Nordstrom vs Macy’s: There’s No One-Size-Fits-All Approach to Outlasting

Department stores, once brimming with discovery, a full range of merchandise and amenities like tailoring, food, and childcare, are struggling in a challenged retail environment. This type of retail is something of an endangered species today, but there are two merchants well positioned to weather the sea change, say analysts: Macy’s and Nordstrom.

They are both working hard to bounce back in the next few years. Which one is more likely to pull off a successful turnaround?

Nordstrom vs. Macy’s: A Department Store Showdown

Nordstrom and Macy’s are two of the most ubiquitous department stores in the US and there are similarities in their audiences. These findings below reveal powerful ways that each brand could gain an edge in a competitive retail marketplace.

Macy’s Customers Less Traditionally Domestic

Perhaps unsurprisingly, the exclusively Nordstrom audience skews wealthier—they are 95% more likely than the average person to have a household income of $100,000 or more. Meanwhile, Macy’s segment is 31% more likely to earn between $75,000-$99,000.

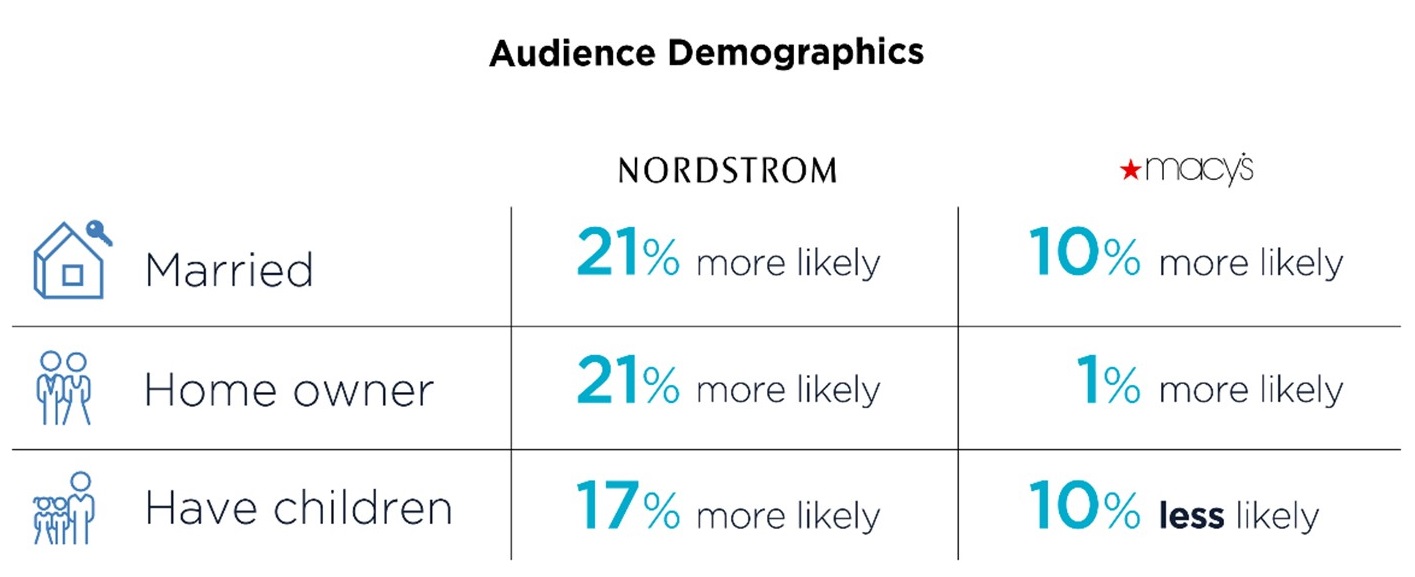

In terms of home life, Nordstrom loyalists exhibit a higher propensity towards traditional families. They are 21% more likely to be married and own homes—meanwhile Macy’s shoppers are only 10% more likely to be married, and are about average when it comes to home ownership. The biggest disparity is reflected in children. Nordstrom’s loyal customers are 17% more likely to have children at home, while Macy’s loyal shoppers are actually 10% less likely than the average American to have kids.

Nordstrom Shoppers Have Stronger Apparel Opinions

It comes as no surprise that both audiences are interested in fashion—but their attitudes towards apparel and clothing are markedly different.

Nordstrom customer attitudes reflect a penchant for designer labels, fashion magazines and organic products. Their most over-indexed attitudes reflect higher numbers, and very strong opinions:

- “Fashion Magazines Help Me Determine What Clothes to Buy”—208% more likely to agree

- “A Designer Label Improves a Person’s Image”—183% more likely to agree

- “When I Shop for Health and Beauty Care Products, I Look for Organic/Natural Items”—156% more likely to agree

Meanwhile, Macy’s customers also show an interest in the latest fashion trends, and even suggest they are willing to spend more than they can really afford on nice apparel. However, their top three strongest apparel attitudes don’t index as highly as Nordstrom customers do.

- “I Am Usually the First Among My Friends to Try New Clothing Styles”—50% more likely to agree

- “I Am Willing to Spend More Than I Can Really Afford, to Get the Clothes That I Want”—50% more likely to agree

- “I Try to Keep Abreast of Changes in Styles & Fashions”—37% more likely to agree

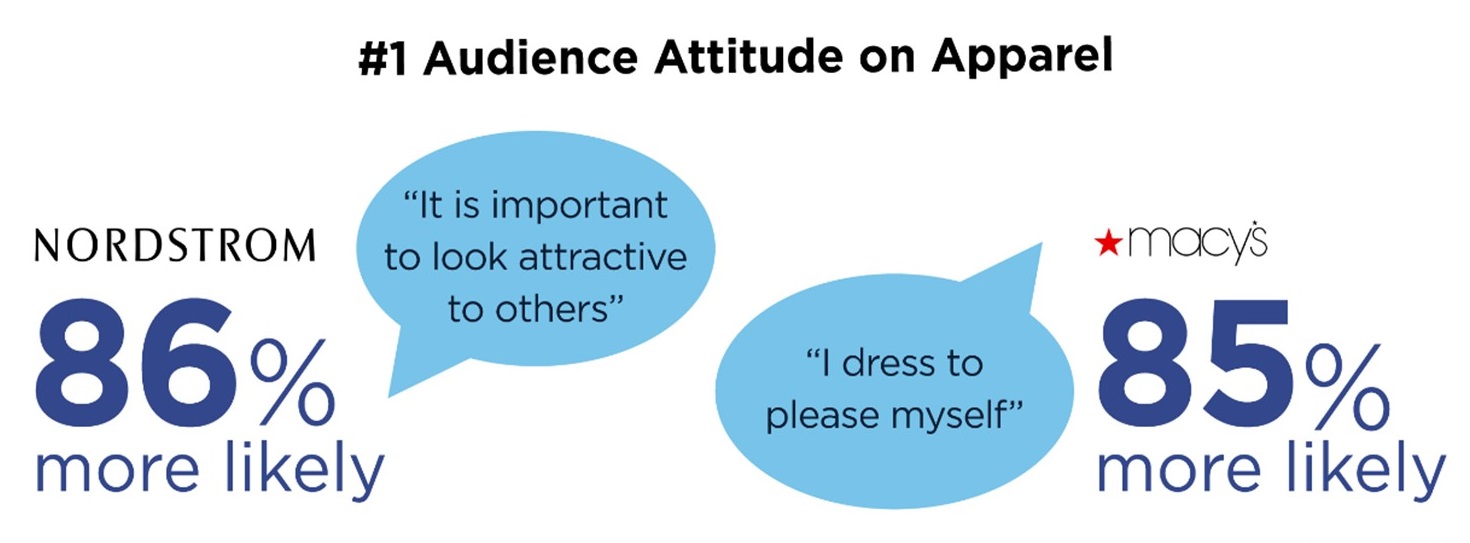

In terms of the largest percentage (rather than highest likelihood), each audience displays very different dominant attitudes.

Macy’s Dominates Online Market Share

On the digital side, Macys pulls over double the market share of Nordstrom. Of all visits to retail websites measured over a month, Nordstrom(dot)com received 0.24% of visits while Macys(dot)com received 0.57%. Not only does Macys(dot)com get a larger share of traffic overall, but its mobile ratio is also higher; 58% of its traffic is on mobile devices, while only 44% of traffic to Nordstrom(dot)com is mobile.

Perhaps even more insightful from a competitive standpoint is analyzing the journey that online shoppers take before and after hitting Macys(dot)com and Nordstrom(dot)com. Deconstructing the flow of visitor activity reveals whether one retailer is losing customers to another, and where there are opportunities to conquest shoppers earlier on.

Macys(dot)com visitors tend to visit search engines, email, and Amazon (as is the case with most retailers) before and after hitting Macys(dot)com. Nordstrom sits lower on the ranking—underneath JC Penney as the 15th most common website hit before Macys(dot)com, and 16th most common after.

Conversely, Macy’s represents a more menacing competitive figure for Nordstrom. Macys(dot)com is the 6th most visited website before Nordstroms(dot)com and the 7th most visited after, second only to Amazon in terms of retail competition. Not only is Macy’s ranked high in Nordstrom’s activity stream, Macys(dot)com traffic increases from 804,989 visitors before Nordstrom(dot)com to 829,109 afterwards, suggesting that more comparison shoppers may ultimately end up at Macy’s. The data suggests Nordstrom may be losing customers to Macy’s online.

Ultimately, there are lessons to be learned for both Macy’s and Nordstrom. Understanding your own best customers—and what sets them apart—can help brands double down on their most loyal audience. In the same token, as e-commerce overtakes the retail industry, it’s crucial that brands understand areas where they are excelling and falling behind major competitors online. Most importantly, retail brands must identify opportunities to capture greater market share, whether it’s by providing a mobile experience, targeting only luxury shoppers, or competing on price.

“Stores have been cast as a liability in an Amazon era, but they’ve been making a comeback as something that’s critical to a retail strategy,” said Claude de Jocas, manager of L2’s Intelligence Group. “Digital is the connective tissue between online and in-store.”

To compete, a seamless online-to-offline experience is imperative for department stores to go the way of the dinosaurs. Here’s how Nordstrom’s and Macy’s digital efforts to edge out Amazon stack up:

Mobile App User Experience

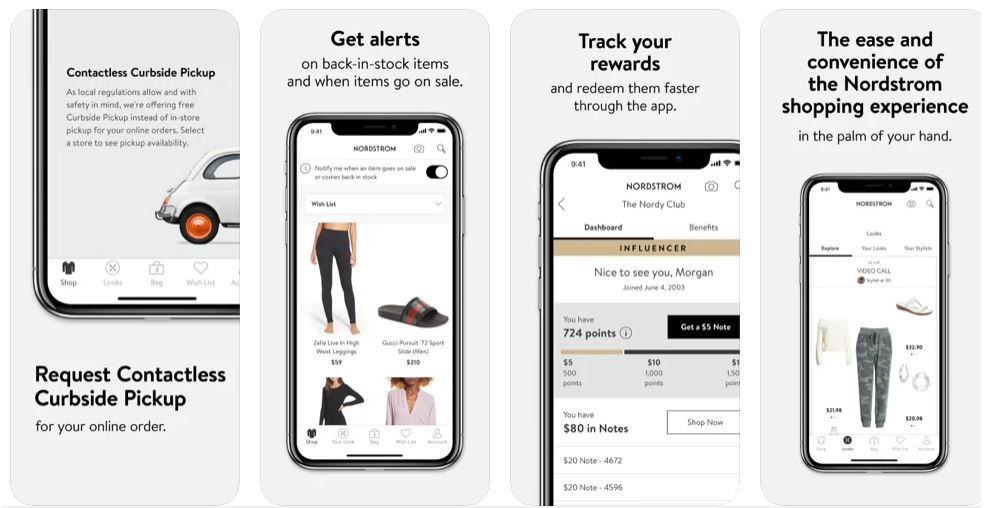

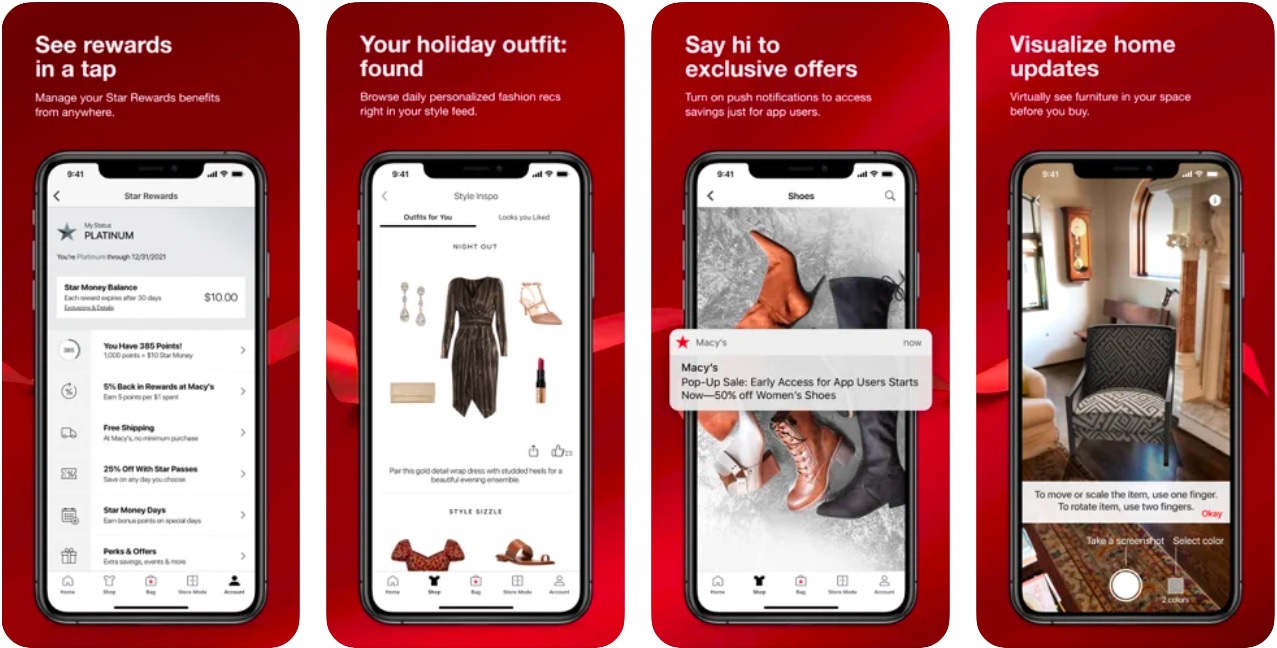

A true omnichannel experience requires easy mobile navigation. Nordstrom and Macy’s apps focus on similar main features: tracking user reward points, locating nearby stores, finding in-stock items in a particular region, scanning barcodes, and utilizing beacon messages (for instance, if you pass by a Nordstrom store that has an item in your mobile shopping bag in stock, the app will tell you, if you opt in).

On iOS platform, it is rated 4.9 stars (from 528,738 reviews) for Nordstrom’s app, and 4.8 stars (from 1,130,912 reviews) for Macy’s. The rates barely differ, but it seems Macy’s app draws much more attention than its rival.

Outside of their native apps, both Macy’s and Nordstrom’s Instagram accounts are comprehensively shoppable, a tricky point for retailers on the platform. The brands’ followers can find links to products through shoppable third-party service Like2Buy, but Nordstrom enjoys greater reach: The retailer has 3.3 million Instagram followers, compared to Macy’s 1.9 million.

Payment and Rewards

The point of purchase has to be as streamlined as possible for shoppers bagging items in-store, online and on their phones. Both Macy’s and Nordstrom have invested in digitizing their point-of-sale systems to enable sales associates to fulfill requests and track customer needs both online and in-store. They both were also among the first to adopt Apple Pay, and their mobile apps store customer credit cards, shipping addresses and rewards points to make m-commerce checkouts easier.

These efforts demonstrate how seriously Macy’s and Nordstrom are taking digitization, apart from the “sexier” tactics like social media, according to de Jocas.

“Incorporating digital into the retail experience, like digital payment methods, doesn’t get as much press, but it’s the less sexy stuff, unlike social media, that really drives returns,” she said.

Macy’s joined Plenti, a coalition loyalty program that rewards customers who shop within the coalition (Rite-Aid, Exxon Mobile, Hulu, and others joined with Macy’s) with points and rewards. The My Wallet feature within the Macy’s app is a catch-all way to keep track of all promotions, points, and payment methods that users have filed in their Macy’s profile. De Jocas said that the retailer has invested heavily in making payments digitized, having put $2 billion into the effort.

Different Approaches During Tough Time

In a time where traditional brick-and-mortar retailers are shutting down at a frantic pace, two retail stalwarts are showing the power of evolution. As retail continues to shift and be disrupted, including a record 9,300 physical stores closed in 2019, it’s the brands that are willing to evolve that will survive. Macy’s and Nordstrom are each taking a unique approach by evolving to stay relevant and set themselves up for long-term success.

Nordstrom Expands into Secondhand Items

Nordstrom is known for its wide selection of brand-name items. But now, some of those items come with steep discounts just because they’ve been slightly worn. Nordstrom recently opened a secondhand boutique at its flagship New York City store and online. Called See You Tomorrow, the shop features discounted items handpicked from Nordstrom’s customer returns. The items are exactly what customers would expect to find at Nordstrom except for the fact that they were previously owned.

The sustainable, secondhand market is a huge growth opportunity for Nordstrom. The resale market is already worth $7 billion and is expected to triple by 2023. An estimated 56 million women purchased secondhand items in 2018, up from 44 million in 2017. Customers want sustainable fashion and to breathe fresh life into previously worn items.

Nordstrom’s approach is a win for customers and the brand: customers can score great deals while also contributing to sustainable fashion, and Nordstrom can lower its carbon footprint in the notoriously environmentally un-friendly fashion world and work through its backlog of returned items. The evolution opens the store to a new wave of customers looking to score great items at discounted prices and has the potential to scale quickly to other locations and further growth online.

Macy’s Shuts Down Stores to Incite Future Growth

On the other end of the spectrum is Macy’s evolving retail strategy. Although dramatically different from Nordstrom’s, it has the potential to be just as successful in the long run. Macy’s announced it will close 125 of its stores over the next three years, mostly those in weaker-performing shopping malls.

The company will also move its headquarters to New York and streamline many of its internal departments and processes. The long-term shift is to create smaller stores outside of traditional shopping malls and be closer to where customers live and work. By creating a more efficient internal structure, Macy’s hopes to save money that it can invest into the new store strategy.

Macy’s evolution reflects changes in how consumers shop. Customers used to travel to department stores to find everything they needed for their homes and wardrobes in one place, but that shopping philosophy has been replaced by the convenience of online shopping and specialty stores. Macy’s hopes that by restructuring its stores to be where customers already are and offer products they already need, it can connect with a new generation of customers and push past the mall days.

Macy’s Latest Results Confirm Nordstrom Is the Outlier

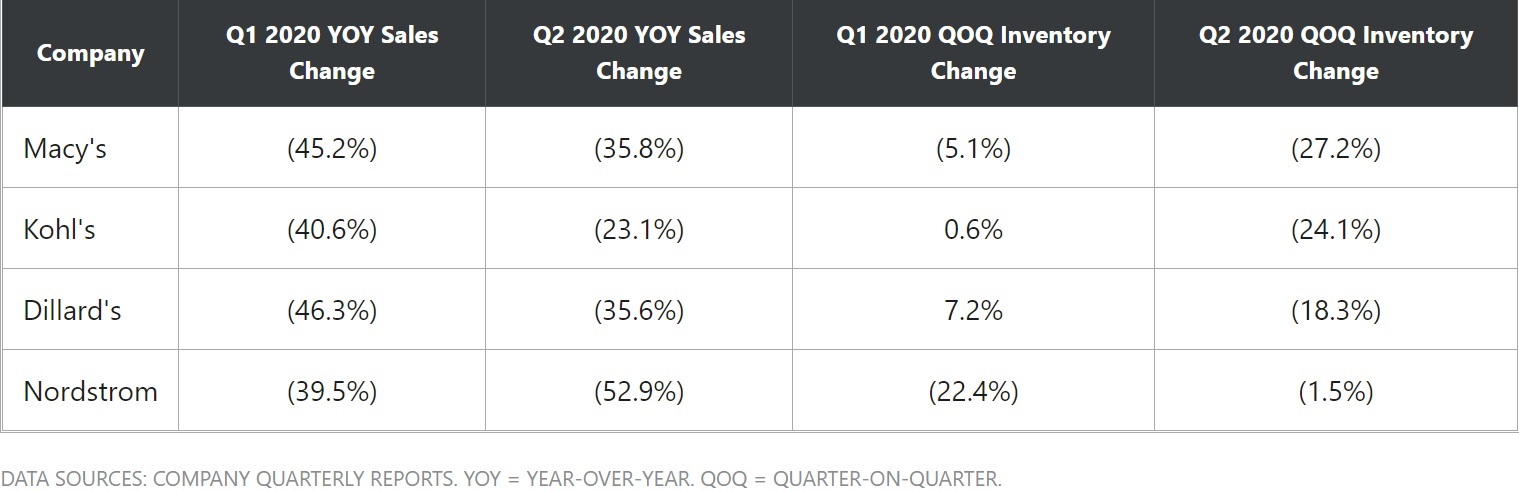

If there was any doubt Nordstrom bucked the industry’s second-quarter trend by stocking up rather than scaling back on inventory, Macy’s erased that with its latest results. Like rivals Kohl’s and Dillard’s, Macy’s also slowed down merchandise receipts during the three-month stretch, by almost as much as sales fell year over year.

It may prove to be a brilliant decision if Nordstrom was able to sell through a big chunk of that inventory during the recently ended Anniversary Sale and then proceed to sell through more of it as we near the end of the year. If Nordstrom failed to so, though, it may stifle the chain’s financial flexibility headed into 2021.

The Path Less Traveled

For the second fiscal quarter ended Aug. 1, Macy’s net sales fell from $5.55 billion to $3.56 billion, a 36% setback that was widely expected and mirrored by other department store chains. The COVID-19 contagion has been tough for most businesses but downright brutal for retailers. In some senses, the setback is forgivable.

Making the shrinking top line even more forgivable is how much Macy’s adapted in the meantime. Rather than accepting and then sitting on inventory it would struggle to sell, Macy’s total merchandise-on-hand was scaled back by 27% quarter over quarter from $4.92 billion to $3.58 billion. Macy’s made the same basic decision competitors Dillard’s and Kohl’s did.

Not Nordstrom, though.

Yes, to its credit, Nordstrom culled inventory in a big way during the first quarter. Its rivals didn’t, and in most cases probably couldn’t do so as quickly as Nordstrom did. When given the choice to continue cutting back on second-quarter receipts, though, Nordstrom went the other way instead.

It matters more than one might think.

Unlike most of the goods carried by the likes of Walmart or Dollar General, fashion-oriented apparel has something of a shelf life. Spring goods don’t sell well in summer, and summer goods don’t sell well in the fall. Fall goods don’t sell well in the winter. You get the idea. The longer an article of clothing sits unsold in a store, the deeper the markdown needed to sell it. Older merchandise also takes up valuable floor space, and it even ties up money that can be used to procure more marketable and higher-margin inventory. That’s why, in this volatile retailing environment, most retailers are looking for ways to commit to a minimum degree of inventory, not more.

Macy’s aggressive inventory reduction was another reminder that Nordstrom chose the riskier path headed into the current quarter by procuring goods it didn’t have to.

A Calculated Risk

There may have been a reason Nordstrom made the risky choice to beef up inventories despite its sharp sales drop last quarter. Its annual Anniversary Sale that normally takes place in July was pushed back to August, also pushing back the financial impact of that event from the second to the third quarter of fiscal 2020 in the hope that the coronavirus would be less of a challenge by then.

CEO Erik Nordstrom even commented during the company’s latest conference call in August, “We’re in the final week of the event, and results are in line with our expectations, reflecting a notable sequential improvement in Full-Price sales trends.” Exactly what that meant in fiscal terms was never divulged.

Nordstrom did say enough, however, to raise the question of whether or not maintaining inventory levels in the current environment was the right call. He further explained during the call that moving the Anniversary Sale from to the third quarter only resulted in revenue shift of approximately 10% of the usual top line in the second quarter.

Subtracting 10% from last year’s second-quarter net sales of $3.78 billion would have translated into a comparable sales figure of $3.40 billion, but even taking that into account, the $1.78 billion of net sales in the latest quarter was still down 45% year over year. Either way, Nordstrom experienced a much bigger sales tumble than any of its key rivals suffered.

If the company hasn’t already sold through a huge chunk of the $1.47 billion of inventory it was holding as of early August, it’s now going to be carrying a huge stash of summer and fall goods into the fast-approaching winter season.

Retailers Must Evolve or Close

Over and over again, we’ve seen that the retail stores that close have failed to evolve with the times. Changing technology, trends and customer preferences have forever shifted the retail space. But brick-and-mortar isn’t dead; it’s simply evolving. Macy’s and Nordstrom show that there isn’t a one-size-fits-all approach to surviving these turbulent times. The key is for brands to understand their customers and evolve in ways that best meet their needs. Instead of sticking with the status quo or giving in to what many retail brands view as the inevitable, retailers need to evolve or run the very real risk of shutting down.

More than price or product, experience is a brand’s biggest competitive advantage. Building strong relationships with customers, understanding their needs, and building an innovative experience to meet those needs is what turns retail stores into thriving businesses instead of just another statistic about closed stores. In the retail world, it is to evolve or to be closed.