Neiman Marcus: The Bankruptcy and Learning Experience for Digital Transformation!

Each and every year, we can hear about the increase in online sales, and as e-commerce continues to grow, talk of the downfall and bankruptcy of brick-and-mortar continues to grow with it. In this digital day and age, although there is some validity to their arguments, brick-and-mortar stores aren’t going to dissipate if they are able to adapt.

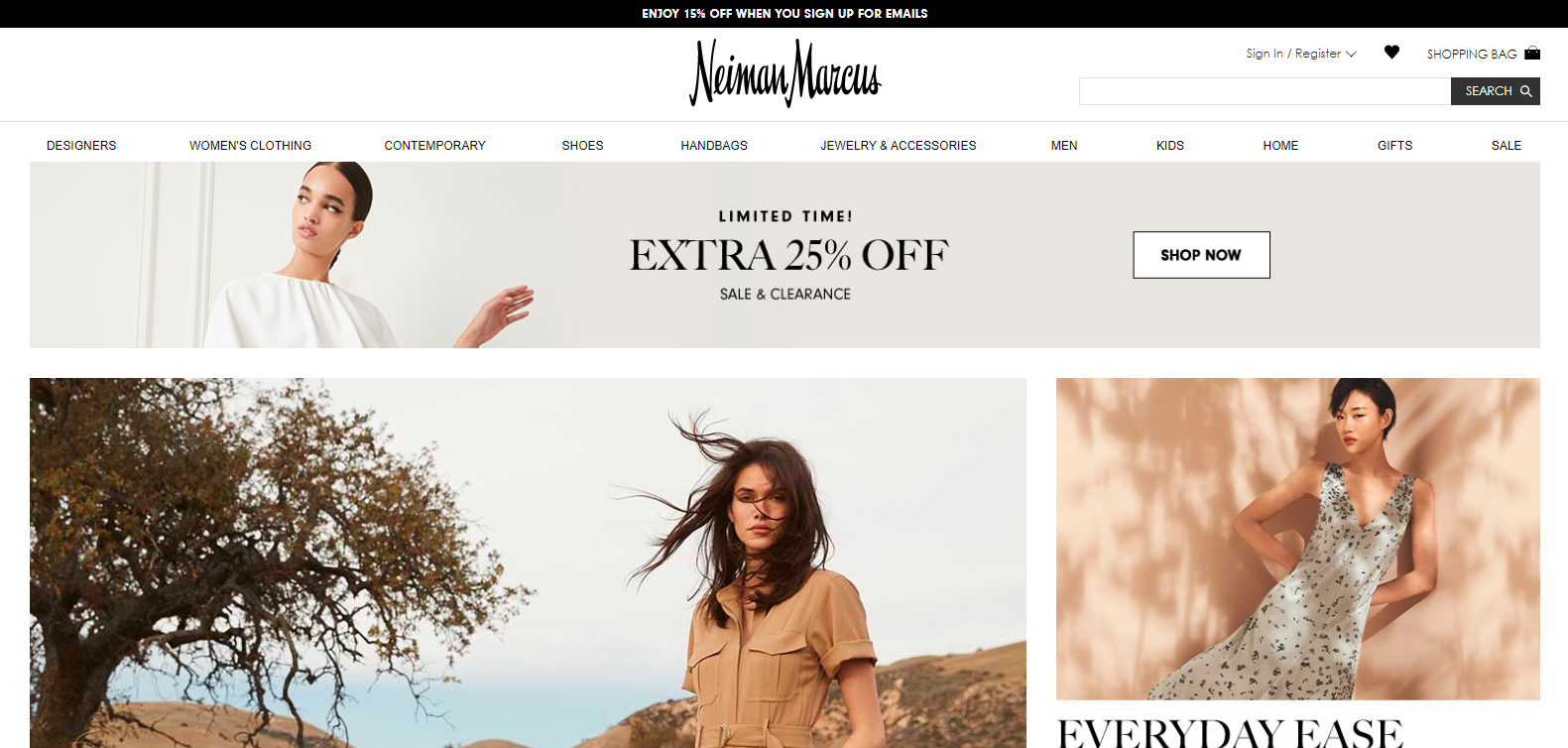

The downfall of Neiman Marcus recently is one specific proof. Neiman Marcus is an American chain of luxury department stores owned by the Neiman Marcus Group, headquartered in Dallas, Texas. The company also owns the Bergdorf Goodman department stores and operates a direct marketing division, Neiman Marcus Direct, which operates catalog and online operations under the Horchow, Neiman Marcus, and Bergdorf Goodman names. The company is currently preparing to undergo bankruptcy due to high debts and the COVID-19 pandemic. This is also the first brick-and-mortar company in the U.S. to file bankruptcy at this time.

In order for brick-and-mortar businesses to keep their footing, there are adaptations they can make to stay strong in their market and beat out their online-only competition. The chains with brick and mortar stores depend heavily on foot traffic. With widespread stay-at-home orders still in place, these companies might also be fighting for their lives in the wake of the outbreak.

A Closer Look on Neiman Marcus Business

The Neiman Marcus Group retails high end and luxury apparel, shoes, accessories, jewelry, cosmetics, furnishings, antiques, rare books, and decorative home items. Its target customers are the ones who are in the top 2% of the income bracket in the U.S. and equally wealthy people around the world. According to the company’s website, its average customer has an advanced degree, is well-traveled and sophisticated.

The first store established on September 10, 1907, was lavishly furnished and stocked with clothing of a quality not commonly found in Texas. From the very beginning, the founders of Neiman Marcus aimed high. The original store was opened in Dallas. The company was founded by Herbert Marcus, his sister, and his brother-in-law. Their initial investment was $25,000.

The Bergdorf Goodman flagship store opened in 1901 in New York City. That company was founded by Herman Bergdorf in 1899 as a tailor shop. That tailor shop was purchased by Edwin Goodman in 1906 and the business started evolving to the luxury retailer it is today. Carter Hawley Hale Stores acquired Neiman Marcus in 1969 and Bergdorf Goodman in 1972. Neiman-Marcus Group, Inc. was split off in 1987.

Neiman Marcus Group, Inc. retails upscale merchandise through its Specialty Retail Stores segment and its Direct Marketing segment. Its specialty retail stores segment includes Neiman Marcus stores, Bergdorf Goodman stores, and Horchow stores. It’s direct marketing segment consists of the world-famous Neiman Marcus Christmas Book catalog, and the Horchow Home catalog, as well as e-commerce websites for Neiman Marcus, Bergdorf Goodman, and Horchow.

Since that time, Neiman Marcus’s mission statement was “Neiman Marcus Stores will be the premier luxury retailer recognized for merchandise leadership and superior customer service. We will offer the finest fashion and quality products in an exceptional environment.”

The Bankruptcy of Neiman Marcus

Neiman Marcus has struggled to stay afloat with brick-and-mortar stores as consumer shopping increasingly shifts online.

The filing for bankruptcy is something that Neiman Marcus has been trying to avoid for the past few years. Neiman Marcus has been struggling with the debt load, due mainly to its 2013 leveraged buyout by Ares and Canadian public pension fund CPPIB from other private equity firms. The company is around $5billion in debt and is reportedly in the final stages of brokering a deal with its creditors, which could help keep some operations going during bankruptcy proceedings.

Put simply, luxury shoppers aren’t spending as much time in department stores like Neiman Marcus and the company’s Bergdorf Goodman chain. Look no further than rival Barney’s, which liquidated in 2019. Same-store sales have been drifting down in recent quarters for Neiman Marcus. After increasing 2.8% in the first quarter of 2019, they rose only 0.7% in the second quarter and fell 1.5% in the third quarter.

These chain of high-end department stores, also did not pay interest on bonds on April 15, according to the content of a letter that Marble Ridge Capital Fund – holding nearly $ 138 million worth of bonds of Neiman Marcus – addressed to the management of the retail chain. Neiman Marcus bonds will maturity in October next year. The chain is due until mid-May to make the interest payment. Then, if Neiman Marcus does not pay, the bondholders can take the corporation to court to declare bankruptcy.

Neiman, like most brick-and-mortar retail chains, is facing an unprecedented sales downturn as United States officials have shuttered businesses deemed nonessential to slow the spread of the novel coronavirus. This company has approximately 14,000 employees. The retailer announced furloughs and temporary pay cuts as a cash-saving measure during the COVID-19 pandemic. Neiman Marcus has very few options after the company closed all 43 stores, including more than 20 Last Call stores, and two Bergdorf Goodman stores in New York.

Reuters reported on April 20 that Neiman Marcus was discussing possible bankruptcy protection this week. Right before COVID-19 appeared in the United States, department stores’ business had weakened because they were slowly adapting to changing consumer tastes. While some department stores have been investing in ways to get customers back, the boom of COVID-19 forced them to suspend sales and no one knew when they would reopen supermarkets.

Many department store chains in the United States are like ships about to be sunk due to the COVID-19 pandemic, and perhaps government support cannot help them save the situation. Neiman Marcus is weighing all of its options to ensure its “financial strength,” according to a statement by the luxury retailer, as it grapples with the cost of doing business during a pandemic.

Digital Transformation Will Redefines Retailing

In 2019, Following Forever 21’s decision to file for bankruptcy, many are suggesting the strong growth of e-commerce and online retailing is killing old-fashioned brick and mortar retailing. While some traditional retailers will survive the “retail apocalypse,” many will not. And in 2020, Neiman Marcus is about to file for bankruptcy due to the pandemic.

Digital businesses will definitely redefine traditional retailing and marketplace boundaries. They drive internal change toward new, unprecedented business environments and are led by customer-first strategies characterized by newfound flexibility.

A leading-edge digital retailer will connect or integrate assets (businesses, divisions, staff, and technologies) to remove barriers that inhibit the blurring of the physical and digital worlds.

Collaboration at multiple levels – staff, processes, and technologies – is a necessary step for digital transformation to occur. Successful retailers will build ecosystems that include other retailers, suppliers, shippers, customers, and technology vendors.

Brick-and-mortar stores now become controllable – and hence, valuable – last-mile distribution and fulfillment outlets that differentiate traditional retailers from the online-only players. A brick-and-mortar distribution network, or digital transformation will help minimize the costs associated with returns, delivery, and even marketing. The chains should put its brick-and-mortar locations to work as a core component of a digital strategy, where it would leverage its physical facilities to fulfill the orders of digital customers.

How Brick-And-Mortal Can Survive in E-Commerce Wave?

E-commerce might be showing a growing trend but that does not mean that brick and mortar retail stores are planning to give up the spotlight. In fact, brick-and-mortar stores contribute to 94% of retail sales. And after taking a look at a retail giant, Amazon, opening a physical store we can see that brick-and-mortars are here to stay for a while.

#1 Building the Customer Experience Power

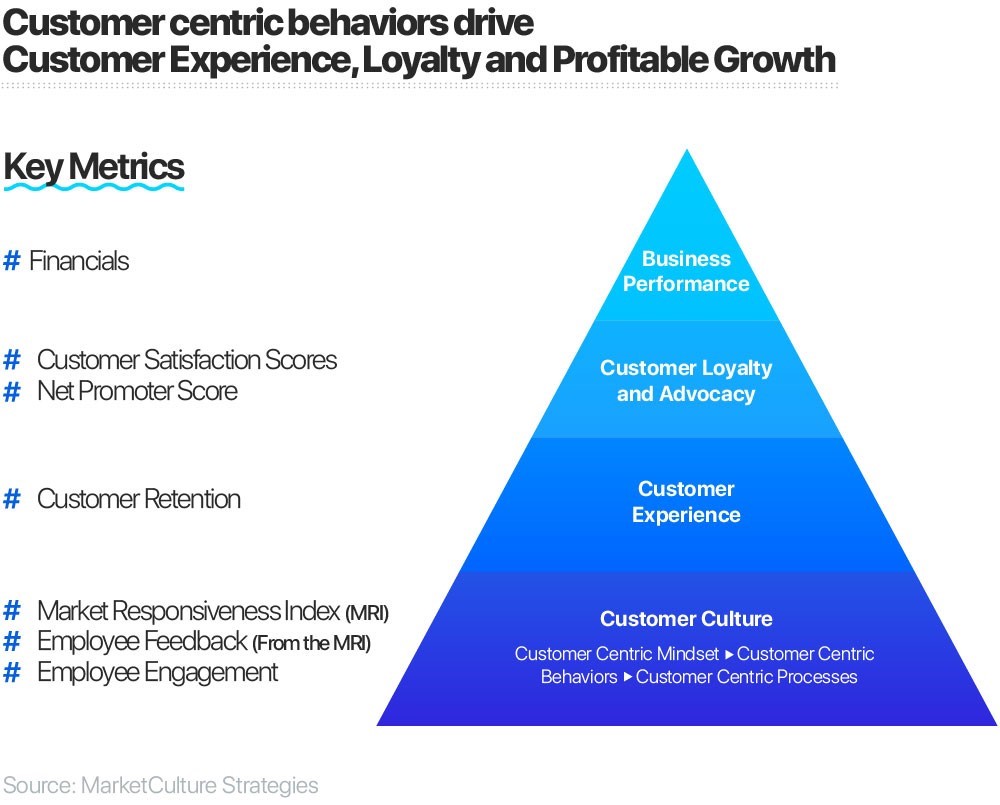

Many businesses need their physical stores to offer something worthwhile and that will motivate customers to walk in stores so that they can “experience” the brand. This is the way you walk into Neiman Marcus and experience Vera Wang. The in-store experiences can gain “fans”. Retail companies also look to customer experience as a way to generate loyalty in customers. This helps them drive their brand up in terms of customer perception, and thus boost sales at all points of the customer journey.

In our age of information, it has never been easier to obtain information, period. However, this leads to the problem of finding the right information that will cause a positive impact on your business. If you can obtain the right information about your customers and what they want/need, managing CXM (Customer Experience Management) will be easier and provide better outcomes. So, here are some key points to take into account when looking to optimize your CXM.

The whole point of this business practice would be to offer the customer the best, most personalized and informative experience with your brand whether they access it at home or on their phones or whether they decide to physically walk into your stores.

Customer experience is a term that is hard to define and manage. However, there is a great incentive to do so as it is what will drive shoppers through your online portal and into your physical stores, simultaneously. Investing in creating an engaging, unique, and pleasant experience for shoppers with your brand will likely drive your business forward and it is something everyone should consider investing in.

#2 Add More Value with Technology

Stores give brands a place to experiment with different activations and innovations. The future of physical retail is making stores as easy to shop as it is easy to buy online. As such, it’s important to experiment with intuitive and novel digital features that make finding and buying product seamless and friction-free — from mobile checkout with digital payment methods, to VR/AR applications or in-store robotics. The McKinsey ‘store of the future’ is a good proof point for the many areas in which today’s brands are experimenting to bridge the online and in-store shopping experience.

One advantage brick-and-mortar will always have over online is its store associates. Data suggests that 43% of shoppers who interact with retail associates are more likely to make a purchase. Further, their transactions account for 81% more value compared to customers who don’t interact with a store associate. These retail store workers are the heart of the store experience. Even though most shoppers today are tech-first, they still value the opinions and support of store associates. With Omni data at their fingertips, store associates are able to maximize the most critical shopping moments.

A major challenge for store owners is keeping shelves well stocked and having inventory in the right place. Now retailers such as Lowe’s are using robots to do this work. The device, by Fellow Robots, rolls through the aisles checking for misplaced items and empty shelf space. If it sees, for instance, that a store is running low on an item, it will alert employees to reorder inventory. By connecting to their inventory management system, this robot helps them save time and money, allowing employees to focus on more difficult and creative tasks. Robots can also answer shoppers’ questions and help them find what they’re looking for, creating a shopping experience like no other.

Brick-and-mortar retailers have opportunities to leverage the distinct benefits of traditional, in-person shopping. Retail winners will be those who are able to blend the digital world into their stores in a manner that delights customers, builds loyalty and generates brand value. The way in which data can be collected can directly impact marketing communications in a relevant way that supports a personalized and positive shopping experience.

#3 Exploring Recent Digital Trends

Digital technologies, such as augmented reality (AR), can engage customers in a fun and exciting ways, with fashion and home décor retailers leading AR app development. Providing comprehensive product information can help convert these applications from gimmicks into actual sales.

Within digital, consumers are spreading out their retail purchasing across channels, forcing retailers to spread out their online marketing budgets. Paid search, affiliate marketing, and email all increased their share of e-commerce referrals last year, according to Custora.

Mobile continues to drive the most sales growth for retailers, but sales still aren’t keeping up with retail traffic. IBM found that smartphone traffic beat both tablet and desktop, making up 53% of all online traffic. But mobile still only accounted for 29% of all online sales. Almost 60% of the American population own a smartphone device, and out of those, 80% use it for purchases online. However, there is still a need for consumers to go to brick-and-mortar stores for reasons such as trying before you buy.

#4 Consider new sales channels and apps

Help your clients reimagine their business by considering new sales channels and apps they can integrate into their online store. Even if they were solely a brick and mortar merchant before now, chances are good that they were using different digital channels, such as email and social media, to market their products or services. Integrating apps to your client’s existing and new sales and marketing channels will help them create a seamless shopping experience for their customers.

Connecting all appropriate avenues and channels available to your client’s online store lets their customers know that they are still operating during these times, and what new products or virtual or digital services they are now providing. It also helps your clients monetize these channels in a way they may not have considered before, and create a more unified customer experience and sales funnel.

#5 Sync Your Online and Offline Efforts

At the end of the day, you want to sync your efforts online and in-store. If you are offering a discount online, make sure that it is happening in the store, too. If a customer sees the product for sale online, but you won’t match the price in-store, or vice-versa, you are missing an opportunity to create a lasting client relationship.

Creating a consistent and helpful environment for customers is key. All it takes is one poor customer service experience to make a bad impression that a client will always remember. The future of retail will be in the hands of those who manage to incorporate offline and online sales to provide one uniform experience across the board. The digitization of physical stores is probably the most popular way of doing it, like Amazon or Apple.

Mobile connectivity changes in shopping habits. Some people will use their phone in-store to check out product reviews or share a picture of their outfit with friends to see if it suits them. Consequently, retailers are incorporating the Internet of Things to enhance the shopping experience. For example, consumers can download a store-specific app and based on their activities they will be sent notifications about relevant products or specific deals. Another example of using the Internet of Things in-store is scanning a QR code and directly get information about that product, such as where it was made, features and also showing people who purchased this product other items also purchased. This has seen to lead to an increase in sales.

Retailers now need to identify which channels are top performers for referral traffic and new opportunities for reaching consumers. The, analyzing how retailers are responding to the rise of mobile purchasing and where they’re falling short.

Online Stores Are the New Brick and Mortar

While you’re moving quickly to transition your client’s brick and mortar business online, it may take some time for their sales to gain traction and recover. The commerce landscape is changing at a rapid pace, and we all have to adjust and adapt. That’s exactly what you’re helping your client to do.

While the door to your client’s brick and mortar store may have closed for now, with your help, their online store is officially open for business. And with a little time, support, and tweaking, your client’s online store may become their reimagined brick and mortar business.

There are plenty of ways that brick-and-mortar stores can maintain their share of the business and combat the growing e-commerce trend while joining in on the growth instead of falling prey to its projected success.

COVID-19 is changing the way to run many businesses, especially for retailers. The social distancing policies have been used in many places, many brick and mortar shops are shutting their doors and considering new ways of working. This means transitioning to eCommerce is in need. It will upend our way of life, in some ways forever.

The Bottom Lines

Today’s consumers are accustomed to dependable online and mobile experiences, in addition to an elevated physical experience if they so desire. Neiman Marcus’ inability to execute on delivering these omnichannel experiences is just one of the many ways this former retail hero let down its once-booming customer base.

Neiman Marcus’ ultimately failed because of its reluctance to fully believe in the consequences of a rapidly changing retail landscape with digital transformation. But they certainly were not alone. Businesses like Mattress Firm, Sears, Toys R Us, and Sports Authority have crumbled in recent years because they held on to an outdated view of the world for too long, were too focused on their traditional buying and selling cycles, and were too slow to transform.

Companies like Walmart, Target, and Macy’s, who are reshaping their businesses to engage consumers in new ways, are the ones who’ve not only embraced digital transformation to compete in the age of Amazon but have invested in integration technology to help fulfill the promises of those digital strategies.

Retail success stems from an accumulation of many small, practical changes and meaningful evolutions that help protect against any strategic failures. The world has changed many times, and it is changing again. All of us will have to adapt to a new way of living, working, and forging relationships. But as with all change, there will be some who lose more than most, and they will be the ones who have lost far too much already.

You May Also Like: