Business Insider vs. Bloomberg: Will Business Insider Make It to The Top of The Media Race?

Business Insider is a leading online business news site covering a variety of categories including financial, media, tech, defense, and other industry verticals.

The site offers daily posts on hot topics in the news and is read by over 76 million visitors per month. Just started making money from subscription fees, the site has done good business from advertising. Later the company launched Tech Insider, a site aimed at technology news for consumers.

Business Insider was acquired by Axel Springer of Germany for $343 million for 88% of the company in September 2015. Axel Springer previously purchased a 9% stake in the company.

Amazon founder Jeff Bezos led a $5 million investment round in April 2013 and will still own 3% of the company following its acquisition.

Business Insider has raised over $18 million in venture funding from Institutional Venture Partners, RRE, Marc Andreessen and Allen & Co.

The site was first launched as Silicon Alley Insider on July 19, 2007, led by DoubleClick founders Dwight Merriman and Kevin Ryan and former top-ranked Wall Street analyst Henry Blodget. Of course, that was after Blodget was banned from the securities industry by the SEC in 2003 after working as an analyst at Merrill Lynch and for giving recommendations on stocks that contradicted what was published.

On What Ground Has Business Insider Not Yet Surpass Bloomberg?

Business Insider might be thriving than others, however, to compare with Bloomberg, there are still a lot to catch up since Bloomberg has been around decades ago.

Bloomberg News was founded by Michael Bloomberg and Matthew Winkler in 1990 to deliver financial news reporting to Bloomberg Terminal subscribers. The agency was established with a team of six people. Winkler was first editor-in-chief. In 2010, Bloomberg News included more than 2,300 editors and reporters in 72 countries and 146 news bureaus worldwide.

Bloomberg has enjoyed being the dominant player in what has essentially been an industry of one for most of its existence. That being said, the company has not taken that for granted, and in nearly four decades has grown its list of offerings tremendously.

However, there were legal troubles in its past, including a 2007 class action suit regarding female employees and maternity leave, and it has also faced challenges related to data breaches, as indicated above. Newcomers in the finance data analytics field have come and gone, but that’s no guarantee of Bloomberg’s dominance in the future. Still, though, it seems unlikely that this dominant company is going anywhere anytime soon.

So, on what ground has Business Insider not yet surpass Bloomberg? Even with its traffic growing fastest in the past year, No. 2 site Business Insider (up 81 percent to 40.8 million uniques) still lost in other fields.

For instance, Cost Per Thousand impressions (CMP), ad rates vary widely depending on what inventory you buy (display, video) and how you buy it (direct, programmatic). But anecdotally, buyers said Yahoo Finance and Business Insider command lower ad rates than do Bloomberg. At Bloomberg, the price quoted was $30-$50 compared to Business Insider of $20-$30 for desktop and tablet banner ad CPMs.

Will Business Insider Lead the Digital Publishing Race?

Business Insider has been able to build over the years a massive presence across several channels, and it has been able to adapt quickly to the changing digital landscape. With an editorial team of more than 300 journalists Business Insider site is the place where monetization happens and where the company can have control of its users and subscribers experience. Only for 11 years and the company has owned its place in the race, but to go further and own the game, will there be chance it does? Let’s break down a few of its business features to see what it’s got in hands!

How Does Business Insider Make the Most Out of Its Paywalls and Free Content?

The method of charging readers for news is so commonplace now that it’s almost hard to contemplate how revolutionary — and even radical — it seemed when The New York Times adopted it in 2011. At the time, many within the media industry doubted that paywalls would ever work. Not only were people skeptical that readers would pay for news, but they also feared that installing any type of paywall would destroy web traffic, in effect obliterating a news site’s ad revenue. However, the gambit paid off, to an astonishing degree. The Times recently announced it had reached 4 million digital-only subscribers that generate $400 million a year in reader revenue.

Which bring us to Business Insider’s approach to paid content — an approach that other publishers should consider when assessing their reader revenue strategy.

To understand how the company established its paywall, you first have to travel back to a time when most of Business Insider’s revenue was generated through advertising, which wasn’t all that long ago. For the first decade of its existence, it was largely a pageview factory; its writers would take information that was reported elsewhere and write it up in a punchier, blog-like format. It pioneered early web-traffic gimmicks, such as publishing slideshows that loaded a new page for every slide, thereby triggering another ad load.

Though it focused primarily on business and tech news, Business Insider slowly began expanding into other topic categories. It launched a politics vertical, for instance, hiring Josh Barro as a star columnist. Lifestyle and entertainment content started creeping onto its homepage. Remember, this was an era when niche publications like Mashable and PolicyMic were broadening their coverage in a VC-fueled quest to scale their web traffic.

But then the German media conglomerate Axel Springer bought Business Insider in 2015 for a reported $450 million. The company had just concluded a bruising fight with Google over the search giant’s right to display its content, and its CEO has long been a skeptic of the information-wants-to-be-free beliefs that many in the industry had adopted. “I see no justification, neither democratic nor market-related, for content to be generally free on the internet,” he told The Wall Street Journal in 2009.

It was around the time of the Axel Springer acquisition that Business Insider spun off a new brand called Insider. Helmed by Nicholas Carlson, Insider started as an operation mostly focused on creating short videos that it then distributed on Facebook, but it eventually established its own website. At that point, it slowly began migrating content verticals from the main Business Insider site to this newly established entity.

By 2017, Insider was publishing articles on food, beauty, and style. In 2018, three verticals that had, until then, been operating under Business Insider — politics, news, and military/defense — were also moved over to Insider, so that now Business Insider focused solely on business-related content. According to Carlson, most of the traffic for Insider comes through Facebook, and it relies almost entirely on programmatic advertising to generate revenue.

Meanwhile, Axel Springer did not wait long post-acquisition to begin developing Business Insider’s paywall strategy. To streamline this process, it brought over Claudius Senst, who at the time worked in Germany as the company’s SVP of business development. In his new role as head of consumer subscriptions at Business Insider, he immediately set out to assess how a paywall could be structured. “We spent a long-time testing what was the right fit for the Business Insider brand when it came to consumer subscriptions,” Senst said in a podcast interview last year. “… In late 2017, we started rolling it out to a broader audience.”

Business Insider Prime costs subscribers $12.95 a month, or $99 a year. But instead of debuting a metered paywall, Senst and the BI editors developed a system for differentiating the paywalled content from the articles that remained free. Under this framework, clicking on a Business Insider link could lead you to a free article or immediately trigger a pop-up requiring a user to log in and/or subscribe. When Senst was asked why he chose this model over a meter. “Where I struggle the most with the metered approach is that if I read three amazing, in-depth journalistic pieces and then hit a fourth story that’s just a short snippet of an article, and on that story I hit the paywall, I always feel betrayed as a user,” he replied. “I feel like ‘why is it asking me to pay now?’”

In other words: not every article is created equal. Sometimes a journalist just wants to write a bloggy column based on news reported by another outlet, and a publisher should feel free to publish that column without worrying if it’s “exclusive” enough to justify the paywall. By placing it in front of the paywall, in fact, the publisher could generate ad revenue while also exposing its brand to a larger audience. Meanwhile, readers are forced to pay for the content that truly is exclusive and exceptional.

So how does Business Insider differentiate between free and paid content? “The editorial leadership team knows best whether a story is need-to-know information,” versus “a story that you might be able to pick up somewhere else, where we might find that we have a different tone, but not an exclusive angle,” said Senst. “That is a decision that the editorial team performs for each and every story. Over time they get an understanding over what kind of story is a subscriber story, versus which story is a broader, general interest story.”

Grand Effort and Impacts Had Been Made with Transforming Business

Business Insider three weeks ago announces the latest iteration of Transforming Business, its annual editorial feature highlighting the work of business visionaries who are propelling innovation in their fields.

The Transforming Business series reports on a wide range of industries faced with disruption, including consumer tech, retail, energy, finance, supply chain, manufacturing, healthcare, enterprise tech, media, and advertising, and investing. The series profiles business executives and entrepreneurs, and features about what’s next in sustainability, technology, and innovation.

ING is a partner in the special series, which for the first-time spotlights 100 business leaders for each of three regions of the globe: North America, Asia, and Europe. The lists were compiled through extensive reporting by Business Insider’s editorial team. Among those profiled are Gwynne Shotwell, President and Chief Operating Officer of SpaceX; Ezinne Kwubiri, head of diversity and inclusion at Stockholm-headquartered H&M; and Malaysia-based AirAsia Group CEO Tony Fernandes.

Said Alyson Shontell, Editor-in-Chief of Business Insider: “A key part of Business Insider’s editorial mission is to report on the drivers of business transformation. During this extraordinary time, when business and society are facing unprecedented challenges, these stories are even more critical. Our reporters and editors have identified 300 transformative people — CEOs and activists, founders, investors, and inventors — whose influence resonates far beyond their own organizations.”

Said Mark Pieter de Boer, ING Wholesale Banking Chief Commercial Officer and Head of Sectors: “ING believes that progress is always possible and in people who pursue it in a responsible way. We support changemakers – people and companies that ignite, lead and advocate for sustainable change in the world. Even in this challenging year for global business, innovative leaders are proving it is possible to keep companies’ transformation efforts on track, or even accelerate change.

“That’s why ING is partnering with Business Insider to present the 100 People Transforming Business lists, and a series of special reports and articles providing leadership guidance from industry-specific perspectives.”

With this series, readers now would have a better view, especially business owner whose companies need transformation and innovation for the future. Not only Business Insider is exciting to release this series but also its readers crave for the fresh news.

What to learn from the way Business Insider Drive Its Dynamic Machine?

Business Insider has three primary revenue stream including advertising, subscription, and licensing. By looking at its business model and digital strategy, it is clear that Business Insider can teach us a few critical lessons:

#1. Combine old media with new digital channels:

Just like BI has been able to build a sizeable organic reach with its site, it also established a strong social media presence, and it can dominate new digital channels.

#2. Diversify revenue streams:

Advertising has been the traditional revenue stream for publishers in the last century and a half. Yet BI has invested massively to create alternative revenue streams, based on sponsorship agreements, licensing and high-priced subscription plans.

#3. Use news to generate buzz for editorial content:

BI uses what might be defined as an editorial barbell strategy. On the one hand, it covers stories that have a short lifespan but create short-term buzz also for the editorial side of the business which will have a broader spectrum and timeframe spectrum and timeframe.

#4. Target multiple customer segments:

In the business jargon, it is highlighted often the importance of identifying a customer persona. While this might work initially often, you might leave up significant opportunities on the table. Indeed, if we look at the organic traffic of BI, it is clear that it spans across several segments. Not only business professionals read BI, but also a broader base comprised of consumers. That is also why BI is expanding from B2B to B2C, which allows it to expand monetization, diversify its business in the long run and opens up new opportunities.

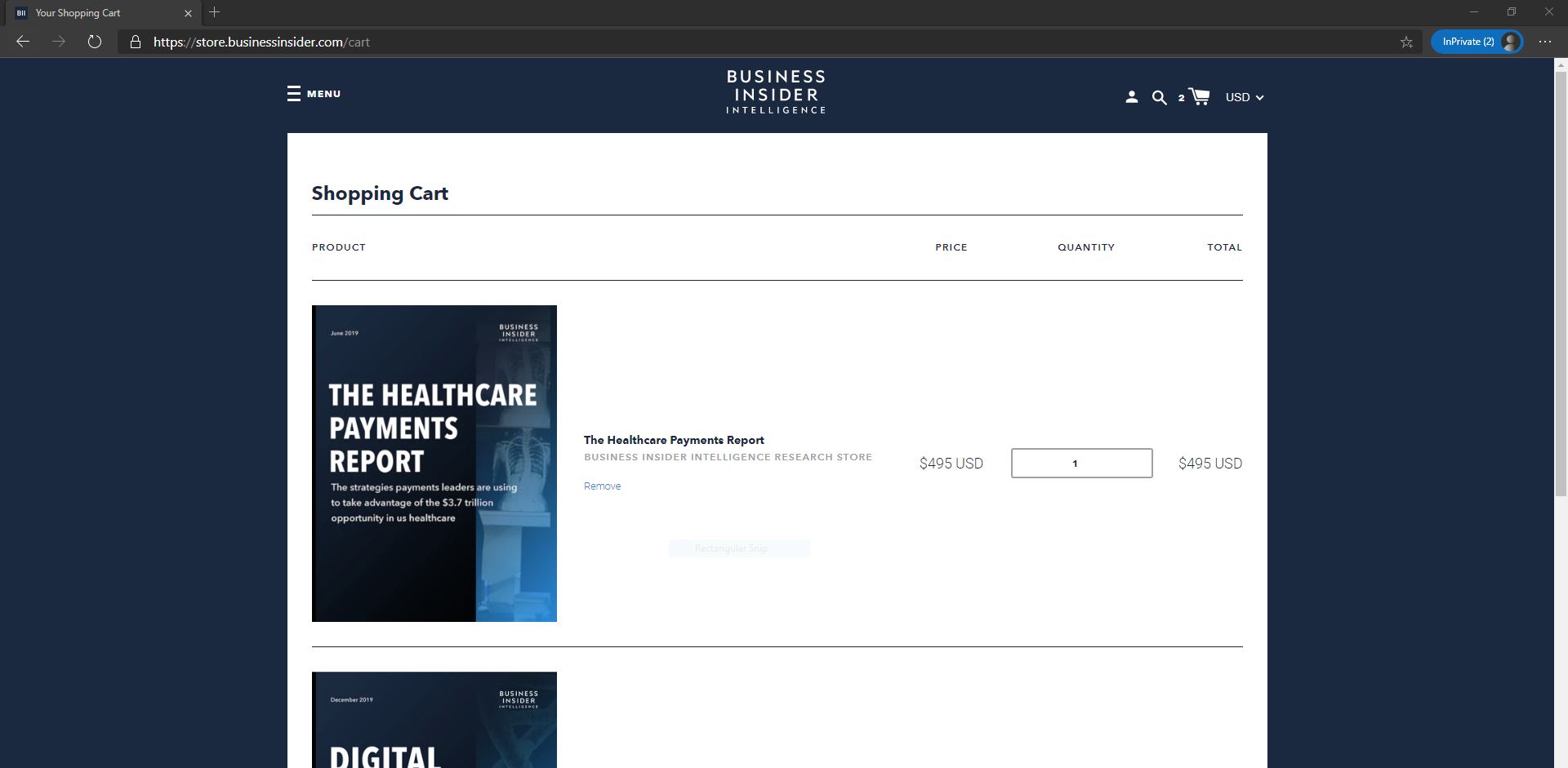

#5. Leverage on bundle offerings:

When you look into BI subscription plans it is interesting to notice how single reports cost way more than a subscription plan which comprises a bundle of the reports available on the platform. There isn’t anything new with this repackaging approach. Yet it is important to notice that BI might be leaving up revenues on the table today, to build a more solid subscription-based business model in the future.

The Bottom Lines

Indeed, even though in the short term the company might have to swallow the fish, which means experience a marketing expense in acquiring new members to its platform, in the long run, if this strategy proves successful it will become a significant part of the revenue generation for Business Insider. Thus, the company is leveraging on its primary driver of revenues, advertising, to sustaining a new part of the business primarily based on subscriptions.

It’s for sure the company is resilience and thriving but to be a head of the game, Business Insider still in need of many more spectacular features and especially, more time to kill off other old oak giants like Bloomberg or The Journal for examples, however we cannot deny it is a promising prospect!