The JetBlue Effect: People Keep Being Impressed by Price and Unmatched Flying Experience

Back then, air travel was far too expensive for everyone, and the in-flight experience wasn’t worth the fare. Modern commercial airplanes now boast amenities that were unimaginable for their counterparts in the mid-1990s and early 2000s. People in the past couldn’t enjoy such ordinary things like flat beds in business class and individual screens for each passenger

That can be the reason why people at the time was so upset with what air travel brought to them. When a problem appears in an industry, anyone who holds the key to a new door will start to gain the upper hand in the game like we have been witnessing.

In the story of aviation, people craved to have a better airline to show up. Fortunately, their dreams came true as JetBlue began flying in 2000 with a mission that air travel should be accessible to the masses, not just the rich. They aimed to offer affordable fares without compromising on comfort and service.

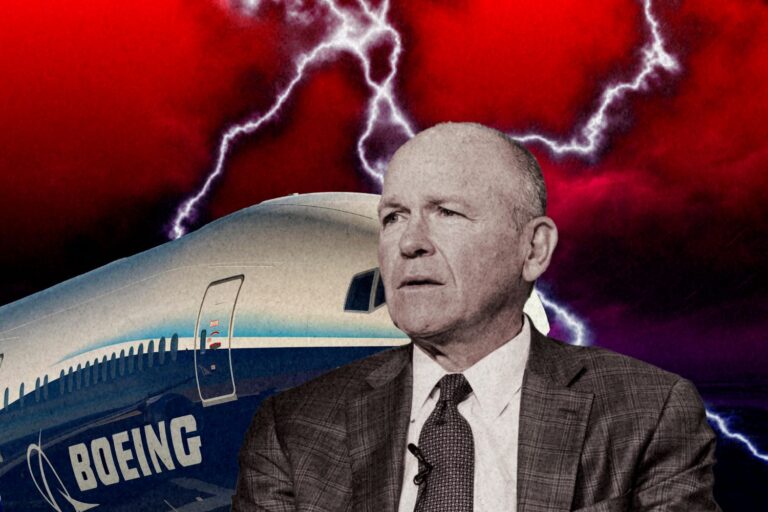

Leveraging the low cost structure, JetBlue has been keeping its presence recognizable, but there are more to it when we talk about how this carrier has created an empire so fast. As always, the captain keeps whole crew running, that’s why we need to mention David Neeleman, the founder, initial CEO of Jet Blue.

Instant Success – David Neeleman Golden Touch on Aviation Industry

In the 1980s, June Morris started a low-cost airline – Morris Air with the help of David Neeleman. The airline was operating charter flights before branching out to scheduled flights in 1992. Two years later, Morris Air was acquired by Southwest.

David Neeleman earned an estimated $20 million for that deal, and he had to sign a non-compete clause which stated that for the next 5 years, he wouldn’t work for another US carrier.

Over that time, he contributed to creating WestJet Airlines in Canada and the Open Skies reservation system in the US. Once that non-compete clause was expired, he set out to start a new journey.

At around 40 years old, David Neeleman had already an icon in the game that he gained so much trust and raised $130 million to start his new airline – JetBlue. This was more money than any other similar startup had ever received.

He used the money to hire experienced figures from rival airlines, especially John Owen, who had served as Treasurer at Southwest for 14 years. Owen was crucial because much of JetBlue’s strategy was inspired by Southwest.

With an abundant $130 million and John Owen’s secret sauce, JetBlue purchased a fleet of their A320 airplanes from Airbus, which are comparable to the Boeing 737.

That’s how JetBlue got started, it’s been more than 20 years since the carrier first flight on February 11th, 2000, which really disrupted the entire industry. To do such thing, JetBlue must hold powerful instruments to play.

The Beloved Disruptor – JetBlue’s Unique Balance

Right from the start, they operated with brand new, identical, appealing, and efficient planes, which not only reduced costs but also drew in passengers. And being a low budget carrier is a key pillar of their strong foundation.

Affordable – The Recipe to Flood Cheaper Airfares

Want low ticket fares, go to JetBlue! Averaging around $100 early on, JetBlue tickets was far more reasonable than most other carriers. To make this happen, they have to keep their costs down.

JetBlue’s cost advantage stems from its emphasis on fleet efficiency. By operating a modern and fuel-efficient fleet, JetBlue greatly diminishes its fuel consumption and associated costs. The airline strategically invests in newer aircraft models that have aerodynamics advances and fuel-saving technologies.

JetBlue bolsters its cost efficiency through fuel hedging practices. The airline actively employs hedging strategies by entering contracts to lock in fuel at set prices. Through fuel hedging, JetBlue mitigates the risks linked to unpredictable fuel price fluctuations in the market.

Additionally, JetBlue has embraced technology and innovation to propel its operational excellence. Implementing a ticketless reservation system resulted in significant cost savings on paper, postage, and processing, surpassing those of other airlines. Customers were booking their flights directly with JetBlue online, bypassing travel agents and their related commissions.

Many of JetBlue’s employees worked from home, reducing overhead costs. Not to mention their fleet of identical aircraft and operational measures, inspired by Southwest, such as flying point-to-point on numerous routes instead of using hubs, further contributed to their efficiency.

Customer Satisfaction – Bring Humanity Back to Air Travel

It’s reasonable to say that customer satisfaction is the most important element behind their success. “Bring humanity back to air travel” has always been their motto since day one.

In 2000, the air travel was turning people off. The Department of Transportation was overwhelmed with complaints on overbookings, flight delays, and mishandled baggage. In that setting, JetBlue figured out that they could stand out from the rest by offering a positive experience at an affordable price.

The Jet Blue experience at the time, which in-flight offers included leather seats, free snacks, more space, and live satellite TV – a significant feature, especially during the early 2000s.

These days, JetBlue still doubled down on installing TVs across all its aircraft while many of its rivals have drop seat back entertainment. Plus, their content is free and keeps growing. Also, JetBlue was the first domestic airline to offer free Wi-Fi to all passengers on every flight.

David Neeleman was even showing up on the flight serving snacks as a way to get intimate to the customers and listen to their feedbacks.

As expressed by David Neeleman in an interview in 2011, “What we’ve learned is that when someone has a negative experience with your company, they tell nine people on average. When they have a good experience, they tell two people on average, you so have to figure out, if you’ve had a negative experience, how do you turn them around and how do you make them a loyal customer for life? That really is not easy.”

In 2014, the airline introduced its Mint product and almost immediately, passengers was obsessed. Overtime, JetBlue Mint has been upgrading to be the carrier secret sauce, now we have three classes of Mint seats with top-notch designs and offerings.

Being Available – Strong Presence in Busy Airports

JetBlue became popular by making JFK Airport in New York their base. Unlike Southwest, which aimed to avoid busy airports like JFK or Boston to ensure quick flight turnovers, and this has created a vast opportunity for JetBlue to fill up low-cost flights demands.

JetBlue has kept operations smooth by scheduling most of their flights outside the congested hours of 3:00 to 8:00 p.m. This strategy has helped them attract millions of customers from across the area.

Efforts to Stay Relevant – JetBlue Cut Through Hardships

It’s been a while since the inception of the carrier, there are several times that JetBlue has to counter roadblocks or find any possible ways to scale up their business. One such instance is the 2007 crisis.

Media Crisis – The 2007 Valetine’s Day Bad Luck

In February of 2007, JetBlue’s operations fell apart after an ice storm hit the East Coast of the U.S., leading to 1,200 flights in the course of a week, affecting 131,000 customers.

It was a tragic confluence of unwise choices, lack of preparation, and pure bad luck. JetBlue thew an estimated $30 million out of the window. However, the worst part was the damage on their reputation.

During the downfall, the press really went for their throat. Local newspapers exaggerated claims of “hostage” situations caused by JetBlue, alleging customers were stuck on airplanes for 10 or 11 hours.

CEO David Neeleman took responsibility and never blamed the weather. He went on YouTube, the Today Show, Letterman, and Anderson Cooper, not to justify his case, but to sincerely apologize for his company’s faults. JetBlue also introduced a customer’s bill of rights, and provided a detailed list, including monetary compensation, outlining what the company would do to assist all affected passengers.

They even enlisted an external team to help identify operational weaknesses, aiming to improve and prevent such incidents from recurring. Overtime, they were able to regain the public’s trust and respect, returning to consistent profitability by 2009, even exceeding a billion dollars in profits in 2017.

By that year, they had expanded their sales to over $7 billion and reduced their debt to $1.2 billion. The subsequent year, they encountered challenges with fuel prices and hurricanes, and then, of course, the pandemic struck them in 2020.

Combat Covid with Cost Cutting Strategy

Like most airlines in 2020, JetBlue faced significant challenges due to the prolonged impact of COVID-19 on the travel industry. Simple Flying reported in late 2020 that the airline was burning through up to eight million dollars a day, experiencing a forty-five percent to fifty percent decrease in year-on-year traffic.

In the fourth quarter of 2020, JetBlue’s revenue declined by 67 percent, and the capacity of aircraft flying decreased by about 47 percent. Overall, the airline incurred a loss of more than $1.3 billion throughout the year.

However, a slew of cost-cutting strategies helped them end the year with over three billion dollars in the bank, positioning them much better than many of their competitors. The cost-cutting measures included reducing capacity, paying cuts for VPs and above and increasing cash reserves.

Robin Hayes, the former CEO of JetBlue, said that “2020 was a year like no other as the COVID-19 pandemic challenged our industry in ways we’ve never seen before. However, we meaningfully reduced our cash burn and are starting to shift our focus to rebuilding our margins. More importantly, this crisis has made us a more agile, creative, and resilient airline.”

Weak Domestic Network and the JetBlue-Spirit Deal

The reality is that JetBlue’s presence is relatively limited. Its primary dominance lies in the American northeast, with hubs in New York and Boston. Despite its efforts, the airline has faced challenges in expanding its operations from coast to coast.

According to Coby Wayne, Aviation Creator & Analyst, “On average business class takes up just 12% of a plane’s capacity, but despite that, it can generate up to 75% of an airline’s revenue. It’s no surprise then that flights between JetBlue’s home in the northeast and the U.S. west coast are some of the most lucrative on earth.”

He added, “Both regions are massive economic centers and as a result, draw a large number of high-margin business travelers. By all accounts, JetBlue’s Mint business class product has drawn rave reviews and is widely considered to be one of the best in the United States. So, you might imagine that it’s a major player in this premium transcontinental market. But it isn’t, because try as it might, it’s failed to build a presence in San Francisco and LA.”

Expanding into SFO and LAX is a dauting task since they are two of the most slot-restricted airports in the US. That’s why JetBlue’s had to be incredibly innovative to establish a presence in these markets.

For example, JetBlue was once a major operator at the small Long Beach Airport, just 25 miles from downtown LA, but difficult to access due to LA traffic. In San Francisco, the airline bought limited gate slots in the international terminal, requiring them to pay a premium for gates usually reserved for wide-body aircraft.

Ultimately, neither of these solutions proved highly scalable. Without a significant influx of slots, JetBlue faces challenges in becoming a major coast-to-coast player. This leaves acquiring a California-based airline as the only viable option.

In 2016, Virgin America went up for sale, presenting a fortunate opportunity for JetBlue as SFO and LAX were two of its major hubs. This sparked a fierce bidding war between JetBlue and Alaska, which JetBlue ultimately lost.

It’s painfully clear that the carrier missed out on a once-in-a-lifetime opportunity. However, JetBlue had that chance again to bid on a deal to acquire Spirit Airline.

Spirit isn’t as good as Virgin. They have slots in LA and Las Vegas but not in San Francisco. However, JetBlue can’t be choosy. Spirit might be their last chance to enter California, so they have to go all in given the industry consolidation.

Unfortunately, an unexpected bad luck has occurred. On January 2024, the prospect of a JetBlue-Spirit Airlines merger took a major hit in court when a federal judge sided with the Biden administration and blocked the $3.8 billion deal.

JetBlue, and Spirit have filed for an expedited appeal on the judge who blocked the proposed merger.

According to JetBlue new CEO, Joanna Geraghty, “You know, we strongly disagree with the lower court’s decision. Our hope is that the First Circuit will recognize some of the challenges that that decision presents.”

She added, “At the end of the day, JetBlue and Spirit are two small airlines trying to combine to become a bigger one in this world where there are four very large legacy carriers. So, we’re hopeful that the judge does reverse or that the Court of Appeals does reverse that lower court decision, and we will move through as needed.”

However, JetBlue Airways and Spirit Airlines will have to wait until June 2024 before a federal court hears their appeal of a ruling that blocked the deal. Now the deal is far from reality. If JetBlue wants to stay relevant, they need another take.

Shift Gears – Transatlantic Market and Key Advantages

Instead of prioritizing westward expansion, the carrier appears ready to expand eastward with the goal of becoming America’s first low-cost transatlantic carrier.

However, breaking into the transatlantic market is notoriously challenging. Flights between the East Coast and Europe are highly competitive, and other low-cost carriers like Norse and WOW have struggled significantly in their attempts to enter this market.

Despite the mentioned challenges, JetBlue possesses several strengths that could contribute to its success in flying to Europe.

According to Coby Wayne, JetBlue has highly coveted slots and a major presence at both JFK and Boston, which offers a tremendous launchpad for crossing the pond. These airports see tens of millions of European travelers annually, so demand clearly exists where JetBlue is already based.

He also mentioned that JetBlue has the right fleet of aircraft. The carrier was the first and remains the only US airline to operate the A321LR. This modern long-range narrow-body has the legs to actually cross the Atlantic, and since narrow bodies are generally less expensive to operate than their widebody brethren, it can help JetBlue continue to offer low-cost fares.

Third, and perhaps JetBlue’s most significant advantage, is its Mint business class product. Up to 75% of an airline’s revenue comes from premium travel, a figure that may be even higher on certain transatlantic routes.

Thus, if JetBlue aims to penetrate the market, it must attract some of these sought-after premium travelers. Fortunately, JetBlue’s Mint is among the most highly regarded business class products available, featuring fully enclosed suites, exceptional bedding, and gourmet meals.

Coby Wayne stated that, “Ultimately, JetBlue’s resources haven’t helped them all that much in domestic expansion, but they could have the exact right ingredients to become a real transatlantic player. Early returns have been promising. In the past few years, we’ve seen them experiment with routes to Amsterdam, London, and Paris, which has helped them drive record profits, albeit still modest ones when compared to the competition.”