Inari Medical: The Story to Redefine Operational Excellence with 5 Growth Levers

Inari is a commercial-stage medical device company focused on developing products to treat and transform the lives of patients suffering from venous diseases. The company was founded in 2013 as a spin-out of Inceptus Medical, a medical device incubator. After making its debut back in 2018, the company has rapidly seen commercial traction. Under its seasoned leadership, Inari is looking to differentiate itself with devices designed specifically for use in the venous system.

“We have committed to a mission. We have committed to changing the lives of our patients in important and beautiful ways, and we increasingly sense responsibility more than merely opportunity in tackling some of the most challenging unmet needs in all of medicine,” said President and CEO Bill Hoffman.

Let’s discover how Hoffman and his team execute so crisply on all five of Inari’s growth drivers!

Expanding the Salesforce

As Hoffman believes, salesforce will eventually rival the largest interventionally focused sales organization in the market when fully built out. For that reason, it’s consistently listed as one of the company’s five levers of growth for the future. Inari is making progress and its sales force has expanded the number of territories in every quarter.

For the time being, the company is continuing to expand its sales organization to target new hospitals and physicians, estimating the size of its US target addressable markets. In doing so, Inari needs to hire people, which is something almost every organization has been struggling to do. Given the tight labor force, specialized knowledge, and lag between hiring a salesperson and getting trained doctors to use the products, it will be important for the company to show it is on pace to achieve its aggressive target.

“We are very early in our effort to treat this patient population, and we believe the effort will require a lot more sales professionals,” said Hoffman. “Consistent with our usual cadence, we recently completed another round of hiring of field sales professionals, and we are comfortably on pace to land in the high end of this range by the end of the year.”

Management reports a good proxy for that hiring – sales territories. It started the first quarter of 2021 with 130 and added 20 over the subsequent three months. After previously guiding to only 10 additional territories per quarter, Inari began the second quarter with 150 territories and now believes it can have 180 to 200 territories to finish the calendar year.

The expansion of salesforce is always an item that Inari’s management would point to as a key to its impressive growth. This density of the sales organization provides an opportunity to more effectively address the company’s second growth driver, which is building awareness and driving deeper adoption at existing hospital customers.

Driving Increased Awareness and Adoption

As the second growth driver, increasing adoption among existing hospital customers plays an important role. Irani’s goal is to access this patient population by educating and communicating regularly about the benefits of large volume clot removal with the noninterventional physicians who manage these patients, such as the emergency physicians, pulmonologists, hospitals, and intensivists.

Training of noninterventional physicians who are responsible for treatment decisions for these patients is important. At Inari, there can be both in-person and Zoom-based training of these physicians in groups and individually. In addition, the sales professionals routinely visit with these physicians in the current less restrictive environment, often inviting them to observe Inari procedures.

“We’re doing this in several ways. We continue to leverage Clot Warrior Academy, and we have recently expanded it to include live cases, local hospital Clot Warrior Academy unplugged sessions and a leadership series for our key opinion leaders in both interventional and noninterventional specialties,” said Hoffman.

Clot Warrior Academy (CWA) is a Zoom Video Communications-based online platform that includes training using live cases, leadership talks, and a weekly educational series. Since its launch in March 2020, CWA has engaged over 2,800 customers, 70% of whom are physicians, across 150 live-streamed events, featuring over 50 physician faculty members. In addition, the CWA online portal has received over 1,000 unique customer visits to more than 100 online courses.

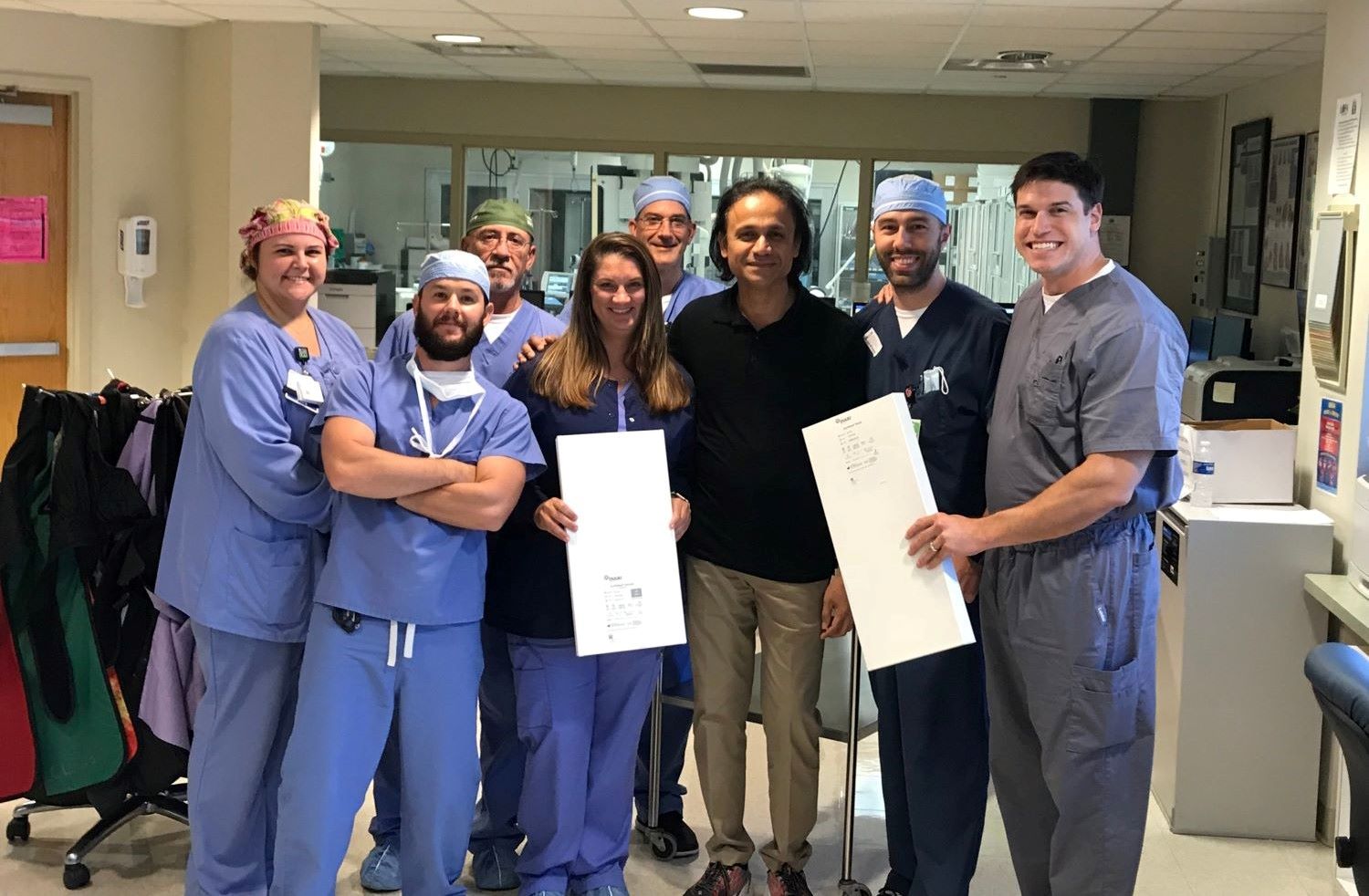

Besides, management has also expanded its medical affairs capability, establishing an executive position and hiring a world-class interventional radiologist. The role can help customers develop a more consistent process for identifying patients who might benefit from Inari’s devices. These processes are standard for heart attack and stroke patients but virtually nonexistent for blood clots. With the right resources and focus, Inari believes it can have a positive impact on these dynamics.

“We recently hired Dr. Venkat Tummala, a world-class, high-volume interventional radiologist, as VP of medical affairs. This is a full-time position, and Dr. Tummala has exited his clinical practice. His broad clinical skills, deep technical expertise and strong social media presence in the interventional radiology community helped further our ability to communicate with a broad customer base.” said Hoffman.

Building upon the Base of Clinical Evidence

Another driver of Inari’s growth is to continue to build upon the base of clinical evidence by publishing studies showing the effectiveness of the company’s devices. Inari believes that its devices change lives in the most extraordinary ways, and it remains 100% committed to validating this with the highest level of evidence possible. Inari’s two most recent studies, FLASH for PEs and CLOUT for DVTs, are doing just that.

About FLASH, it is a 500 patient study of blood flow within organs for PE removal. FlowTriever demonstrated best-in-class safety and yielded immediate normalization of vital signs. The study has been expanded to 1,000 patients and more sites across the U.S. and Europe. The trial also added a smartwatch-assisted monitoring component to track heart rate, oxygen levels, and physical activity.

These acute data demonstrated excellent safety in dramatic on-table improvement in a battery of hemodynamic variables. The 30-day follow-up from the same patient population was presented at the American Heart Association’s scientific sessions. “We believe the 30-day data demonstrate the potential for FlowTriever to both interrupt the natural progression of the disease and impact patient recovery in positive and significant ways,” said Hoffman.

The CLOUT study was similarly designed, but targeted at DVTs. These lower extremity clots are severe, but not as life-threatening as PEs, which are in the lung. In the study, Inari’s ClotTriever system achieved 90% median clot removal in an average procedure time of 34 minutes. Compared to the alternative, thrombolytic drugs that force patients to stay in the intensive care unit for observation, it’s a clear benefit for the patient, doctor, and hospital.

The effectiveness was compelling. An independent core lab analysis showed near-complete clot removal in more than 85% of the patients, which led to excellent clinical outcomes. At six months, every single patient reported a reduction in pain, and 92% were free from the moderate and severe post-thrombotic syndrome. All of these results are best-in-class by a pretty wide margin.

“Meantime, we continue to invest heavily in clinical studies and the production of data that is useful for expanding the market, driving adoption, and informing the design of randomized and controlled trials that we remain committed to executing,” said Hoffman.

Inari’s management believes also that each cut of registry data, each new and more clinically relevant endpoint they measure, each RCT they initiate and successfully execute not only increases awareness, helps drive adoption and moves the company closer to establishing these devices as the standard of care, but also raises the bar by which new devices and competitors will be evaluated.

Continuing to Broaden the Product Portfolio

Inari has been innovative in developing products for new applications as its fourth growth driver is to continue to expand the product portfolio. One of those is T20 Curve which is included with the FlowTriever system and is designed to improve navigation and torque to remove clots in challenging locations. It is also used for clots in transit and management estimates the device increased the addressable market by $200 million.

“We have included the curve in our per-procedure pricing, so that it, like all devices in the FlowTriever system, can be used for a single price,” Hoffman said. “This ensures that physicians can make appropriate decisions about which tools to use, either procedurally based exclusively on clinical need, without any concern for the impact on the hospital’s procedural economic. We remain committed to the best possible patient outcomes above everything else,” he added.

Another development is the company’s FlowStasis, designed to improve suture techniques to close venous access sites. FlowStasis represents a simple and consistent method of tensioning the compression stitch often used to attain hemostasis after the procedures. It stops bleeding faster, improving clinician workflow, keeping patients safer, and allowing procedure rooms to be turned around faster. Management is exploring applications of the device beyond its core DVT and PE patient population.

Not stopping there, in July this year, Inari received notification from the agency that its FlowSaver is considered substantially equivalent to previously approved devices. FlowSaver is an intuitive disposable filtration system that enables physicians to reintroduce extracted blood back into the patient and it delivers two important advantages for both the patients and the company.

“Number one, we believe that removing all of the clot carries great clinical value to the patient, and FlowSaver allows pursuit of this goal by enabling the physician to whoosh as many times as they deem necessary without concern for blood loss. And number two, by virtually eliminating blood loss in FlowTriever procedures, FlowSaver establishes bloodless thrombectomy across the entire spectrum of Inari procedures, again setting the bar higher both for existing and future competitors. FlowSaver has been highly anticipated by our physicians and has already been received with great enthusiasm,” Hoffman explained.

In addition, the company also reported FDA clearance of its T24 FLEX, which is a much more flexible version of its 24-French aspiration catheter. That flexibility makes the device more trackable, more deliverable, and easier to use. This has accelerated migration to the larger 24-French system, and it is now used in more than half of Inari’s PE procedures.

Looking further, Hoffman and his team at Inari are excited about the robust lineup of new products and innovation in their pipeline. Like most entrepreneurs, he is driven by consistent growth and progress. The expansion doesn’t come from acting on just one idea but it stems from pursuing multiple opportunities with a diverse product portfolio.

Pursuing Adjacent Markets and International Opportunities

Inari has been actively working to address unmet needs beyond the core products. The company’s fifth and final growth driver is expansion into adjacent and international markets and it has made some important progress early in its Europe launch. COVID-19 lockdowns have limited the travel and hospital access required for a more aggressive sales push, but the company remains positive on the region long-term.

“Despite what remains a very challenging operating environment, we have now completed ClotTriever and FlowTriever cases across most major Western European markets. Enthusiastic feedback from physicians remains highly positive, and we are seeing steady increases in our monthly case volumes,” Hoffman said. “Most importantly, we are gaining clarity on our longer-term commercial, clinical, and reimbursement strategies. There is much work ahead of us, but we remain optimistic about our European opportunity.”

Management is seeing considerable enthusiasm for both devices as many European physicians have seen the positive readouts from the FLASH and CLOUT registries and investigator-initiated trials. Limited access and other challenges caused by the pandemic have certainly created challenges for Inari’s initial European launch. But at the same time, they are encouraged by the interest they’re seeing and the progress they’re making. “We look forward to a much more constructive environment in Europe soon,” said Hoffman.

In addition to its efforts in Europe, the company has also begun work on the long path toward regulatory approval and reimbursement for its products in both Japan and China. Regarding opportunities in markets adjacent to its core DVT and PE markets, Inari has identified multiple unmet needs in the venous space and in the vascular space more broadly, and it continues to explore these ideas.

“I’d like to conclude by reminding you that we are committed to our mission to save and transform the lives of our patients. This cause is bigger than ourselves and much more important to us than business. We believe that nothing is more important than taking care of our patients. Any business success and consequent value creation that we might enjoy are never the goals but instead are merely byproducts of doing the right thing for our patients while taking care of our customers and our teammates,” said Hoffman.

The Bottom Lines

Inari is more than a business for Hoffman and his team and they are only in the earliest phase of their mission. Sticking to the core growth drivers is vital for any organization to develop. In the case of Inari, it helps the company continue to grow sustainably and aggressively for many years to come, as Hoffman believes.