‘H&R Block’ to Change or to Die: The Urge to Transform in a Digital DIY World

Who knows you best: Your doctor, your personal trainer, or possibly your tax advisor? The answer will vary. But for many of us, the person who prepares our taxes knows more about the details of our lives than anyone other than our family. They know how much we earn, how much we save (or don’t), how much we spend (and on what), how much we donate (and to whom).

People have complicated relationships with money. And your tax advisor sits with you right in the middle of all of that complication. Your anxiety and generosity will be on display in the financial moves you make throughout the year – moves that get documented in your tax return.

This puts a tax business like H&R Block in an interesting position as our society transitions from an age of standardization (when people did what they were told to do inside the box they were given) to our current age of personalization (when it’s becoming less and less efficient to have boxes at all). Doing your taxes is a very personal experience.

A Gloomy Future for Old-Fashioned Tax Preparers

There are some specific industries that can always rely on a steady stream of customers. As taxes are definitely an inescapable element of life, income tax preparers have enjoyed a similar level of job security for the past several decades. But changes in demographics and clientele have caused uncertainty regarding the future of this profession. Taxpayers now have more options than ever when it comes to filing their returns, and preparers have been forced to offer an ever-wider array of services in order to maintain their business.

The Changing Marketplace

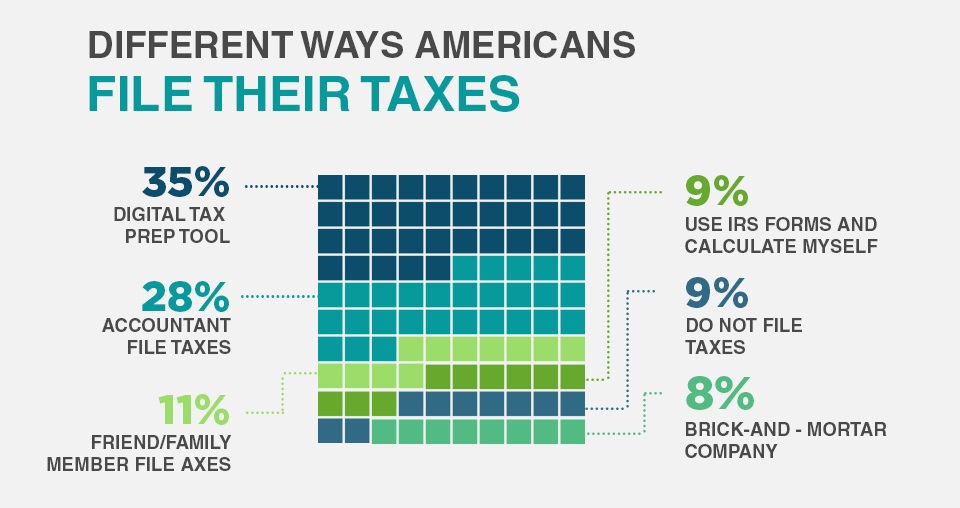

In 2019, there were about 156 million individual returns filed in America. Despite recent changes, taxpayers still have several basic avenues to choose from when they file.

About half of filers went to a Certified Public Accountant (CPA) or a tax preparation franchise like H&R Block to have their taxes prepared. Filers with complex returns, such as those who have business-related income or deductions from corporations, partnerships or oil and gas leases, or day traders who will require complicated basis calculations, will continue to use trained professionals to prepare their returns.

But the majority of filers with simpler returns are being presented with more and more options that make it possible for them to accomplish this task on their own. Of course, these software programs have been available for years to allow even those with moderately difficult returns, such as someone who runs a side business out of his or her home and itemizes deductions, to file their returns electronically.

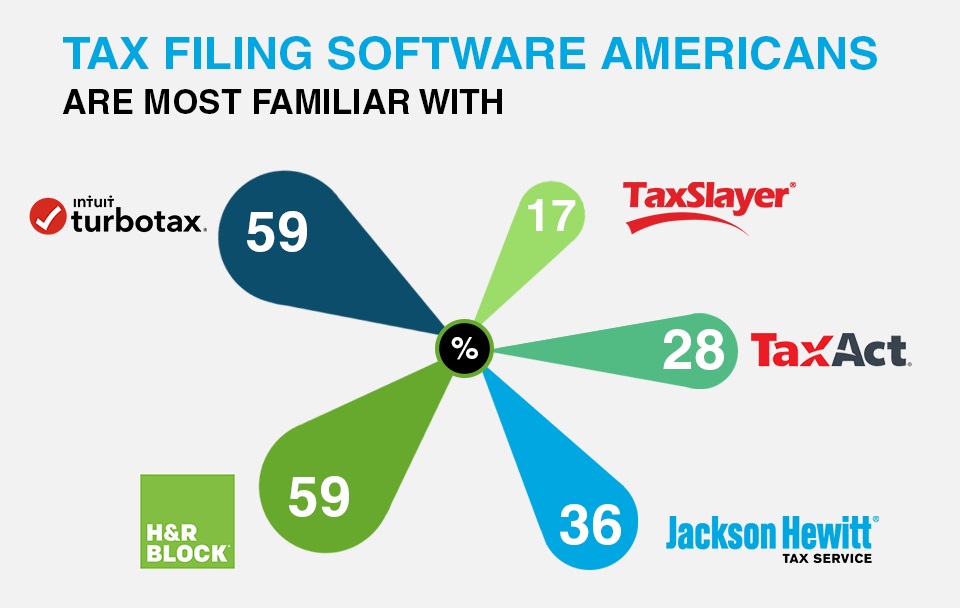

The market has become even more competitive with cheaper web-based programs such as TaxAct and TaxSlayer that are now available through the IRS Free File program. The recent introduction of free electronic filing of state returns through state tax websites provides many filers with a no-cost alternative for state filing, which usually comes with a charge even with IRS Free File programs. Regardless of this move, tax preparers are still in high demand, just in different ways.

The demise of refund anticipation loans (RALs) has also significantly diminished the bottom lines of many smaller preparation firms, as well as the major franchises. Preparers who own or work for small firms that previously depended upon return preparation fees as their primary source of revenue have seen a major reduction in their incomes as a result of this change.

Online DIY Tax Prep Trend Won’t Stop Growing from Now On

People who got a taste of do-it-yourself (DIY) tax tools this year because of the coronavirus pandemic may continue turning to those services in the future, forcing companies to adapt to what may become the new normal.

The current filing season is unique in several ways: it comes in the middle of a global pandemic and is three months longer than usual. That has sped up what market analysts have been increasingly seeing in recent years: more Americans are doing their taxes themselves, rather than going through the effort of meeting in person with a tax preparer.

A significant number of individuals who are using DIY services for the first time this year are likely to continue with that method, even after social distancing requirements and stay-home orders are lifted, according to analysts. If that prediction holds, the shift will benefit companies like Intuit, the maker of TurboTax, over companies like H&R Block – the ‘classic player’ that used to rely heavily on in-person, assisted tax preparation.

“This gives it even more of a boost—that people are sort of forced to use DIY or work on their own,” said Andrew Silverman, a tax policy analyst.

Last year, about 1.2% of filers who were using tax professionals to prepare their returns shifted to DIY preparation—doubling the prior year’s migration rate. So far this year, the shift is about 5% based on the IRS’s filing statistics, though the actual number is probably closer to 3% because the DIY figures include individuals who normally wouldn’t file tax returns but did so in 2020 to get access to Covid-19 relief payments.

Into Digital DIY World: H&R Block Finally Learned to Transform

The same digital trend that flipped commerce upside down is also shaping tax filing. And just as large retailers are feeling the heat, so are tax centers. H&R Block announced the shutdown of 400 locations in 2018. In the same amount of time it took for H&R’s stock to dip 15 percent, Intuit saw a 260 percent increase.

Why? Because people would rather do their taxes in their pajamas on the weekend than use spare time to consult with a practitioner. E-filing software is quick and easy to use. You respond to simple questions, take pictures of your W-2, and can save results for quicker filing the following year.

Not to mention, it’s cheap. Most digital tax software costs less than $100 to file both state and federal taxes. It’s hard for physical tax locations to pay salary and overhead and still compete with those prices.

Also, DIY tax software works best for the masses. Most tax experts agree that tax software is suited for those with simpler returns making less than $100,000 a year. That income range includes about 90 percent of Americans, leaving only 10 percent for other tax solutions.

“The current pace of technology innovation challenged us to look at our entire service offering in a very different way,” says Sameer Agarwal, Manager-Enterprise Data Analytics at H&R Block. “We set out to reimagine the services we deliver to customers.”

Large-scale IT transformation is never easy, but H&R Block finally recognized the risk associated with not continuing to innovate. In recent years, H&R Block has started positioning itself to tackle future challenges head on—and providing the exceptional multichannel experiences that keep customers coming back.

Tax Pro Go: Professional Experiences Right at Home

In late 2017, H&R Block released Tax Pro Go as an easy, convenient service for busy Americans to get their taxes done by an expert tax professional, without stepping foot in a tax office. This feature employs technology to facilitate a virtual tax prep experience, matching filers with a tax pro trained to handle their unique situation.

Once all tax documents are uploaded, the tax pros do the rest. This means on-the-go clients don’t have to spend their precious time doing their own taxes. In addition to saving people time, H&R Block is the only major tax prep company to provide upfront, transparent pricing, so Tax Pro Go clients will always know their price before they begin.

“In a recent survey, we found 88% of Americans between the ages of 18 and 40 said they would add one or more hours to their day, if possible, with more than half (52%) adding four hours to their day,” said Karen Orosco, senior vice president of U.S. retail for H&R Block. “They also told us time is valuable, which is part of what makes Tax Pro Go such an innovative service. It saves people time by making the tax prep process both modern and convenient through a digitally enabled solution providing expert tax prep without the office visit.”

With Tax Pro Go, H&R Block clients are matched with a tax preparer trained for their specific filing needs, and the service allows convenient collaboration through secure messaging or via phone. Most H&R Block tax pros average 12 years of tax experience, allowing many people to work with the same trusted tax pro year after year. Digital innovation supported by expert human care is the key to Tax Pro Go’s success.

“Research also revealed 75% of Americans wish there were more ways to get things done online rather than in person,” Orosco said. “Tax Pro Go provides a valuable online service, but we take it a step further. At H&R Block, we believe the best technology is blended with human expertise and care, as exemplified through Tax Pro Go.”

H&R Block’s Core Value: “Human Advantage”

While there is certainly a role for technology – and H&R Block offers a mix of in-person, online and virtual options – the leaders all agreed that the personalization of the future is grounded in what they called the “human advantage.” H&R Block is deepening those connections with intention. It’s the only way to keep up with changes that happen faster and faster.

“Conversations between tax professionals and clients ebb and flow at the speed and at the level of detail that the client prefers,” said Karen Orosco. “Some clients want to get to the punch line as fast as possible: ‘How much do I owe or how much am I getting back?’ Other clients want to know exactly how it works: ‘What’s happening in my tax situation?’ Tax professionals are amazingly skilled at being able to personalize the experience, so the client gets what they want out of that experience. And that’s truly about the human advantage. You can’t solve that personalization exclusively with technology.”

At its core, the company believes marketing is about experience. In recent years, H&R Block has focused on experience as a core value to drive business. Connecting with customers on an emotional level builds the relationship, which is then strengthened with technology-supported services. In its continual evolution of the tax process, H&R Block is rolling out new services this year, including the ability for online customers to chat with a tax pro about questions and a digital drop-off program for customers to send in their tax forms electronically so that their taxes are already in process for their in-office appointment.

The overall goal is to not only simplify the tax process but also provide great service and meet the needs of all types of customers. Some customers just want to file their taxes as quickly as possible, while others want to learn about the process and have a conversation with an experienced professional. H&R Block provides services that hit all points on the spectrum.

Companies across all industries, especially H&R Block, have to balance the push for new technology and automation with the natural urge for human connection. H&R Block’s goal is to make sure human connections are more tangible and valuable. Even with all of the new technology and automation, it doesn’t want to lose sight of human relationships.

“It would be terrible for us to forget that our human needs are greater than speed,” said Vinoo Vijay, CMO at H&R Block. “We need to find ways to serve the fullness of our communities and our people.”

Helping customers file their taxes in a convenient, simple, and personalized manner comes down to continually evolving and adopting new technology without letting go of what makes us human—those connections with other people. By tapping into all areas of the equation and building emotional connections, H&R Block can continue to improve its customer experience.

Positive Signals Recently: Going Digital Was A Smart Move

A month has gone by since the last earnings report for H&R Block in September 2020. Shares have added about 10.1% in that time frame, outperforming the S&P 500. H&R Block surpassed Q1 earnings and revenue estimates. Adjusted earnings per share of 55 cents beat the Zacks Consensus Estimate by 48.7%. Revenues of $601 million surpassed the consensus estimate by 7.7% and increased more than 100% year over year. This is a good signal compared to the same quarter last year when H&R Block suffered a loss of 72 cents per share.

If we travel back in time to mid-March 2020 when most of the U.S. was under a shelter in place order, two corporate giants were among the many grappling with the sudden shock. For H&R Block, it was the middle of tax season, and the company had to enable its 70,000 field associates and tax professionals to get nearly instantaneous updates on fast-moving federal, state, and local tax information that was tied to the stimulus package.

The immediate challenge was that most of these field workers were not set up to work from home—and guidelines from government agencies kept changing. As a result, H&R Block had to make changes to its operating model and relied mostly on its DIY and virtual-assistance service offerings, such as Tax Pro Go.

“Our biggest pivot was enabling our field associates to work from home since we weren’t prepared for that. Luckily for us, we had begun making significant investments in digital transformation and we were pretty far along the journey of adopting cloud technologies,” said a senior IT executive at H&R Block. “Otherwise, there is no way we could have envisioned, designed, and rolled out a new learning and employee communication solution in less than two weeks.”

The company’s cash generation capacity enables it to pursue opportunities that exhibit true potential. H&R Block exited the fourth quarter of fiscal 2020 with cash and cash equivalents balance of $2.66 billion compared with $192.34 million at the end of the prior quarter.

“I don’t think there will be a ‘return to normal.’ I think this is the ‘next normal’ and we will have to continue to iterate,” explained one senior HR leader at H&R Block. “Right now the world is absolutely a volatile real-time environment, and in the future, that means you have to be digital so you can be flexible and agile.”

The main drivers of the H&R Block’s performance include digital enablement of business, client retention in both Assisted and DIY; greater usage of AI and machine learning for product improvement; as well as expansion in small business. Strategic investments in price, technology and operational excellence will help the company achieve overall objectives of clients, revenues, and earnings growth over the long term.

Bottom Lines

Although the tax preparation industry is likely to survive, and perhaps even to thrive for the foreseeable future, preparers at both large and small firms can expect their competition to increase. They need to differentiate themselves from their peers in order to maintain profitability. Customers will be offered an ever-widening array of choices for preparation in not only how they can file, but also of additional financial and accounting services that they might need.