T-Mobile vs AT&T: T-Mobile Surpassed AT&T as #2 Mobile Carrier with 5G Advantage

Lately, the US wireless industry has seen nationwide consolidation. This industry is intensely competitive, and performance is largely dependent on network superiority, service quality, and scalability. Cutthroat price competition puts pressure on telecommunications companies’ margins.

Now that Apple has released another new iPhone, millions of Americans will suddenly gain access to 5G wireless service. This will change the way individuals interact with wireless networks as more virtual reality (VR), artificial intelligence (AI), and Internet of Things (IoT) applications will probably run on these devices. Additionally, COVID-19 could speed this adoption as more people choose to work from home.

AT&T and T-Mobile are two of the three largest companies that will provide 5G service across the United States. Along with Verizon, they’ve formed an oligopoly in this essential service.

Separate Path Despite Similar Offerings

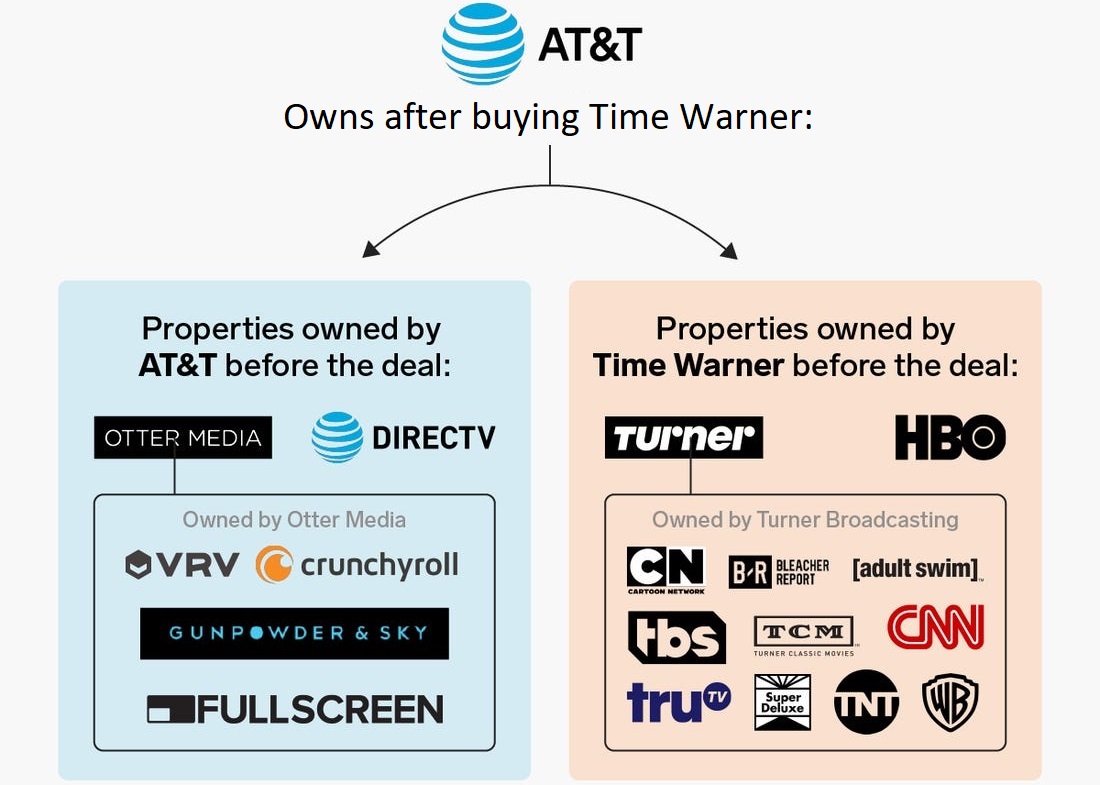

Although both AT&T and T-Mobile can provide 5G service, they have taken different paths to arrive at this point. AT&T was a landline service provider before entering the wireless business. It also made some investments outside of wireless, such as its purchases of DirecTV and WarnerMedia. This differs from T-Mobile, which has spent its entire history as a wireless provider. T-Mobile grew through mergers and price competition, the latest being the acquisition of Sprint.

T-Mobile’s Tradition: Focus on Wireless

Over the last few years, the wireless industry has seen Verizon buying up Internet properties; AT&T making huge bets on video; and Sprint engaging in some of the savviest financial engineering moves ever seen just to manage its heavy debt load (before merging into T-Mobile).

But what of T-Mobile? Under outspoken CEO John Legere, the company hasn’t bought any cable, satellite, Internet, or smoke signal-based media companies. Instead, following Legere’s “Un-carrier” strategy, T-Mobile has simply focused on giving wireless customers more of what they want. That’s meant lower prices and features like free roaming and music streaming that doesn’t count against data caps.

The big knock on T-Mobile’s aggressive efforts to woo customers has been that it wouldn’t be able to afford offering deals forever. But again, the financial reports showed otherwise. While other carriers showed little or no rise in wireless revenue, T-Mobile showed a remarkable increase, more than analysts had expected.

AT&T’s Benefits: Mix & Match Services

“Before its growth slows down, T-Mobile must expand its vision and find new ways to thrive. Today, T-Mobile is like a racehorse with blinders on so it can stay focused. Any way you slice it, over the next few years, T-Mobile will need to search for new growth avenues – the same way Verizon and AT&T have been doing in recent years.” – said a business development analyst.

Consider what AT&T is doing in this space. The ‘mix & match’ strategy gives it a competitive advantage which should grow over time.

AT&T Mobility is on a very aggressive expansion and growth path, and it has been for several years. AT&T is transforming and growing into a full-service communications, news, and entertainment company.

It now owns Warner Brothers Studio, WarnerMedia, which includes CNN and other programming assets. It just launched AT&T TV and HBO Max and are one of the top companies stretching the space in meaningful ways.

AT&T’s new CEO John Stankey will continue to take them in this new growth direction.

Financial Results

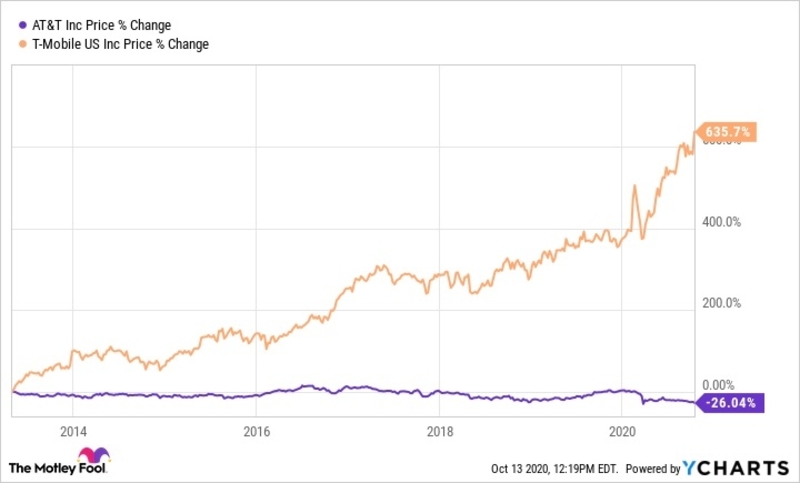

Though AT&T has invested tens of billions of dollars over the years to keep up with the changing technology of the industry, the stock has not seen a proportional benefit: It trades at levels it first reached in the mid-1990s.

T-Mobile stock has not existed for that long but has offered superior performance. Since T-Mobile US debuted on the New York Stock Exchange on May 1, 2013, it has risen by more than 630%. AT&T has lost 26% of its value over the same period.

T-Mobile Rose to #2 Position from Near-Death Experience

It’s worth noting that T-Mobile showed a spectacular recovery from its near death experience several years ago. John Legere’s unorthodox marketing method took T-Mobile from the edge of extinction to a real competitor once again. T-Mobile is no longer much of an underdog, though it still has plenty of spunk in its step.

After its takeover of Sprint in the spring of 2020, the company leapfrogged over AT&T to become America’s second-largest mobile network, with 98.3 million customers at the end of the second quarter. Though T-Mobile took on ample debt to pull it off, it’s still a much nimbler enterprise than both AT&T and Verizon, and it remains a better growth stock within the US telecom industry than its two rivals.

T-Mobile’s development has been an impressive story over the last decade. While often behind the technology curve as far as network speed and reliability go, T-Mobile’s run in the last decade can be attributed to its “un-carrier” model for providing competitive pricing to customers.

Its total customer count and revenue were 33.2 million and $20.6 billion, respectively, in 2011. Compare that to its nearly 100 million customers and trailing 12-month revenue of $51.7 billion as of the end of June 2020. T-Mobile’s advance on these two metrics has come at a cost — its operating profit margin of 10.6% over the last year trails behind Verizon (22.2%) and AT&T (16%) – but it has nonetheless catapulted the company to the position of legitimate contender for mobile network supremacy in the US.

That’s because, after the inclusion of Sprint, T-Mobile expects to squeeze $6 billion in annual cost savings by merging the two businesses together. That would more than double the company’s trailing 12-month operating income of $5.48 billion (if it can pull it off). Additionally, it is still winning handily in the net new subscriber battle. It reported over 1.2 million net new subscribers during Q2 2020. If it can maintain its pace of new subscriber additions, this growth story is far from over.

AT&T’s Stock Stagnation

In contrast to T-Mobile, the current century has not treated AT&T stock kindly. At about $29 per share, the stock sells at levels first seen in 1995! Now, 20 years after the dot-com bubble burst, it trades at approximately half its peak during that boom.

So what happened? In 1995, the company derived most of its income from local monopolies in the landline business. However, since that time, AT&T has had to spend billions every year to keep up with the various changes in wireless and internet technology over the last quarter-century.

The 5G buildout, as well as investments such as DirecTV and WarnerMedia, have contributed to a long-term debt load of more than $153 billion. This is a considerable burden for a company worth about $193 billion in stockholders’ equity, the amount left after subtracting liabilities from assets.

It has also had to compete to retain its wireless and internet customers, especially with Verizon and T-Mobile.

The Many Moves That Pushed T-Mobile Ahead of AT&T

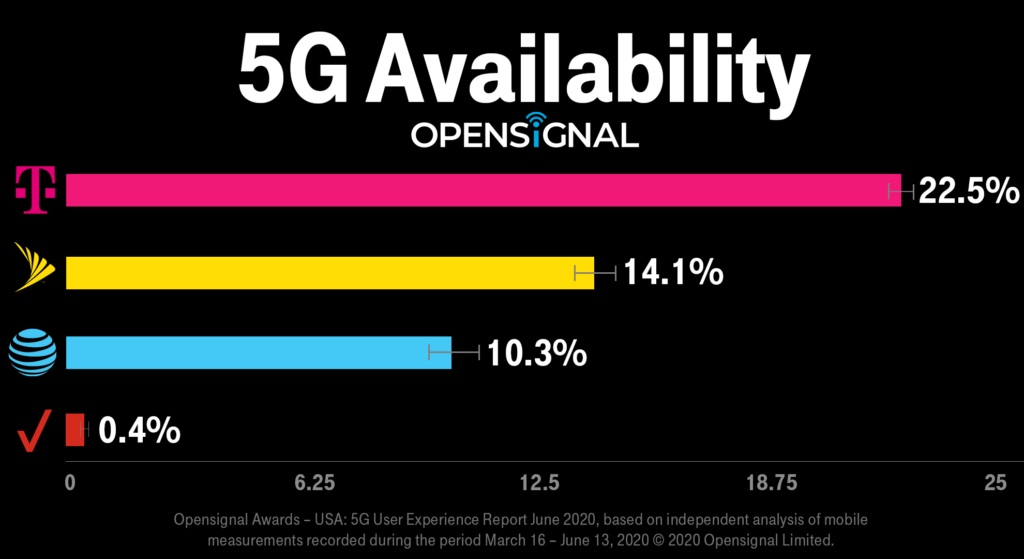

T-Mobile’s approach to implementing 5G across the nation is one of the key reasons why it was able to pull ahead of AT&T. Also, it has more 5G coverage, and a T-Mobile’s 5G coverage spans 1.3 million square miles to more than 250 million people. That is more than double AT&T’s coverage, while Verizon, the #1 carrier in the nation, has only .4% of that 5G coverage.

Growth in Coverage Translates to Growth in Customers

Arguably, T-Mobile’s growth in coverage has taken part in its growth in customers, leading it to be an industry leader in customer growth in Q2 of 2020. T-Mobile US counted 1.245 million net additions with the vast majority coming from postpaid subscribers; that gives it a total customer count of about 98.3 million which it characterized as more than AT&T, effectively making T-Mobile the second biggest wireless provider in the US, although there’s some disputes about how that math breaks out. Total revenues hit $17.7 billion in the quarter with $110 million in net income.

Nevertheless, T-Mobile excelled because of it, and it is a similar strategy we see with T-Mobile’s rollout of its 5G Standalone network. T-Mobile’s strategy was to roll out not the fastest 5G band first, rather the band that has the most coverage first, which is 600MHz. This was the right strategy, perhaps, because coverage is usually the most difficult thing to deliver when rolling out a new network. This is especially true when you consider that Verizon and AT&T both went mmWave first.

Another reason that T-Mobile was able to expand its coverage and drive growth faster than AT&T and Verizon is a direct result of the T-Mobile, Sprint merger. Mergers are generally a difficult task to pull off, and the merger had a lot of push back and resistance. One of the key advantages that Sprint brings to the new T-Mobile is more enterprise service balance given a historically consumer-centric T-Mobile.

We can also look at T-Mobile’s focus as the “un-carrier” or the advertisement that it doesn’t want to be a looming carrier service that has hands in both pockets, rather, wireless connectivity is a product that should be given to customers as freedom and value. This affordable “un-carrier” theme and T-Mobile’s quality customer service approach are two very appealing sentiments for customers. It makes the Sprint merger even that much more valuable for T-Mobile as 5G is more than just coverage for consumers and will benefit and create opportunities enterprise for the cloud, data center, and edge.

World’s First Standalone 600MHz-based 5G, Miles Ahead of AT&T and Verizon

T-Mobile US CEO Mike Sievert and President of Technology Neville Ray, discussing the operator’s second quarter financial results, touted the expansion of 600 MHz-based 5G coverage with the recent activation of a standalone core and provided an update of the ongoing integration of Sprint assets.

To sum it up, Sievert said, “In the 5G race, T-Mobile is pulling way ahead…AT&T and Verizon don’t want you see what’s becoming so painfully obvious. T-Mobile is miles ahead of both of them.”

T-Mobile has described its 5G approach as like a three-tiered layer cake with 600 MHz as the coverage foundation, Sprint’s metro 2.5 GHz blending coverage and capacity in the middle, and millimeter wave on top providing 1 Gbps-plus speeds in urban cores.

Ray put it in terms of breadth and depth, noting the low band 5G network covers 250 million people. “That gives us the breadth,” he said. “The depth comes from the 2.5 GHz spectrum…And all I can say is, we are baking that cake super, super fast.” How fast? Up to 700 sites per week. “You can all do that math…We are running very, very hard.”

“In Q2, T-Mobile once again led the industry in total branded customer growth for the 22nd consecutive quarter firmly establishing New T-Mobile as the leading growth company in the industry,” Sievert said.

He noted that 2.5 GHz 5G has been activated in markets like New York City, Houston, Los Angeles and others and added, “By the end of the year, customers will find mid-band 5G in thousands of cities and towns across the country.”

Interesting enough, this is not the first time T-Mobile has done something like this to become the first to roll out a new network. In the early adoption of 4G, T-Mobile became one of the first to have 4G-like speeds with its HSPA+ network. HSPA+ isn’t really 4G but rather a faster and more 4G-like 3G network in terms of speed built off T-Mobile’s already existing 3G network. It was sort of a big deal and was advertised as 4G even though it technically wasn’t, and it didn’t require customers to upgrade devices to get the network.

And in keeping with long-standing company tradition established by predecessor John Legere, Sievert dinged the hell out T-Mobile’s competitors. “Maybe they’ll deliver nationwide 5G coverage someday, but they’ll beg, borrow and steal from their LTE networks…claiming tools like Dynamic Spectrum Sharing will overcome their spectrum shortage. When you get to what’s real about 5G, T-Mobile’s network is demonstrably ahead of the competition even as we just start pouring on the gas.”

Hold On, the Game Is Not Yet Over for AT&T!

Combine a pandemic with some concerning company performance metrics, and AT&T starts to look like a questionable investment for investors. AT&T faces an increased threat from T-Mobile, which boosted its position in the competitive US market through a merger with Sprint.

Today’s State of Affairs

Even before the pandemic, critics were concerned with the company’s massive debt load, totaling $152 billion at the end of the second quarter. AT&T took on this debt to acquire DIRECTV and Time Warner in an effort to build a media empire. Paying this debt down has been more difficult because of the pandemic and the ensuing revenue decline.

AT&T’s media division, WarnerMedia, was particularly hard hit by the pandemic, causing the company’s earnings to suffer. WarnerMedia witnessed its revenue drop a whopping $2 billion year-over-year in the second quarter. The division’s business model depends on television advertising and box office receipts, which both dried up when the pandemic caused the shutdown of sporting events and theaters.

These metrics are grim, but more concerning were the results for the company’s telecom business, its one dependable revenue source. Second-quarter results revealed AT&T is steadily losing wireless customers over time.

Its postpaid subscribers, the most valuable type of wireless subscriber, are at lowest point in two years. Total postpaid subscribers dropped to 74.9 million in Q2 this year from 75.5 million last year. This contributed to AT&T’s wireless service revenue dropping 1.1% in Q2 after four consecutive quarters of growth.

Opportunities Are Still There

AT&T’s troubling Q2 results combined with its debt load form a murky future. But many factors point to opportunities for the storied telecom titan.

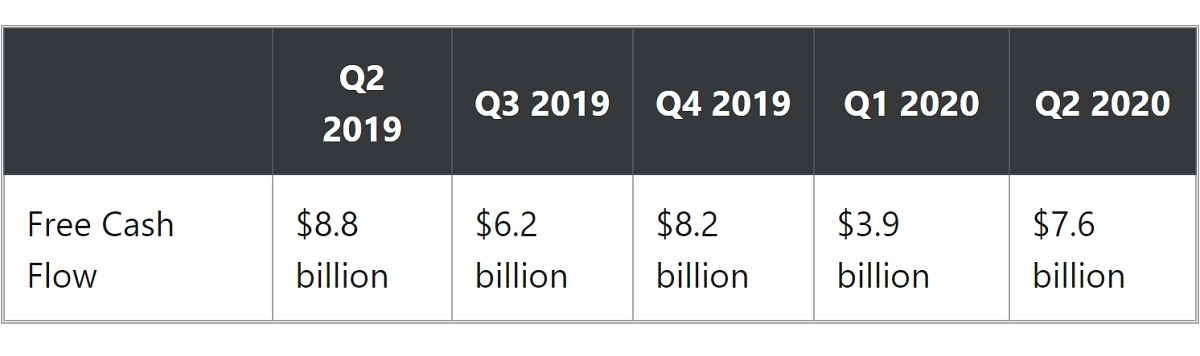

Free cash flow remains strong. This allows AT&T to continue paying down debt while funding its high-yield dividend.

The company completed a nationwide rollout of its faster 5G network in July. The 5G benefits extend beyond improved internet speeds and include the ability for more devices to connect online while reducing lag time. AT&T can capture greater revenue through 5G-enabled device sales and premium pricing for 5G subscriptions.

AT&T also launched its new streaming service, HBO Max, at the end of May. The service provides AT&T with several advantages:

- HBO Max builds on the popular HBO brand, but appeals to a broader audience by folding in entertainment content from across WarnerMedia’s assets, such as the Friends TV show.

- It’s offered through several subscription options, including a bundle with 5G access, to incentivize purchases at a higher price point.

- It provides a differentiated offering over AT&T’s telecom rivals.

HBO Max is tracking toward company targets for subscribers, activations, and revenue. It had over 36 million subscribers at the end of the second quarter.

AT&T also owns a digital advertising platform, Xandr. New CEO John Stankey plans to use Xandr’s technology to deliver an advertising-supported streaming entertainment option next year, opening up new revenue opportunities.

While challenges exist, AT&T’s bright spots remain compelling. It spent $1 billion to acquire new 5G spectrum assets in the second quarter, strengthening its 5G position. Once the pandemic passes, WarnerMedia revenue will recover.

Wrapping Up

One question regarding this oligopoly is whether the price wars of the 3G and 4G eras will continue. The good news for AT&T is that this is less likely. T-Mobile, who drove much of the price competition, also had to spend tens of billions of dollars to build its own 5G network and acquire Sprint. This leaves less room for T-Mobile to draw customers with lower prices.

T-Mobile has experienced tremendous growth over the past year with its full 5G Standalone coverage nationwide. And its merger with Sprint has created newfound synergies with an expansive spectrum footprint. This has led to overtaking AT&T and becoming the second-largest wireless carrier based on prepaid and out paid customers. As a result, I don’t see T-Mobile slowing down or stopping anytime soon.