From Idea to Reality: Banking App In Denver

Understand What You Are Doing

It is reasonable to say that if you are going to do something, the first step is to know everything about it, inside and out.

In the case of creating an online banking app, you need to check the theory about Fintech.

Learning about Fintech could sound basic, but you might be surprised at how ambiguous it still is to you. Here are some fundamental concepts about Fintech you should know.

In terms of definition, Fintech is the act of using technology to simplify or improve the convenience, effectiveness, and security of existing financial services on the Internet platform.

Secondly, you need to be clear about the aim of Fintech, why did people are becoming more and more depending on this type of doing finance instead of the traditional way so that you could meet those expectations and even more. The main reason many people are adopting this technology is, one word, convenience. This could either comes from fewer clicks or less screen time. Overall, it’s the resource-saving way of managing your money.

Keep Your App Customer-Oriented

The next step, it is high time to raise the question: “What do our customer really need?”

Number one, don’t rush to push out your service if you are not certain that it will soothe your customers’ sore points. Number two, what you feels right doesn’t apply to your customers. Personal bias is a deathtrap for hundred of companies.

So what should you do? Basic answer: Market Research!

The only way to know what will satisfy your target market is to ask them. Now, if you are to develop an Internet Banking, you might want to know about whether they would like to subscribe for an Internet banking account, which service do they want to be included in one app, what kind of transactions do they usually makes, what benefits do they want to have as a subscriber, etc.

Model Testing

Once you have figured out all the highest priority features, it is time to think through the user experience and build a prototype base on all the information you have collected. For time- saving purposes, the prototypes need not be a perfect product, it could even be a blueprint, or sketch that describe pinpointing most essential characteristics of your app, what it is, how it will look, and function.

The goal of developing a prototype is to gain feedbacks about it. You can consider run the campaign in one small area to “test the water,” see how your consumers react to the app, and learn from your mistakes.

Build up a Strong and Secured Banking App

After all the hard work is done, let’s go, let’s just make it and bring it out to the market!

WAIT!

You might don’t know, but banks, accounting firms and other companies in the financial sector now face huge obstacles when it comes to digital security. According to one study’s estimate, hackers steal as much as $575 billion annually. And while that study did not clearly distinguish between incidents involving mobile apps and traditional websites, the potential for app vulnerability exploitation is noticeable for every user of financial apps. That reality force banks and other financial institutes respond to the situation and further secure their apps.

So which features should the banking app development in Denver needs to create a secure app?

1. Have a Multi-Factor Authentication

Simply require for one password upon signing in was outdated for ages. Do you want your million of dollars to be protected by merely a fragile secret text, which can easily be beaten?

By adding a multi-factor authentication feature, you can add more layers of defense for the sake of your clients’ assets. Some prominent authentication methods are the combining of two or more independent credentials such as what the user knows (password), what the user has (security token) and what the user is (biometric verification; fingerprint)

2. Promote the Use of NFC-embedded Sim Card

NFC (Near-Field Communication) is a set of ideas and technologies that enable smartphones and other devices to establish radio communication with each other by touching them together or bringing them into proximity ( 3.9 inches or less)

An NFC-embedded SIM card is a SIM card that allows consumers to securely download their credit card information into the Near Field Communication (NFC) SIM card.

This solution is more for the means to lessen the risk of carrying your real card around or unintentionally gain access to your mobile bank account.

3. End-to-End Encryption

Right now, there are thousand, billion of data flying around you, some of them comprise information that worth a fortune. What do you say if you can easily pick them out from the air?

As ridiculous as it might sound, hackers are doing just that to exploit other people money.

With end-to-end encryption, it makes sure that only the two machines making the transaction are able to read the message. Even if hackers can pick those information out of the air, it will just be a string of meaningless data.

4. Communicate with Real-Time Text and Email Alerts

It’s trustworthy if you can inform your customers about what is happening to their account, provide them a record of transactions in another form. It’s also beneficial to prevent fraud if the trade is not confirmed or the amount spent is more than the actual bill.

5. Utilize Machine Learning in Fraud Detection

Imagine that you are at a cafe when your phone rang notice a message. It’s from the bank you currently register saying your account is going to be deducted $160 and ask for my confirmation. Of course, you deny the transaction immediately. The ability of Machine Learning to locate a phone ID at one place and the transaction being carried out in a strangely faraway place and automatically enact a solution is mind-blowing.

Fraud detection and prevention is facilitated by comparing at-the-moment transactional data against a well-known set of patterns or real-time information to prevent incoming transactions that are in doubt of fraud. Modern self-adaptive machine learning with the assist of Big Data can study and track past behaviors of customers and devices to enable identification of fraud on time.

6. Secure Connection.

Now, you already have a secure app, a secure way of conducting transactions, the only thing left is to put your app into a safe environment.

Using secure connections via technology like HTTPS, you can better protect your customer information.

Why Banking App Development in Denver is an Ideal Procedure

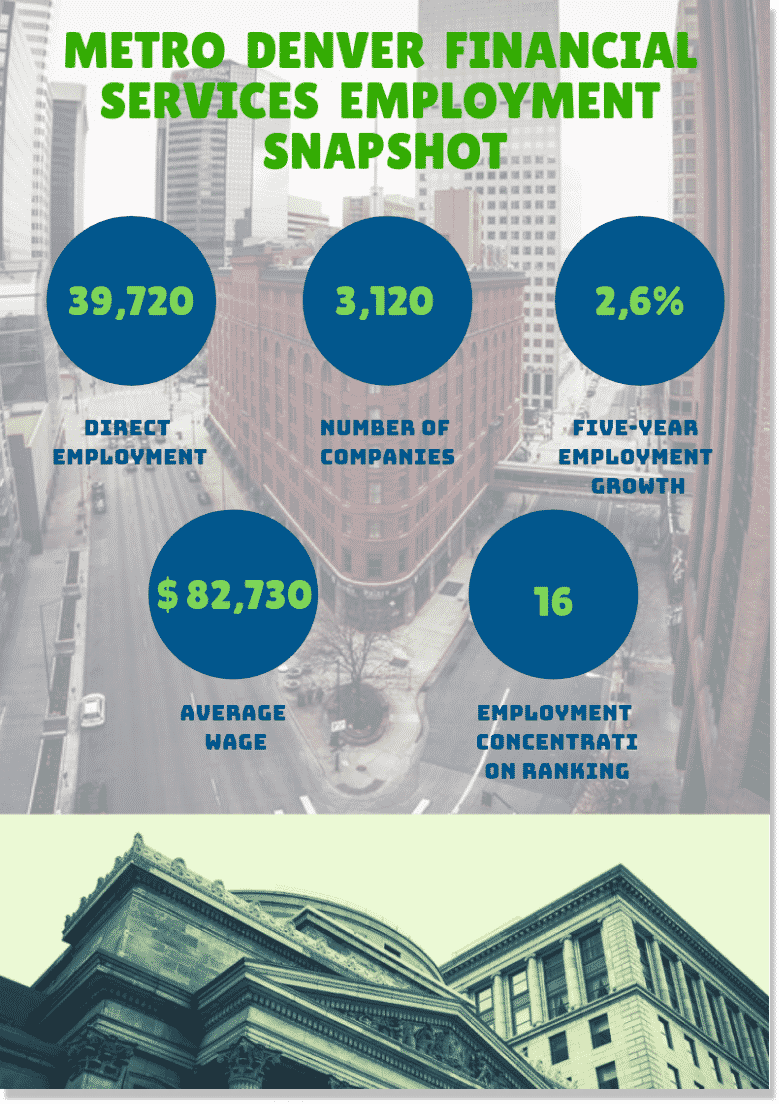

As “The Wall Street of The West,” Colorado is substantial with financial service in three key industries: banking, investments, and insurance. With more than 39 percent of financial services-related occupations in Colorado require a high school diploma or equivalent, while 57 percent require a bachelor’s degree or higher, the area is blessed with a competent workforce in the finance industry.

Key industry financial services in Colorado.

Furthermore, the Banking industry has been thriving making app development in Denver becomes demanding than ever. Over the past five years, financial services employment grew 10.7 percent, while financial services companies employed 4.4 percent of the region’s total employment.

In addition, we have not mentioned other regional characteristics such as a favorable and competitive tax structure, and being at the center of the nation but at the edge of the global market, this state would be the cradle to nourish successful financial start-ups.

Conclusion:

So what do you think? No?

Well, we understand your worries.

The Banking app development in Denver might be extremely complex process if you don’t have adequate technological knowledge or the tools to make it happen.

Of course, you can develop it by yourself, but that will take time, and the outcome might not justify your cost. Furthermore, in the race of technological advantage, every minute and every second count.

Do you know that there is one more option to fast forward the procedure, still guarantee the quality of your app just as you imagine, and at a reasonable cost? Please contact us and find out more.

Your Might Also Like:

Has Your Business Well Aware of App Development’s 3 Benefits?