Salesforce Buying Slack: Turning a $27.7B Megadeal into a Game-Changing Strategy

Following days of speculation, Salesforce formally announced that it was acquiring Slack, the wildly popular enterprise messaging and collaboration platform, for a hefty $27.7 billion.

The deal marks the largest purchase in Salesforce’s history and is among the top 8 biggest acquisitions in 2020 – trumped by multibillion-dollar deals like S&P Global’s $44B purchase of IHS Markit and AMD’s $35B purchase of Xilinx.

Salesforce co-founder & CEO Marc Benioff didn’t mince words on his latest purchase. “This is a match made in heaven. Together, Salesforce and Slack will shape the future of enterprise software and transform the way everyone works in the all-digital, work-from-anywhere world,” Benioff said in a statement.

Salesforce & Slack: What They Want from Each Other

You’ve heard about the concept of a “one-stop-shop”, haven’t you? It’s where a customer can go and get everything they need without having to go anywhere else.

For Salesforce, as well as other companies in the enterprise solutions space, that is the ideal form that they can take. This is because one revenue stream can often lead to many others for little to no added cost, and once a customer is embedded into a company’s network, there’s a sort of stickiness to that relationship.

It was with this strategy in mind that Salesforce decided to acquire Slack. Salesforce is known as a giant in the CRM space. The company’s platform offers features that helps unify commerce shopping experiences, helps to manage leads, provides tools that allow customers to forecast sales, and that allows a customer to have detailed data on their own sales and customers. They also make communication between enterprises easier.

Slack, on the other hand, is a communications and organization tool for companies and teams that works very much like private chat rooms. Through regular Slack features, users can access other applications that have integrated with the platform. This has been made possible through the company’s open-source approach to business (the same open-source mindset adopted by Salesforce).

Salesforce’s Gain: A Huge Ecosystem of Apps

This is clearly a huge gain for Salesforce and will enable the company to expand its presence in the enterprise, not just among Salesforce customers but with any company undergoing digital transformation. Upon close of the transaction, Slack will become an operating unit of Salesforce and will continue to be led by Stewart Butterfield.

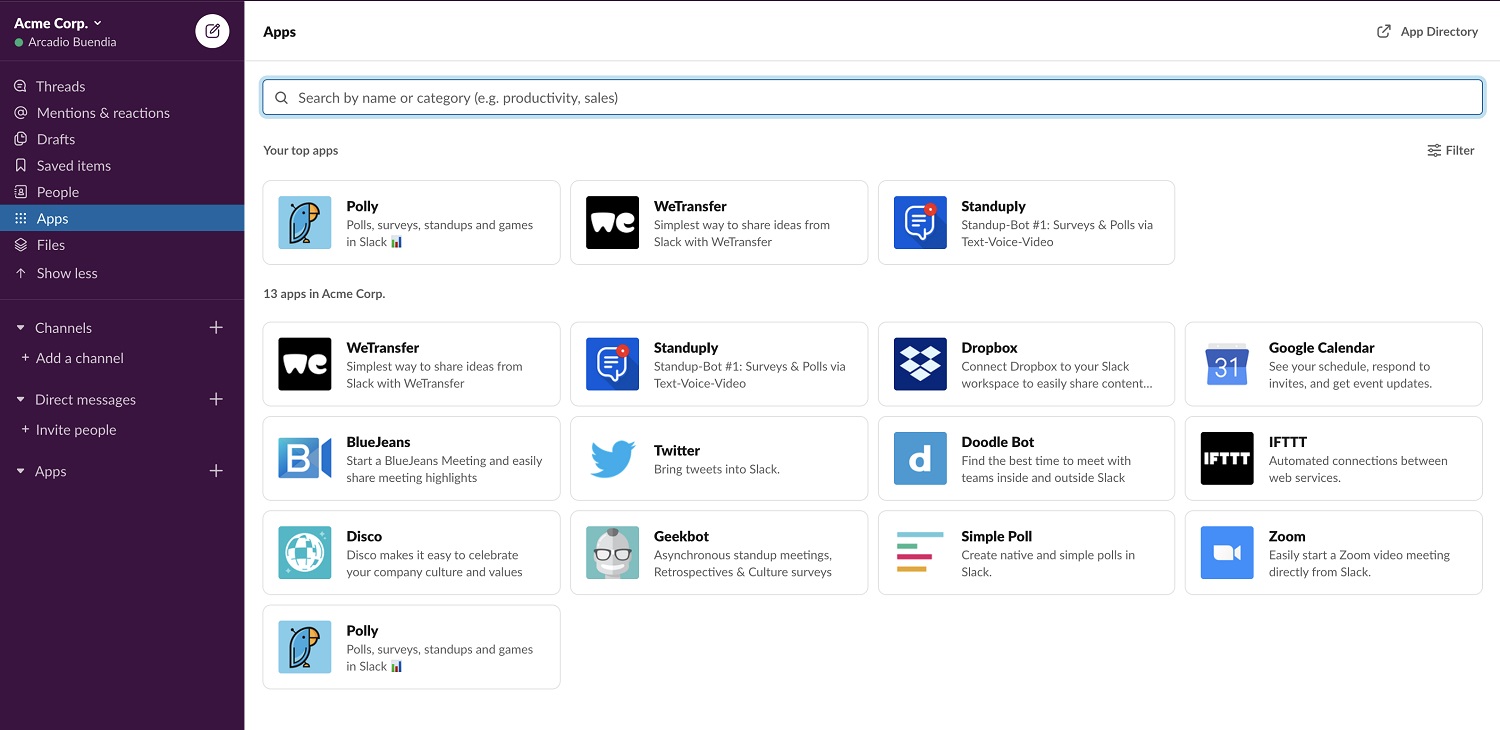

From a technology point of view, Slack’s platform already integrates with more than 2,400 apps that people use to collaborate, communicate, and get work done. Salesforce for its part has arguably the largest enterprise app ecosystem. Combined, they should be able to create a company that will provide enterprises with the easiest way to build and deliver apps to connect with customers in new ways. In fact, the result is likely to be the most extensive open ecosystem of apps and workflows for business that will empower millions of developers to build the next generation of apps with clicks not code.

At first look, the deal looks perfect. San Francisco-based Okta, an independent provider of identity management for the enterprise, has quantified the growth of one and dominance of the other in its own market. Its Businesses@Work data report, based on the login activity of 7,400 companies to more than 6,500 apps, showed that Slack is the 6th most popular app by number of customers and 11th most popular by monthly active users.

Slack’s growth spiked once the pandemic hit with 19% growth in unique users between February and March 2020. Salesforce is the 2nd most popular app by number of customers and 5th most popular by monthly active users.

Initially, Salesforce seems like a slightly awkward fit for a suitor, given its core focus on software that supports business-to-customer (B2C) relationships.

“The first question that comes to mind with these reports is why would Salesforce be interested in acquiring Slack, given that — despite its acquisition of Quip four years ago — employee productivity and collaboration is outside its core domain,” said Raul Castanon, a senior analyst at 451 Research/S&P Global Market Intelligence.

In addition to acquiring collaborative productivity app Quip in 2016, Salesforce previously made forays into employee collaboration with enterprise social network Chatter and social portal Community Cloud. Neither was particularly successful in expanding the company’s reach outside of sales.

An acquisition now of Slack would provide Salesforce with an immediate route to expand its focus on customer-facing tools and address the market for employee engagement.

“Technology vendors have typically gravitated to one or the other, however, the customer journey cuts across both,” said Castanon. “Combining their core capabilities could enable a comprehensive approach that could significantly impact the customer experience.”

“Acquiring Slack would be a major boost here, and Slack’s integration and app story would also play well with Salesforce’s strategy,” said Angela Ashenden, a principal analyst at CCS Insights.

Bridging the gap between employee and customer communications is not entirely a novel concept. She cited Twilio’s recent frontline worker product announcement as one example. “But the intersection of customer care with internal communications is still a white space full of opportunities.”

At the same time, Slack has been creating a more open collaboration space, with the launch of Slack Connect this year making it easier for a business using Slack to interact with external organizations, including partners and clients.

“The potential of Slack Connect and creating a B2B collaboration network would also jive well with Salesforce’s business enablement story,” said Ashenden.

Slack’s Gain: Armed for the Race with Microsoft

A key benefit for both parties would be bolstering competition with Microsoft, which sells a rival CRM platform to Salesforce.

Slack would have plenty to gain with an acquisition, too, with ownership by Salesforce putting it on a firmer footing against the dominant player in the collaboration and productivity software industry.

Since launching Teams in 2017, Microsoft has invested heavily in its collaboration platform, moving users over from Skype for Business and rapidly developing a large breadth of features. Teams — which has 115 million daily active users — also benefits substantially from its availability at no extra cost within Microsoft 365 subscriptions. That gives it a large footprint among enterprise users.

“From Slack’s viewpoint, it is clear it faces a formidable challenge from Microsoft and could benefit from being part of a larger entity,” said Castanon.

Salesforce could help reignite user adoption, too. The rapid growth Slack saw in its initial years appears to have slowed in the past 18 months, said Ashenden, and it has seen a more muted benefit from the rapid shift to remote work during the COVID-19 outbreak compared to other vendors.

“With strong ambitions as to where it could take the business next, Slack needs a way to step up its market reach and product investment opportunities, and doing that as an independent can be very challenging,” she said.

Ownership by Salesforce, a highly acquisitive company with substantial experience integrating large acquisitions such as data visualization tool Tableau (in 2019 for $15.3 billion) and integration platform MuleSoft (in 2018, for $6.5 billion), would likely give customers confidence. That said, a deal to acquire Slack would likely dwarf previous acquisitions in terms of value.

Integrating Slack into its operations would also be a challenge for Salesforce and possibilities include allowing it to operate at arms-length as a standalone unit for some time, as has been the case with its previous multi-billion deals.

Should such a deal get the go-ahead, it would have benefits for end users, too.

“It would inevitably mean much deeper integration across the breadth of Salesforce’s portfolio, but there will be many Slack customers that are already Salesforce customers, and they’ll only benefit from tighter connections there,” said Ashenden.

Slack has had an ongoing battle with Microsoft and its Teams product for years. It filed suit against the company last summer in the EU over what it called unfairly bundling of Teams for free with Office 365. In an interview last year with The Wall Street Journal, Butterfield said that he believes Microsoft sees his company as an existential threat. Hyperbole aside, there is tension and competition between the two enterprise software companies.

Salesforce and Microsoft also have a long history, from lawsuits in the early days to making friends and working together when it makes sense after Satya Nadella took over in 2014, while still competing hard in the market. It’s hard not to see the deal in that context.

In a recent interview, Battery Ventures general partner Neeraj Agrawal said the deal was at least partially about catching Microsoft.

“To get to a market cap of $1 trillion, Salesforce now has to take Microsoft head on. Until now, the company has mostly been able to stay in its own swim lane in terms of products,” Agrawal shared.

While Butterfield cited a list of large clients in enterprise tech, insurance and banking, the narrative has always been that Slack was favored by developer teams, which is where it initially gained traction. Whatever the reality, with Salesforce, Slack is definitely in a better position to compete with any and all comers in the enterprise communications space.

The $27.7B Price Tag: Big Money, Big Expectation

Building an Operating System for the Future

Salesforce’s acquisition-happy strategy is well known, but some investors aren’t fans.

The last few years in particular have featured big blockbuster deals (MuleSoft, Tableau, now Slack) punctuated by smaller ones along the way. These are usually paid for with a combination of cash and issuance of new stock, the former a drag on profitability and the latter an event that dilutes ownership for existing shareholders.

It isn’t for everyone, but Salesforce’s heavy-spend strategy has nonetheless been very successful at handily outpacing new share creation with even faster profitability growth.

However, it’s been clear for years that the software company’s real goal hasn’t been maximum profits, but rather to transform itself from a niche cloud computing service to a primary software platform of choice powering all of a company’s modern infrastructure and operational needs.

Adding Slack now more clearly defines this. The tie-up, expected to close by the second quarter of next year, is being described by Salesforce CEO Marc Benioff and company as creating “the operating system for the new way to work.”

That phrase “operating system” is key. Salesforce has built an incredibly popular ecosystem of apps ranging from customer to commerce to data management, and recent acquisitions have been focused on making it easier for Salesforce users to integrate and make sense of all the disparate data they have.

But to continue its march forward as a full-blown tech platform, a primary business operating suite is crucial if it’s going to catch up to the likes of Microsoft. Slack will become the backbone of said operating system and help connect users and data in the new remote work world that has suddenly become reality.

But the question now is whether the price tag is worth it. Salesforce will shell out $26.79 in cash and 0.0776 of its own stock per share of Slack — valuing Slack at nearly $28 billion at the time of the announcement. It will be Salesforce’s biggest takeover yet, and a hefty premium for a company that hauled in just $834 million in sales over the last 12 months (although Slack did report 39% year-over-year growth during its most recent quarter).

However, as is always the case with Benioff and his team, it isn’t the individual part that’s important, it’s how it transforms existing services overall. And Slack’s work to grow beyond an internal communication and collaboration tool to one that also extends to communication and collaboration with an organization’s suppliers and customers jibes with Salesforce’s vision.

Turning Blockbuster Deals into Game-Changing Services

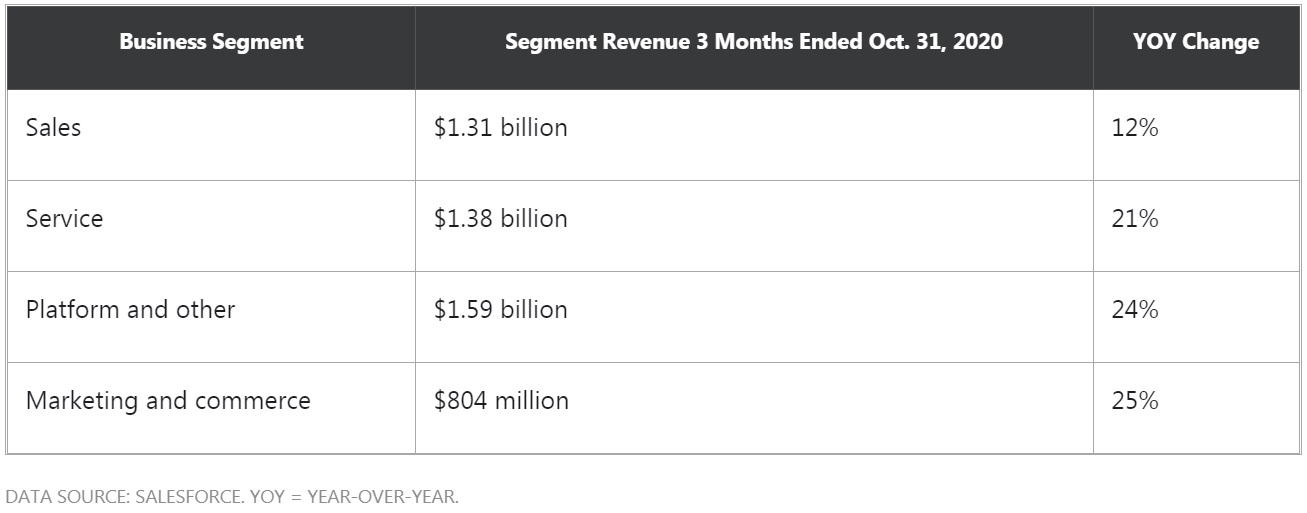

There’s reason to believe this will work. Benioff has been masterful at plugging acquisitions into Salesforce and growing them into something much larger than the sum of their parts. Take the Commerce and Marketing Cloud segments, started up a few years ago (primarily with Demandware in 2016, purchased for $2.8 billion). Benioff said on the last earnings call that the two e-commerce segments processed more than 31 million orders in the last quarter, up 62% year over year.

The Platform segment, digital data integration services started by MuleSoft (acquired in 2018 for $6.5 billion) and Tableau (acquired in 2019 for $15.7 billion), also continues to grow at a fast pace and power companies’ digital transformation by making it easier to gain insight from data and build new applications. All of these segments complement the still-expanding customer sales and service relationship bread-and-butter where Salesforce got its start.

Put simply, it’s good to see like Salesforce’s chances at doing it again with Slack, at using a smaller growing software firm to augment its own trajectory and set itself up for future expansion. Management provided an initial outlook for next year in which it sees its revenue growing another 21% to $25.5 billion (up from the expected 23% growth to $21.1 billion this year).

Sure, Slack will be a big help, but early guidance for the fourth quarter of this year and first quarter of next year calling for 17% year-over-year growth in each period ex-Slack demonstrates that Salesforce has organic momentum on its side too.

Further down the line, Benioff has started talking about how Slack and the new “operating system for the future of work” has laid the groundwork for his company eventually reaching $50 billion a year in revenue. Getting there will no doubt entail more big acquisitions. The worry that’s presently pushing shares down is predictable.

If history repeats itself, the market will fret over the purchase cost, and the stock will tumble, only to eventually reverse course when Salesforce reports an “acceleration” in its growth due to said acquisition. There are many investors who believe in the long-term prize as the company aspires to eventually be among the largest tech firms in the world.

So, the Deal Seems Perfect, Except for One Thing

Beyond concerns that Salesforce might be overpaying, investors might also be puzzled about the deal’s structure. They’re wondering if it was better for the CRM specialist to use more stock in its offer.

60% Cash & 40% Stock

Rumors suggested that Salesforce would seek to use half cash and half stock for the purchase, but that ended up not being the case. Salesforce is offering $26.79 in cash and 0.0776 shares of Salesforce for each Slack share. Based on the closing price of Salesforce stock right before the deal was announced, that translated to about $18.73 in stock, bringing the total consideration to $45.52 per Slack share.

In other words, the proportions were close to 60% cash and 40% stock. By contrast, Tableau was an all-stock transaction.

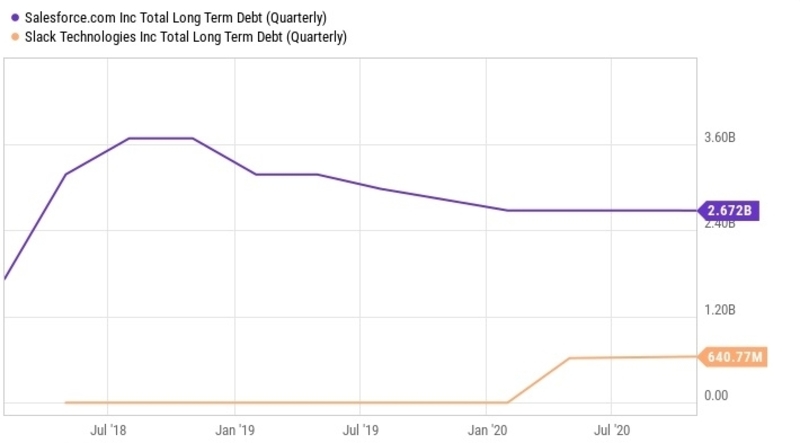

Salesforce’s use of cash is peculiar for several reasons. For starters, it simply doesn’t have that much on hand. The CRM tech giant finished the third quarter with $9.5 billion in cash, while the cash component of the offer is over $16 billion. To make up for the shortfall, Salesforce has secured a $10 billion bridge loan facility from a consortium of big banks that will be good for a year.

Neither company currently has an excessive debt load, so the combined company’s balance sheet should remain fairly stable.

Additionally, Slack’s $640 million in debt is from the convertible note offering from earlier this year. Salesforce’s proposed acquisition puts Slack shares well above the conversion price associated with that paper ($31). Slack can choose how it wants to pay back that debt — with cash or stock — if a bondholder elects to convert.

Should Salesforce Have Used More Stock?

How companies structure acquisition offers can potentially be telling.

If management has confidence that the deal will ultimately succeed and create value, it’s better to use cash to essentially buy out all of the acquisition target’s shareholders. That way, the acquirer can capture the subsequent value creation for itself and its shareholders. If there are doubts, then using stock as currency makes sense. This move shares the potential downside risk with the target’s shareholders if the acquisition doesn’t meet expectations or synergies don’t materialize.

There’s another factor to consider though. When a company’s stock is soaring – like Salesforce’s had been this year – then using stock is appealing. The company can get a lot of bang for its buck this way, reducing the dilution associated with issuing shares as currency for an acquisition.

Many variables are at play, but Salesforce may have been better off using more stock than cash in its offer, particularly when considering the sheer size of the blockbuster acquisition. A higher stock proportion would have minimized how much debt the company needed to take on, reducing its overall financial risk level. Sure, the confidence signal associated with using cash is encouraging, but using more stock to share potential downside could have been the right move due to valuation concerns.

The challenge these two firms now face as they move forward with this acquisition, and all of the expectations inherent in a deal this large, is making it work. Salesforce has a lot of experience with large acquisitions, and they have handled some well, and some not so well. It’s going to be imperative for both companies that they get this right. It’s now up to Benioff and Butterfield to make sure that happens.