Unveiling of How Small Businesses Fight the Coronavirus Recession

A rampant fatal disease was unleashed by a highly virulent COVID-19 virus led to unprecedented impediments not only to the essential errands but also to a prospect of precarious economy flow, and the public articulation of national emergencies in United State, regarding the acceleration of infectious cases in U.S. The pandemic crisis has now reached a perilous zenith, where public health systems need to take decisive action to effectively suppress the surge in new hotbeds in America. Additionally, increasing demand for urgent medical care and rising deaths tolls are straining national health systems.

Beyond any doubt, the prominence of lethal outbreak is to find out viable vaccines and effective healthcare solutions to alleviate the death-induced disease. However, the economic impact is also considerable, and many enterprises are floundering toward business survival strategies, huge waves of lay-offs and insolvencies from the unfolding events that are on the cusp of economic shock. Unforeseeable twists and turns will be unveiled with each news cycle, and a complete picture will be only reflected in retrospect. Given the miscellaneous assortment of preparedness across venture businesses, the further potential for economic turmoil and the value of leveraging of disruptive technology for future dilemma, it is worth endeavoring to draw upon for what entrepreneurs have learned so far.

The pandemic is reverberating U.S economy including trade and financial market when the virus spread to America, stoking fears of a national economic stagnation. With stringent policy closing national border to restrict foreign access to pandemic sources, the movement of people and the tourism flows have come to a shrieking halt. Millions of employees are facing the forlorn prospect of the unpaid furlough.

The fallout from COVID-19 has provoked profound shifts to the economic ordering. As the world begins to surmise the scale of COVID-19’s economic consequences, there is an increasing sense that the pandemic will reshape the fundamental relationship between the states and the markets for many years to come. Nevertheless, many debates have focused on policy changes in relatively middle-income businesses. For many low-and middle-income businesses, it may be harder to reconstitute the structures of the new economic ordering.

This article will help you find out how small-and medium-sized businesses at the epicenter of the outbreak are grappling with mandatory stay-at-home announcement and labor force reduction to keep their business running amid the coronavirus recession.

Surviving During the Pandemic-Related Economic Recession?

The coronavirus pandemic is turning U.S economy and American daily lives upside down. Coronavirus has decisively forced a plethora of businesses to scale down and temporarily close, and compelling residents to remain home for all but essential errands as municipal authorities and state governments implement shelter-in-place policies to stem the spread of the highly contagious disease. In confronting adversity erratically surging, businesses – the peculiarly small and medium-sized businesses – across the United States are grappling with tough decisions in maintaining their business operations and curbing a mandatory unpaid employee furlough. These institutions play an indispensable role in U.S economy, employing 58.9 million people in the United States, or about 47.5 percent of the outright private sector labor force. Factly, their GDP contribution accounted for USD 5.9 trillion in 2014, the latest year for small and medium-sized business GDP data is available.

Lower-income entrepreneurs are endeavoring to deal with the coronavirus pandemic will be on cusp of financial calamity that is likely to be worse than what they endured during the Great Depression more than a decade ago. Without incoming cash, several small and medium-sized businesses – especially on-site restaurants and shops on American Main Street, will soon have to lay off half of their workforce following economic stagnation or even shut down permanently.

The JPMorgan Chase Institute anticipates that an average small and medium-sized business has 27 days of cash in reserve, whilst Main Street enterprises usually have less than 20 days’ worth to imperatively navigate business model as well as pull back from the brink of bankruptcy. In lieu of the divergent forecast, many public health experts do not expect an outbreak of death-induced disease to abate for at least eight weeks, presuming that social distancing and other mitigation efforts can alleviate the acceleration of U.S death cases.

On the other hand, according to a survey by the new National Small Business Association, approximately 77 percent of lower-income business owners said they were deeply distressed about the outlasting economic consequences of COVID-19. Nearly half of the 950 people surveyed said that customer demand had decreased and one-third of the respondents were struggling with supply chain disruptions and distracting from leveraging of technological applications amid the phenomenal growth of necessary online delivery services. More than half foresee the United States to slump into recession in the next 12 months, up from 14 percent in January.

Several small-and medium-sized enterprises are hanging on a thread and encountering existential menace as customer demand for non-essential product curtailment in advance and encountering existential menace of impermanently unnecessary establishment shut-down.

A month of what several entrepreneurial connoisseurs compared to the blackout has nearly bisected economic activity. One additional month could result in the long-lasting loss of one-fourth of all U.S. businesses, which is equivalent to four trillion dollars in revenue. For New York City, the Independent Budget Office foresees that the pandemic could cost the city about USD 10 billion in tax revenue. It could be indisputably ruinous for entire municipalities and U.S local corporate survival, as well as venture entrepreneurs who are adapting to unprecedented crisis and needing relief in the midst of economic impact of the COVID-19 pandemic.

Nevertheless, essential businesses are fortuitous to remain open in order to provide necessary services to the communities during the coronavirus pandemic, but keeping operations running during the economic downturn has come with a host of challenges. Meanwhile,

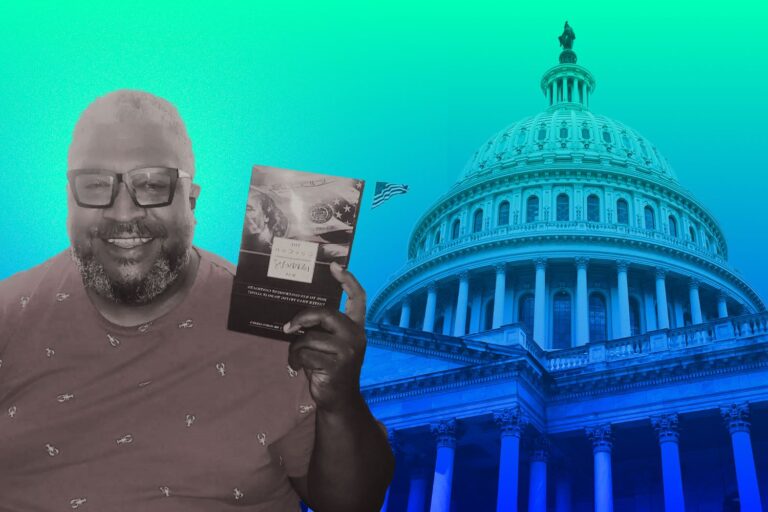

Moe Issa is the owner of Brooklyn Fare, a chain of three sizeable grocery stores and a three-Michelin-starred restaurant in New York City, with 18-seat bar and open kitchen inside a Boerum Hill grocery store. Whilst all his business activities are presumed necessary, Issa has shut down his high-ranked restaurant when Governor Andrew Cuomo issued a shelter-in-place policy and put draconian new restrictions on New Yorkers on March 20. Unfortunately, Issa had to forced roughly 60 employees to take a long, unpaid furlough. Streamlining his three grocery stores concurrently is possible, however, it would be a laborious process to persevere with unrivaled steps to minimize the negative influences over the U.S business landscape.

He says most of his time is devoted to persuading perturbed employees – the main drivers of exposure and lack of protective insurance -to come to work, making sure the stores are on offer and keeping up with the spike of online sales. “I had a gut feeling that things were going to change a little bit” Issa articulated. “I actually spoke to a couple of my managers I was telling them to stock up a little bit more on a dry good that I thought there might be some kind of panic, but to be quite very honest with you, not in my wildest dream I thought it would go to this level.”

Moe says while supply declined significantly due to U.S ramifications of domestic labor policies shortcoming, running stores with nearly half the regular employees is his unheard-of challenge. “It’s about 6:15 in the morning, 6:20 going to pick up the food from 37th street to take it to the Brooklyn store because we had to close the kitchen in Brooklyn store because we’re short on employees.” Issa expressed in grim reality. “Every morning I just got to deal with it. I lose two. Three come back. I lose four, two come back. If this lasts a few months this is going to be very difficult, extremely difficult.”

Changing consumption behavior is one of the most unequivocal impacts of the pandemic. The empirical data on credit card transactions illustrate that consumption trend has declined in most categories except for groceries and liquor. Notwithstanding with alcohol consumption among stay-at-home residents and their preference of liquor in advance, Jonathan Goldstein, co-owner of the Park Avenue Alcoholor Shop, nestled between bustling Grand Central and Bryant Park, this has not been the case. Without foot traffic and loss of all corporate business, Goldstein said the store dropped 75 percent to 80 percent in sales.

“I don’t think people want to be in midtown or in a crowded part of the city. We are missing that part of the business. We are missing corporate business. There are no parties, there are no staff meetings. There’s no after hours.” Goldstein said. The shop has had to lay off 12 out of 20 staff members.

In early March, Congress and the Trump Administration granted USD 7 billion in disaster loans to small-and mid-sized businesses hammered by pandemic-related economic stagnation. The program helps businesses in states that have announced emergency status to borrow up to USD 2 million and repay it over 30 years with an interest rate of less than 4 percent.

Both chambers of Congress are considering additional relief, with business loans packages of over USD 300 billion under consideration. It would hope that the national government will take it an extraordinary step further and allocate interest-free loans and work to include new financial technology companies, such as Square and Kabbage among authorized lenders. Ultimately, small-and medium-sized businesses contribute roughly 2 million net new jobs annually and employ 47 percent of the labor force. Even though macroeconomists rarely provide them with their debt, lower-income enterprises contribute 44 of US gross domestic product. Helping them withstand the brutal cash crunch will support the broader economy.

Understanding of The Prospective Scenarios for Small Business Recovery

Whether economies can avert the recession or not, the path rebounds to recuperation under economic impacts of the pandemic will highly rely on a range of drivers, such as the extent to which demand will be delayed or eschewed, whether the shock is actually spike or persistent, or whether there is structural deterioration, among other factors. It is conceivable to outline three broad scenarios clearly delineated as V-U-L:

- V-shaped: This scenario depicts the classic real economic shock, a shift in output, but growth eventually recovers. In this scenario, the annual growth rates can completely absorb the shock. In the V-shaped, the market recuperates quickly, as the market has reached the lowest point. Entrepreneurs are seeking to take advantage of attractive entry points for long-term asset investment.

- U-shaped: This scenario is a grotesque shape of V – the stagnation perseveres, and while the inaugural recovery path is restarted, there is some perpetual loss of output. In the U-shaped recovery model, the worst can come to an end, some market sectors have established a roadmap for rebirth. Investment choices for this type of condition might include allocating to the least volatile firms with stable income, low debt and high return on equity.

- L-shaped: This scenario is a vile relation of V and U. Economic impacts of the COVID-19 do phenomenally structural deterioration and threaten to labor markets, capital formation, or productivity function. This is hard to conceive even with despondent premises. At some point you are likely able on the other side of this outbreak. In the L-scenario, you have not seen the worst for the market. Other options for those who prefer high security may include traditional assets like gold, cash and long – maturity government bonds.

According to the Harvard Business Review, the economy after a major crisis as Covid-19 may change in a different direction:

- Microeconomics: Crises, including epidemics, can spur adoption of technologies and create new business models. When schools in many countries worldwide are closed, online learning and distance learning can be considered the preeminent form.

- Macroeconomics: It seems like a pandemic will accelerate the process of decentralization of global value chains – essentially, this virus causes economic agreements to contemplate both the “biological” and fragmentation tendency.

- Politics: Global political ramifications cannot be ruled out, as the virus has challenged the ability of many political systems to be effective in protecting their citizens.

What Small Businesses Need to Recuperate in Emerging Market Post COVID-19

The pandemic will influence on U.S economic activities and how entrepreneurs navigate pandemic-related shift in the acceleration of digital market. As a business, you still have to keep grappling with and surmount this crisis. Here are some tips for entrepreneurs to weather the gloomy economic status:

- Take a step back & strengthen the foundation – Take a step back to build the foundation: small-and medium-size entrepreneurs usually just take care of sales, having no time or not yet to build the foundation, especially accounting issues, financial management, employee training and development, standard operating procedures, build automation tools, and more. This is the best time to turn back to reorganizing, building and completing the structural frameworks that you have used to pretend to be too busy to focus on. Give yourself a short hiatus to envisage the likelihood of your business in frantic economic flow post-COVID-19, then take a step back so you can go 3 steps for years afterwards.

- Make relevant changes to your product portfolio – Change / adjust the product profile: When products and services on-premise (at the branch) face difficulties as consumers do not go shopping, then product utilization and on-site service need ideate – think of products and services that can be delivered at home. This change is not too big, just ask what you can do to switch products from on – premises to in-home.

- Re-structure sales channels – Shift sales channels from offline to online distribution: Several small-and medium-size businesses’ revenues come from offline channels. Conversely, many entrepreneurs articulated that online revenue has reached at low proportion as lack of online distribution knowledge to efficiently deploy as well as structural processes for implementing sale online via social networking platforms regarding Facebook. The epidemic has altered the consumption behavior, and then the selling style of the businesses must also adapt quickly, putting total force to promote online channels to reach high revenue in the coming time.

- Cut costs: Review major expenses in your financial statements and cut down on everything you can to survive. For example, the cost of premises must be negotiated immediately at this time. If the cost office rent is not necessary as it is possible to work online, entrepreneurs should cut down on it. Brand marketing expenses must be halted to focus on building an online sales channel. Expenses for good will – intangible assets are temporarily put aside and needed personnel with this economic volatility must be kept. This difficult time is when it seems imperative to do things assumed impossible.

The Bottom Line

The economy post COVID-19 is unlikely to return to the world that was. Many trends already underway in the U.S economy are being augmented by the impact of the outbreak. The future of work has arrived faster, as well as its challenges – many of them potentially multiplied – such as income polarization, worker vulnerability, more gig work, and the need for employees to adapt to occupational transitions. This acceleration is the result not only of technology advancement but also of new considerations for health and safety, and economies and labor markets will take time to recuperate and will likely emerge adjusted. With the growth of these trends, the realities of this crisis have sparked reconsideration of several beliefs, with possible effects on long-term choices for the economy and society. These effects range from attitudes about efficiency versus resilience, the future of capitalism, densification of economic activity and living, industrial policy, the role of government and institutions.