Budgeting Tools for Professional Services: Top 10 Revealed

No matter which industry or niche you’re in, budgeting is typically a challenge. From tracking expenses and invoicing to day-to-day accounting and year-end tax preparations, there exist countless financial duties that take time away from providing services or producing goods. Whereas a large number of SMBs are still employing Spreadsheet for manual budgeting processes, the modern planning demands are far more complex than what the traditional budgeting program can offer – especially when it comes to professional services organizations with distinct industry-specific focuses and budget needs.

Fortunately, within such an ever-evolving Tech-powered business landscape, there is a plethora of modern tools that will probably save business owners time and headaches that come with daily financial tasks. Should you wish to streamline the financial side of your business, let’s go through our pick for the top incredible budgeting tools for professional services.

Indispensable “Ingredients” for A Winning Budgeting Solution

Before delving deeper into the specific budgeting software, it’s more than vital to first take a look over some essential qualities – the “must-haves” – you should look for when choosing your would-be “financial partner”.

1. Automated and User-Friendly Time Tracking & Expense Management

There is no denying that timesheets and expense reports remain the backbone of managing project costs and evaluating budget estimates versus actual figures in real-time.

In former times, team leaders or project managers had to contend with multiple spreadsheets containing information from different teams, which would then need to be reconciled to eventually present the full picture of a project’s progress. These days, even as people become more virtual, remote and flexible in how they work, time and expense data can be easily entered and integrated into a centralized Professional Services Automation (PSA) solution as well as provide automated notifications well ahead of time if a project or campaign is running over time or over budget. Rather reinventing the wheel on every project, such a feature does make a lot more sense to have your resource and time information in one single place

2. Hassle-Free Invoicing and Accounting

After all the time spent delivering a service or working on a project, invoicing customers or billing clients is definitely a “must” to minimize the chances for revenue loss. Billing against projects can be, nevertheless, a complicated process – particularly when payments are closely tied to project milestones, pay-as-you-go contracts, or other complex service agreements.

Additionally, all hours worked by your employees, including the contractors, as well as related client projects expenses need to be accurately captured to produce the right invoice. One of the essential features that make a budgeting tool desirable is its ability to dramatically reduce the time it takes to bill clients by generating an accurate invoice with just a few mouse clicks, which can also be customized and sent directly to the client from within the system.

3. Effective Resource Management

The ebbs and flows of working in a professional services business mean that the team needed throughout the year will also evolve. Thus, a solid PSA solution will not only the one that can determine resources required on a project and how many hours against their billable rate, but will also track skills and availability against their profiles. This function is particularly helpful especially when it comes to identifying teammates across multiple regions (for instance, match projects against employee expertise around the globe instantly) and enabling greater billable utilization.

Clearing project management against specific activities and milestones is another super-powerful feature for a budgeting tool. Beyond any doubt, one of the greatest hurdles in managing so many projects is to make sure that they are completed on time, on budget, and on value.

Based on the McKinsey’s research conducted in collaboration with the University of Oxford, half of all large IT projects—defined as those with initial price tags exceeding $15 million—massively blow their budgets. On average, large IT projects run 45 percent over budget and 7 percent over time, while delivering 56 percent less value than predicted. It’s also revealed that software projects run the highest risk of cost and schedule overrun. As a result, it’s more than crucial to seek a solution that goes beyond Gantt charts to track project activity and milestone dates, as well as include intuitive dashboards so that professional service providers can course correct if a project starts to go awry.

4. Additional Software Integrations

In addition to integrating with timesheets, expense reports and invoicing, sharing data with other software is significant to grasp the proper understanding over the lifecycle and business impact of a project. For example, while integrating with a Customer Relationship Management System can better manage contacts, accounts, and streamline opportunities against future resource requirements, integrating with an Enterprise Resource Planning system can further automate project billing and collection.

When evaluating a budgeting tool in particular – or a PSA solution in general, think out carefully not only at your project management needs but also at other systems to ascertain that all essential project data “talks” to each other.

5. Built-In Analytics

So as to drive sustainable growth and profit margins, every single company needs real-time visibility into their project or business performance, which consists of insights on resource utilization, billing forecasts, budgets versus actuals, and other key financial reports.

The best budgeting solutions in the market will be one that boast highly configurable and robust dashboards, reporting and analytical tools, which can instantly present clear-cut insights on virtually any project, user, and timeframe. Not only should these reports provide at-a-glance data for senior management but they can also zoom into focus on specific areas to drive the optimal business decision making.

6. Cloud & Mobility

In recent years, professional services organizations are realizing the benefits of a cloud-based solution. Actually, an impressive number of companies have moved their budgets to cloud – and there are good reasons behind that.

Firstly and obviously, cloud-based budgeting software is less expensive than on-premise products. Smaller companies also lack the infrastructure and IT staff to manage the complicated infrastructure of on-premise software. Besides, with so many professional services professionals traveling to and from client projects and other appointments, mobile capabilities emerge as a must-have for any PSA solution, including budgeting-focused tools.

10 Best Budgeting Tools for Professional Services

#1. Scoro

Scoro is a cloud-based system for small to mid-sized businesses that is available as a mobile app. Such a handy software combines efficient budget planning and forecasting capabilities with other useful features that let you invoice, juggle expenses and manage project budgets. Furthermore, it does include an intuitive financial dashboard and CRM, thus, you can manage your entire business operation in one solution as well as access every bit of its financial data in a single place. Also, Scoro is customizable and can integrate with other applications.

Key Features

- Budget planning and forecasting

- Financial reports and analysis

- Unlimited project budgets

- Project management (budget allocation, project portfolio, planned tasked and more all from one central page)

- Financial KPI dashboard

- Invoicing and professional services automation

- Automated revenue stream from invoices

- Work scheduling and tracking

Pricing: From $26 user/month, 14-days free trial.

#2. Float

Should you be in search of a user-friendly budgeting tool to erase your financial concerns, then Float is going to be your best fit!

This easy-to-use cash flow management and budget forecasting software seamlessly integrates with popular financial tools such as Quickbooks, Xero and Free Agent. Besides, it does feature a highly visual and intuitive platform that can help you bring greater clarity to your company’s budget and available cash flow.

Key Features

- Cash flow forecasting

- Business budgeting

- Visual reporting

- Intuitive interface and resource scheduling

- Project planning

- Team management

Pricing:

As regards Float’s pricing policy, there are many pricing plans available to choose from – amongst them, some may be worth your consideration:

- Essential (3 user accounts) $69/month (billed monthly)

- Premium (10 user accounts) $119/month (billed monthly)

Each with 14-days free trial!

#3. Adaptive Insights

Adaptive Insights is gaining a growing popularity as a comprehensive tool offering cloud-based budgeting and forecasting software combined with reporting and analytics features. The budgeting tool will enable you to manage your finances as well as more accurately plan for future needs through a range of sophisticated modeling features. Plus, it can pull source data from other software systems to ensure that the obtained insights are accurate and remain up-to-date. KPIs can be visualized, and reports can be shared among different users as well.

What’s more, this budgeting, planning, and modeling software includes Excel-like sheets, allowing you to drill into cell values to grasp a clearer understanding of data. Since Adaptive Insights’s also fully configurable, you can customize calculations and create more flexible models that suit your unique business needs.

Key Features

- Modeling (fiscal modeling, combined with a wide variety of planning and forecasting tools)

- Revenue management

- Capital management

- Balance sheet & cash flow statements

- Expense management

- Personalizable visualizations and dashboards

- Board and external reporting

- Financial consolidation (conducted in real time and with no long-running processes and no batch jobs)

Pricing: Upon request

#4. Planning Maestro

If you’re looking for a highly comprehensive financial intelligence solution, Centage’s Planning Maestro might be the answer.

Planning Maestro is a cloud-native budgeting, planning, forecasting & analytics platform that delivers year-round financial intelligence. Directed specifically at small and medium-sized businesses, Planning Maestro provides users with a robust financial planning solution to help them create viable budgets for their operations and build reliable forecasts models to project future performance and direction. It lets you harness the power of financial intelligence so you can slice and dice your financial data as well as reveal insights and opportunities.

Additionally, the software is scalable for changing to unique business requirements, effectively automating many of the error-prone, time-consuming manual spreadsheet processes to produce a more accurate budget.

Key Features

- Integrated powerful financial intelligence

- Frictionless synchronization of all your financials

- Budgeting

- Forecasting

- Workforce & scenario planning

- Financial dashboard and reporting

- Comprehensive analytics

Pricing: Upon Request

#5. Prophix

Prophix is a powerful and feature-rich corporate performance management system deployed by a large number of users worldwide to help them make sense of their financial data and give more value to financial information. Such a handy tool is designed to automate and streamline all processes involving financial data consisting of budgeting, planning, consolidation, and reporting.

What’s more, the platform helps to eliminate the risks and the obstacles that hamper financial data collection and analysis. Prophix takes errors and inaccuracies out of the equation, leaving you with up-to-date, accurate, and reliable financial information that will empower you to achieve a solid and stable financial future for your company.

Also, as a corporate budgeting tool developed with a multi-user role in mind, Prophix is built to be easy and straightforward, as indicated by its very familiar spreadsheet-style interface.

Key Features

- Budgeting, planning, and forecasting

- Financial, statutory and management reporting

- Profitability modelling and optimization

- Financial Consolidation

- Integrated Financial Planning

- Visual Analytics

- Personnel planning

Pricing: Upon Request

#6. Planguru

Compared with Planning Maestro and Prophix, Planguru is a more simple budgeting software solution, which might be exactly what you’re seeking for to manage your small service-based company’s budget.

To be more specific, Planguru is an affordable web-based dynamic software for businesses and non-profits worldwide. With a range of features and functionalities, it makes the tasks of budgeting, forecasting and financial planning easier for customers ranging from entrepreneurs, creating a high-level forecast for investors to larger corporations requiring a detailed multi-departmental operating budget. Especially for finance professionals working on many project or clients, this tool will help you to simplify complex budgeting and forecasting practices.

Amazingly, Planguru boasts a separate analytics tool that helps to get a better overview of financials and drive better decisions. Employing Planguru for your business, more accurate analysis can be produced in less time.

Key Features

- Pre-built Integrated Financial Statement Structure

- Reports and Analysis

- Payroll Utility

- Inventory and Services Management

- Engagement Tools for Professional Accountants

- 20+ Standard Forecasting Methods

- Forecast using Non-Financial Data

- Scalability and Expandability

Pricing: $99/company/month + $29 for each additional user

#7. FreshBooks

Speaking of budgeting tools, FreshBooks turns out to be a very familiar brand, especially with small and growing businesses.

FreshBooks is a reliable and fast accounting suite that turns otherwise complex financial management into an enjoyable experience. Actually, with FreshBooks, producing professional-looking invoices can be done in just a few clicks as the software doesn’t require experience in budgeting. Furthermore, it automates tasks such as client follow up, time tracking, expenses organization to save you more time. The software also integrates seamlessly with a wide variety of third-party apps – Stripe, Shopify, PayPal, and G Suite, to name a few – to extend the app’s functionalities.

In practice, the award-winning software does pack a robust set of features that are offered in flexible, SMB-friendly pricing plans. Adopting FreshBooks, you will be enabled to customize the branding of your financial documents by modifying its design, colors, and logo to be more professional.

Key Features

- Online invoicing

- Time-saving auto-bills and recurring payments

- Invoice-to-payment functionality

- Expense and time tracking

- Project management and collaboration

- Accounting reports & taxes

- Simple reports and dashboards

Pricing Plans:

- Free Trial: 30 days

- Lite (up to 5 active clients) $15/month

- Plus (up to 50 active clients) $25/month

- Premium (up to 500 active clients) $50/month

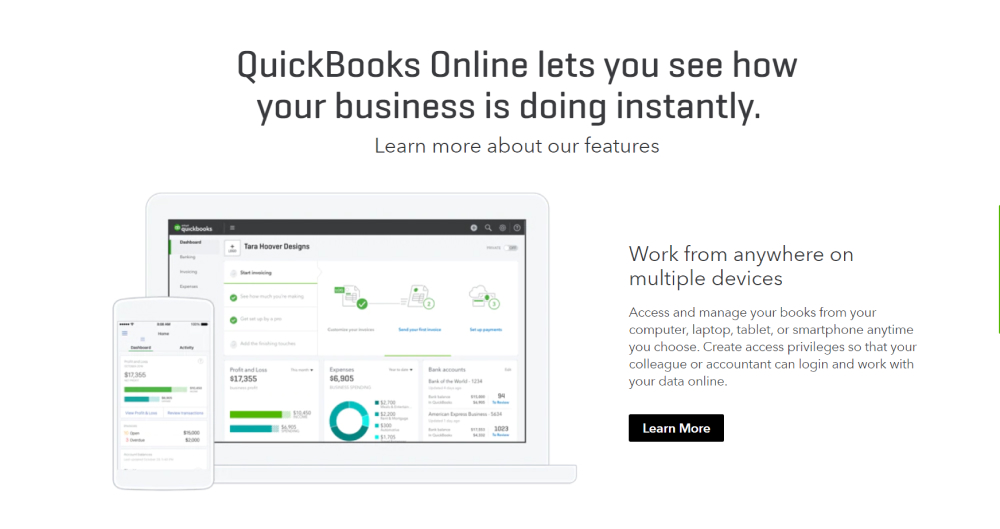

#8. QuickBooks

Just like FreshBooks, QuickBooks is amongst the leading small business accounting and budgeting tool employed by accountants all over the world. Providing various features from expense tracking to invoicing, QuickBooks puts the things you need most all in one place, empowering professional service providers to obtain a complete overview of their budgets and stay on top of their financial health.

Key Features

- Tracking expenses

- Custom invoice templates

- Sending invoices

- Managing and paying bills

- Automatically download & categorize bank transactions

- Profit & Loss, Balance Sheet + more reports

Pricing:

- Simple Start plan $15/month

- Essentials plan $23/month

- Plus plan (unlimited features) $31/month

Each with 30-day free trial

#9. BudgetPak by XLerant

Designed for mid-sized professional service organizations, this easy-to-use cloud-based product is an all-in-one cloud-based, budgeting, reporting and forecasting solution. Emerging as an ideal solution for finance teams that need to improve accountability and engagement, BudgetPak includes an intuitive and flexible interface that offers step-by-step guidance for financial and non-financial end-users.

Furthermore, it offers a flexible budgeting process, straightforward GL integration, and high user adoption – with minimal to no IT intervention. It’s also noteworthy that BudgetPak features quick implementation and expert support from attentive XLerant professionals.

Key Features

- Strategic budgeting, forecasting & planning

- Complete reporting and analysis

- Increased ownership & enhanced oversight

- Complete revenue & expense planning

- Detailed headcount & salary planning

- One-click what-ifs

- Real-time excel integrations

- Cross-department budgeting for special initiatives

- Multi-participant budgeting with intuitive interface and guided workflow

Pricing: upon request

#10. Vena

Designed for businesses of all scales, Vena is a super-powerful budgeting, planning and revenue forecasting software solution for those who that wish to create and implement foolproof budgets for their operations, purchases, acquisitions, and more based on reliable financial data and analytics.

Actually, the software turns the traditional Excel into a centralized cloud-based budgeting solution that offers automation of their workflows and processes, absolute version control, reliable audit trails, user permissions, and more. Vena’s strength lies in shortening the typical budget cycle, with a drag-and-drop budget process design tool to map out the automation process. The automated routing, review and approval workflow will allow you to monitor each step carefully and flush out bottlenecks and revisit your process accordingly.

Key Features

- “What If” Scenarios

- Graphical Data Presentation

- Modeling & Simulation

- Performance Metrics Analysis

- Cash Planning & Management

- Consolidation / Roll-Up

- Budgeting & Forecasting

- Statistical Analysis

- Run Rate Tracking

- General Ledger

- Reporting & Financial Statements (Income Statements, Profit / Loss Statement, Balance Sheet, …)

Pricing: Upon request

The Bottom Lines

The emergence of numerous budgeting tools these days has set a huge transition from boring and confusing spreadsheets – that are prone to errors and plagued with technological limitations – to a streamlined process of budget planning and execution. Let’s leverage such a positive transition to stay on top of your service-based business’s financial health and map out a consolidated budgeting strategy to skyrocket your success.

Besides effectively managing your finance, your online presence is what you should pay the most attention to, especially within such a competitive online landscape. Should you need any help with a dedicated team to get your business well exposed to the digital world, don’t hesitate to get an online presence manager.