Hedge Fund: The “Hammer” on Newsrooms That Already Wither Under Pandemic Cuts

Amidst the “black swan” pandemic and sluggish economic recovery, hedge funds, also described as “mutual funds on steroids”, become the Wall Street villain under numerous Americans’ eyes. Are hedge funds mysterious and controversial? Are they really “inherently evil”?

Periodically, stories bubble up in the mainstream media that paints these funds in a poor light. Yet, recently, hedge funds have been squarely on the radar of a wider cross-section of society than ever before, given their aggressive “participation” into the newspaper landscape that remains withering under COVID-19 cuts.

Do these hedge funds present a golden opportunity for newspaper rejuvenation or a dire threat to its already-struggling survival? As a potential force for good or for evil? Let’s read on to figure out your own answer!

A Brief Look: An Uphill Battle for American Newspaper Sphere

Before delving into the controversial “combination” between hedge funds and newspaper, it’s critical to first cast a quick glimpse over the current American newspaper spaces.

Whilst things were not going well for the local newspaper industry prior to the pandemic, COVID-19 might have “officially” brought it to its knees. Undoubtedly, it has been a catastrophic and uncertain time for American newsrooms. By the end of March 2020, at least 106 U.S. news outlets experienced cutbacks whereas staggeringly 1,200 more newsrooms, even ones owned by such large-scale media conglomerates as Gannett, Lee Enterprises and Adams Publishing Group, were affected by cuts as well.

The pandemic cost newsrooms jobs and communities’ critical work and eventually end entire newsrooms: Specifically, as Coronavirus ran rampant, more than 70 local newsrooms, including the long-established ones, closed across the country – even as they covered the most readable story in decades.

“As far as readers, we saw that skyrocket during the pandemic,” shared Emma Way, Editor at Axios Charlotte. However, “at the same time that revenue was falling, readers were spiking. It was kind of this dilemma that I’m sure a lot of news organizations faced.”

However, as previously mentioned, American newspaper industry had been struggling to stay afloat long before the pandemic. The total circulation of U.S. daily newspapers has been continuously declined since the 1970s. Whereas newspapers once reached more than 63 million Americans during their peak in 1973, since 2018, they reached only around 23 million people during weekdays and a slightly bigger 30 million people during Sundays.

“Even before the pandemic, many newsrooms were really struggling financially,” shared Penny Abernathy, the visiting professor at Northwestern University (Medill School of Journalism, Media, Integrated Marketing Communications) and a former executive with The New York Times and Wall Street Journal. “Unfortunately, most people who depend on newspapers hadn’t realized that at all. What they noticed was a diminishment of the local news that was relevant to them.”

She further informed, “As a result of that, we’ve lost a fourth of our newspapers in the U.S. since 2005. That’s 2,100 newspapers, most of those have been in small communities. So, when you lose a local newspaper in a small or mid-sized community, you’re losing the person that shows up to cover the local school board or to cover the county commissioner or to give you the information during a COVID-19 crisis – how many people are infected and whether it’s even safe to go to the local grocery store.”

“Every time a newspaper dies, even a bad one, the country moves a little closer to authoritarianism.”

Richard Kluger, The Paper: The Life and Death of the New York Herald Tribune

Whilst historically, newspaper’s revenue mostly originated from print advertising, it’s now almost impossible to make money from that source as the Internet has reshaped the economics of the newspaper business – readership has shifted online and so has the advertising.

Since 2015, two tech giants – Facebook and Google – have basically cornered the market, “attracting almost as much as 75% of the digital revenue and even the smallest markets. That means that newspapers, digital startups, television and all legacy media are basically fighting over the digital scraps. Put that together, that’s just not enough to sustain local newsrooms,” explained Penny Abernathy.

Based on Abernathy’s analysis, whilst newspapers in small and mid-sized markets typically had operating margins of 20% – 30% during the 1990s, almost all newspapers today – even if profitable – operate in the low 10% or single digits. In fact, some local newspapers could not swiftly adapt to the fast-changing digital era, with even many buying into the idea that news should be free during the dot-com boom, which hurt many newsrooms. At present, it emerges as an uphill battle for newspapers trying to bridge the digital divide.

Hedge Funds & How They Scoop Up Local Newspapers

Given these unprecedented challenges, Gannett, the giant behind USA Today, one of the largest newspaper owners, offered voluntary buyouts to all of its employees in October 2020. Ravaged by the pandemic, many largest newspaper chains and community newspaper holdings had layoffs, pay cuts and furloughs. Meanwhile, McClatchy, a family-run news chain, which furloughed around 4.4% of its staff at 30 papers, was acquired by hedge fund Chatham Asset Management in September 2020.

In fact, the New Jersey-based hedge fund has started investing in McClatchy since 2009, soon after a recession accelerated the Internet-driven loss of advertising dollars across the industry. By April 2019, this hedge fund owned almost a quarter of McClatchy’s stock and had become its largest lender. Then, until September 2020, a federal bankruptcy judge approved Chatham’s bid to convert $263 million of existing debt into credit, and add $49 million in cash, to buy McClatchy. This $312 million deal officially took the 163-year-old company private.

Before McClatchy, this hedge fund owner followed a similar path with two other media holdings, taking controlling stakes by turning loans into ownership. Specifically, in 2016, Chatham swapped $268 million in debt for 65% ownership of Canada’s largest media chain, Postmedia Network Canada Corp. Two years earlier, Chatham and another investor, Omega Charitable Partnership, had taken control of the National Enquirer’s parent company, American Media, by swapping more than $500 million in debt for 100% ownership.

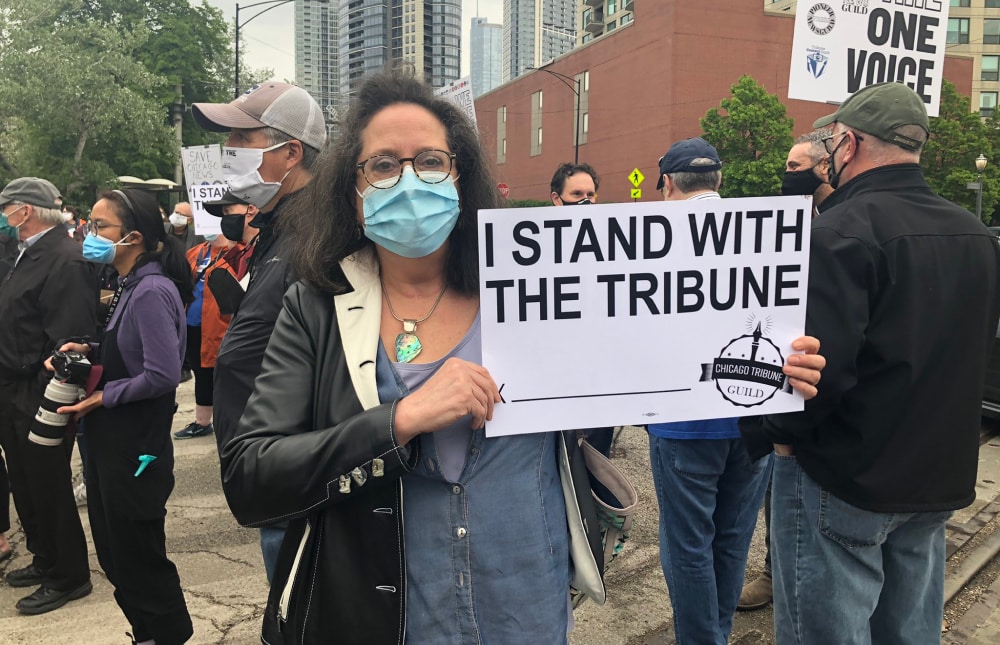

Likewise, Tribune Publishing, the publicly traded media company behind the Daily News, the Chicago Tribune, the Baltimore Sun and other major dailies, has been bought and taken private by Alden Global Capital in a deal worth roughly $630 million. Through its Digital First Media chain, Alden also owns the Boston Herald, Denver Post and San Jose Mercury News. Such a wide portfolio makes the New York-based hedge fund the second-largest newspaper owner in the U.S. behind Gannett. The bidding win by Alden Global, described as a “vulture fund”, casts lots of doubts and raises mounting concerns on the survival of local journalism.

At present, the new owners of many of these struggling newspapers are hedge funds and private equity firms. “In fact, hedge funds and other financial firms control half of the daily newspapers in the United States, according to a recent analysis by the Financial Times [as of January 2021]. Newspaper conglomerates like Tribune, McClatchy and Media News Group are owned, controlled by or indebted to financial firms.”

Hedge Funds to Newspapers: Drop Dead?

Hedge Funds as Americans’ Wall Street Villain

Before deep-diving into their contentious “role” in journalism spaces, let’s grasp a quick look over hedge funds and some negativities around them.

To simply define, “hedge fund”, at its broadest, can refer to all unregulated investment vehicles not otherwise categorizable as “private equity funds” or “real estate funds”. If mutual funds take risks on what stocks will go up and currency exchange rates will go down, hedge funds – described as “mutual funds on steroids” take very, very big risks. The roll call of well-known hedge fund managers includes many names that are becoming more familiar to casual readers of mainstream newspapers and magazines, including Jim Simons, Ray Dalio, Ken Griffin, Steve Cohen, Carl Icahn, David Tepper.

Known for its higher risk investing strategies to yield higher returns, many new hedge funds are launched annually in the hopes of attaining the success and recognition of the giants in the industry. At present, they control more than $3 trillion in assets globally.

However, they have stirred up intense hatred among many Americans by gutting companies, such as former American retail icon Sears, resulting in layoffs and engaging in questionable financial practices that possibly contributed to the near collapse of the U.S. financial system in 2008.

As stated by Prof. Itay Goldstein, Finance and Economics Faculty, the University of Pennsylvania’s Wharton School of Business, “They’re associated with ruthless financial institutions that are out there to make money and not care where it’s coming from.”

“Most people see it as guys in suits looking down their nose at you,” wrote Adam Bixler on the WallStreetBets Reddit forum. “How I feel is probably how a lot of people feel when thinking about the financial crisis and the massive wealth inequality that exists in this country.”

So, as hedge funds snap up “titles”, what does it mean for journalism?

Hedge Funds & American Newspapers: a Bad Mix?

“Their goal is financial returns. They’re going to get a return for their shareholders, one way or the other, whether it’s cutting costs or building up revenue,” noted Penny Abernathy, adding that “in a declining industry, the easiest way to get a return for shareholders is to cut the cost.”

In practice, since the 2008 recession, a handful of hedge funds and private equity firms have aggressively bought out hundreds of newspapers. Then, they reportedly reduced costs by laying off staff, freezing wages or reducing benefits. Notably, profits generated from these sources were not often reinvested – but spent on management fees, shareholder dividends and even to pay off debt.

The New York hedge fund Alden Global Capital, now the second-largest newspaper owner in the U.S., is infamous for its aggressive cost-cutting tactics. After acquiring struggling newspapers on the cheap, this hedge fund hostilely lowers operational costs and reaps the profits that can still be made from advertising.

A recent investigation by the Washington Post revealed that in 2019, Alden Global Capital might have mismanaged 294 million dollars of its newspaper’s employees’ pension savings by putting them into its own funds, according to the investigators at the U.S. Labor Department. In response, Alden stated the U.S Department of Labor’s Employee Benefits Security Administration (EBSA) “made no conclusive findings, all assertions of wrongdoing were disputed, and the EBSA closed its investigation following actions taken voluntarily by Media News Group and planned fiduciaries.”

“We’ve seen some of the private equity companies closed newspapers in Arkansas because they got everything out, they probably got a good return on their investment,” shared Walter Hussman, publisher of the Arkansas Democrat-Gazette in Little Rock, the largest newspaper in Arkansas. “That’s not to catch any disparagement against those companies. It’s just part of the capitalist system. It’s got a huge cost for society absolutely.”

From several business analysts and insiders, hedge funds do not care much about the long haul, nor do they feed and nurture distressed businesses in hopes they’ll persevere; rather, their objectives are clear – to buy low, and if they can’t sell high, extract as much profit as possible before they dump and move on. Likewise, hedge funds that buy out newspapers “are not doing this because they have a warm glow about owning socially useful enterprises devoted at least partly to serving the common wealth. They are in it because they perceive a chance to make a lot of money a few years down the road,” wrote news business consultant John Morton in the American Journalism Review.

Furthermore, given the urgent need of most local news outlets to move onto digital platforms to capture online readership, hedge funds, with their emphasis on quick profits and extracting rather than investing cash, reportedly try to make that shift nearly impossible. Specifically, such hedge fund chains as Alden Global Capital simply aren’t investing to ignite the online presence of their newspaper arms as Alden has made clear it considers it a waste of money. Notably, when it made an unsuccessful attempt to acquire Gannett, Alden was highly critical of the chain’s emphasis on digital, arguing the investment cut into shareholders’ returns.

These arguments do not suggest the hedge funds gobbling up troubled newspapers are also laundering cartel money. Yet, “their extreme lack of transparency and disinterest in sustainability should be concerning. And we don’t know who invests in those particular funds registered in foreign tax havens,” noted Julie Reynolds, editor of the NewsGuild and co-founder of Voices of Monterey Bay, a nonprofit bilingual news outlet.

“We, Americans, don’t like it when mysterious, unknown entities are in charge of a community’s primary source of information. We’re used to knowing who owns the TV news network or newspaper in our towns, even if only to complain about them. We want to know who they are, so we can judge whether their interests or biases align with our own,” she explained, stressing that “Firms like the privately held Alden have long been highly secretive.”

Actually, Alden and the previously mentioned Chatham Asset Management are not all hedge funds involved in the newspaper landscape. Gannett, the largest newspaper chain across the nation, was managed by hedge fund Fortress Investment Group, yet managed to negotiate an early exit by paying nearly $30 million in December 2020. Apollo Global Management is also taking on Wall Street with massive newspaper loan deals while buying up dozens of local TV stations to compete with Sinclair and Fox.

For the time being, the biggest threat seems to be the fact that “these large chains continue to buy up newspapers and see them primarily as a business. Newspapers in our country have has been historically important because they have been not just businesses,” explained Penny Abernathy. Instead, “they are businesses protected by the First Amendment because they provide us with the news and information that we need in order to make wise decisions about the quality of our life, the quality of our government and the quality of the few of future generations.”

The Bottom Line

Whilst American newspapers have struggled for the past two decades to reinvent themselves in the face of readers local news outlets hip shifting online and advertising revenue lost to the likes of Google, newspapers could be breaking even or turning modest profits – were it not for hedge fund owners bleeding them dry.

Time will tell whether hedge funds actually present opportunities or threats, yet, their return-focused stewardship and aggressive cost-cutting practices undoubtedly ravage local news outlets and eventually hurt Americans’ public interest.