It’s Okay to Fail Yet It’s Not Okay to Give Up: Let’s Recover Gracefully in 2021

The unprecedented arrival of the “black-swan” COVID-19 pandemic leads to an obvious consequence that a myriad of large-scale companies has been going bankrupt at a record pace – yet, that’s only the tip of the iceberg. Actually, small businesses are disappearing by the thousands amid the pandemic, and the drag on the economy from these failures is undoubtedly going to be huge.

Whilst it would take years to find the exact answers as to the economic impacts of the coronavirus, one thing is painfully clear right now: Small businesses across the country are facing an existential threat. Given the fact that SMBs constitutes an essential part of the U.S. economy – specifically, businesses with fewer than 500 employees account for 48% of American jobs and 43.5% of GDP, these firms are often financially fragile, with little cash on hand or resources to buffer even a minor financial shock. In the throes of the sweeping disruptions resulting from the pandemic, countless businesses around the country have closed temporarily, many of which have ongoing expenses, with little or no revenue, and face the prospect that they may never reopen

At present, though the pandemic-related crisis abates, its impacts do linger on. For those businesses facing failures, it’s time to stop crying over spilled milk, adopt a new business psychology so as to come back and once again serve as an engine of American innovation.

The Pandemic Crisis Within the Small Business Landscape: Depressing Figures & Insights from The Insiders

Whereas it’s an obvious fact that small businesses take a hard hit amidst the COVID-19 period, the wave of failures by SMBs remains silent and goes uncounted. This is in part because real-time data on small businesses is notoriously scarce, and that small business owners often have no debt, whereby there is no need for bankruptcy court.

“Probably all you need to do is call the utilities and tell them to turn them off and close your door,” shared William Dunkelberg, Chief Economist for the National Federation of Independent Business. Nevertheless, closures “are going to be well above normal because we’re in a disastrous economic situation,” Dunkelberg said.

In an effort to slow the spread of the coronavirus, public health officials are urging Americans go on social distancing together with adopting some isolation measures – this proves to be good for public health but tough for the “financial health” of various small businesses, especially those within the hospitality industry.

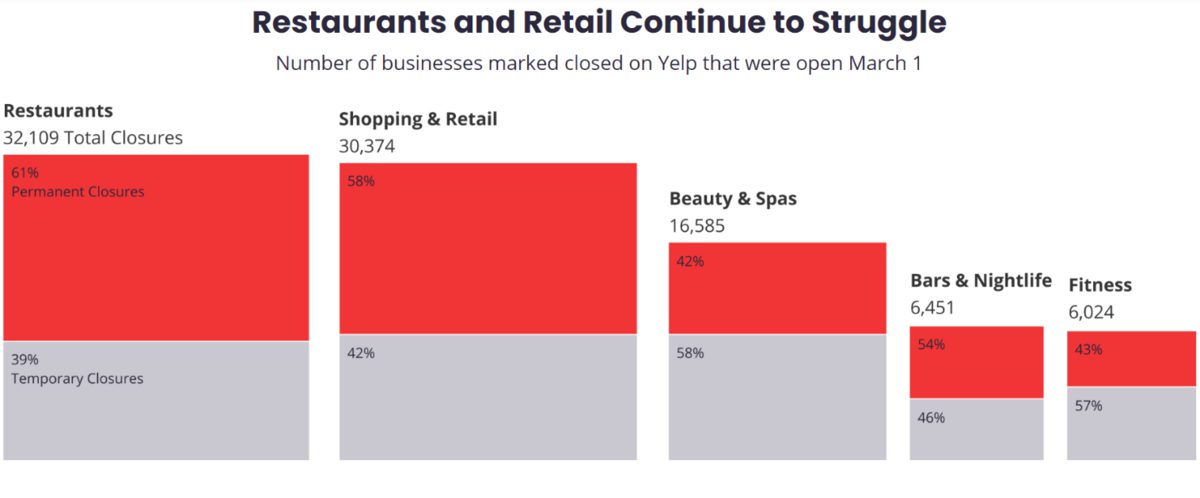

A report issued by the National Restaurant Association did warn that over 100,000 restaurants have permanently closed in 2020 and unless action was taken, a larger number would end up in going liquidation. “It’s been an incredibly hard time, no one’s seen this challenge before,” stated Mike Whatley, Vice President of State and Local Affairs at the National Restaurant Association.

Jose Gamiz and Leticia Gamiz, owners of the vegan Mexican restaurant Mi Vegana Madre restaurant in Glendale, Arizona, closed their restaurant on July 31. While thousands in government loans did help and they only had four part-time employees, the bills started piling up and they were just not taking in enough cash. “It was too much of a gamble to keep Mi Vegana Madre open”, said Jose Gamiz. Given that the couple had lost the first house they bought during the 2008 crisis, they thoroughly knew the dangers of taking risks. “We wanted to take that as a lesson,” Jose Gamiz shared. “Sometimes it’s okay to let it go and not expend every penny.”

Justine Bacon, the owner of a Yoga Brain studio in Philadelphia, also decided to shut her business permanently, thinking that it was too dangerous to hold indoor classes in the light of the pandemic. In fact, Bacon did not file for bankruptcy; rather, she just simply closed up shop and went out of business. “I felt it better to close with some money in the account and not have to worry about bankrupting the business.”

According to the American Bankruptcy Institute, up to 800 small businesses did file for Chapter 11 bankruptcy from mid-February to July 31. Given that, the trade group expects the 2020 total could be up 36% from the previous year.

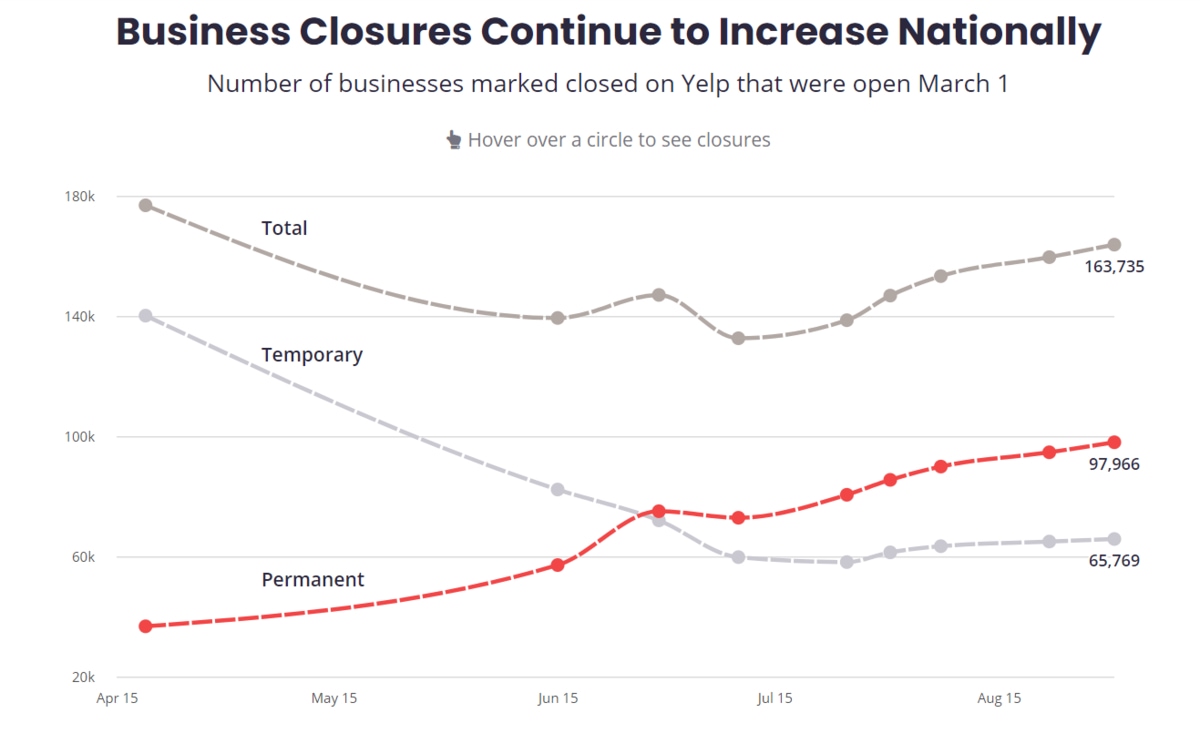

As of Aug. 31, on Yelp’s latest Economic Impact Report, some 163,735 businesses have indicated that they have closed, which was down from the 180,000 that closed at the very beginning of the pandemic. Nonetheless, it actually points out an upward trend of 23% in the number of closures since mid-July. Besides, monitoring closed businesses, Yelp also takes into account the businesses whose closures have become permanent. That number has steadily increased during the second quarter of 2020 – that figure reached 97,966, representing 60% of closed businesses that would not be reopening. “Overall, Yelp’s data shows that business closures have continued to rise with a 34% increase in permanent closures since our last report in mid-July,” commented Justin Norman, Vice President of Data Science at Yelp.

Furthermore, a survey by Harvard Business Review in partnership with the small business network Alignable on approximately 5,800 SMBs from most major industry groups, states, and firm-size categories across the United States, suggests that 45% of small businesses were temporarily closed due to COVID-19 and accordingly the total employment by these businesses declined by staggeringly 40% since the end of January. In fact, the economic carnage was particularly acute at the epicenter of the American pandemic: the mid-Atlantic region that surrounds New York City. To be more specific, within that area, more than 55% of small businesses had closed and employment had fallen by 44%. The Pacific region, with statewide closures in California and an early outbreak in Washington, has also witnessed equally dramatic employment reductions.

Black-owned businesses have also suffered more and more disproportionate hardship during the coronavirus pandemic, according to an August analysis by the U.S. Federal Reserve. They have been hit from every direction: as the research’s finding from the FED reveals, COVID-19 cases are not only higher in predominantly Black areas, but Black owners have also had more trouble accessing capital — historically from commercial banks and from the federal government’s Paycheck Protection Program — than White business owners.

As shared by Kevin Dick, president and CEO of Carolina Small Business, service-oriented businesses in North Carolina that require in-person interaction are disproportionately Black-owned.

Before arriving at the decision to close her studio for good, Patrice Graham had run “Colors of Yoga Raleigh” for three years – her business became the city’s only Black-owned yoga studio, an inclusive space for people of color and the LGBTQIA+ community to feel comfortable and confident practicing. Whereas her space was intimate, and she kept class sizes to 12 or under, it was plenty big enough to serve people who often felt unwelcome in other yoga studios. Actually, Patrice Graham is proud of the community she helped foster, in which members would stay for an hour, sometimes two, after classes to sip tea and talk. Everything went smooth until the advent of the COVID-19 outbreak. Seven months into the coronavirus pandemic, she has transitioned all of her classes online, and she gave up the lease on the studio. Though many of her core members are still taking virtual classes, they don’t tend to stick around after class anymore – after all, almost no one prefers the idea of taking Yoga class via Zoom.

“I’m worried every single day,” Graham shared. “No matter what I do, I’m going to be anxious and worried about if the yoga studio will survive.”

Like other small business owners in North Carolina and across the country, Graham has had to pivot to keep her business alive in a new world in which none of the old rules apply. In March, in the early phase of the COVID-19 outbreak, SMB owners braced for what seemed like a few weeks of financial pain. Yet, since the pandemic drags on for months – and even for the time being, has no signal of an official end, a plethora of small businesses are operating at limited capacity, on a shoestring budget or have shuttered completely and permanently.

What’s more, within the Coronavirus-obsessed world, entrepreneurs tackle not only the quotidian stresses of weathering through the global pandemic, they also are grappling with ever-changing health and safety standards, managing potentially hostile customers as well as spending money to restructure their physical stores to be “COVID-compliant” – all while bringing in significantly less revenue.

It’s Okay to Fail: Mindset of A Real Entrepreneur

As the more-than-tough 2020 draws to a close, it seems that the negative socio-economic impacts from the “black-swan” pandemic still linger on: Thousands of companies – irrespective of their scale and fields – have been struggling to navigate against the crisis whereas several other – maybe more – ends up going out of business. And in case your SMB is – unfortunately – amongst one of them, being back to square one, it’s completely ok.

“Everybody has got failures,” according to the psychologist Perpetua Neo. “If you see people with success, you’re looking at their shiny front. We don’t see how many failures it took for them to be like that.”

Undoubtedly, the COVID-19 hit took a heavy toll: many businesses failed and several entrepreneurs fell into depression. “I wasn’t working, and both my personal and professional reputations were tarnished,” shared Paul Pruitt, Professional Photographer and Success Coach, Founder of PROFITographers.com, on his first-time failure “from being on top of the world to being more than $3 million in debt”.

There exist countless reasons for you, especially as an entrepreneur, to fail – yet, there also remain several approaches to tackle with your failures. After all, it is your choice that is the key to making your failures productive or destructive. When it comes to Paul Pruitt, “I tried to use some of this unproductive time to reflect on what I truly valued… I learned some harsh lessons along the way. When we find ourselves in a negative cycle, we must break the pattern. I decided to flip the story. Instead of focusing on why this happened to me, I asked myself how I could be happy again and feel fulfilled.”

From the standpoint of Kim Perell, CEO of Perell Ventures, “success requires the ability to execute” and most of the time, the actions required of an entrepreneur make rejection or failure a distinct possibility. As room for failure exists everywhere, it’s a “should” and also a “must” to approach failure like a lesson. Let’s regard “FAIL” as “Frequent Adaptation Inspires Learning” – this is all about changing your perspective and how you see failure.

“I gained some important insight about risk-taking. I realized that when we come from nothing, we have nothing to lose. That mindset helped me achieve success in the real-estate world. And it inevitably led to my success in a new venture: creating a thriving photography company,” stated Paul Pruitt.

“Failure teaches self-confidence and tenacity,” commented Cass Phillipps, the Co-founder and Executive Producer of the internationally renowned conference FailCon – an event on business failure, when we learn from it, and how we recover. “There are people who fail and take it very, very personally, and that makes it hard to recover from it… We tell people ‘Don’t take this so personally. Failure’s actually really great.’”

Actually, “entrepreneurs are innovators: They defy conventional wisdom to find ways to improve it, and they challenge assumptions to approach a given industry or need from a unique perspective. They live at the intersection of innovation and practicality. For them, failure is a necessity to reach success. So, maybe failure’s “teachable moments” are actually worth striving for because they help you attain that innovation,” presented Kim Perell.

How to Recover Gracefully from Failure & Reinvent Your SMB in 2021

It’s okay to fail yet it’s not okay to give up. When it comes to entrepreneurship, there always exist ways to fail “successfully” – and no matter specific paths you adopt, the core principle lies in a shift from the understandable psychology of fear into useful action.

Below are some keys to reinvent some business as well as reinvent yourself, empowering you to rise above challenges and hurdles you’re tackling with:

Fostering your USP:

In fact, almost every single small-business market is oversaturated: There always will be a plethora of businesses offering goods and services at low or discounted prices. And to a certain extent, such a strategy does not make sense for long-term success, so let’s stop solely focusing on them – and stop blaming them. The most powerful weapons to succeed are all around differentiating yourself from your competitors. A segment of the market would always be willing to invest in a product or service, so long as they perceive the value is aligned with their preferences and lifestyle choices.

Saying a permanent goodbye to your instant-gratification attitude:

Since long-term success is undoubtedly a marathon, let’s strive to become top-of-mind for a particular product or service, which happens over time as you slowly build influence. This is of utmost importance since most of your competitors will give up well before they’ve built up the relationship capital it requires to persuade a client. Patience and resilience is critical when it comes to establishing or re-establishing your business credibility with the general public.

Being consistent:

Indeed, it’s so easy to sabotage yourself, especially when you’re self-employed or rebuilding your life. You need to show up at work every day, work as if you have a boss leaning over your shoulder and you must make every hour count. For several SMB owners facing failures, the disappointment of their failures was so strong that they are unwilling to put in an appearance. Yet, it should be borne in mind that unless you dislike the idea of leading a successful life, it’s a “must” to adopt consistent courses of action – especially on those days when you do not want to do anything at all.

Embracing the “growth mindset”:

In the popular book “Mindset: The New Psychology of Success”, Carol Dweck, the book author and the Lewis and Virginia Eaton Professor of Psychology at Stanford University, discussed a concept known as the “growth mindset.” A growth mindset requires recognition that you can always improve through a willingness to push yourself beyond what is known and to master the most important life and business survival skill: adaptation. The key to deploying failure as a tool for adaptation and success is to change your perception. Remember that every rejection and failure bring you closer to success: after all, experimentation is vital to successful innovation, and failure is a part of experimentation.

The Bottom Line

Beyond any doubt, 2020 is not going to be a favorite year for several individuals, especially SMBs struggling to weather through the crisis. Since the turbulent 2020 draws to a close and a promising 2021 begins, it is more than critical that owners and managers of small businesses act both with a sense of urgency and with prudence, stopping crying over spilled milk and fostering an entrepreneurial mindset shift so as to navigate the ever-evolving complicated landscape and thrive within the “new normal”.

Tacking with the operational hurdles to thrive in the post-pandemic landscape is already overwhelmed with several activities yet keeping your business image visible online is also crucial to ignite the profitability of your business. Should you need any help with a dedicated team to get your business exposed to the digital world within the “new normal” era, don’t hesitate to get an online presence manager.