Intel’s Throne Got Toppled by Japanese Microprocessors: Fairy Tale with Happy Ending

During the 1980s and 1990s, the technology industry experienced tremendous growth and innovation. Personal computers were becoming increasingly popular and more affordable, leading to a surge in demand for computer chips and other components. This created a lucrative market for companies that could develop and manufacture these products at scale.

Intel, one of the most recognized names in the tech sphere, has a long and storied history. Founded in 1968, the company was instrumental in the development of microprocessors that have become ubiquitous in today’s digital age.

However, over the years, Intel has faced a number of challenges that have threatened its dominance in the market. In 1985, Intel’s market share had plummeted to just 1.3%, and the company’s losses totaled over $100 million in 1986 alone. This decline in financial performance was a significant hindrance for the company, which struggled to compete with the well-funded and technologically advanced Japanese companies that were rapidly gaining ground in the microprocessor industry.

Given that, the company has remained resilient, continuously innovating and pushing the boundaries of what is possible in the world of technology. In this article, we will explore some of the challenges that Intel has faced and examine how the company has navigated agaisnt them over the years.

Japanese Competition: Dire Threat to Intel’s Microprocessor Empire

Before going in great lengths, let’s first cast a glimpse over our tech giant’s history!

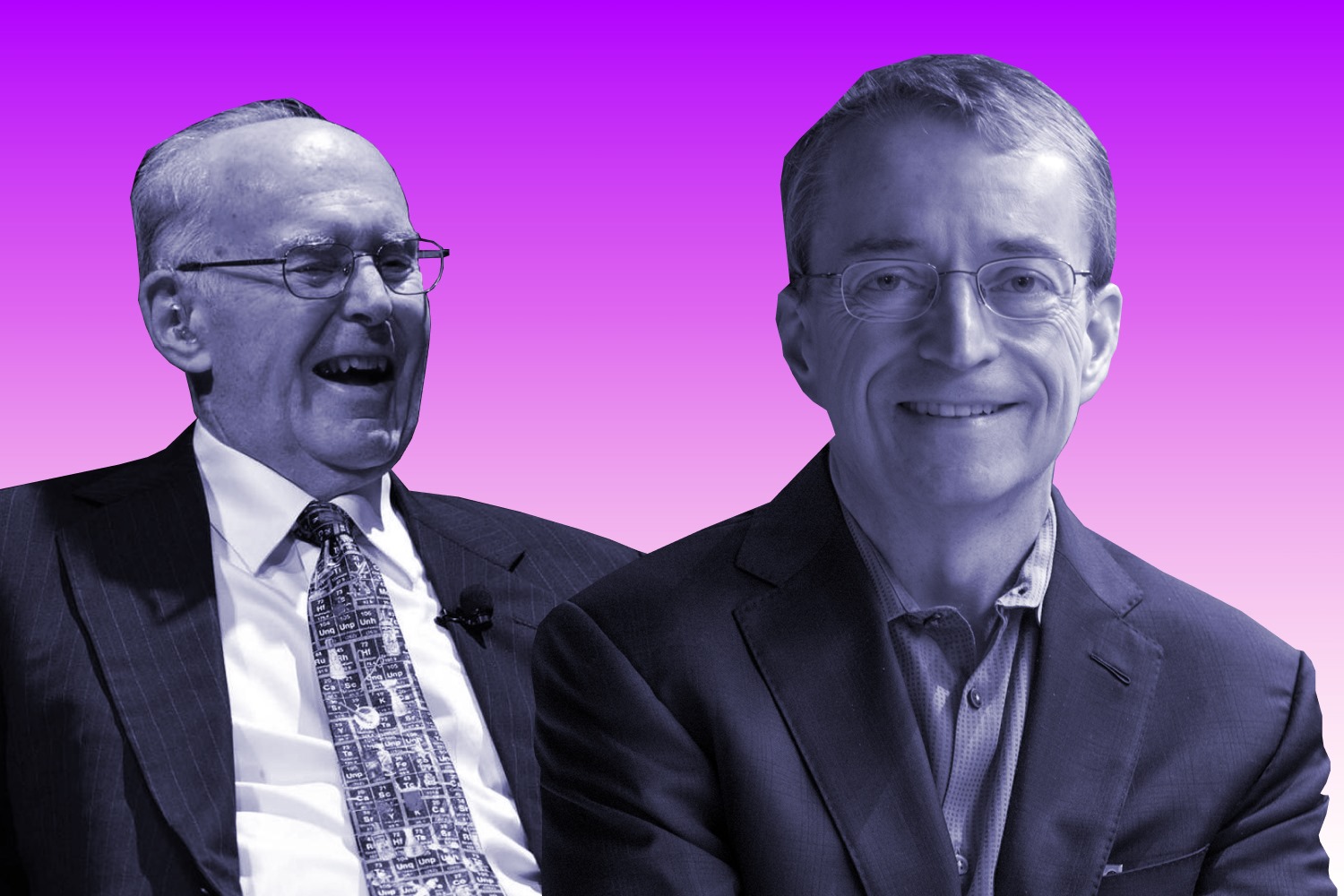

Intel’s founders, Robert Noyce and Gordon Moore, set out to create a company that would focus on developing microprocessors, which they believed would revolutionize the computer landscape.

In its early years, Intel quickly established itself as a leading manufacturer of semiconductors and microprocessors. The company’s first major success was the development of the world’s first microprocessor, the Intel 4004, in 1971. This groundbreaking invention paved the way for the development of personal computers and other electronic devices.

Throughout the 1970s and early 1980s, Intel continued to innovate and dominate the microprocessor market with the release of the 8008, 8080, and 8086 processors. These instant hits allowed Intel to rapidly expand and become one of the largest companies in the semiconductor industry.

Moreover, Intel’s success had a significant impact on the U.S. economy, particularly in the region around Silicon Valley where the company was headquartered. The growth of the semiconductor industry helped to fuel economic growth and job creation, with many other companies and industries benefiting from the innovations and technologies that were developed.

However, by the late 1980s and 1990s, Japanese companies such as NEC, Fujitsu, and Toshiba were able to develop their own microprocessor designs and threatened Intel’s market dominance. Japanese companies were responsible for nearly half of the world’s semiconductor production by the late 1980s.

One of the reasons for Japan’s success in the semiconductor industry was the strong support provided by the Japanese government.

Particularly, the government provided substantial funding for research and development in the industry, as well as tax incentives and other measures to support the industry’s growth. This support allowed Japanese companies to invest heavily in research and development and build up their technological capabilities quickly.

One piece of evidence supporting the strong government support for the Japanese semiconductor industry is the Ministry of International Trade and Industry’s (MITI) “Sunrise Project,” launched in 1971. This project aimed to develop Japan’s semiconductor industry through government investment in research and development, as well as coordination between government agencies and private industry.

According to a report by the Congressional Research Service, “The project helped Japanese firms to make breakthroughs in microprocessor design, to reduce manufacturing costs, and to achieve a higher level of quality control.”

In addition to government support, Japanese elephants had a strong focus on quality and reliability. The Japanese philosophy of continuous improvement, or “kaizen,” was applied to the semiconductor industry, with a focus on minimizing defects and improving product quality. This approach helped Japanese companies build a reputation for their products and compete effectively with Intel.

Former Fujitsu executive, Tadashi Sekimoto, sheds some light on this aspect of Japanese culture: “Japanese companies believed that quality control should be applied at all stages of production, from raw materials to final inspection. Defects were not tolerated. The attitude was that any defect was unacceptable, and that quality was everyone’s responsibility.” This emphasis on quality was reflected in the use of statistical process control and other quality management techniques to minimize defects and improve product reliability.

Besides, it’s Japanese culture of cooperation and collaboration that allowed them to pool their resources and work together to develop new technologies and products. This approach was in contrast to the more competitive culture at Intel, where secrecy and individual achievement were often emphasized.

A report by the National Bureau of Economic Research states that “Japan’s keiretsu system allowed semiconductor manufacturers to cooperate and share technological knowledge in a way that was not possible in the more competitive United States.” The report goes on to note that this collaboration was facilitated by the close relationships between Japanese companies and their suppliers, as well as between companies within the same keiretsu.

A Rocky Road: The Financial and Talent Losses that Plagued Intel in the 1980s

In fact, during the 1980s, Intel faced a number of financial and talent losses that had a significant impact on the company’s growth trajectory. These challenges were largely a result of increased competition in the semiconductor industry, as well as management missteps and strategic misjudgments.

Speaking of the failure to retain top talents, a number of Intel’s top engineers and executives left the company to join startups or other established semiconductor companies. This talent drain was a significant blow to Intel, as many of these individuals had been instrumental in the company’s early success and were responsible for developing many of its key products.

One notable departure was that of Federico Faggin, the lead designer of the Intel 4004 microprocessor and one of the company’s co-founders. Faggin left Intel in 1980 to start his own company, Zilog, which competed directly with Intel in the microprocessor market.

Another key departure was that of Marcian “Ted” Hoff, who had been responsible for the development of the microprocessor architecture. Hoff left Intel in 1982 to join Atari, a video game company, which was seen as a significant blow to Intel’s microprocessor development efforts.

Pat Gelsinger did leave Intel in 2009 after working at the company for over 30 years. He then served as CEO of EMC Corporation and later became CEO of VMware. However, in January 2021, it was announced that Gelsinger would return to Intel as its CEO.

Gelsinger’s concerns about Intel’s reliance on the x86 architecture and the need to diversify into other areas were widely known during his time at the company. In a 2016 interview with Fortune, he stated that “Intel has to be cautious that we don’t become too dependent on one architecture.” He also expressed a belief that Intel needed to make significant investments in areas like the Internet of Things (IoT) and artificial intelligence (AI) to stay competitive.

Gelsinger’s return to Intel as CEO in 2021 was seen by many as a sign that the company was serious about addressing these concerns and taking steps to diversify its business. In his first letter to employees after taking on the role, Gelsinger emphasized the need for Intel to invest in new technologies and innovate to stay ahead of the competition. He also pledged to address the company’s manufacturing challenges, which had been a major source of concern for investors and customers alike.

In addition to the loss of talent, Intel did weather through huge financial challenges. In the mid-1980s, Intel’s financial situation took a turn for the worse. The company heavily invested in the memory chip market, which was experiencing a period of rapid growth and high profitability. However, this market was also highly competitive, and as new competitors entered the market, prices began to drop.

The behemoth had invested heavily in expanding its memory chip production capacity to meet demand, but this resulted in surplus supply and a glut of chips on the market. This, combined with falling prices, resulted in a sharp decline in profitability for Intel’s memory chip business.

At the same time, Intel was investing in the development of new microprocessors, including the iAPX 432. This chip was intended to compete with more powerful processors from such companies as IBM and DEC. However, the iAPX 432 turned out to be a complex and expensive chip that was difficult to program; saddeningly, it did not offer significant performance advantages over existing processors.

As a result, the iAPX 432 failed to gain notable market share, and Intel was left with an extravagant investment in a product that was not generating revenue. Additionally, Intel had to write off millions of dollars in inventory and other expenses related to the memory chip market.

All of these factors contributed to Intel’s financial losses during the 1980s. In 1986 alone, the company reported a loss of $107.23 million. Intel was forced to take drastic measures to cut costs and refocus its efforts on more profitable products. This included laying off thousands of employees and selling off its memory chip business.

In Grove’s book “Only the Paranoid Survive”, he discussed the financial losses Intel faced in the 1980s: “In 1985 we lost $13 million; in 1986, $107.2 million. That loss was greater than the aggregate earnings of the company since it went public in 1971. Our net worth had shrunk to $220 million, down from a peak of $1.8 billion in 1983. The net worth of the company, on which we were going to base the next stage of our strategy, had dwindled to almost nothing.”

From Risk to Reward: How Intel’s Bold Move in the PC Market

After encountering countless difficulties in the 1980s, Intel has taken stringent measures for cost optimization and focus redirection.

In the 1980s, Intel made a bold move into the PC market that would ultimately lead to record-breaking revenue and market capitalization. At the time, IBM was the dominant player in the PC market, but Intel saw an opportunity to establish itself as a key supplier of microprocessors for these machines.

To make this happen, Intel developed a new microprocessor, the 386, that was specifically designed for use in personal computers. The 386 was a significant improvement over its predecessors, offering faster speeds and better performance. In addition, Intel worked closely with Microsoft to optimize the performance of the 386 with the Windows operating system, creating a powerful combination that would come to dominate the PC market for years to come.

The success of the 386 was a turning point for Intel, as it established the company as a key player in the PC industry. As demand for PCs grew throughout the 1990s, so did Intel’s revenue and market capitalization. By the end of the decade, Intel was one of the most valuable companies in the world, with a market capitalization of over $500 billion.

According to a report from The New York Times, “The 386 chip…became the industry standard for desktop computers and helped make Intel the dominant supplier of chips for personal computers.” This dominance was reflected in Intel’s financial performance, as the company’s revenue grew from $1.9 billion in 1985 to $8.2 billion in 1990.

However, as competition in the PC scene increased, Intel faced new challenges. Chief of these was from Advanced Micro Devices (AMD), a semiconductor company that had developed its own line of high-performance microprocessors for use in PCs. According to a report from Forbes, “AMD’s Ryzen processors have been a thorn in Intel’s side since their launch in 2017 and have forced the company to step up its game in terms of performance and innovation.”

Coupled with the competition from AMD, Intel had another stumbling block – the rise of mobile devices. As consumers increasingly shifted away from traditional desktop and laptop computers, Intel was forced to adapt to these changing market conditions. To do so, the company has focused on developing new products for data centers, artificial intelligence, and autonomous vehicles, among other areas.

One example of this innovation is the development of Intel’s Xeon processors, which are designed for use in data centers and other high-performance computing environments. According to a report from The Motley Fool, “Intel’s Xeon processors remain the go-to choice for data center operators…The market for data center processors is expected to grow at a compound annual rate of 19% through 2023, which should help Intel maintain its dominant market share in this segment.”

Another example of Intel’s innovation is its development of products for the autonomous vehicle market. According to a report from Business Insider, “Intel is one of the key players in the self-driving car market, thanks to its acquisition of Mobileye in 2017. Mobileye’s technology is used in a number of autonomous vehicles, including those produced by Waymo, Tesla, and BMW.”

To stay competitive, Intel has continued to innovate and develop new products, including powerful processors for data centers, artificial intelligence, and autonomous vehicles. While the PC market remains an important part of Intel’s business, the company has successfully diversified into new areas and continues to be a leader in the semiconductor industry.

The introduction of the Pentium processor in 1993 was a game-changer for Intel. The Pentium was the first processor to use a superscalar architecture, which allowed it to execute more than one instruction per clock cycle.

The Pentium quickly became popular among computer manufacturers and consumers alike, as it offered a significant performance boost for personal computers. In addition, Intel’s partnership with Microsoft helped to drive demand for personal computers, as Microsoft’s Windows operating system became the dominant platform for PC users.

As demand for personal computers grew throughout the 1990s, so did Intel’s revenue and market capitalization. In 1996, Intel’s revenue broke $20 billion, a significant milestone for the company. By 1997, when Grove stepped down from the CEO position, Intel had a market capitalization of over $200 billion, making it one of the largest companies in the world by that measure.

The success of the Pentium and Intel’s continued focus on innovation and product development helped the company maintain its leadership position in the semiconductor industry throughout the 1990s and into the 2000s.

Bottom Lines

During the challenge, Intel demonstrated its continued dominance in the semiconductor industry by producing a powerful and energy-efficient chip that outperformed its competitors. Its focus on innovation and cutting-edge technology has empowered the tech giant to maintain its position as a market leader.

Intel’s future looks promising, as it continues to invest in research and development to create new and more advanced products!