Meet Redwire – The Pick-and-Shovel Provider for the New Space Gold Rush

Established in June 2020, Redwire is differentiated from its peers because it offers both rich flight heritage, with more than 50 years of space flight experience and more than 150 missions flown, and unmatched innovations in space infrastructure, including over 100 patents and applications.

The company has numerous organic growth opportunities without substantial capital needs driven by its proven capabilities and transformative technologies. To achieve the resounding success as today, it has made many important decisions throughout its development journey. Let’s see what we can learn from them!

Innovative, but with Great Heritage

As an operating partner at AE Industrial, which is the private equity partner behind Redwire, the company soon recognized that the space industry was at an inflection point with the reduction in launch costs driving down the cost of being in space. It sees increasing opportunities as that decreasing launch costs continue to enable exponential growth in deployed space infrastructure.

“When you look around the industry now, you have a lot of the older traditional space players and you have a lot of these new space entrants, many of them are pre-revenue,” Redwire Chairman and CEO Peter Cannito said.

To Cannito, the space industry is shaped somewhat like a barbell with large aerospace primes on one side which are diversified across multiple sectors. For that reason, they’re not considered pure-play companies. Although they have extraordinary flight heritage, they seem to struggle with innovation because they might be cannibalizing their own legacy programs.

Then we don’t see much of a middle market in space. There are small companies in a very fragmented market on the other side of the barbell. Some of them have tremendous flight heritage and are focused on a specific niche technology. They would extremely be capable of that technology, but due to a lack of capital, they have never been able to scale.

Now we have New Space, the recent commercialization of the space sector, which has a lot of disruptive technologies. However, they don’t have a lot of flight heritage when flight heritage is the coin of the realm in space.

“We came up with a differentiated position that combines some of these niche technology providers with the disruptors that have demonstrated they can cross the valley of death and gain market acceptance and become cash flow positive. It’s the best of both worlds – disruptive, but with great heritage. We refer to ourselves as a first-mover, industry consolidator, filling that middle market for a pure-play space company of scale,” Cannito said.

Formed in June of last year by AE Industrial Partners, Redwire was initially created through the merger of Adcole Space and Deep Space Systems (DSS) as a new space-focused platform. Both of those companies have been at the forefront of space exploration for decades and together, as part of a single company in Redwire, have the unmatched flight heritage to address the growing demand for the next generation space architecture.

“What we wanted to do with Redwire is take some of the traditional space heritage from the small, agile, and innovative companies out there like Adcole and DSS and combine them with a true innovator,” Cannito said.

As a result, shortly after its formation, the company announced that it has acquired Made In Space, an innovative provider of industry-leading on-orbit space manufacturing technologies. The addition of Made In Space added 3D printing to the company’s portfolio. Made In Space, as Cannito argued, is that “true innovator” his company was looking for.

“The things that they’re doing are things that have never been done and really have the potential to change the economics of space,” he said. “That filled a key gap in our strategy.”

In the case of Redwire, combining the game-changing innovations of Made In Space with the unmatched flight heritage of Adcole Space and DSS has resulted in a truly unique platform for the company to be a first-mover. A combination may be a great idea for any business out there. It’s not always true to think that you can’t reconcile one thing with another that it is opposed to.

Acquisition Makes Unique Strength

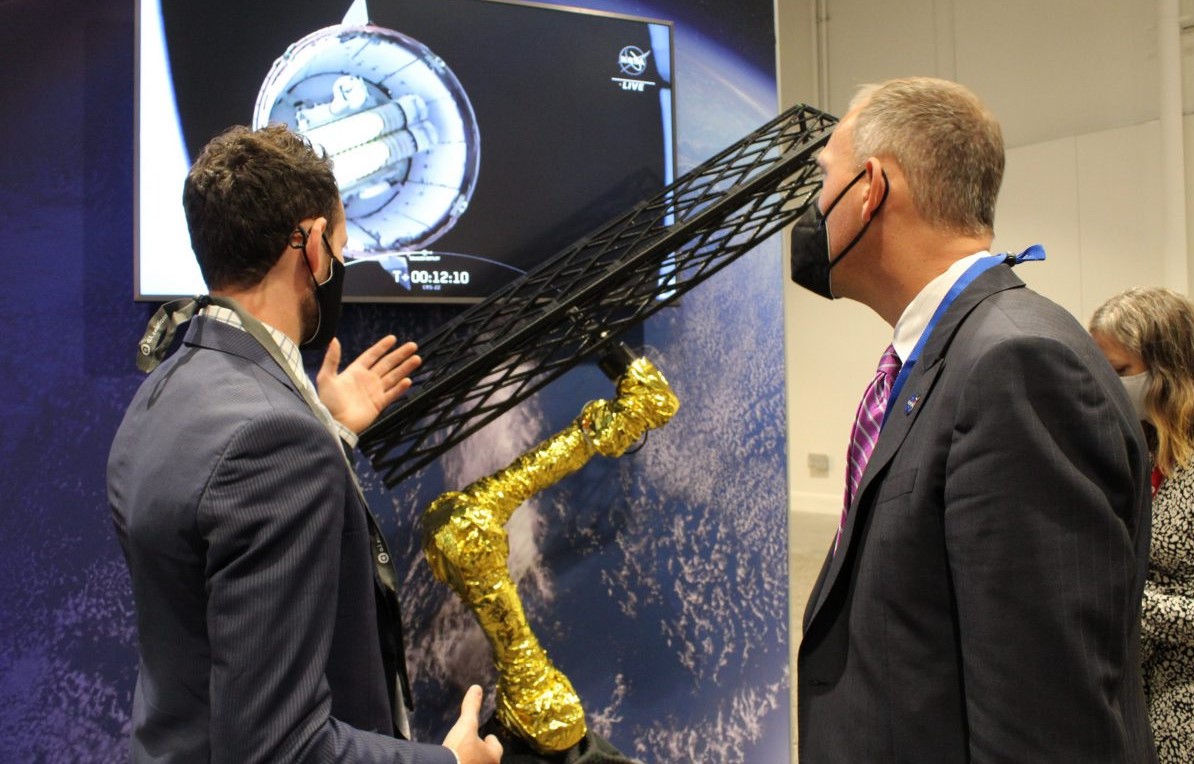

Since then, Redwire has had a busy year. Its acquisitions continued throughout 2020 and 2021, including Deployable Space Systems, LoadPath, Oakman Aerospace, and Roccor. Redwire’s collection of firms includes technologies such as navigation sensors, solar arrays, deployable structures, in-space manufacturing, and robotic arms. Behind the company’s serial acquisitions, there’s definitely an excellent strategy.

“Redwire is focused on acquiring successful companies – we don’t look for turnarounds. We partner with founders who may have a unique technology or have been able to break into a program, and aren’t sure that they want to go it alone to achieve the scale to realize their full potential. We call it joining the cause,” he said. “I’m very proud of the fact that all the founders of the companies that we’ve acquired, who were actively involved in the day-to-day operations of their business, have stayed on and become a part of Redwire.”

There is a misconception to think of them as a holding company. Actually, they are an integrated Redwire unifying under a single brand. The company would be sunsetting the legacy brands, while still honoring their legacy over time. However, approaching integrating the different companies to acquire is not an easy task as sometimes that can be seen as a roadblock for them.

“Do No Harm” Approach

To overcome this, the company has to prove the integration would “do no harm.” It only acquires companies already successful in their own right, it doesn’t intend to do anything to mess that up. During the due diligence phase, Redwire ensures these companies have a good cultural background and a technological alignment that fit the overall vision. “Companies come in with very similar DNA to Redwire at large, and to the other companies that we’ve acquired,” says Cannito.

That type of approach takes some time. In the beginning, Redwire allow them to operate within the company as a separate entity to get acclimated, as well as for it to understand their businesses. Then it moves toward integrating the low-hanging fruit, typically things like business development.

Cannito has learned that many of these companies have extraordinary opportunities, great customer relationships, and great technology, but don’t have the scale necessary to invest in large-scale business development operations. They typically have a gap, somewhere they’ve been struggling.

Maybe some of them don’t have a mature financial enterprise, or others may have urgent needs in terms of IT. Understanding that, the company starts working on those urgent needs concurrently with business development until they work on all the different segments of the business.

Making acquisition is a very important decision as it will profoundly affect the whole structure and future of any company. Therefore, even when it seems to be time-consuming, it’s vital to go through a step-by-step merger process until everything is fully integrated.

Perspectives on Moving Forward

To Cannito, Redwire is looking at its future acquisitions from two perspectives:

The first one is continuing to strengthen its focus area. With the acquisition of Roccor and the most recent acquisition of Deployable Space Systems, the company is starting to generate critical mass in next-generation deployable, solar arrays, power solutions. And it’s looking for opportunities to strengthen those core competencies.

Second, the company is still looking for other areas of opportunity where there are critical space infrastructure systems that are relevant across civil, commercial, and national security space. Picks and shovels all of that regardless of your mission in space, would be a critical capability.

Adopt Simulation as Soon as Possible

Redwire’s Advanced Configurable Open-system Research Network (ACORN) is a modeling and simulation development environment for space system design, integration, and test. With the help of the ACORN system, Redwire has successfully launched many projects. Along the way, the company has come across several major barriers for teams that are building components and whole spacecraft in leveraging modeling and simulation tools more effectively.

“I think we touched on one of those barriers already in pretty good detail, which is the lack of standardization and interoperability. It’s very difficult to utilize a simulation tool when it’s not going to actually work with your mission profile or with your environment or with your specific spacecraft,” said Chad Meskimen, Product Manager of ACORN.

Even not having the confidence that a simulation is going to work can be a barrier itself. Whether or not it’s actually going to do that, it’s always hard for any leader to decide to shell out a large amount of money for simulation, because there is a high cost associated with it. Moreover, not only purchasing but also setting up the simulation, is hard to want to shell that out.

“Another barrier is the learning curve that’s associated with these modeling and simulation tools. These tools are by their nature, very complex. You know, we’re remodeling very complex systems and so there’s going to be some complexity, and there’s going to be some learning curve associated with setting it up. And there’s going to be some time and resources that you have to allocate in order to be able to use the simulation effectively,” Meskimen said.

Despite all of those challenges, to Meskimen, the benefits that you are going to see over the full system lifecycle are well worth the cost, especially for simulation tools, like ACORN which do offer value across the full system lifecycle of Redwire. This is especially true if you’re going to be planning on doing multiple satellites. Because once you’ve laid the foundation with that first satellite, you’re going to benefit from the mission and cost savings that simulation provides, but not have to encounter that learning barrier.

Related to that learning barrier, you have the issue of companies turning to simulation too late in the design process. You still can get benefits out of simulation later, as Meskimen said that ACORN offers Redwire the benefit across its full lifecycle. Nevertheless, the best outcome would be starting with a simulation carried end-to-end. Not to mention, a late adoption would increase the learning barrier that Meskimen mentioned above.

His important recommendation here is that if any entrepreneur has ever been thinking about adopting simulation or is going to start out in the design process, then just do it as soon as possible. By doing so, you will stand a great chance of getting the most benefit from it and being able to get into a rhythm with that simulation tool.

“And then one other adoption barrier I want to touch on is just the market awareness. Not knowing what modeling and simulation tools are available out there,” Meskimen added.

How to Go Public Right

The question of when a company should go public can be a difficult one to answer. There are several large requirements and milestones that have to be met before a company can do this. In March of this year, Redwire officially added its name to the list of space companies going public through a special purpose acquisition corporation (SPAC). So why was this the right timing?

“The timing was a result of the amount of traction that we were able to achieve in a really short period of time. We did seven acquisitions in 12 months, which really accelerated our growth. We quickly came to the conclusion that going public only strengthened that position by allowing us to access the public markets for additional capital, which is important when acquiring companies, integrating, and innovating like we are,” Cannito said. “We already feel that we’re the acquirer of choice for space founders that see the benefit of joining a larger, high-growth company to fulfill their goals or to scale in their particular focus area. Having that public currency is a way to incentivize deals.”

At that time, Redwire was in the midst of going public through a merger with Genesis Park Acquisition Corp., which would make the company a publicly traded company valued at $615 million. It sounds like a suitable time for the company to go public and work to integrate its acquisitions into a cohesive company.

A SPAC merger is one of the most important events in a company’s lifetime, and thus it is crucial to pick the right partner. The SPAC merger process is only the beginning of a company’s journey to the public market, and thus the company needs to consider the long-term and where the SPAC sponsors and management team can take it in the future.

“As a public company, Redwire will be an even more attractive acquirer because we will have a public currency further strengthening our positioning as a forever home for founders looking to join in our tremendous growth,” Cannito said.

The Bottom Lines

A big success is determined by many decisions. By making those decisions right and in time, Redwire now becomes a bright player in the commercial space age. Looking back on its journey, being brave to do differently to be unique and constantly expanding the company’s scale is an important lesson learned.