The Spectacular Rise of Public Storage: Giant Success Started Small!

Should there comes a time when you stash your extra stuff into a storage unit, high chances are that you’ve driven past one of the thousands of Public Storage facilities.

So, what is Public Storage? Operating as a real estate investment trust (REIT), Public Storage is among the top 10 world’s largest public real estate companies by 2020. Not only are they the largest self-storage provider in the U.S., but Public Storage is also the biggest self-storage operator in the world – in fact, it is so huge that it’s often mistakenly used as a generonym to describe self-storage facility, catching all its descriptor in general.

Beyond any doubt, the real estate investment trust is merged as one of the greatest success stories in American business, and with its signature orange signs dotting highways coast to coast, there is little likelihood that you haven’t come across one of their locations. Yet, how did the story of Public Storage start? Where has Public Storage recently been positioned at? And what has been the key drivers shaping the striking success of such a real estate behemoth? Let’s read on to explore!

Public Storage’s Story: Giant Success Started Small

It can sometimes seem that such businesses as Public Storage, with more than 2,200 locations, have always been giants. Yet, that is never true! Quite similar to some other striking success stories, Public Storage started small – very small.

Its company history is the story of two smart, hard-working men – B. Wayne Hughes and Kenneth Volk Jr. – who decided that they liked working together and harbored an idea in the 1970s to invest in a new industry. Indeed, each man ponied up only $25,000 in seed money to grow what today is among the most prosperous companies in the world. This was exactly all of what took these two very special people to start Public Storage down this road.

“I met the neatest guy, the best young deal-closer I ever met,” Ken Volk shared about Wayne Hughes, through Ken’s wife’s recount. “He told me I was one of the smartest guys he ever met, and I told him I thought, next to me, you’re the smartest guy I ever met and we should partner up on something.”

The business concept started out when Ken discovered a small storage facility in Houston, Texas. Stopping in to investigate and discovering the units were sold-out with a waiting list, he saw their opportunity. Then, the first Public Storage location was built in El Cajon, California in 1972 with a fiesta complete with mariachis and bright orange doors to catch the attention of potential customers driving by on the nearby highway. Initially, these founders planned to build the storage warehouses as a temporary source of income until the land became more valuable and could be redeveloped for another use.

Its first customer was a distributor for STP Motor Oil, who needed a place to stash the cans that were in his driveway that “had to be gone” at his wife’s insistence. Then, within three months, the first location was breaking even with a 35 percent occupancy. Whereas the units were rented for a similar price per square foot as apartments or office space, they cost 35 to 50% less to build and maintain. A property management subsidiary called Public Storage Management was formed in 1973. By 1974, 20 locations had been built.

Growing steadily after that, Public Storage was added to the Standard & Poor’s 500 Index by 2005. Thanks to the spark of an idea and the forethought of two guys who liked working together, what began in 1972 as a partnership is now a publicly-traded S&P 500 business, being the world’s largest owner/operator of self-storage facilities and being an employer of more than 5,000 employees all over the world.

“As long as there’s activity, we’ll do fine. People move, businesses start, businesses fail, people get married, divorced, kids go to college, people die. These activities make us necessary,” said Public Storage Former CEO Ron Havner. “Is there new technology that can shrink people’s stuff? … Even if you can, we’ll still have the best real estate. Wayne made sure of that right from the start.”

At present, Public Storage operates under four segments, including Self-Storage operations, Ancillary Operations, Investment in PS Business Parks (PSB), and Investment in Shurgard, among which the first and the second stand as the principal ones.

- Consisting of the nearly 2,483 total units it owns across the US, the Self-Storage segment accounts for almost 95% of revenue. The self-storage business rents storage units mostly on a monthly basis to individual and business customers. Whilst individual customers will typically store furniture, household, and personal belongings, and vehicles, businesses often store excess inventory, records, seasonal goods, and equipment and fixtures.

- Accounting for over 5% of sales, the Ancillary segment re-insures policies against losses to goods stored by customers in the company’s self-storage facilities, and sells merchandise, such as locks and boxes.

- By the end of 2019, Public Storage owned approximately 42% of PS Business Parks and 35% of Shurgard

Public Storage’s Recent Performance

When it comes to this El Cajon-based REIT’s recent performance, according to its 2019 annual report, Public Storage’s businesses delivered solid results and achieved record revenues and net operating income (“NOI”). Given a challenging operating environment, the combined revenues of these given businesses did grow by roughly $122 million, to a record $3.6 billion, and their NOI increased to a record $2.5 billion in 2019.

Successfully maintaining Public Storage’s financial flexibility as well as improving its cost of capital, Tom Boyle, the company’s CFO, performed an excellent job in the capital markets in 2019 and the first two months of 2020.

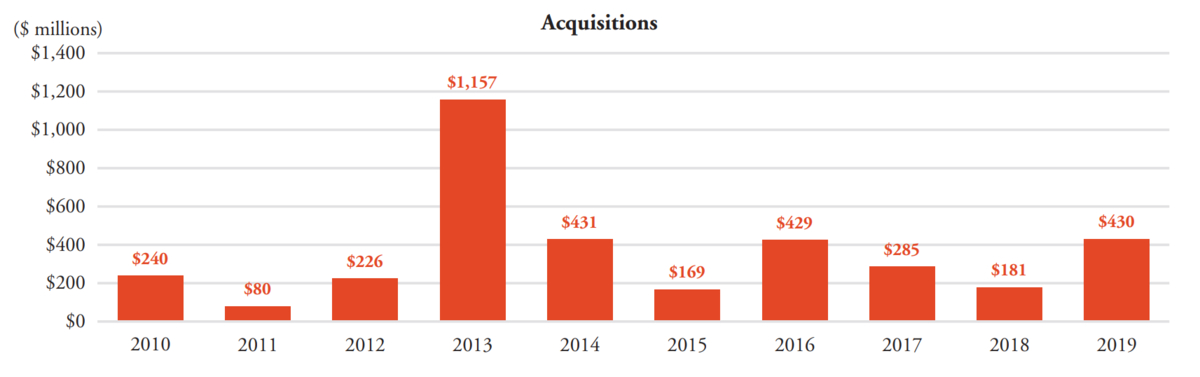

Besides, Public Storage’s property expansion efforts are also a highlight within the year of 2019. Whereas the acquisition environment in the U.S. is much more robust than Europe, it is extremely competitive. Despite the abundance of capital seeking self-storage investments, Mike McGowan, Senior Vice President of Acquisitions at Public Storage, and his team did an exceptional job, acquiring staggeringly $430 million of properties.

One key reason behind such accelerated acquisition volume is the challenging operating environment owning to a significant amount of newly developed properties coming online. Given that its organic growth still remains challenging due to a vast amount of new supply in many markets, the good news is that the volume of new development has “peaked,” which bodes well for longer-term rent and occupancy growth.

Given that, 2020 seems to be not a straightforward year for Public Storage – actually, it’s a tough year for almost every single business.

“As Public Storage approaches its 50th year, we have clearly weathered significant economic cycles, and this one will likely rank as one of the most extreme,” stated CEO Joe Russell during the company’s earnings conference call with analysts.

In face of the unprecedented headwinds, Russell strongly maintained that the REIT behemoth was well prepared to navigate away from such a turmoil. “Our teams are battle tested, our product is resilient, and we have intentionally crafted a fortress balance sheet to not only survive, but thrive in times like these,” Russell firmly believed.

Given that, Public Storage undoubtedly did suffer pandemic pain. The executive board stated that they expect same-store revenue in the second half of 2020 to drop even further than it did in the second quarter — 3% versus the same period last year.

As regards the second-quarter revenue decline, it is supposedly attributable toa 2% decrease in realized rent per square foot and a 31.8% plunge in late fees and administrative charges. Whilst late charges and administrative fees represent just 4% of revenue, they contributed to nearly half of the revenue decline in the quarter that ended June 30. Besides, the charges and fees dipped since there were fewer move-ins, stepped-up fee concessions as well as accelerated rent collections.

Although the second-half outlook seems to be uncertain – and, to a certain extent – dim, there exist certain positive signs that promise to improve demand for storage. So, what are they? Such optimistic trends include a jump in year-over-year occupancy, a moderation in rental rate decreases for move-ins, together with the continued low rates for move-outs.

On a positive note, the Public Storage’s CEO confirmed that Public Storage has restarted its lien auctions and has reinstituted rent increases following a pandemic-triggered hiatus.

When it comes to this El Cajon-based REIT’s acquisition initiatives, given that the company struggled with pandemic-related headwinds in the second quarter, it notably proceeded with six acquisitions totaling $67.1 million. Furthermore, after the quarter ended, Public Storage bought or was under contract to buy five facilities for approximately $33.3 million.

Looking forward, Joe Russell said Public Storage is “shopping” for value-added acquisitions – typically non-stabilized facilities or properties that round out its presence in certain markets. Additionally, the REIT’s acquisition team also is considering undeveloped land, which is in various stages of entitlement.

Public Storage’s Success: What Are the Strategic Drivers Behind?

Whilst there exists a myriad of factors attributable toits meteoric rise, four outstanding drivers have performed strategically critical roles in shapingpublic storage’s striking success.

#1. Its Winning Culture

A crucial “quality” of Public Storage that may be more elusive to view from the outside is its culture, which has oriented great focus on integrity, accountability, entrepreneurialism, employee development and diversity. The intended and achieved result is also a culture aspect that is well-aligned with its strategies to promote long-term value creation while wisely managing risk.

The Public Storage culture begins with one core value of integrity. Characterized by two of its most prominent mottos– “do the right thing” and “tell it like it is”, integrity is well indicated in Public Storage’s efforts of seeking, hiring, retaining great people as well as promoting adherence to ethical behavior in everything they do.

Furthermore, their long-held practice of hiring “the best” has led to an extremely diverse and inclusive workforce, with the majority of female and majority people of color.

#2. Non-Stop Expansion Efforts Through Acquisitions, Third-Party Management, And Development

There goes without saying that Public Storage remains the largest owner, operator, and developer of self-storage properties all over the world. With nearly 2,500 properties consisting of around 169 million square feet located across 38 states, there are significant benefits of scale in its business, which includes revenue, operating, and overhead expense efficiencies. In fact, the REIT does own more self-storage square footage than its next three largest competitors combined. Public Storage’s scale, coupled with its technologies, operating platform, and brand, afford outstanding advantages that result in superior operating margins and cash flow generation.

To obtain a much crystal-clear insight into it, let’s take a look over Public Storage’s expansion efforts in 2019 when the company grew its footprint by 76 properties. Over the last year, it was a prevalent “trend” that many developers who wished to “get in” a few years ago are now eager to “get out.” Some have performed well yet simply acknowledge that their operating ability can’t take their properties any further, whilst many others have undergone tough experiences, given the nuances of self-storage development and operations. Nonetheless, the tougher environment is also revealing the importance and competitive advantages of sophisticated revenue tools and brand. In fact, such a dislocation has granted golden opportunities for Public Storage through acquisitions and third-party management.

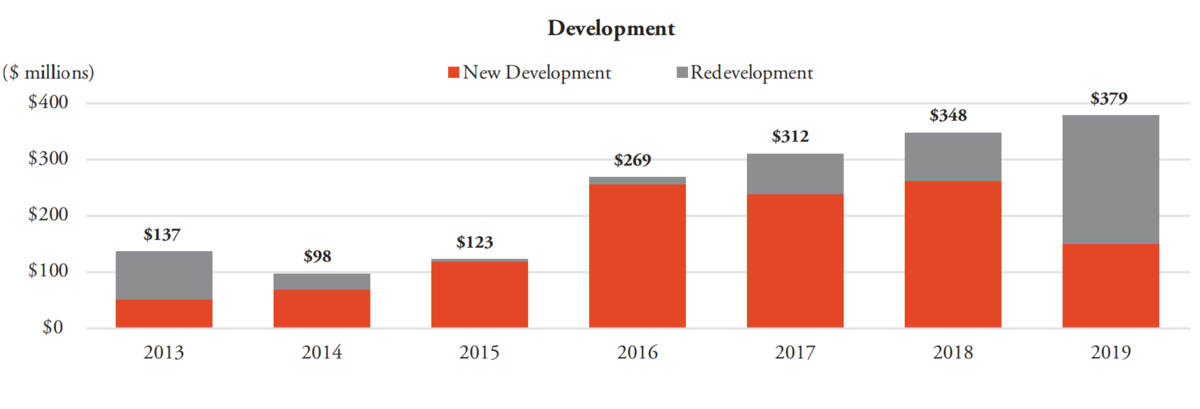

What’s more, Public Storage is – for the time being – the only one owning its in-house, nationwide development program in the industry, which is an overwhelming competitive advantage. Since 2013, the company has invested more than $1 billion into new property development at an average cost of approximately $120 per square foot – as well as another $500 million on redevelopment and expansion of existing properties. Establishing directly does allow them to develop properties at costs well below the inflated values at which most stabilized and newly built, unoccupied properties are trading in the marketplace, which is dilutive to short-term earnings yet brings about huge value over the long-term.

Actually, “we continue to find new development and redevelopment opportunity,” said Russell in the company 2019 annual report. Entering 2020, its pipeline consists of 4.4 million square feet at a total cost of $619 million, approximately 70% of which is the redevelopment of its existing properties. In the meanwhile, the company teams have been actively seeking additional development sites and analyzing the next phases of redevelopment within Public Storage’s nearly 2,500 property portfolios across the country.

#3. Property of Tomorrow

In parallel with Public Storage’s efforts to grow the company’s platform, its teams do invest in retooling existing assets with more focused capital investment.

To do it, the company had innovated its approach to facility maintenance of existing assets by employing strategies that leverage the company’s competitive advantages so as to further optimize its property operations. The adopted innovative approach does include a continued trend towards initiatives that make both environmental and economic sense, consisting of LED lighting, solar panels, low water-use landscaping, and a new centralized property access system that we developed with a technology partner.

Lead by John Sambuco, the President of Asset Management, the Property of Tomorrow program is among its key initiatives which they began rolling out to major markets nationally in 2018. To put it simply, this is a comprehensive rebranding of prior generation properties across the portfolio as Public Storage update older assets with components of new “Generation Five” developments.

Through 2019, they have implemented Property of Tomorrow at 290 properties across major markets including Los Angeles, San Francisco, New York, Miami, and Chicago. This initiative has generated a great deal of public attention, with the prominent use of the color orange, new signage, landscaping, and interior upgrades with LED lighting and offices that cater to better customer service.

#4. The Public Storage Brand

Beyond any doubt, Public Storage has one thing that no other self-storage operator in the U.S. has – a national brand. Not only do they stand alone within the industry, but their brand has also been one of the most recognizable in the country. When combined with the company’s unmatched scale, the benefits are powerful as is evident in its leading operating margin and free cash flow generation.

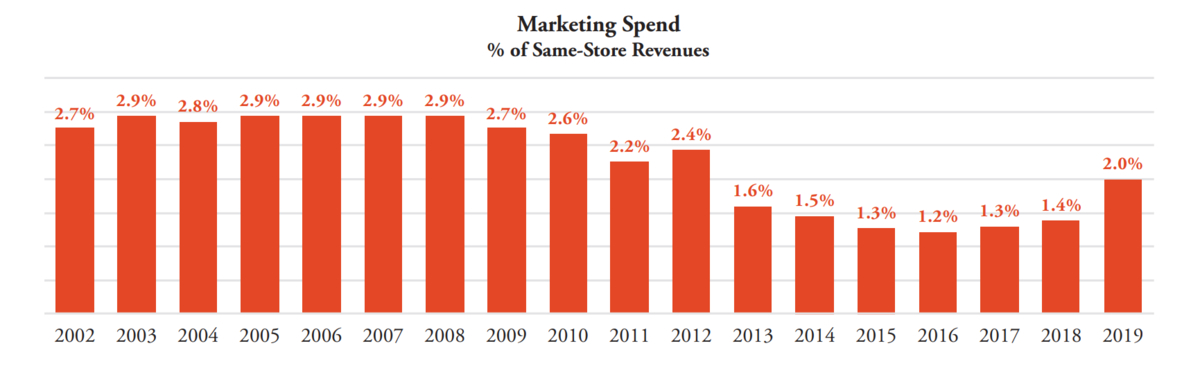

A more recent and particularly relevant advantage to its commanding brand comes with the unmatched ability to market to customers online, which is also the path the majority of people now find it. There comes a time when “Public Storage” ranks as a top-five search term within the industry. Continuously, they strive in enhancing their brand recognition not only through online but also offline channels, which include the new website and customer-centric initiatives. To be precise, Public Storage did increase its marketing expenditure remarkably in 2019 (up 47% year-over-year, to be more specific) in order to drive large move-in volume. The success of this strategy is reflected most clearly in the 40-basis point same-store occupancy increase to 93.5%, which runs counter to stabilized occupancies generally being flat to down across the sector.

The Bottom Lines

Emerged as the commanding force within the self-storage landscape, Public Storage has been intentionally crafted to deliver solid and sustainable growth, even in the face of such unprecedented events such as the “black swan” coronavirus epidemic. Its spectacular success has come through some key strategic pillars that promote the business’s long-term resilience of our properties and our company. Maintaining a high-integrity culture while continually growing scale, strengthening the dominant brand, and innovating their platform, Public Storage teams have gone a long way in its journey towards the self-storage throne.