Will Burlington Survive this Digital Era Without Ecommerce?

Burlington Stores has achieved phenomenal success in recent years by breaking the perceived rules of modern retail. While most brick-and-mortar chains have invested aggressively in e-commerce, Burlington had a small e-commerce business but decided in early 2020 to shut it down for good.

The No.3 US off-price retailers could afford this old-fashioned approach because it was able to drive strong traffic to its stores with deep discounts and rapid inventory turnover. As a result, during a five-year period ending in late February, Burlington stock more than quadrupled, smoking the S&P 500’s return.

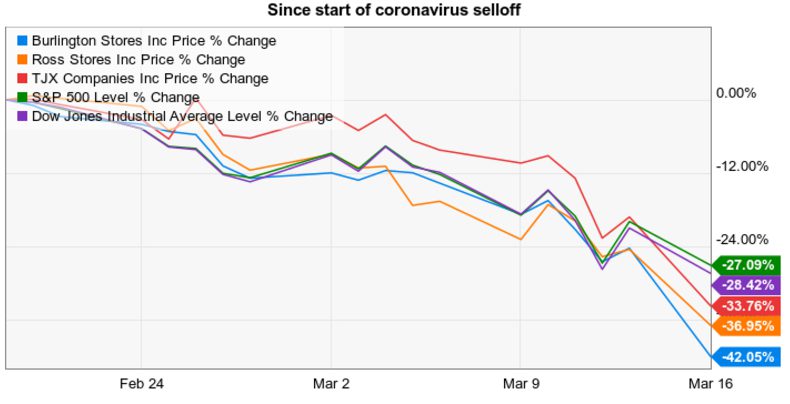

However, the COVID-19 pandemic changed everything, at least temporarily.

Burlington Stores During a Weak First Half of 2020

Burlington Stores Inc. has been hit hard by the coronavirus pandemic, as evident from the company’s performance during the first half of fiscal 2020. It reported loss per share in Q1 and Q2, while sales remained dismal for both the quarters. Burlington posted a pre-tax loss of $649 million (a -35.8% pre-tax margin) and a net loss of $381 million ($5.79 per share) for the first half of the year.

Q1 Sales Decline by Half

Burlington closed all of its locations in late March because of the pandemic, leaving them with no sources of revenue. Because the stores wouldn’t be able to reopen soon, Burlington furloughed the vast majority of its workers and implemented other expense reductions in early April. As a result, Burlington reported that sales plummeted 51% year over year in the first quarter, which ended in early May.

Michael O’Sullivan, CEO, stated, “Despite the impact of the COVID-19 pandemic and the fact that our stores have been closed since March 22nd, we ended the first quarter in a strong financial and cash position. We began to re-open our stores earlier this month, and expect to have over 400 stores open by this weekend; we have been pleased with the traffic levels and sales that we have seen so far. There is clearly pent-up demand, and our customers are responding positively to our clearance strategy. That said, we do not know how long this will continue, as sales could slow down as we sell through our clearance merchandise. But as an off-price retailer, we are excited by the chance to turn our inventory and to pursue great opportunistic buys in what we expect will be a very strong off-price buying environment. There is considerable uncertainty ahead, but we are currently on our accounts payable, we have lean inventories, and we have ample liquidity. Therefore, we believe that we are well-positioned to chase the sales trend or to pull back based on whatever situation we face in the coming months.”

O’Sullivan continued, “The most important priority as we have re-opened our stores has been to ensure very high standards for safety and social distancing. We have implemented a detailed set of safety measures, and our associates and customers have responded very well to these actions. This will remain the over-riding priority for us.”

Total sales decreased 51% to $798 million. All of the company’s stores were closed by the end of business on March 22, 2020, and remained closed through the end of the first quarter, due to the COVID-19 pandemic. Currently, 332 of the company’s stores have re-opened and 402 stores are expected to be open as of May 29, 2020, with most of the balance of our stores expected to open by mid-June.

Net income was a loss of $334 million, or $5.09 per share versus net income of $78 million, or $1.15 per share for the first quarter last year, and Adjusted Net Income represented a loss of $312 million, or $4.76 per share versus $85 million, or $1.26 per share last year. Adjusted Net Income and EPS exclude the previously anticipated 4 cents per charge per share for management transition costs. This decrease in Adjusted Net Income was driven primarily by the $272 million inventory charge due to aged inventory, as well as the significant decline in sales, both of which were driven by extended store closures related to the COVID-19 pandemic.

Rapid swings in sales trends also made inventory management a tall task this year. Store closures caused all of the off-price retailers to end the first quarter with a glut of unsold spring inventory. This led to big inventory write-downs at the end of Q1. By late June, the glut had turned into an inventory shortage, as sales had outpaced expectations for reopened stores. Not until July was Burlington able to bring in fresh goods in adequate quantities to meet demand.

Mixed Results in Q2

The majority of Burlington Stores reopened in Q2 as customers came flooding back for discount shopping. But the off-price retailer couldn’t refill brick-and-mortar locations fast enough to keep up with pent-up consumer demand.

The company reported mixed quarterly earnings as a result, with smaller-than-expected losses, but still expects “a lot of risk in Q3,” said Michael O’Sullivan, chief executive officer.

“The second quarter had some highs and some lows,” O’Sullivan said in a statement. “The pace of our reopening sales significantly exceeded our expectations, and we turned our aged spring merchandise very rapidly. This enabled us to go back into the market and take advantage of great merchandise availability.

“But we were not able to get these fresh receipts to our stores as quickly as we needed them; our in-store inventories declined and our sales trend fell off dramatically in the back half of June,” O’Sullivan said.

In fact, with May store traffic and sales levels well above expectations, the company purchased hundreds of millions of dollars’ worth of goods in May and June, O’Sullivan said on Thursday morning’s conference call with analysts.

“At that point in the quarter we were flying. We were exactly where we wanted to be,” O’Sullivan said. “In normal times, as an off-price retailer, these are all of the things you want. The trouble is that these are not normal times. Although we had written the orders and bought the merchandise, some of our vendors had struggled to deliver our receipts as quickly as we needed them. They themselves were coming back from a standing start.”

As a result, Burlington’s quarter-end merchandise inventories decreased 26% year-over-year to $608 million, compared with $824 million last year. With late June and July store inventories “below acceptable levels,” O’Sullivan said the company left “significant sales dollars on the table.”

More precisely, total revenues for the three-month period ending Aug. 1 fell 39% to $1.01 billion, compared with $1.65 billion the same time last year. Comparable store sales, defined by Burlington as stores that were open prior to the start of the second quarter, fell 14%, year-over-year. The company lost $46.7 million during the quarter as a result, compared with gains of $84.5 million a year earlier.

“That said, we continue to believe the inventory constraints across the entire industry are more a function of inventory supply constraints, rather than company-specific missteps, evidenced by the broad industry-wide light inventory reports,” Simeon Siegel, managing director and senior retail analyst at BMO Capital Markets, wrote in a note. “As we have noted throughout this earnings season, we believe that when retailers stopped ordering, manufacturers stopped producing.”

Burlington reduced its selling, general and administrative expenses by $40 million to $492 million during the quarter. The New Jersey-based company ended the quarter with about $1.08 billion in cash and equivalents and 739 locations spread across 45 states and Puerto Rico.

The off-price retailer is not providing guidance, but said it expects sales trends to improve as it gets more inventory in stores. Even so, the CEO pointed out that the current quarter is still highly unpredictable with delayed — or in some cases altogether canceled — back-to-school seasons, record high unemployment rates and uncertainty around a possible resurgence of the coronavirus.

“This may be what life is going to be like for a while,” O’Sullivan said on the call. “We have to assume that the underlying drivers of this uncertainty are not going to go away in the third quarter. In fact, they could continue for the next several quarters and well into the next year.”

Burlington In an Effort to Overcome Coronavirus Woes

Burlington did not provide any kind of sales guidance for the third quarter, noting that trends had been very erratic. With a substantial number of consumers limiting or avoiding discretionary shopping trips because of the pandemic, store traffic is likely to remain quite weak for this off-price retailer. Adding to the headwinds, demand for fashion apparel is depressed right now.

Speaking of Burlington Stores’ strategies, the retailer has made multiple changes to its business model to adapt to the ongoing changes in the industry. Also, the company has made technological advancements, initiated a better marketing approach and focused on localized assortments. Additionally, the company has been optimizing markdowns, effectively managing inventory and controlling SG&A expenses.

Also, it seems focused on its store-expansion strategy to drive top-line growth. During the second quarter of fiscal 2020, the company inaugurated three stores, and expects to open 37 outlets with seven closures or relocations in the upcoming quarter. For fiscal 2020, the company now anticipates opening 62 stores while relocating or shuttering 26, thus adding 36 net new outlets.

Certainly, the limitations revolving around Burlington Stores cannot be overlooked in the near term. However, the company’s strategic initiatives to bring itself back on the growth trajectory somewhat appear encouraging.

Is It a Right Decision to Close Ecommerce Site?

Just before the outbreak of COVID-19, it didn’t seem so crazy for Burlington Stores to announce it was doing away with its e-commerce platform. Because online sales made up a negligible portion of its business and discount consumers enjoyed the treasure hunt atmosphere that they could only find at its stores, the retailer said it would wind down its digital presence.

Yet now in the midst of a global pandemic, where state and local governments are enforcing non-essential business closures and people are heeding the advice to practice social distancing and self-isolation, an e-commerce presence may be the only way some businesses make it through this crisis.

Admittedly, buying name brand fashion, even at a deep discount, isn’t top of mind for most consumers. When meat display cases at grocery stores are empty and hand sanitizer, paper towels, and toilet paper are in short supply, snagging a great deal on that shirt you were eyeing seems superfluous.

Yet retailers without an e-commerce presence risk losing sales, market share, and potentially future customers to online retailers like Amazon, which is prioritizing shipments of basic essentials that consumers need just to get through a day. Maybe an e-commerce platform, even if it contributes negligible amounts during good times, is still essential for when the bad times inevitably come.

While the response to the pandemic evolves rapidly, the importance of e-commerce is becoming clearer, and those with a platform are prioritizing it. More than 110 retailers, including national chains like Apple, Macy’s, and Nordstrom, have temporarily closed all of their physical locations in the country, and more are doing so daily. Rival TJX Companies only just launched an e-commerce site last September at its Marshalls chain (TJX Maxx has had one for some time) and may find it was a very timely addition.

Gap Stores, which just closed all of its North American stores across all of its concepts, told analysts that with social distancing being enforced, its $4 billion online business is now more critical than ever to its operations. Incoming president and CEO Sonia Syngal said, “It’s a profitable business for us, driving outsized growth with much runway ahead.” It’s going to need those sales now.

Of course, it’s also true that helping the country get out in front of and controlling the spread of the pandemic may be a higher priority for businesses at the moment than making a sale. But companies can’t go too long with zero revenue coming in. That’s going to place extra strain on retailers like Ross Stores, which has never had an e-commerce platform.

There are (or were) very good reasons behind the discount chains eschewing a digital presence. Where Gap finds online sales to be profitable, Burlington says it’s difficult to make money through e-commerce, because the average unit price is $12. The margins just aren’t there, and it’s a more challenging method of selling due to the high inventory turnover rates.

CEO Michael O’Sullivan said during an earnings call on March 5, “E-commerce, when you fully account for the costs of merchandising, processing, shipping, accepting returns, it’s very difficult, impossible to make money at those price points in the businesses that we compete in.”

We’re in fairly unprecedented territory at the moment, so there may be no right answer. As the legal maxim that hard cases make bad law indicates, reactions to extreme situations could result in poor policy.

Still, the pandemic shows the potential pitfalls of not having an e-commerce backup policy in place, just as the national grid crashing would show the risks with being an online-only retailer. An omnichannel presence may really be the best of all worlds for retailers, and discounters like Burlington Stores, Ross Stores, and TJX may be best served by having at least a minimal online presence.

Looking Ahead

Unlike many retailers, Burlington Stores is continuing with its store expansion efforts and plans to open 37 stores in the fiscal third quarter and 62 in the full fiscal year. It also intends to close or relocate 26 stores in fiscal 2020.

It continues to expect depreciation & amortization, exclusive of favorable lease costs, of nearly $230 million. Interest expense, excluding $24 million and non-cash interest on convertible notes, is still projected to be $80 million for the fiscal year. Furthermore, capital expenditures, net of landlord allowances, are envisioned to be at nearly $260 million.

On the brighter side, the off-price retailer has been experiencing a significant improvement in sales trends since mid-July as it brought back its inventory levels. Yet, Burlington Stores expects fiscal third-quarter comparable sales to decline by about 20% as uncertainty continues to impact the back-to-school season buying.

When a vaccine does become available, Burlington Stores should bounce back quickly. Brick-and-mortar retail has a big cost advantage over e-commerce at the low-price points typical for most items the two companies sell. As a result, deal-hunting consumers who have turned more to e-commerce during the pandemic are likely to flock back to off-price retailers when they feel comfortable visiting stores again.