The Team at Socure Ups Their Identity Game and Fight Fraudsters

Most security breaches occur because of problems with digital identity processes, tools, and reach. Looking at recent breaches in the news, most victims lacked multi-factor authentication and strong authentication of administration accounts. Many also use custom-made identity processes that open the door for bad people to do bad things.

Tons of these problems occur because companies try to stick with the old ways. The proliferation of data, systems, tools, and procedures of today, coupled with digital transformation and the accelerated use of cloud services, are pushing often-manual legacy processes beyond their limits.

That’s why customers expect an exceptional digital experience, driving firms to provide an omnichannel, frictionless customer journey. This is where Socure came into the picture.

The company double-checks user information with social information available to make sure the user matches the actual person. If the profiles don’t match Socure targets and blocks any potential fraudulent behavior.

The solution is great and delivered on time, thanks to the effort of Socure founders – Johnny Ayers and Sunil Madhu in carrying out the mission of verifying 100% of good identities and completely eliminating identity fraud.

Navigating Digital Identity Challenges – Duo’s Expertise Shines Through

For the last 50 years, the risk decisions used by enterprises in developed countries have been primarily credit-focused and have primarily centered on offline data.

In the last few decades years, if you signed up for a credit card somewhere or you decided to open an account, the personal information (name, address, phone number, etc.) that you passed to the financial institution is then passed to a credit bureau or data broker.

Those companies then attempt to match that data with the offline data they have about the consumer. If there’s a match, they tell the institution the identity is verified so they can proceed with onboarding.

The problem is that much of the data that the credit bureaus have been operating with has been stolen or compromised in recent years by data breaches – so that data is easily available to fraudsters.

There’s so much data about the U.S. population out there now that “fraud-as-a-service” is actually a business model. To be a fraudster, a fraudster doesn’t have to commit fraud themselves, they can pay someone to do it for them. What’s more is that all of this information can be purchased for under $5 per identity from a lot of these shadow dark websites.

Being a first-generation immigrant, Sunil Madhu thought about how hard it was to get credit in the US, even after having an established history in Europe. Having come from an information security and identity background – though multiple start-ups like Netegrity IPO (NETE) in 2003, Securent $100M exit to Cisco in 2007, he set out to explore the problem further.

Having spent 20+ years in identity and access management and briefly ventured 4 years into an omnichannel marketing/advertising start–up, it occurred to him that online & social data has potential applications for security and identity verification.

Then he tapped Johnny Ayers, whom he worked alongside at General Assembly – to co-found Socure and focus on building a scalable business model and partner network, to address the challenge of financial inclusion for millions of people worldwide, using online & social media data.

Mr. Madhu was instrumental in helping Socure develop its proof-of-concept digital identity platform into a market leading technology. However, having been nurturing Socure for 7 years, in 2019, Sunil Madhu resigned as Chief Strategy Officer and member of the Board of Directors to pursue a new venture.

As for Johnny Ayers, since founding the company in 2012, he has had a number of roles, including managing and leading strategy for the Direct Sales, Channel, Product, and Growth organizations.

Johnny has been influential in building the company’s tremendous customer base and suite of industry-leading digital identity and fraud solutions. He is also a frequent expert speaker on fraud, authentication, and KYC/AML, and has been quoted in publications such as the WSJ, Forbes, Thomson Reuters, Cheddar, PYMNTS.com, and more.

Outside of Socure, Johnny is an investor in and advisor to companies including Commerce Ventures, Lytical Ventures, Public, Astra, Paytm, Acorns, Zaam, Alloy, BillGo, and others.

With his entrepreneur life at Socure, he is following one important insight. According to him, his platform in is hired today to answer two questions: ‘Is Joe a real person, and is this Joe?’ That is an internet-wide problem and obviously a massive problem as it relates to fintechs that are trying to verify and file underbanked, credit-invisible people.

Tackle the Weakest Link in Identity Verification

Socure is solving the single most difficult problem in identity verification – validating a person that’s never done business with an organization before.

Using traditional approaches for vetting the identity of new customers in a mobile and digital world has been a miserable failure.

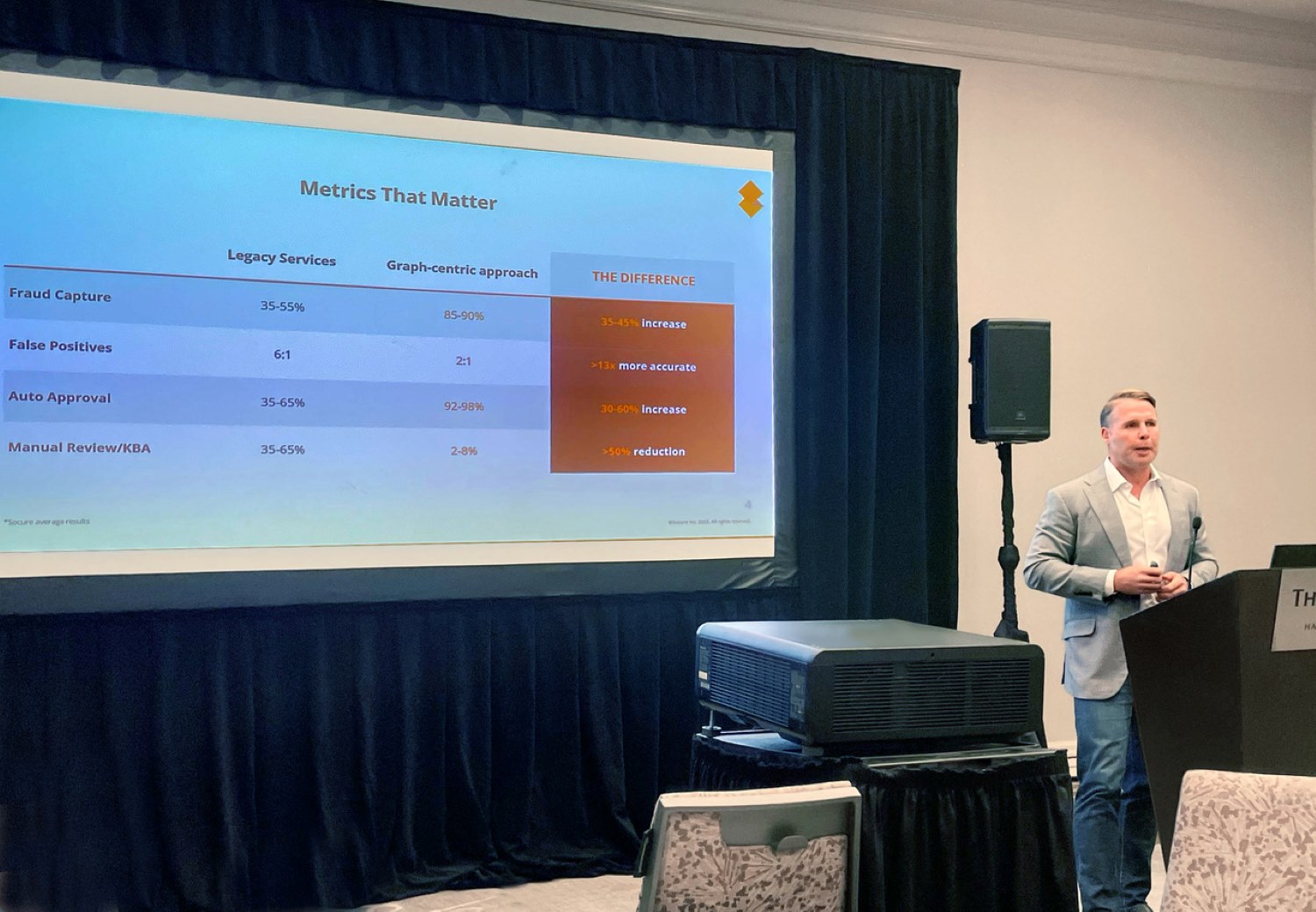

Looking closer at the company’s solution, Socure uniquely looks at every dimension of the person’s name, email, phone address, date of birth, social IP device, behavioral velocity, physical documents, image, video, so from a single session or a single identity, they generate over 17,000 features.

So, when an API call comes into Socure for name, email, phone address, date of birth, the service generates 17,000 data points about that identity across every one of them. IP to phone, phone to address, name to email, email to phone, email to address, address to date of birth, your name to all past addresses, there’s this massive number of features that Socure can calculate across its graph, using third party data providers and internally derived. Those are the main kind of PII elements that they are deriving insights on the back of.

Socure’s methodology includes using input data, advanced clustering, multi-dimensional queries with multiple data sources, and intelligent rank decision outputs, all with insightful reason codes. This methodology allows digital gaming operators to increase auto-enrollment rates, reduce manual reviews, and maintain compliance (e.g., age verification, sanctions, watchlists, etc.).

With such a vast array of clients, privacy is the concern that always haunts people, but according to Johnny Ayers, Socure uses the most potent forms of encryption of data in motion at rest.

He said, “We use a variety of techniques to ensure that we’re not just protecting one bank’s data. We’re protecting hundreds and soon to be thousands, which certainly comes with enormous responsibility, which is why we look at all the security certifications we have.

He added, “We have multiple years of SoC two Type 2; we have ISO 27,001 17-18, we have high trust certification and are getting 800 171 as we move into the public sector, so security is a core part of how we design products. It’s a core cultural component, and security is everyone’s problem.”

Socure fully understands appreciating the amount of data they have, and it’s been a core part of the business; given the type of data that they deal with and the duration of time that they’ve been dealing with this, they had to mature very quickly.

Emerge as Behemoth’s Authentication Mantra

Socure has built an end-to-end platform for verifying identities across every dimension of a consumer’s identity: name, email, phone address, date of birth, social IP device, network velocity, physical document authentication, facial biometrics, and liveness detection.

And so, they’re the only solution in the market that has built out internally every single part of a consumer’s identity. They’ve then built a variety of different machine learning models on top of it to deliver the most accurate, comprehensive solution in the market, delivering for customers the ability to say yes to the most significant number of good consumers, fully automatically with the least amount of fraud.

Johnny Ayers said, “We do that no matter how identity is onboarded or channel-agnostic, and we are agnostic to whether it’s PII or physical documents, or both. So, clients hire Socure because we help them onboard the largest number of good consumers safely.”

He also said “Here in the US, we have four of the top five banks, twelve of the top fifteen credit card issuers, and the majority of the consumer-facing Fintechs. I know publicly we’ve talked about Chime, Public, Stash, Varo, but just about every prominent FinTech in the US is utilizing Socure.”

Socure’s become the gold standard, but identity is not just a problem in financial services. They also have some of the largest HR payroll, online gaming, and Telehealth providers, and they’re starting to aggressively move into e-commerce marketplaces and both state and federal agencies in the US market.

“And we just turned nine years old in September, so we’re going on a decade, really focusing on being the first to verify 100% of good identities and eliminate identity fraud.” Said Johnny Ayers.

Paving the Way to New Horizons – Building a Strong Financial Foundation

Socure, a leading digital identity verification company, has been successful in securing a substantial amount of funding throughout its journey. Over the course of fourteen funding rounds, the company has raised an impressive total of $741.9 million.

Socure is a post-Series E company with a valuation of $4.5 billion, according to the company. It snapped twice in 2021, the first a $100 million in Series D funding, then valued at $1.3 billion, and again at the end of that year, a $450 million Series E round, boosting its valuation to $4.5 billion.

Notably, their most recent funding round took place on March 8, 2023, and involved a Debt Financing round with a $95 million, three-year credit facility with J.P. Morgan, Silicon Valley Bank, and KeyBanc Capital Markets.

Speaking on the deal, Socure founder and CEO Johnny Ayers said, “Socure is in an exceptional position to solve what organizations and government agencies need most today — accurate and inclusive real-time identity verification without costly fraud and friction within the customer experience.

“With this facility further strengthening our balance sheet, Socure is in a tremendous position to leave the recession much stronger than when we went into it while continuing to distance ourselves from the competition through investments in new solutions, verticals, and strategic acquisitions.”

The venture capital fundraising environment has been a challenging one over the past year. In the U.S., venture capital deal value in the third quarter of 2022 was $43 billion, a nine-quarter low, according to PitchBook and the National Venture Capital Association.

Though we’ve talked a lot about the abundance of VC dry powder, firms are more selective now and even requesting new terms, like more equity, before committing to a new investment.

As startups sought out alternatives, many turned to non-dilutive debt and credit facilities. The PitchBook and NVCA report noted that venture debt figures in the U.S. continue to rise. Activity was over $22 billion in the third quarter of 2022, the fourth consecutive year above $20 billion.

Typically, companies with strong revenue and already venture-capital backed are good candidates for a loan or a line of credit.

We’ve recently seen companies like Navan, formerly TripActions, valued at $9.2 billion, take $400 million in credit facilities, and PayEm secure $200 million, now add Socure to that list.

Seizing the Opportunity – Perfect Time to Take on a Credit Facility

It was that equity, its tripled customer base in the past two years and existing relationships with many of the top banks and financial institutions that gave Socure founder and CEO Johnny Ayers confidence that the company was on firm footing to kick off credit facility discussions.

“We had the opportunity to have some conversations with a number of the banks, certainly they’re able to borrow money at the cheapest overnight rate of anyone, and so we felt it was an opportunity at very attractive rates to pretty significantly strengthen the balance sheet and put us in a really good position to be offensive,”

Ayers said. “We were given terms, and an amount that we were able to raise, in an environment where good companies are going to be worth a lot less than they thought they were, which will give us an opportunity to grow inorganically in a unique way.”

Ayers explained that there are companies — unicorns included — that will come to the realization that their $10 million or $20 million of annual recurring revenue was not worth a billion-dollar valuation. This will lead them to take a down round or look to strategic acquirers to get stock in a company so that it could be worth that valuation.

Socure’s line of credit results from the company being in a position where it is not waiting for a new round and can show it is one of the few companies that can build a robust platform, Ayers added.

Not only does the line of credit strengthen Socure’s balance sheet, but where Ayers references being “offensive,” he is referring to the ability to make acquisitions and break into new markets.

Teamed up with Berbix – Socure Spurs Mutual Advancements

Socure announced on June 2023 that it has acquired Berbix, a San Francisco-based startup that developed a high-accuracy document verification solution with a patent-pending forensics engine able to detect spoofed IDs – including AI-generated fakes – which are visually indistinguishable to the human eye. The approximately $70 million cash and stock transaction marks Socure’s first acquisition.

Socure has already integrated Berbix’s technology into its own to launch its Predictive Document Verification (DocV) 3.0 solution.

The new tool combines Berbix’s forensics engine and data extraction with Socure’s image capture app. The company has found that DocV 3.0 has been able to increase first-attempt auto approvals of good consumers by 26% and increase fraudulent document capture by 27%.

Socure Founder and CEO Johnny Ayers pushes back in the announcement against the perception that all document verification software offers the same performance. He says the company’s internal testing with several vendors shows quite the opposite.

“In fact, we found endless examples of other vendors in the market providing inaccurate stats that just couldn’t be validated. I don’t blame users for their lack of faith here,” says Ayers.

“Conversely, Berbix was the opposite in our testing. They delivered substantially better results than what was promised with far superior performance in accuracy and speed, which we have been able to pair with our superior user experience and fraud models.”

Berbix was founded in 2018, and CEO and Co-founder Eric Levine will take the role of SVP and head of DocV Product Management with Socure.

“I’m extremely proud of what we built at Berbix to advance state-of-the-art document verification. Moving forward with Socure, we are able to multiply our impact on day one by leveraging our technology with Socure’s substantial customer base, reach, and reputation.” said Levine.

He added, “Combining our independent investments in document verification is yielding stunning results – and we’re just getting started.”

The acquisition of Berbix accelerates Socure’s product roadmap for document verification by more than 18 months, according to the announcement, and opens up new markets and use cases. The company points to telehealth, remote workforce, ride-sharing, high-risk financial services, and restricted product sales among targets.

Socure’s international expansion plans also get a boost with global coverage of ICAO-compliant travel documents like passports and national ID cards. New ID documents can also be added to the company’s library quickly with natural language processing that can learn IDs with changing formats, Socure said.

Berbix’ capabilities can also support NIST IAL2, which is used in government onboarding scenarios. The announcement points to U.S. FTC stats showing a 30 percent year-over-year increase in consumer fraud losses in 2022.