Rick Heitzmann on Riding the Wave of the Dot Com Bubble

From its initial days as a military-only system to its present position as one of the developed world’s main sources of data and communication, the Internet has seen meteoric growth literally in a flash. Since the evolution of the Internet, numerous businesses have benefited from this game-changing advance.

Behind the stages of the extraordinary performances of startups that have been taking advantage from the “dot com” bubble since 2000 is the venture capitalists who poured money into these enterprises to scale up their ideas from the initial stages. As a matter of fact, a lot of these VCs have seen the current dominance of the Internet long before its inception.

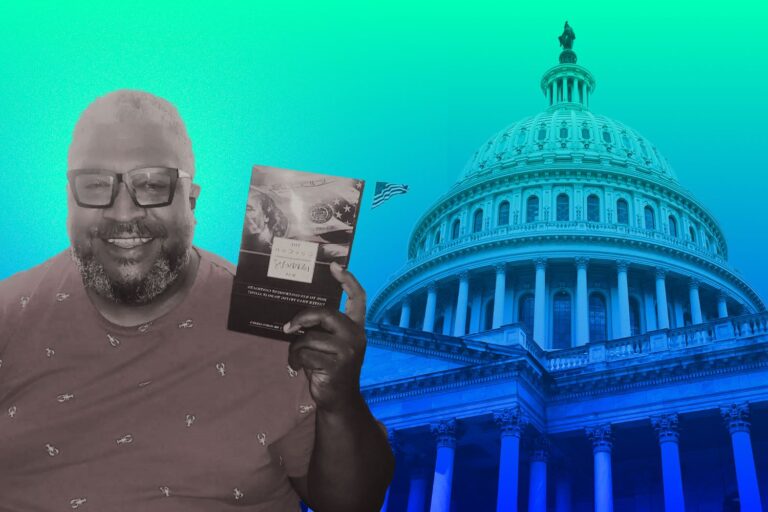

Rick Heitzmann is one of them!

This man is a Founder and Partner of FirstMark, concentrating on consumer and enterprise investments in media, advertising technology, gaming, mobile, and data services. The company is renowned for its attempts to develop a community and an ecosystem as well as its impressive track record in investments. FirstMark is focused on early-stage investments, with more than 100+ active portfolio companies and $1B+ latest early and growth stage funds.

Talking about how much cash Heitzmann owns has been no longer attractive, that’s why the journey to his throne is becoming more fascinating to readers. Having been sharing the vision for creating a healthier relationship between entrepreneurs and capitalists, Rick Heitzmann appears to be not only the one that gives money to the seed companies, but also a friend with sympathy since his starting as an entrepreneur. Let’s read on.

Rick Heitzmann and His Futurist Perspectives on the Dot Com Bubble

One obvious thing about this capitalist is that he is obsessed with the Internet, and Internet-based startups that he’s been betting on for a long time. This interest has come to him even prior to his career as a backer.

In the mid-1990s, when Rick Heitzmann began using the Internet, he realized that this advance was going to create a fundamental shift through a broad range of industries. “Wouldn’t my life be so much better if I could be part of a growing pie fundamentally changing growth as opposed to fighting over a shrinking pie in distress buyouts (the industry I had come from),” he thought.

That’s basically the motivation behind his transition to VC and spent some time in venture both in San Francisco and in New York City prior to actually having left to become an entrepreneur and then circle back into VC later on in life with the formation of FirstMark in 2008.

When Heitzmann decided to start FirstMark, he teamed up with venture capitalists that he had collaborated with prior to First Advantage and they began working on the approach of the fund in 2005 before the recession hit.

“As an entrepreneur, you hope that what you’re working on lasts more than one economic cycle and that there will be plenty of headroom to grow. We started FirstMark on a couple of different themes,” said Rick Heitzmann.

The first was to concentrate geographically on New York. The second was to be sector specific. Deep industry knowledge allows capitalists to support their portfolio companies and create an ecosystem within that industry. It also offers backers a competitive edge when sourcing deals.

The third factor was keeping an eye on the early stages of development and knowing what was available in terms of open source, AWS, or other tools to aid founders in gaining traction more quickly and affordably. Everything was handled under the assumption that the endeavor should be a service-based firm.

All these themes have been engraved in the core of FirstMark since the beginning. However, it’s just the first step. To survive in the industry, not only entrepreneurs, but also backers must fix their investment philosophy to adapt with changes in the game, and one of the most key factors to Rick Heitzmann’s success is not to keep and conservative mind.

The Hunter that Always Craves for Disruption Points

“We were competing our hearts out. It was competing for mindshare. It was competing for deals. It was competing just to get meetings with companies”, said Rick Heitzmann.

Without being pejorative to some of the older players, when Heitzmann was starting off, the older and more established VCs wouldn’t return his calls. Numerous of these guys are no longer around.

He added, “We’d see founders we knew at conferences where they’d ask us condescendingly what the hell we were trying to do with FirstMark. They’d look at us and let us know that they had the official Boston VCs behind them as if to let us know that we’d never fit in their picture. They’d often look at us like we were asking for a job.”

The disruptive factor in the way this man invest is he doesn’t wait until entrepreneurs reach out to him but go out and find them.

According to Rick Heitzmann, “We believe that the best opportunities don’t always walk into our office. We identify and research megatrends and proactively reach out to those entrepreneurs who share a vision of where the world is going.”

With some Limited Partners (LP), his organization developed a relationship with them for nearly a decade before investing in one of their funds. Sometimes, LPs wouldn’t even allow FirstMark access to their workplace.

The competition is changing every single second, and it is essential to alter theses and let theses play out. “You see different industries being disrupted at different times”, Rick Heitzmann said.

As a VC, the FirstMark CEO is constantly looking for the beginning of disruption. He will look at the company from many sides to evaluate the potential of it before plumping tons of cash into that business.

With Pinterest, for instance, the world became more mobile, more visual (tiny screen while walking), and more social, all of which made curation essential. When all of those different ideas were put together, Pinterest made sense. That’s where Rick Heitzman jumped in and stole the deal.

“As an investment thesis, we look for multiple points of disruption to occur that were never possible before.”

There were other points of disruption outside of his Uber business that made that conceivable. Granted, others tried it so implementation was important, but several factors led to the existence of that type of service and it was important to build a thesis to track those. Every person who drives a cab or a car and every person who needs a cab has a smartphone thanks to its widespread use.

The FirstMark founder added, “The GPS embedded in mobile phones is such that we’ll always know where those people or cabs are.” There is now a sophisticated advance to pay and track those people. Within a year of Uber’s creation, all those features appeared. Multiple levels of disruption are present. The majority of such interruptions occurred simultaneously.

Follow these theses which lead to Heitmann’s success during his career as a capitalist. His venture capital has made 344 investments. The most recent investment was on Dec 7, 2022, when SurrealDB raised $6M.

Moreover, FirstMark has made 50 diversified investments. The most recent diversity investment was on Sep 13, 2022, when HopSkipDrive raised $37M. This VC has 54 exits. Some of the most notable exits include Pinterest, DraftKings, and Riot Games, just to name a few.

Heitzmann’s most notable investment was his seed bet on Pinterest in 2012. When the company went public in 2019, he saw a 1,900x return on his investment.

The capitalist saw two more successful IPOs in his portfolio in 2020 including Airbnb, with a current market cap of $103 billion, and DraftKings, currently valued at $7 billion as of April 2022.

FirstMark’s CEO also took stakes in two current unicorn companies including Ro, currently valued at $7.1 billion, and Orchard, valued at $1 billion.

Focusing on the potential that the companies that backers back is a must, but without building a culture between entrepreneurs and venture capitalists, a VC may not survive in the game that’s demanding more ideal standards day by day. Heitzmann has been executing that since his inception. This man is building a relationship that gets him a big return, we’re not talking about money, but sympathy.

It’s The “Healthy” Relationship with Founders That Matters!

Now everyone talks about VCs helping businesses, but that has been a major shift from the 1980’s and 1990’s VC who had a tremendous power distance from entrepreneurs which created a hierarchical system. There was not much value-add from the venture capitalist and it wasn’t a collaborative partnership. These core foci, plus the idea of a collaborative partnership, were not obvious 14 years ago.

At FirstMark, the team asked the founders questions and helped them get to a solution. What are the problems founders facing so they can’t sleep at night, therefore, can’t make decisions during the day? What problems are founders solving for as they’re scaling an organization, customers, financing?

Heitzmann and his group were interested in finding out how they could work alongside entrepreneurs to address those issues.

He wondered, “How can I build a fund that creates an ecosystem around them?”

“We can invest in companies as early as the first institutional round in the seed. Sometimes we invest in companies even before they’re formed, even before they have bank accounts. We can invest through the public markets and hopefully, as we’ve learned, as being former entrepreneurs, we want to be true partners in the journey,” Heitzmann shared,

When he was an entrepreneur, he occasionally believed that his board would defeat him if he didn’t meet targets, which was difficult to explain given that everyone at the table had the same objectives and was working to address the same issues.

From these experiences in the past, Heitzmann is building a more ideal relationship between his capital and entrepreneurs. With his funds and as a partner, he can support entrepreneurs on their journey and shares their vision and empathy.

Not only as an investor or a board member, but also, his capital puts money in surrounding the business with as much love as possible by being able to provide what Heitzmann calls platform services of talent, media and community, corporate development, and a whole myriad of platforms that help companies to feel more included than they might be as a-couple-of-person-startup.

Having always been a backer with futurist perspectives on businesses powered by computer vision, he poured his effort into this field since its early days. However, as the world is changing and there are sectors that’s drawing attention to its rising demand, healthcare is one of them.

Rick Heitzmann’s Bullish Take on Healthcare Sector

Healthcare is a delicious pie, but definitely hard to chew. In practice, many venture capitalists avoid healthcare or have historically avoided it because of the bureaucracy, the FDA approvals, and everything else. Even so, these inconveniences can’t hold Heitzmann back, he is super confident about healthcare.

In order to more accurately diagnose, treat, and cure patient diseases, the healthcare industry has habitually placed a priority on innovation and improvement. More than two years into the pandemic, healthcare has undergone more change as a result of the outbreak and the difficulties it posed than at any previous time in contemporary history.

Healthcare was compelled to quickly adapt and evolve in order to accommodate and safeguard patients and providers alike, resulting in significant changes that will have an impact on the industry for years to come. Heitzmann saw it and started to put his fingers to this sector.

Probably four of Heitzmann’s last eight investments are in the healthcare field. “We like it because it’s a huge market that’s changing tremendously. We view people taking more control of their healthcare, both their healthcare budget with higher deductible plans, and then also their knowledge.” Heitzmann said.

The capacity for individuals to own their healthcare and own their healthcare decisions is much larger than maybe our mom and dad’ generation or our grandparents’ generation who had a tremendous amount of lack of control between the medical industry and themselves. They followed the doctor’s instructions without inquiry.

Now, with the advent of the internet, distributed knowledge, very micro-level ability to understand the disease, understand how you’re feeling, and then take ownership of your care is incredibly important, according to the FirstMark CEO.

FirstMark has invested in Ezra, which is looking at full-body scans and the ability to catch cancer at an early stage, as well as other diseases and help save lives.

The capital also funded Rowe health, which is understanding patients more and being able to provide a full patient-centric and seamless healthcare experience in both the physical and digital world.

Heitzmann disclosed that his capital will shortly be making another announcement in and around that sector. Then even on the infrastructure side with things like Klarna, they’ve seen a lot of opportunities to change the way the healthcare conversation is going.

“It’s going to be incredibly important as we think about caring for folks and the ability to have all your care delivered to you digitally,” said Heitzmann.

Healthcare is getting here and there since many investors have jumped into that “pool”. Meanwhile, there is a hot topic about AI these days since the OpenAI ChatGPT has been freaking people out by its amazing but scary features. It’s so crazy that people have left the stock market, it’s like a ghost town out here, but the opportunities are so good right now as AI is drawing so much attention. Heitzmann couldn’t be outside of the game, in fact, he is putting AI on top of his list.

The “Next Big Thing” AI as His Priority

The excitement surrounding the bots has pushed well-known chip stocks like Nvidia, Mobileye, and Ambarella higher to begin 2023. But more elephants are enjoying the wave, too.

In an interview in February 2023, Heitzmann expressed his interest in this sector. According to him, AI is becoming a buzzword, but he saw that data was going to be released. For better data systems, that data then became machine learning, so you could have algorithms around it or software around it. And that led to AI, which is software learning from software.

Heitzmann said, “Probably 5 or 7 years ago as this got unlocked, there were different applications, either horizontal AI, which does some jobs in the background of software applications, or vertical AI, which does jobs around search or writing college essays if your chatGPT or whatever it may be so. That’s where when that’s been a long-term play for us and now it’s just starting to get hot again in the BC ecosystem.”

He added, “Corporate end user makes it hotter.”

His capital firm has a company that processes billions of documents for the government every day and takes the forms from the DMV, Social Security, just to name a few. He said, “I want to make sure Dan’s really Dan, I want to make sure this is really his address.”

According to the FirstMark CEO, the processing of vast amounts of information is the best use of AI. Obviously, as you get someone like Social Security Administration as a customer, that’s a long-term customer, much prefer that as opposed to people using AI as a toy.