Mortgage Brokerage: How to Build a Successful Company?

Are you interested in starting a mortgage brokerage business? As an entrepreneurial business, the job is a rewarding one. You help business owners, families, and renders close deals on spaces and homes. A mortgage broker is a middleman that negotiates with the lender, so the buyer doesn’t have to do themselves.

What Do Mortgage Brokers Do Exactly?

When property and housing markets are on the rise, people will be looking more and more towards their mortgage brokers to help them purchase owner-occupied houses and investment real estate alike.

The job of mortgage brokerage business is to find customers the best loan options. They research what the potential borrower qualifies for and use this information to choose the loan that is right for them. The business is constantly in contact with lenders and people they know in the real estate industry. A mortgage brokerage is always in search of the best in the real estate marketplace. After they’ve locked onto a deal, the broker checks the paperwork with the lender to verify its legality. The broker’s target market can be businesses, people or families, and investors. They charge clients a percentage of the mortgage loan.

Mortgage brokerage careers can be some of the most rewarding in the financial world, but it’s important you gain all the right skills and qualifications before you begin. Once you’ve undertaken mortgage broker training, you’ll be able to help people find the home loan that most suits their needs and make those all-important first steps onto the property ladder.

Having an Extremely Busy Career

A lot of people get into the mortgage broking profession without seriously considering this question. When they get out of bed each morning and trudge to the office, what do they find themselves doing with their day? What sorts of tasks do they take on, and what are the major challenges that come up? Before diving into the mortgage business, you may want to consider these questions.

Everyone understands the basics of the job, but what are the nitty-gritty details of how to be a successful mortgage broker? or what’s your day like? You have to be prepared for a wide range of challenges. They may include:

- Developing new business: There are always new clients to reach out to, building relationships and angling to make deals.

- Connecting with lenders: It’s not easy to get banks, insurance companies and other financiers in your corner. This takes persistence on a daily basis.

- Building your network: The more colleagues and business partners you have, the more opportunities you’ll find for referrals.

- Hunting for new loan solutions: When you have a spare moment, it’s good to analyze applicants’ finances and look for new opportunities to offer better more profitable loans.

There’s never a dull moment when you’re juggling all of the above responsibilities. The hard part is balancing them all.

Dealing with Challenging Clients

In a good day, you could relax into a relaxed schedule and easily hammer out all of the above-mentioned to do things. But you learn, as you are a mortgage broker, that not every day is perfect. Often an especially troublesome customer comes along, and you’ll have to meet with them for a whole afternoon just to get a simple mortgage deal completed

It is suggested that the more problematic borrowers, they may need to hear your sales pitch in a different way or hear it more than once. Getting someone across the finish line to sign for a loan might require sending them written material rather than a verbal pitch, or passing them to another broker so they can hear a fresh new voice. Alternatively, you may just have to hang up and call back tomorrow.

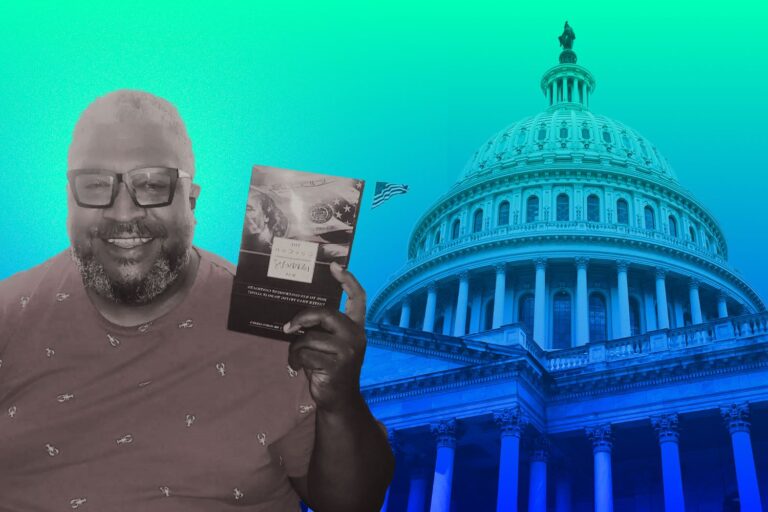

Build Your Mortgage Business by Developing Yourself – Khash Saghafi

Khash Saghafi of Liberty Home Mortgage who ultimately built a $12M mortgage brokerage after being in 6 figures of debt. His personal income from that business was roughly $1.6M in 2018. He is an approved instructor by the Department of Commerce, Division of Real Estate in Ohio, Florida and California. Khash Saghafi is also an approved instructor by the Ohio Supreme Court in regard to his expertise in the banking and mortgage industry.

Khash Saghafi’s business is 100% referral-based which is why he is always accessible and works so hard to stay on top of today’s current issues so that his clients receive the best advice, service and direction on their home. He will tell you that what it takes to be an entrepreneur, and the spirit of never giving up to achieve your dreams and goals.

“If you’re not taking a portion of your money and reinvesting it in yourself, you’re completely missing the boat and won’t scale your business.”

– Said Saghafi

You’ve got to be willing to push yourself to limits financially. That will stress most people out and they won’t go to and that’s ultimately what got me to where I am is the willingness to take risk at any cost with no fear of failure. Saghafi said that the only limit is yourself. First, you have to answer these questions: What sacrifices are you willing to make to achieve your goal? How deep were you willing to take it?

As a mortgage originator and owner, you must develop yourself in many ways, from learning new loan programs and more effective ways to communicate to establishing good habits and daily discipline for such things as time management and personal growth. Owners who truly work on these skills and implement these daily habits will see a steady stream of business. That’s the foundation that you can build on when it comes to sustaining a long and successful career.

Nevertheless, hiring employees is also an important part. A basic math for the owners: If you bring this person in and he generates five grands of revenue, he wants to get paid for that. So how much does he want of the five? Maybe he wants three grands of the five, but it costs money to support him, it cost a grand to support the office space, the other support in need. Let’s pretend that it costs three grands to support him and he wants three grand, that’s six grands. And that employee only generated five, that is negative. He is always analyzing, whatever came in and how much of this drive to section out would give out, how much is left for the company. So, it’s all about income and expenses to grow your company.

The golden nugget Khash Saghafi want to say is that: believe in yourself, believe in your dreams and never give up. You can achieve anything you want. You’ve become as big as you want, you can become anything you can imagine.

There are two of the main traits that those looking into mortgage brokerage careers should have.

Good Communication Skills

First and foremost, being able to communicate with the clients in a direct and clear way is one of the fundamental skills needed to succeed as a mortgage broker. For example, being able to explain the intricate details of the various financial factors involved in a concise way to clients will be an important aspect of your career.

Potential clients believe that a commercial mortgage broker with ample industry experience is more likely to provide a lot of value. If you’re just starting out, showcasing your experience is obviously more difficult to do, but it’s something you should be conscious of from the beginning so you can build evidence over time.

Furthermore, being able to sit back and listen to the needs of each individual client will help you get to the bottom of their issues easily. Empathizing with people and working with them to find the perfect solution will become a great mortgage brokers main strength.

Establishing the Authority

What use is a mortgage broker who isn’t up to date with the latest developments occurring in the home loan landscape? Being attentive and involved with the wider context of Australia’s economy will provide you with the information necessary to make informed, educated decisions. Being aware of the various real estate statistics occurring in your area – like median house prices, auction clearance rates and rental yields – will help you provide context to people’s questions about the market.

You can also demonstrate your knowledge with updates on social media talking about the state of the property market or writing articles on your website’s blog. Both activities enhance your brand by signaling you as an expert. When a big part of the value you provide depends on the specialist knowledge you have, you need to be seen as having plenty of it in potential customer’s eyes. Building trust with your audience in the digital world can be time-consuming and require technical expertise that your team might not be capable of. A solution of online-presence manager package could help your company solve this problem.

Regardless of whether they’re looking for a mortgage for their first family home or a second loan for property investment, being aware of the landscape will aid you in making the best calls possible for each client who comes to you for help.

All this is no less true for a mortgage brokerage. Taking initiative, being highly knowledgeable and well-informed will allow you to make a true difference for people hunting for a home loan in a way that an application cannot.

Income Streams for Mortgage Business

The world of mortgage broking is an appealing one. It is essential that you have a company understanding of what payments will make up your potential income flow.

Mortgage brokers make the bulk of their income based on commissions from the lenders they work with. As a mortgage broker, you will be earning two kinds of commission: an up-front commission and a trail commission.

Income stream #1: Up-front commission

Up-front commissions are payments from the lender for bringing business to them. Because you are acting as a proxy between the home buyer and the lenders, it is in the banks’ best interest to reward you for the new business you bring to their door. Any up-front commission you earn is paid out only once the home loan settles. In other words, the home purchase must be finalized before you can pocket any money. This will form the bulk of your income, at least for your first few years as you establish your broking career.

The amount varies from lender to lender. However, it will generally be calculated based on a percentage of the loan amount, as well as the loan-to-value-ratio also known as the LVR. This is one of the most important elements of a home loan that the lender examines before approving or denying a loan. Essentially, the LVR is how much the loan is for versus the appraised value. If a loan is close to the total value of the home, it is considered a higher risk for the lender. Therefore, loans with a lower LVR are more desirable for the lender and are thus rewarded with a higher commission for the broker.

But up-front commissions are only part of the income of a mortgage broker. For your first year or so, up-front commissions are likely to be your only revenue source, but once you have established yourself and created relationships with various clients, you may begin to add trailing commissions to your income. Trail commissions are payments made by banks for the life of a loan. They are paid by the lender to the broker as a fee for the ongoing services provided to the borrower while their loan is still being paid. Whether it’s real estate to live in or a rental property that’s being purchased, lenders value highly the services brokers offer.

Income stream #2: Trailing commission

Trailing commissions also act as an incentive to ensure you provide your clients with a loan that truly fits their financial needs and that will work for them long term. While many lenders pay a fixed trailing commission, there is also a chance for the percentage to incrementally increase over time. While there is greater risk with this type of trailing commission – if the client defaults or changes their loan in the first year, you won’t see any additional income aside from the upfront commission – a client that stays with their loan for many years could mean a healthy monthly commission for you.

Up front and trailing commissions should be expected to make up the bulk of your income during your mortgage broker career, but there are also additional opportunities to earn money. For example, some lenders may offer a bonus payment or loyalty payments for your continued business with them. In addition to monetary rewards, lenders can provide you with “soft dollar commissions,” which translates to compensation that doesn’t necessarily take the form of cash. This may include tickets to sporting events, shopping vouchers, and even complementary overseas holidays. While these bonuses aren’t likely to help you pay your bills, they’re an exciting fringe benefit to the life of a mortgage broker.

If a customer comes to you with an especially complicated loan, many mortgage brokers will charge a fee for the extra work it entails. In addition, small loans – usually less than $300,000 – might constitute an additional fee, as the commission you make may not make it a cost-effective use of your time. Finally, commercial loans, which require a level of expertise beyond that of a mortgage broker who only does home loans, often come with an additional fee that is charged to the client.

As you can see, there are many revenue streams that come with a mortgage broker career. While it may seem complicated or even intimidating at first, consider that you have opportunities for both short- and long-term steady earnings.

The Bottome Line

Growing your mortgage business doesn’t always require a major brand makeover or complete change in processes. There are many small things that you can do to improve and grow your business in the immediate future, and different steps that can keep your business moving forward and bringing in more prospective borrowers.