Ways Your Small Business Can Start Accepting Credit Cards

American consumers love using plastic to shop, with 80% listing debit and credit cards as their preferred methods of payment. If your business isn’t set up to accept plastic, you’re missing out on a lot of sales potential.

- There are more than 40 billion credit card transactions in the U.S. annually.

- This translates to roughly $3.8 trillion in transactional volume each year.

To ensure you enjoy your slice of this multitrillion-dollar pie, it is critical to set up your payment environment for credit card acceptance. However, there are several steps required to get started. Some of those steps vary depending on how you choose to interface with customers — whether it’s:

- In-store (e.g., brick-and-mortar retail shops)

- On the go — using mobile payment processing

- Online — through an e-commerce store

This article explores some of the most important considerations you should weigh before bringing credit card acceptance into your business.

Getting Started (for all business types)

All businesses interested in accepting credit cards must decide how they will accept payments. Each of the options below has pros and cons. You need to choose the most appropriate channel for your business.

#1. Third-Party Marketplaces

Accepting credit cards through third-party vendors such as PayPal may be the simplest approach. For this convenience, you often pay higher fees. You also give up some control over your payment environment, since all transactions are managed within the marketplace.

#2. Merchant Account + Bank

This approach requires the most setup, since you must configure almost everything in-house. The upside is that you enjoy greater control over your payment environment. The downside is that you’re also more responsible for fraud management.

#3. Credit Card Processing Service

Working with a credit card processor is the most popular approach because it offers the best of all worlds:

- Getting started is relatively easy.

- Fraud protection is usually included.

- You enjoy greater flexibility and control.

Regardless of the approach used, there are some non-negotiable items to expect from every payment processing solution you explore.

For example, PCI compliance is a mandatory requirement for any organization that captures, stores, or processes card payments. Whatever payment processing options you consider, data security should be a priority.

Payment integration is another important consideration. The solution you choose should work seamlessly with the software and hardware tools you’re already using to run your business. With payment integration enabled, for example, all incoming sales will automatically be reflected in your accounting program — without you having to manually input these transactions.

Now, let’s explore channel-specific considerations that change depending on how you choose to interface with customers.

In-Store Credit Card Acceptance

When selling to customers at your brick-and-mortar store, you need hardware to physically capture credit card data. In the past, this meant using credit card terminals that allowed you to “swipe” plastic at the checkout counter. These legacy readers also traditionally came with printers for generating paper receipts.

Newer credit card readers rely on EMV chip technology. Using these more secure terminals allows you to reduce in-store fraudulent transactions and avoid paying punitive fines if fraud does occur. Many EMV card readers also come with Near Field Communication (NFC) technology. Now your customers can swipe, dip, or tap to make a payment during checkout.

In addition to processing payments, some in-store POS solutions also come with software to help with other business operations like accounting, inventory management, and employee scheduling. Consider investing in an all-in-one solution that can streamline your business and allow you to focus your time on more important tasks.

Mobile Credit Card Acceptance

Mobile payment processing allows you to accept plastic using:

- Smartphones and tablets, which are devices you likely already have.

- A small credit card reader that pairs with your smartphone or tablet via Bluetooth. Some mobile payment processing solutions also rely on NFC technology so that you can process contactless payments, like Apple Pay™ or Google Pay™, made via mobile wallets or wearable tech.

When used correctly, mobile payment processing allows you to accept credit cards on the go — as your sales teams travel into the field for appointments, events, and trade shows.

Many brick-and-mortar businesses also use mobile payment processing for in-store sales. Doing so allows them to shorten lines and service more customers per each hour.

Online Credit Card Acceptance

When selling online, you typically need a shopping cart that integrates with a payment gateway, which is the virtual equivalent of a POS card reader. However, e-commerce businesses often pay higher fees when processing card-not-present (CNP) transactions. Remember that you’re selling primarily to anonymous customers scattered around the globe. As such, e-commerce payments carry higher risks.

Worse still, those risks are on the rise, with experts predicting that losses from digital CNP fraud could reach $130 billion globally over the next five years.

Part of this growth stems from the fact that chip-enabled EMV credit cards have made it harder for thieves to rack up unauthorized purchases in person. Thus, these criminals are increasingly turning their attention to the online world, where EMV cards offer the same basic protections as non-chipped plastic.

This explains why PCI compliance rules are more stringent for online merchants. For example, you may have to invest in a Secure Sockets Layer (SSL) certificate to turn the “http” of your store’s URL into an “https.”

A safer (and often less expensive) approach is to use a hosted payment form instead of a traditional shopping cart. These hosted payment forms may be branded to look like your site, but all of the credit card details supplied during checkout are captured and hosted by your payment provider on its server.

This approach helps reduce your PCI scope. No credit card data is ever captured, processed, or stored within your payment environment.

What’s Next?

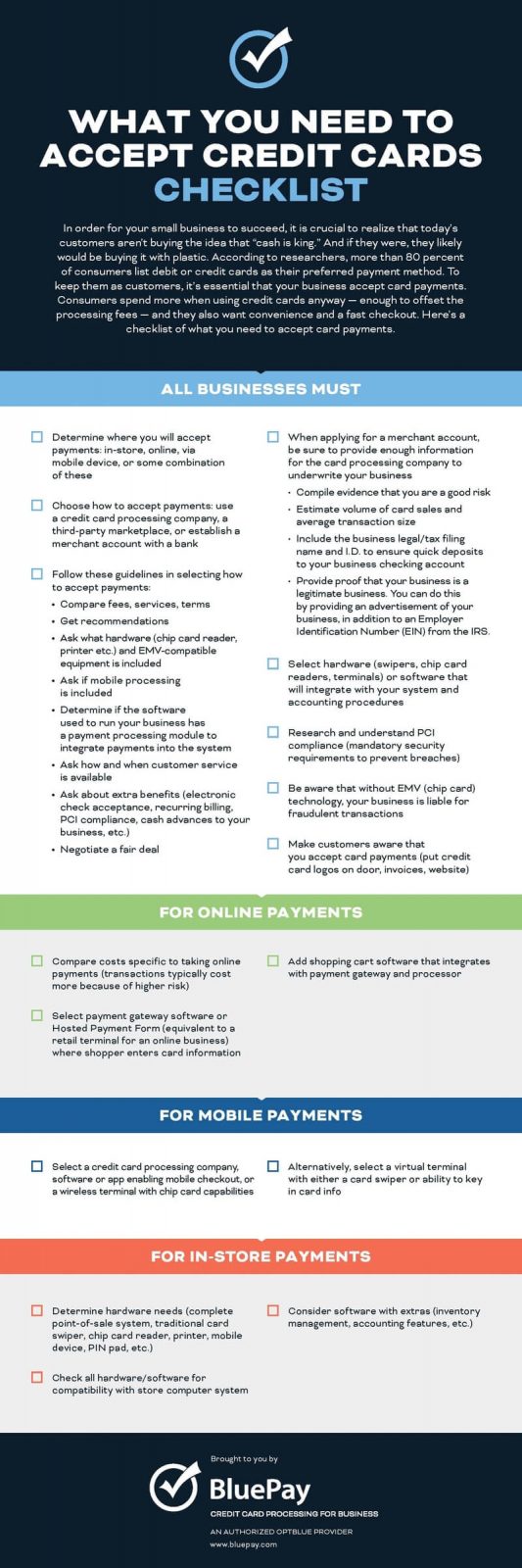

You now understand the broad strokes of credit card acceptance. If you have specific questions about getting started, the free accompanying checklist goes into much greater detail.

Get a copy here

However, there is one more consideration that should factor into your decision-making process.

When shopping for credit card acceptance options, you should always choose a solution that can grow with your business. You might be a brick-and-mortar merchant today, though if you decide to add an online store at some point in the future, whatever payment provider you choose should be able to accommodate this expansion. Otherwise, you may have to migrate all of your data to a new platform and start from scratch.

It’ll save you time and money to get it right the first time. Choose a solution that is flexible enough to meet your payment needs today, tomorrow, and many years into the future.

About author: Kristen works as a Chief Marketing Officer at BluePay, a leading provider of fast, easy and secure credit card processing for small business. She brings more than 25 years of experience in the bankcard industry in direct sales, sales management, and marketing.