Caught Between Green Dreams and Red Flags: America’s Battery Dilemma

Batteries power a vast array of modern technologies, ranging from smartphones and laptops to electric vehicles, medical implants, remote controls, toys, and even greeting cards. They are manufactured in various shapes and sizes to accommodate the specific energy requirements and spatial limitations of each application, from compact button cells used in watches to large pouch cells employed in electric vehicles.

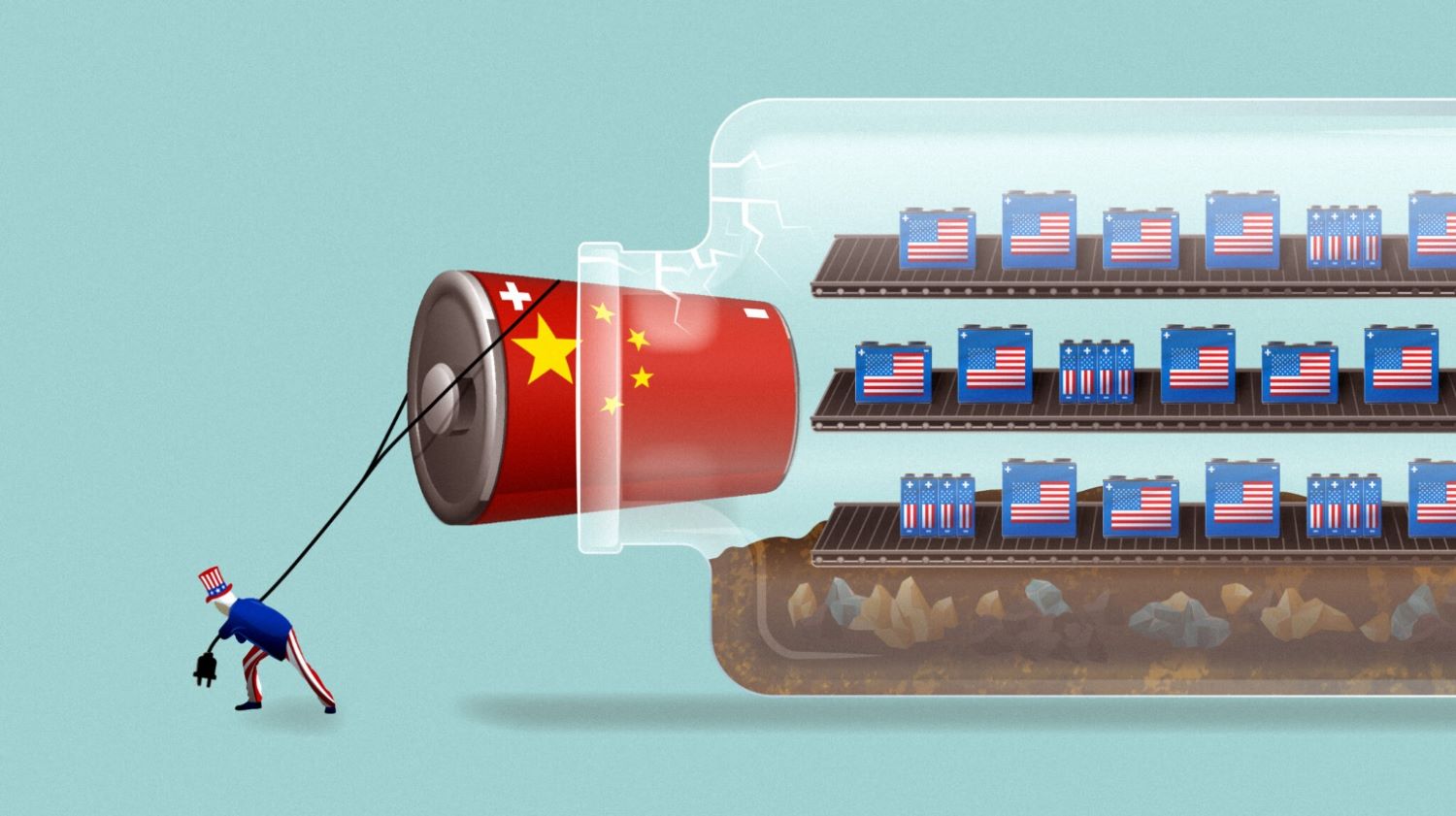

The majority of batteries we use today are made in China. As the global leader in battery manufacturing, China produces over 70 percent of the world’s lithium-ion batteries, driven by its well-established supply chains, access to key raw materials, and strong government support for clean energy technologies.

The United States has been heavily dependent on China for batteries, and this reliance is increasingly viewed as a national security concern by the U.S. government. As battery technology becomes more critical to sectors such as transportation, defense, and renewable energy, concerns have grown over the risks associated with relying on a single foreign supplier. The challenge facing the U.S. is how to reduce its reliance on Chinese battery manufacturing while simultaneously accelerating the adoption of clean energy technologies.

Before exploring the policies aimed at reducing reliance on China, it is important to understand how China came to dominate the global battery market.

How China Has Dominated the Battery Industry

To understand the dominance of China in terms of batteries, we need to go all the way back to the 2000s to meet Wan Gang. While he wasn’t the sole cause of China’s battery dominance, but he was a key catalyst.

Started When There Wasn’t Any Competitor

In 2000, Wan Gang, a former Audi researcher who had studied in Germany, submitted a proposal to the Chinese government advocating for clean energy as the path forward for the nation’s auto industry. The government embraced his idea, bringing him back to China to develop it further, and by 2007 he was appointed Minister of Science and Technology to put his plan into action.

In the early 2000s, China faced serious challenges such as dangerous city smog, heavy reliance on risky oil imports, and frustration with being seen only as the world’s low cost factory, and Wan Gang believed that EVs could be the key to solving them.

After recognizing the potential of electric vehicles (EVs) and renewable energy, the Chinese government began laying the foundation for a domestic battery industry.

When China started focusing on EVs and batteries, no one else really cared about them. Most countries saw the industry as low value and full of problems, so they let it move overseas. China used this chance to move quickly, establish an early lead, and then stay committed for the long term by scaling up production and improving its supply chain.

Government Savvy Plans and Supports

China’s battery industry began to accelerate in late 2000s and early 2010s, when the government launched aggressive subsidies and incentives for EVs and battery production. This included funding for infrastructure, tax breaks, and support for research and development.

China also introduced domestic content requirements for EV subsidies. Only vehicles using batteries from approved Chinese suppliers—like CATL and BYD—qualified for financial support. This policy forced foreign automakers such as GM and Tesla to integrate Chinese batteries into their vehicles to remain competitive in the Chinese market.

As a result, domestic firms rapidly scaled up, gaining production experience that significantly reduced battery costs.

Deep Supply Chain Control

Besides getting an early start and benefiting from strong government support, one key factor behind China’s dominance in the electric vehicle battery industry is its deep control over the entire battery component supply chain.

This control begins with the lithium-ion battery, the standard power source for electric vehicles, which consists of four essential components: the cathode, anode, electrolyte solution, and separator. The cathode typically contains nickel, cobalt, and manganese; the anode is made from graphite; and the electrolyte is composed mainly of lithium salts.

Over recent years, Chinese companies have strategically secured ownership stakes in mines across the globe where these minerals are found. Their approach is simple: by controlling production, they can influence pricing. As a result, China now holds a significant share of the global supply of these critical raw materials.

However, China’s real grip on the supply chain comes after the mining stage. Regardless of who extracts the minerals, China dominates the refining process—where raw materials are processed to isolate the desired elements. This step is highly polluting, which is why it’s less common in developed nations.

Chinese manufacturers also lead in producing the four core battery components and assembling them into battery cells. This capability was built on a strong foundation of battery production for consumer electronics. For instance, BYD began by manufacturing batteries for electronics in the 1990s before expanding into electric vehicles.

Historically, the U.S. has not played a major role in lithium-ion battery manufacturing. That space was once led by Japan and South Korea—but today, China has overtaken both, cementing its position as the global leader.

America’s Heavy Reliance on China’s Battery Supply Chain

According to “Is U.S. Dependence on China for the Battery Supply Chain a National Security Risk?” by Joshua Busby (University of Texas–Austin, September 2023), he pointed out that the United States faced deep vulnerabilities in its battery supply chains due to overwhelming reliance on China, especially in areas like mineral refining, component manufacture, and finished battery production.

A 2022 U.S. Department of Defense report emphasized that China holds a commanding position in the global advanced battery supply chain, controlling the majority of production for key materials and components such as lithium hydroxide (94%), battery cells (76%), electrolytes (76%), lithium carbonate (70%), anodes (65%), and cathodes (53%).

The U.S., by contrast, remains heavily dependent on imports for many critical minerals and battery components. At the time, it had no refining capacity for nickel or cobalt, very limited lithium refining, and produced less than 10% of battery subcomponents. UN trade data further shows that about 80% of the value of U.S. battery imports in 2022 came from China, while the U.S. also relied entirely on imports for natural graphite, with one-third sourced directly from China.

Even with projected growth in domestic production, industry estimates suggest that by 2030, North American output of cathodes and anodes would still cover only 4% and 3% of domestic demand, respectively.

How Battery Dependence Poses National Security Risks?

In his paper, Joshua Busby explained that the Biden administration treated U.S. reliance on China for batteries and critical minerals as a pressing national security issue. In 2021, Executive Order 14017 launched a 100-day review of supply chain vulnerabilities, underscoring concerns that China’s dominance threatened both U.S. industry and defense.

The security rationale rested on two dimensions: broadly, batteries and energy storage were expected to shape future global wealth and military strength, and allowing China to maintain control could erode U.S. competitiveness; more narrowly, there was concern that China could deliberately restrict battery exports during political tensions or conflict, echoing Russia’s use of energy as leverage against Europe.

China’s past actions, such as withholding rare earths from Japan in 2010 and signaling restrictions on gallium and germanium, reinforced fears that it might weaponize supply chains.

Although some analysts argued that short-term impacts would have been limited—slowing clean energy adoption without triggering immediate energy crises—the risks were expected to intensify as batteries became indispensable to both civilian infrastructure and military operations.

The Department of Defense stressed that batteries already powered everything from radios and drones to missile defense systems and electric military vehicles, meaning any disruption could have undermined readiness and capability.

U.S. Early Steps to Break China’s Battery Supply Chain Chokehold

The United States has taken several strategic steps to reduce its dependence on Chinese battery supply chains, driven by concerns over national security, economic resilience, and technological sovereignty.

Policies that Hit Chinese Battery Supply Chains

One of the most prominent legislative efforts is the Decoupling from Foreign Adversarial Battery Dependence Act, which aims to prohibit the Department of Homeland Security from purchasing batteries from Chinese companies linked to the Chinese government or military. This includes major players like CATL and BYD.

The bill, which has passed the House and is under Senate review, is set to take effect in October 2027. It reflects growing bipartisan concern over cybersecurity risks and supply chain vulnerabilities tied to Chinese battery manufacturers.

In addition, the Inflation Reduction Act (IRA) has introduced strict sourcing requirements for electric vehicle (EV) tax credits. To qualify, a significant portion of battery components must come from North America or U.S. free-trade partners. These rules are designed to incentivize domestic production and reduce Chinese involvement in the EV supply chain.

However, some industry experts argue that the regulations may be overly restrictive, potentially slowing EV adoption and complicating the transition to alternative suppliers.

Another key measure is the designation of Chinese firms as Prohibited Foreign Entities (PFEs) under Section 45X of the U.S. Tax and Spending Law. This prevents these companies from accessing advanced manufacturing production credits, even through indirect investments or licensing agreements.

The move is intended to block Chinese firms from benefiting from U.S. subsidies and to encourage the development of independent supply chains.

The US Needs Domestic Battery Supply Chains

The U.S. has launched a multi-pronged strategy to build a domestic battery supply chain, aiming to reduce reliance on China and secure its energy future.

One major initiative is the Li-Bridge project, a public-private alliance led by the U.S. Department of Energy (DOE) to develop a robust lithium battery supply chain in North America. Li-Bridge has outlined 26 specific actions across five key objectives: improving investment attractiveness, supporting R&D and commercialization, securing access to critical minerals, closing workforce gaps, and establishing long-term public-private collaboration.

The DOE has also committed $36 million to 13 projects under its ARPA-E “CIRCULAR” program. These projects focus on creating a circular battery economy by extending battery life, enabling repair and reuse, and developing advanced recycling technologies.

For example, OnTo Technology is working on battery rejuvenation techniques, while Purdue University is developing software to evaluate the economic and environmental performance of circular battery technologies.

In parallel, the private sector has pledged over $100 billion to build a fully domestic battery supply chain. This includes investments in more than 170 new or expanded facilities across mining, processing, and battery assembly. The goal is to meet 100% of domestic energy storage demand by 2030.

This initiative is expected to create over 300,000 jobs and significantly reduce U.S. dependence on Chinese imports, which currently account for nearly 70% of lithium-ion battery imports.

Federal legislation like the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law has been instrumental in driving this transformation. These laws provide tax credits, grants, and incentives for domestic battery production and EV adoption. Section 45X of the IRA, for instance, offers a $35/kWh production credit for U.S.-made battery cells, helping offset higher domestic production costs.

Automakers are also playing a central role. Companies like Tesla, Ford, GM, and Toyota are investing billions in U.S.-based gigafactories. Tesla, for example, is expanding its Nevada facility and building a lithium refinery in Texas. Ford and SK Innovation are constructing three major battery plants, while GM and LG Energy are building four Ultium battery plants across the Midwest. These projects are not only boosting capacity but also creating tens of thousands of jobs.

Working with Allied Nations

The United States has taken concrete steps to support the development of critical mineral supply chains in friendly countries.

The U.S. and Canada have deepened cooperation through the Canada-U.S. Joint Action Plan on Critical Minerals Collaboration, originally signed in 2020. Canada already supplies the U.S. with essential metals and has significant reserves of critical minerals like gallium, niobium, rare earth elements, cobalt, and tungsten.

These are vital for defense technologies and have few substitutes. The U.S. sees Canada as a reliable partner to scale up exploration, extraction, processing, and recycling of these minerals.

Chile and Argentina are central to the global lithium supply, especially within the Lithium Triangle. The U.S. has increased diplomatic and economic engagement to secure access to these resources. Under President Javier Milei, Argentina has pivoted toward U.S. partnerships, including lithium deals and defense cooperation. Chile, while heavily invested by China, is under growing U.S. pressure to diversify its lithium supply chain away from Chinese processing.

Brazil holds 90% of the world’s niobium reserves and is self-sufficient in uranium—both critical for aerospace and defense. The U.S. supports Brazil’s defense industry through partnerships with firms like Embraer and is encouraging Brazil to “de-risk” its rare earth supply chains from China. However, Brazil maintains a semi-aligned stance, balancing relationships with both the U.S. and China.

The U.S. is also exploring trilateral partnerships with Japan and Latin American countries. These aim to create integrated supply chains where Latin America provides raw and processed minerals, Japan handles battery manufacturing, and the U.S. leads in EV production. Public-private partnerships and development agencies like USAID and JICA are being mobilized to support sustainable mining practices, labor protections, and local industrial development.