The Rise of Stripe and How It Sells to Developers

The rise of e-commerce has outpaced the underlying payment infrastructure for years: enterprises looking to open a store had to go to a bank that handles payments and set up a portal to connect the two. It takes tons of hours, people, and fee after fee. Most of the tech in place was decades old and was written by banks, credit card firms and financial intermediaries.

Recognizing the difficulties in online paying methods, Stripe was launched to simplify this process.

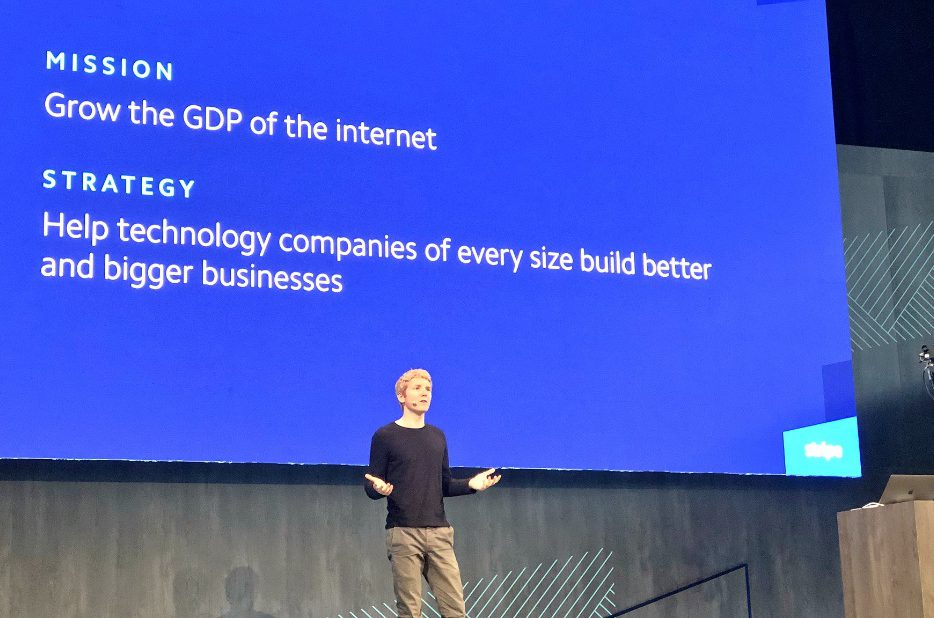

Stripe always believed the businesses are built with a core need of solving a fundamental problem and not to deal with the complexity of the financial system. “We believe that payments are a problem rooted in code, not finance.” Anything that didn’t get the founder jumping out of his bed each morning had to be taken out of the founder’s plate and stripe would take care from a tech standpoint.

Stripe – The Secret Behind a $70B Valuation Startup

Before delving into the story behind Stripe, it’s critical to take a brief look into the fundamental understanding of this business.

Stripe was founded in 2010 by Irish entrepreneur brothers John Collison & Patrick Collison and was based in San Francisco, California. After raising a $2 million investment from venture capitalists Peter Thiel, Sequoia Capital and Andreessen Horowitz, it was released publicly in September 2011.

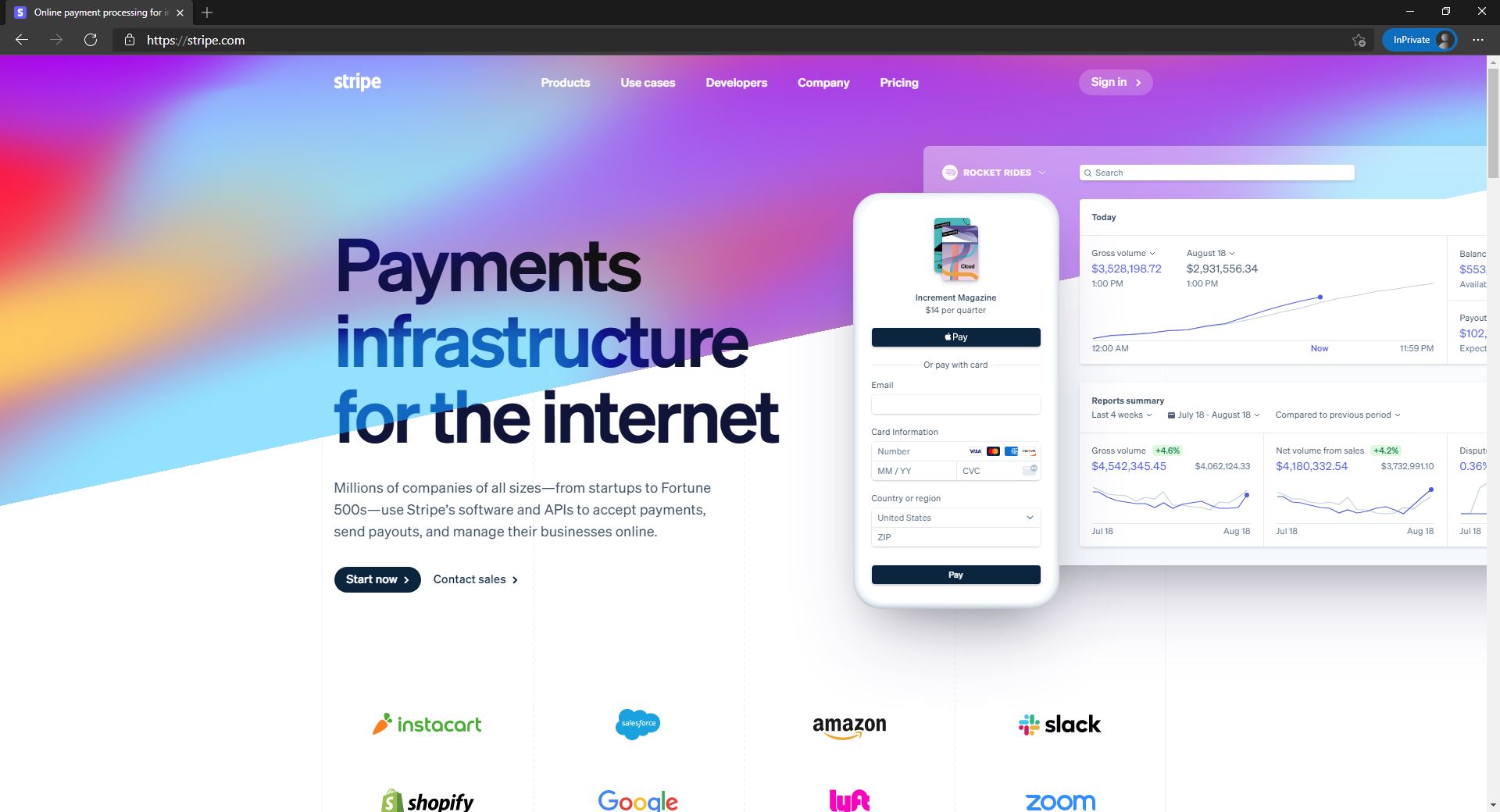

Its goal simply as making it “easy for developers to accept credit cards on the web.” But, more than this, it helps developers manage online payments has expanded beyond sales to solve a much more critical issue for entrepreneurs: setting up an online store.

Stripe is a merchant payment processor and payment gateway all in one. In simple terms, it allows your business to process credit and debit cards, as well as automated clearing house (ACH) transactions, both online and offline. It is highly recommended because they do not have monthly fees or a set-up fee; only a 2.99% + 30 cent transaction fee, which is standard and comparable to PayPal. The difference between Stripe and PayPal is you can take credit cards directly versus having your customers redirected to PayPal’s website to make payment, which can be a turn off for some prospective customers. Stripe can be integrated with almost all major e-commerce platforms including WooCommerce, WP-eCommerce, Shopify, Magento, ZenCart, etc. as well as WHMCS and Curdbee. – Ryan Huang is the CEO of PR Distribution.

Although it was important to have a standout operation, there were other reasons explaining Stripe’s performance. Bear in mind that the business followed a sales strategy that was obsessive about the customer’s needs.

“Stripe caught on because it didn’t sell to companies,” said Dmytro Okunyev, who is the founder of Chanty. “It sold to developers. That is, Stripe offered an alternative to PayPal and Authorize that was so much easier to implement that developers around the world were naturally inclined to use it.”

Since 2020, Stripe has powered the transactions of some of the biggest brands out there, including Lyft, Under Armour, Blue Apron, and Pinterest. The company reports that at some point, 89 percent of all credit cards were processed on a Stripe network. It’s a common solution for businesses that do business globally with the ability to manage 135 currencies.

How Stripe Sets Itself Apart

Stripe combines gateway functionality and payment processing, making it a convenient (if not necessarily the cheapest) way to handle eCommerce. Now let’s look at how Stripe makes it happen.

3 Steps the Two-Brothers Sell to Developers

Step 1: (Really) Know Your Audience

How will enterprises appeal to them if conventional sales methods don’t work for developer audiences? It is found that a key part of the sales process is the product experience. The easiest way to show them value is to get them to use and explore the product if a developer is trying to fix a particular issue.

The user experience for firms wishing to accept payments online will also entail challenging onboarding, dynamic integrations, and difficulties around embracing various payment options, despite competing strategies by PayPal and others.

First-hand understanding with its value is the one thing that can persuade a developer to buy your offering. Your job is to make it as convenient for them to obtain this experience as possible. Developers want a reliable product, good documentation, signed up for frictionless self-service and the opportunity to innovate without devotion.

“We wanted it to be extremely simple to integrate. You should be able to start charging credit cards at once. There shouldn’t be any latency. You shouldn’t have to talk to anybody. The information you have to give shouldn’t be pages long… Google Checkout and PayPal are these confusing things, and we wondered why they hadn’t solved these issues.” — Patrick Collison.

Step 2: Hire the Right People

You need salespeople who have proper technological skills to win their confidence to work effectively with the discerning developer community.

They don’t need to be able to code, but they need to grasp the API’s logic and features thoroughly and be able to convert the understanding into effective solutions for each prospect, depending on what the client is trying to carry out.

MacCaw claims: “Hiring well is the key to all of this, and people are the foundation of any company’s culture… When you hire great people, you can afford to give them a lot of autonomy.”

Over the years, the profile of individuals Stripe recruit for sales has grown. It started with a generalist profile, a popular strategy for younger businesses that are still assessing product-market fit and identifying the demographic of the consumer. For the most part, this early team consisted of individuals who had some technical ability, but not necessarily a lot of hands-on sales experience, in product or consulting. A common mistake made by startups is to employ a salesperson who is too professional as their first sales hire. As early sales are about defining and refining product-market match rather than closing as many deals as possible, this profile sometimes fails.

The sales process became more sophisticated and segmented as the business evolved and more insights were gained in the market. Now, the salesperson profile was refined to focus on those who not only have lots of sales experience, but also have a specific type of experience. It is important to find people who are familiar with marketing to a technical audience, know how to market a more complex product, and are comfortable with an advisory sales approach. On the one hand, it is also crucial to think of analogous products to yours and find individuals who have marketed those products successfully. There might not be instantly clear or items that are close to yours.

The people who can work successfully in a product-led organization with a strong engineering focus, and with strong opinions about what products should and shouldn’t do, are necessarily pivotal. The gap between the front lines and our own developer team needs to be bridged, but in an unbiased manner.

Step 3: Structure Your Organization Carefully

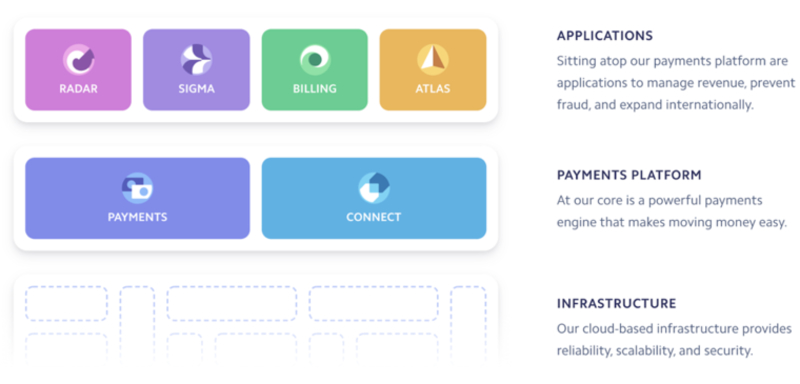

Many SaaS (Software as a Service) entrepreneurs struggle, when faced with the question of whether to go large or deep on their product deals before 2013. At Stripe, by taking an API-led, platform approach, developers have been able to circumvent the challenge. On top of Stripe’s cloud-based network, the main payments software (Payments and Connect) lies, and their suite of sales processing, fraud reduction and foreign expansion technologies rest on top of that platform.

Platform Structure

Radar, Sigma, Billing and Atlas, all the Stripe add-on products, are anchored to our central payment network. You will use none of the software autonomously. Instead, each is incremental to the total experience of Stripe.

This makes it easier to scale since you can sell to your existing customers. Moreover, customers can find it more straightforward because each element is pre-integrated, so the implementation takes less effort.

This model helps customers to do more without much incremental work resulting in a lot of product stickiness.

Collaboration is Critical

The way you sell, particularly when it comes to dealing with developers, is as critical as what you sell. You may have an innovative product, but they would certainly not take the first step to play with it if you are unable to attract the imagination of your audience. You need to match how your buyers want to shop, with how your sales force sells, to excel. This involves taking a collective, product-led approach if you’re marketing to developers, which leaves much of the more conventional sales methods behind.

It’s no small endeavor to create the right kind of sales organization, but it doesn’t need to be as complex as you would imagine. Start by taking the time to develop a deep understanding of the clients, who they are, what they need, and the kind of sales experience that will really help them meet their goals and then over-deliver on their desires. Invest in recruiting the best candidates to provide this, then. The face of your business is these persons. Day in and day out, they are on the front line, and their engagement with and loyalty to your clients will make or break your company’s trajectory. Pick carefully.

Often be proactive alongside your products on how you organize and grow your distribution organization. Look ahead enough that on either front, you don’t paint yourself in a corner and keep ample versatility. Be sure you stay aware and well encouraged by the sales staff so that they can grow as your product does.

4 Key Lessons All Companies Can Learn from Stripe’s Story

#1 – Solve a Real Problem

The hardest part of starting an online business wasn’t coming up with an idea, coding that idea into reality, or marketing that idea to potential customers. As John explained in an interview with Wired, “The hardest part was finding a way to accept customers’ money.”

At the time, PayPal was the predominant choice that allowed businesses to accept payments without having to create their own stack. But it was similarly difficult to connect with PayPal and it was achieved in a manner that allowed corporations to bring their clients to the PayPal platform where transfers were completed.

PayPal also seemed overly clunky and complicated for the Collisons, and it came with so many rules and setup costs. There was also no alternative on the market for developers who wanted to get payments up and running on a website fast and conveniently. At a time when every other aspect of starting an online business had become easier, accepting payments remained complicated.

Stripe stepped in to tackle this issue with a vision. They concentrated on going after developers, the largest community of persons interested with payment incorporation. They realized they wanted to have a super effortless way to do that, enabling developers to collect payments in as few code lines as possible.

#2 – Obsess Over Customer Experience.

It’s easy to see how Stripe’s focus on customer experience increased its popularity among developers, but that’s only the half of it. In addition to reimagining the way sellers accepted payments online, Stripe also reimagined the way buyers pay for things online. Stripe isn’t just concerned about the experiences its customers have; it’s also concerned about the experiences its customers’ customers have.

Unlike its predecessor, PayPal, Stripe didn’t insert itself into the buying process. It worked behind the scenes, so buyers never have to leave a company’s checkout page or enter some third party-branded workflow to complete a transaction. When you buy something from a company via Stripe, Stripe gets out of the way and does its job in the background. This means, as a seller, you support a one-to-one connection with your buyer. It’s a seamless experience for everyone involved – no interruptions.

So, what’s Stripe’s CX secret?

Stripe is willing to learn from its customers and adapt accordingly. Take Lyft, for example. Lyft had been searching for a payment system that could both charge its customers and pay its drivers – which at the time didn’t seem to exist. But Stripe was willing to bridge that gap. As John explained to NPR, “There was no product that enabled a really good driver payment experience…And so we’ve kind of co-evolved with them to enable the best end-user experience.”

#3 – Have a Vision for The Future.

The future of any company hinges on what they do next. It’s a sentiment that Patrick echoed to NPR, saying: “It would be a very dangerous mode to slip into, to become rearward-looking…You don’t have a valuable company unless the company continues to execute.”

As Collison’s message, “It’s easy to send a packet of information anywhere in the world, but sending money isn’t so easy. It’s a question of the economic infrastructure that’s underneath the web. We personally think that’s a really important problem – you have great connectivity at the information level but not at the payments level.”

It’s the belief that businesses shouldn’t be limited by geography.

#4 – Read Books…Lots of Books.

To some, reading books might seem like an odd inclusion on this list. After all, when you’re building a company, it’s hard to measure the impact reading a book can have on revenue acceleration. But for the Collison brothers, reading has been an integral part of their operation from day one.

As kids, the Collisons found school boring but were fascinated with physics and mathematics. According to Wired, Patrick would often smuggle history and science books into his classes. As he explained, “You could try to pound your head against the wall and think of original ideas…or you can cheat by reading them in books.”

So, what’s the point of inspiring the workers to read an old book? As Patrick explained to Stanford computer science students back in 2015, “So much of this early work is better than what we have today. Sure, we have solved all kinds of scaling issues, deployments, technology – but the core problems of helping people work together were thought about more back then. Their concept of technology was the empowering of humans through technology.”

The Bottom Lines

Stripe isn’t a traditional payment processor. It developed a complex suite of tools and resources to help you sell more online without hacking multiple tools together. Regarding the financial services, the simpler digital paying process, the less clumsy work customers must deal with. The global pandemic has intensified the digital transformation phase in several fields, so the less time, money is spent on doing transactions, the more convenient for running business.