with prices ranging between $500-6,000 for handbags and leather goods, shoes, and clothing from $ 300-1200, $400-4,000. And the second one, MICHAEL Michael Kors Collection where products are more accessible with prices ranging between $200-800 for bags, between $45-200 for leather goods, shoes between $70-500 and women’s clothing among $50-500.

With these two different lines, the brand is allowed reach a larger and many different audiences. The affordable line still considered high-quality allows those who cannot afford the luxury segment to feel as if they are part of the MK world. People love Michael Kors because it is an affordable but still luxury brand.

Till now, Michael Kors or its cooperation Capri Holdings has acquired the two luxe buddies Jimmy Choo and Versace, which indicated the company strategy to expand as a conglomerate, to position its level in the upcoming decades, the exact scheme Coach or Tapestry is also applying with it grow path.

3 Reasons Michael Kors Is Leaving Behind

Firstly, it is overexposed. And this is no stranger to fashion brands, when a brand is overexposed it surely loses its uniqueness and rank of luxury. In brief, when everyone has the same bag, it no longer becomes a design of desire.

“Much of this is related to the brand image of Michael Kors. It is somewhat brasher than that of Coach, which is viewed as more of a heritage brand, and I think this has negatively impacted its efforts to become less ubiquitous and turn around its image,” Neil Saunders, CEO of consulting firm Conlumino wrote in an email to Business Insider.

Second, outlets have killed it status. How can you get consumers to pay a premium while they can get it on sale? Consider Gap’s Banana Republic, where the exact practice was happened. It’s common knowledge that as you went shopping for discounts, it is hardly that you would choose a brand, what you want is a discounting outlet. And the worst part is once a brand becomes known as an “outlet” brand, how could it be considered luxurious?

However, on this aspect, its CEO John D. Idol has found the solution. He announced that the brand would be ending its participation in friend and family discounts as well as department store couponing. “We think that this is critical for us to really do three things; number one, to protect our brand image,” CEO John D. Idol said on a conference call with investors. “Secondarily, we think it’s creating confusion in the consumers’ mind relative to the value of the Michael Kors brand, when it’s being seen so often on sale in so many different places,” he said.

Third, the next generation of customer reject Michael as a status symbol. The Millennials or Generation Z do not necessarily want the status or crave such high-end symbol the brand is bringing. This generation has a different view on this matter, they seem to be very financially practical, and is more likely to have a prefer fast fashion over these classic images said an analytical article on Business Insider.

According to NPD Group’s Consumer Tracking Service, compared with the same period three years ago, sales of women’s handbags and totes in the U.S. are down more than 20% over the first eight months of 2019.

Just last year, Piper Jaffray’s biannual survey showed teen spending on handbags had hit an all-time low in the survey’s 38-year history. It indicates an unfortune statistic as female teens are spending down from peak spending of $197, an average of $90 per year on purses.

The ballooning popularity of higher-end handbags, such as products from the LVMH house, analysts said – to some extent, has credited to the fact that secondhand sellers are flourishing, especially among younger shoppers. Not only do secondhand sites make products such as purses more affordable, but younger shoppers also see them as more sustainable.

Finally, department stores – the pain point of luxury brands as well. Malls have ruined their reputations as they cannot control how brands looks in a department store (unless it is a licensed section, like LVMH brand or cosmetic brand). Besides, promotions are another thing that is out of brand’s reach, since department stores like Macy’s always in need to bring in foot traffic.

“When you’re in wholesale there’s a lack of control in their brand, and ultimately the department store is going to do what they have to do to drive sales — and that includes promotional activity,” Gabriella Santaniello, analyst, and founder of consulting firm A Line partners, told Business Insider recently.

This is also a major reason to explain the strategic fall of Michael Kors in 2017 as well as an alarm for this unhealthy retail situation!

Michael Kors’s Fall and The Weak Retail Ecosystem

To address this problem, it was firstly the brand’s fault itself. On the race to maintain the double-digit growth, the company opened far too many retail stores along with a mass of available goods which has unfortunately reduced its status as a luxury label. As of 2017, with this fail attempt to lure shoppers away from its rival handbags Coach, Michael Kors has accidentally cheapened their image. Michael Kors CEO John D. Idol also admitted that the Michael Kors’ “product and store experience did not sufficiently engage and excite consumers.” In the same year, the company announced it will shutter between 100 and 125 of its full-price stores over the next two years in order to improve the profitability of its store fleet. Besides, the rise of e-commerce as well as a decline number of people buying merchandise at full price has led to a significant decrease in sales and drop in foot traffic to their stores.

However, Michael Kors is not alone in this: many retailers are struggling to attract consumers to their stores, with department stores being some of the hardest hit. Despite this, some brands that were previously online-only, such as Warby Parker, Casper, and even Amazon, have begun opening up brick-and-mortar stores. So, what does this say about the future of retail?

By opening up a physical location, brands like Warby Parker and Casper are showing how important experience is to the average consumer. Online shopping is a pretty uniform experience: there is no way for a brand to make it more exciting than it already is. But by elevating the in-store experience, brands can make shoppers excited to shop in-store. When it comes to the retail experience, it is all about how it makes customers feel. And by opening up too many stores and making their merchandise too widely available, Michael Kors inadvertently cheapened their experience in the eyes of their customers – making them less likely to return to their stores.

People do not go to a store purely to buy something. They go to have an experience, which is provided by the staff, the decor, the music – in other words, the overall ambience of the store. Starbucks is one company that has recognized this brilliantly; in fact, this is pretty much the core tenet of the Starbucks brand. But even as Starbucks tries to emphasize the relationship between customer and barista, between consumer and company, they are also constantly integrating innovative technologies to make the consumer experience as seamless as possible. Their mobile app and AI-powered barista are both designed to add to the experience, not mechanize the process. Michael Kors could learn from Starbucks’ example by incorporating technology in a way that does not feel intrusive, and that does not betray the brand’s core values.

There is also the Amazon model, where stores are equipped with sensors that track people as they pick items off of the shelves, and items are added to a virtual cart and charged to the customer once they leave the store. This kind of high-tech experience is unlikely to appeal to those shopping for luxury goods, but given the bleakness of the current retail landscape, it does not hurt to shake things up a bit. Ultimately, the future success of brands like Michael Kors depends on how willing they are to accept the future of retail. Change is coming, whether they like it or not.

Michael Kors and Some of Its Firm Strategies

Despite the hardships, the brand still managed to go forward with many of its solid strategies!

Try to Keep Up with Millennials

For a brand that started in 1981, Michael Kors is doing its best on social media to does not miss a beat with millennials. The New York-based digital impact measurement brand L2 has ranked MK #2, just behind Gucci, in the top 10 fashion brands in digital, crediting its “unbranded SEO performance and strong email marketing campaigns”, as well as its utilization of Instagram shopping tools, for MK’s digital IQ of 143. If, as L2 suggests, 70% of luxury purchases are influenced by online interactions, and 6% of their revenues come from online sales, then Michael Kors seems to be on the right track.

The HENRY Effect

Michael Kors’ marketing seems to target HENRY (“High Earners Not Rich Yet”), consumers. These are the people who make between $100,000 and $250,000. This segment is increasing steadily not just in the US, but all across the globe. Even after admitting the fact that HENRYs individually have a far lower spending threshold than ultra-affluent, there are 13 HENRY households for every ultra-affluent. That is why with a total of 22.3 million households, the HENRY segment is a critically important part of the consumer market. With $550 handbags and $350 watches, Michael Kors is becoming a better choice for HENRYs, as they can flaunt it without putting too much burden on the pocket.

Product Innovations

In the prospect about expansion plans for the Michael Kors brand, and Jimmy Choo, which the company acquired last year, John D. Idol, Michael Kors’ Chairman and Chief Executive Officer mentioned about the Runway 2020 plan, which was initiated last year to reposition the Michael Kors brand and take advantage of its luxury heritage.

As the retail business is a key focus as that represents the key growth engine for the company. Idol claimed Michael Kors is ahead of its plan, with about 65 percent of its products that is now neatly placed in store and all new merchandise designs.

He also said the Michael Kors brand has been focused on product innovation, and that the bellwether has been full price sell-through, which Idol said, “has been growing.” That is an indication that the consumer has been responding to the innovations to the product line, he told investors. Other areas of focus have been accessories and watches, women’s ready-to-wear and footwear.

Whether growing its Instagram following, or its customer database, Idol said the brand has rampantly been working on growing its brand engagement strategy. It has also announced the new Kors VIP as a tiered rewards loyalty program which has helped with brand engagement.

The company has also been investing in renovating its Michael Kors store base, such as at Roosevelt Fields and Short Hills in the Northeast and Beverly Center in California, as well investments in new store formats in London, Oslo, and Singapore. The plan is to renovate 200 more stores, Idol said.

The Bottom Lines

Michael Kors was truly had its moment in the peak of 2014, however, with a slight shift in operations, as of 2017 the biggest fall took place. Which wholesale drop is understandable, considering that Michael Kors, like Coach and others, has scaled back department store sales in its effort to fight the promotional environment there. Not yet to come out such problem, 2020 pandemic strike has completely knock out the industry.

In parts of the world where lockdowns have eased, business has begun to revive. However, demand for clothing and accessories from high-end fashion companies is not expected to rebound quickly as the global economy enters a deep recession and major retailers teeter on the brink of collapse.