Stripe vs Square: Which Payment Method Is Best for Small Business

Which an entrepreneur who at the first step to developer a business, method of payment will ultimately come down to your business’ needs, whether Stripe or Square will be a suitable option. Are you finding a solution that is ready to go and addresses a whole range of payment and sales channels? Or you prefer a method of payment that is targeted primarily at the online space and wholly customizable, but may take a bit more work and resources to get running?

To determine which solution is best for your business: Stripe of Square, this article is aimed to provide some particular features and sides that may help you to have the best decision for your business. We’ll compare the pricing, features for each of the credit card processing companies in-depth along with other positive and negative sides in Stripe and Square.

gBoth Stripe and Square provide flexible, easy-to-use payment processing for small businesses. The significant difference is that Square offers payment processing for online, mobile, and in-store sales, which means Square is targeted for retailers and multichannel sellers. Meanwhile, Stripe is just for online businesses, which is best for tech-savvy online businesses.

Similarities

At a highlight observation in similarities, both Stripe and Square are giant in the payment industry. These two have successfully transformed the way people pay for things and the way merchants accept payments. This has become clear that Stripe and Square are on the leading edge of technology and rely heavily on machine learning to drive their payment processing systems. Otherwise, Stripe and Square provide huge assortments of commerce tools that help merchants to run their businesses easily.

Square

Digital payment processors

Digital Payment Processors (DPP) are digital services that enable you to invoice and collect account payments from customers both in-person and online. This simple diagram from payroll blog Wage point shows where payment processors fit in the sales cycle.

Who is the customer?

These digital processors have become popular as a convenient, user-friendly, and cost-effective way to process transactions thanks to the prevalence of smartphones and tablet technology. This helps to approach multiple types of audiences, ranges from freelancers and small business owners and mid-size businesses and the enterprise sector.

Strengths

Square has predominately marketed to small businesses as mobile and cheap, that want a digital processing solution like their larger counterparts without the big-time fees they pay. Square has well-known for its simple and straightforward pricing and design. Its famous slogan is “Make Commerce Easy” which has truthfully built up a successful industry nowadays.

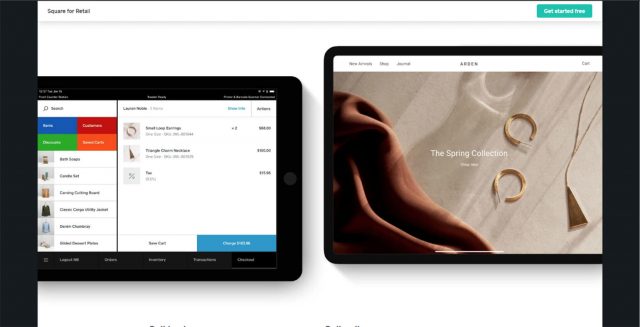

One is among the best features in Square is that Square offers POS systems, online checkout experiences, and invoicing best fit for brick-and-mortar businesses. Square can completely turn your smart device into a powerful point of sale system. For instance, Square can turn an iPad into a countertop POS system. Square exactly is an all-in-one processor that can handle in-person and eCommerce payments, as well as inventory management, CRM, and more.

Cost

Hardware cost: Free to $999

Transaction fees: 2.5% + $0.10 to 3.5% + $0.15

Here is some information about the cost happening while using Square Payment. With Square POS systems, you’ll pay a range of transaction fees from 2.6% + $0.10 to 3.5% + $0.15, depending on which POS hardware you process it through. Any transaction that you process through any Square point of sale system by keying in the card information, you’ll pay 3.5% + $0.15.

Features

Square provides multiple convenience features, like the same rate for all major credit cards, deposits as soon as the next business day, no monthly fees, instant deposits available, no commitments or contracts, chargeback protection, full PCI compliance included, payment dispute assistance, and you can swipe chip cards when you are using.

Stripe

Stripe offers a digital payment processor initially built to create custom online payment solutions for developers. Stripe allows both private individuals and large & small businesses to accept payments over the internet. It can say that Stripe is an online payment API that’s the best fit for high-tech business-to-consumer eCommerce companies, which includes online payment API for businesses’ websites and apps.

Stripe is an extremely developer-centric online payment option that offers customized payment styles like billing and platform payments. It offers payments APIs through the Integrated and Customized versions of their product. This means it is so developer-friendly that their integrations into websites are seamless. In other aspects, Stripe automates online payments for some of the biggest brands out there, like Target, Glossier, and Lyft. Stripe has become generally focusing more on mobile and eCommerce, with powerful tools for marketplaces subscription-based businesses. However, now it’s introduced a POS integration option for in-person payments.

Strengths

Stripe provides friendly APIs, or Application Programming Interfaces, that allows businesses to accept and manage payments using a mobile app. Stripe doesn’t require customers to open a merchant account or set up a credit card payment gateway. Stripe’s simplicity and ease of use have widely been recognized.

Stripe claims on their website that, their success is measured on how little payments code a developer writes to process a transaction. Stripe has the best payment flow on the web and mobile thanks to its customized “Checkout” that features an embeddable payment form that is optimized for conversions. Their unified multi-sided platform supports new tools like Apple Pay and accepts 135+ currencies.

Cost

Transaction fees: 2.9% + $0.30

Stripe has no setup, monthly, validation, refund, card storage or failed payment platform fees. In other words, no extra account fees other than per transaction. If you choose Integrated payments API, only have to pay for successful transactions—Stripe charges no monthly fees or setup fees whatsoever. For each payment that your Square API processes, you’ll simply have to pay 2.9% of the transaction value, plus $0.30 per transaction. If you opt for their Customized API for your business because of your high transaction volume or unique business model, you’ll be able to access customizable rates.

Stripe VS Square

Square

Square is a good option for new business owners or those that don’t process charge cards very often, those unsure about how many debit card or credit card transactions to anticipate, and aren’t familiar with new technology.

Since its ability includes being scalable, reliable since it can accept payments offline, and easy to use, Stripe is best for Primarily Brick-and Mortar-Businesses: Square – recognize that Square offers up far-superior in-person POS solutions. Expand into eCommerce, then Square can offer online solutions. And if you’re primarily working face-to-face with the customer.

Payment processing

Square offers extensive e-commerce options and a host of other tools for payment processing and managing your business. Square, for the most part, focuses on letting merchants accept card payments. You won’t get ACH support, but if you sell online, you can add support for online/mobile wallets.

E-Commerce integrations

Square has acquired Weebly for an easy, affordable eCommerce option. Square Checkout is a premade form that can be dropped into a site with minimal fuss. Square’s list of integrations already includes some of the best shopping cart options. Square’s developer tools make it possible for you to create almost any custom integration you could need.

Free mobile POS app

Square POS is one the most powerful free mobile apps out there, and it does very well as a countertop iPad POS, too. Square offers merchants a free magstripe reader, but prices go up from there to accept EMV chip cards and contactless payments. Square really is an omnichannel solution for merchants who want to sell anywhere without needing to build a complicated system of integrations or do a lot of coding work.

The advantage of choosing Square is that you can get set up quickly with access to all of Square’s free tools and software, and it’s ready to go after you import your products and adjust your settings a bit.

Ease of use

All of the Square software works perfectly together, with centralized reporting. Square’s eCommerce options are likewise easy to use; you just need to connect Square to your online store to enable payments.

Square offers merchants’ phone and email support, as well as an extensive knowledgebase. That’s pretty typical of any processor, but on top of that, Square operates the Seller Community, a community forum about all things. Square offers a free online store for online payments and has a free POS app for in-person payments. It also offers free tools to create a website.

Square also has these strengths, includes a free mobile app and sends all account holders a free mobile card reader for accepting payments. Square’s streamlined, all-in-one solution, it includes a built-in virtual terminal feature in its free point-of-sale system.

Square offers a free POS system that can be used on iOS and Android phones and tablets. Square’s POS app is extremely easy to use and requires very little setup. A basic Square account, including payment processing and POS app, is free. Businesses just pay a transaction fee that is automatically deducted from each payment you process.

Stripe

Stripe has more established businesses looking to tap into foreign markets by expanding their e-commerce platforms and e-commerce solutions.

Stripe accepts more than 100 currencies include Alipay and Bitcoin; Features integrated mobile payments for iOS and Android. Its features and total integrations such as a WooCommerce Stripe plugin is more simple and straightforward.

Best for High-Tech B2C Ecommerce Companies: Stripe. Also, have a developer on your team as Stripe doesn’t currently offer any in-person payment solutions.

Negative

Stripe doesn’t offer an invoicing platform at the moment, so it won’t be a great choice for business-to-business companies that need to invoice their customers.

Ease of use

Stripe is not going to be as simple as Square, especially for users who aren’t exactly tech-savvy for its complexity.

Strengths

Stripe also maintains a self-service knowledge base, its documentation is pretty legendary, which is going to be one of the best resources. Stripe provides a great selection of payment processing options, including cost-saving options like ACH payment processing.

E-Commerce integrations

Stripe has more international payment options, accepts payments in 135 international currencies and handles real-time currency conversions right on your website. This feature is very rare, and something that Square does not offer. So, if you have an international customer base, Stripe would be the better option for you. Stripe also integrates with in-app payment solutions, subscription sites, and multi-seller online marketplaces.

Customer services

Stripe has security guides on its website to walk you through PCI compliance for all of its integration options. Stripe is designed for online sellers, so it can connect with virtually any type of website, online sales platform, or eCommerce platform.

If you are a developer or have one on your team, Stripe has a robust developer toolkit for creating custom eCommerce checkout solutions Stripe is the better solution, particularly for high-volume sellers or businesses with a subscription model.

Highlight features

Stripe has a solution called Stripe Subscriptions that helps you design and manage recurring payments for any type of subscription business, including educational sites, subscription box retailers, health and fitness memberships, free trials, auto-renew payments, and more.

Stripe has industry-standard procedures when it comes to disputes and chargebacks. Stripe provides its sellers with a top-rated fraud protection tool called Radar. It uses machine learning to help you identify high-risk sales and gives sellers tools to flag risky transactions before clearing or block high-risk sales altogether.

Stripe is free to use; businesses just pay a transaction fee that is automatically deducted from each payment you process. Since Stripe is designed for online payments, there are no hardware fees.

Conclusion

The choice between Square and Stripe will ultimately come down to your business’ needs. Do you want something that’s ready to go and addresses a whole range of payment and sales channels? Or do you want something that is targeted primarily at the online space and wholly customizable, but may take a bit more work and resources to get running?

Sit down, think about what features are absolutely mandatory for you to have — and then look at which ones you’d like to have, but aren’t necessarily required. From there, it should be fairly clear which solution is right for you!