Expedia: From A Humble Microsoft Subsidiary to A Standalone Powerhouse

As an online travel booking major providing everything from airline tickets, hotel rooms, car rentals, to cruises, and working “across time zones, hemispheres, cultures and languages”, Expedia is undoubtedly the world’s leading online travel service and the largest travel agency in the U.S. As for a company that has risen to such prominence in its sphere, the Bellevue-based travel behemoth does not have a very dramatic founding story. That being said, it has gone through a fairly circuitous route from low-key beginnings to the nearly “inevitable” online travel giant as it is today.

Let’s read on to figure out Expedia’s growth trajectory from a humble Microsoft subsidiary to a standalone powerhouse, grasping where Expedia came from as well as where it stands now.

The Birth of Expedia.com

Launched by Microsoft Corporation, Expedia.com debuts on web in late 1996 as one of the first online travel agencies: Microsoft Expedia Travel Services. The journey to turn the screen around from the travel agent into the hands of the traveler begins. A union between ‘Exploration’ and ‘speed’, the name ‘Expedia’ is born, and soon becomes synonymous with the new world of online travel.

Having begun “life” as a humble website, Expedia enabled consumers to make air, car, and hotel reservations online and to browse a library of multimedia travel guides. At first, the portal accepted bookings only from consumers, not from other travel agencies. Though, in those days most consumers were adopting the Internet to simply browse rather than to make a serious purchase; hence, it was not clear whether they would adopt an online service to purchase travel services.

At that time, Expedia’s future was so vague that the American Society of Travel Agents, responded to the business’s launch with a statement quoted in Travel Weekly: “There may be a small percentage of do-it-yourselfers who want to book electronically, but most people think their time is too valuable.” By and large, travel agents underscored the personal attention that people wished when they mapped out their vacation plans.

The person at Microsoft taking charge of the development of Expedia was Richard Barton, who then became Expedia’s president and CEO from November 1999 to March 2003. Initially, he worked in Microsoft’s CD-ROM division and was responsible for building out CD-ROM travel guides. Since the CD-ROM market was collapsing, Barton transferred to the multimedia group and came up with the idea of selling travel online. Immediately after presenting the concept to Bill Gates at the company’s annual product review, Barton obtained his approval.

A few months after its inception, around March 1997 to be precise, Expedia reported that it had booked staggeringly $1 million worth of travel reservations in a seven-day period, with about 80% accounted for airline bookings. Meanwhile, the competing online service Preview Travel took up to seven months following its launch in early 1996 to book $1 million a week in December 1996.

Later that year, Expedia upgraded its website and added several critical features, which included airline seat selection, real-time flight information, as well as an expanded directory of hotels and bed-and-breakfast inns. New destinations to its Expedia World Guide – the most popular feature of its website – were also added. Additionally, other improvements included consolidating the Flight Wizard, Hotel Wizard, and Car Wizard onto a single screen, thus reducing download time.

Then, in early 1998, the Microsoft subsidiary launched its Expedia Associates Program, which granted suppliers and other companies access to Expedia’s booking engine to set up co-branded websites. During the first year, several companies such as American Express Vacations, National Car Rental, National Leisure Group, and Hotel Reservations Network joined the program.

Toward the end of 1998, Microsoft expanded Expedia’s reach by launching an Expedia travel service in the United Kingdom. In its first three months of operation, Expedia’s U.K. site booked travel for an estimated 15,000 customers, representing more than £3 million of business. Approximately one-fourth of its business came from business travelers in small and medium-sized companies.

Until mid-1999, Expedia established various versions in the United States, United Kingdom, Germany, Canada, and Australia. In its third year of operation, the giant had become the 25th largest travel agency throughout the country and was projected to be named among the top ten by the end of the year.

Whereas Expedia had yet to yield a profit, the company claimed to generate impressively $250 million in travel bookings in 1998, which was projected to reach $750 million one year after. As regards the site traffic, Expedia’s U.S. website boasted 3.5 million daily visitors and weekly travel bookings worth more than $16 million. From 40 developers, the company had grown to more than 400 full-time employees, including around 250 customer service representatives who provided ticket fulfillment at Atlanta-based WorldTravel Partners.

Expedia As a Public Subsidiary of Microsoft & a Massive “Acquirer”

As the dot-com era of the late 1990s gathered steam, Microsoft decided to float a small piece of Expedia in an initial public offering (IPO)in September 1999. This marked the first time that Microsoft had spun off one of its businesses. Such a move revealed that the e-commerce landscape in general, and the online travel sphere in particular, had become established.

As for both Expedia and Microsoft, this turned out to be a smashing success. Launched on a buoyant market hungry for new online stocks, Expedia’s shares closed more than three times higher than the IPO price on their first day of trading on the NASDAQ. A stock market star was born.

At the time of its IPO, Expedia’s quarterly revenue stood at $15 million, with around two-thirds coming from transaction commissions and the rest from advertising. Net proceeds from the IPO were $72.8 million, of which the company planned to invest $10 million in product development, $30 million in sales and marketing, and $5 million for general and administrative expenses.

Notwithstanding that, overshadowing Expedia’s successful IPO was a lawsuit from Priceline.com that claimed that Expedia’s Price Matcher service infringed on its patents. Similar to Priceline’s online bidding service that enabled consumers to explicitly choose a price they were willing to pay, Expedia’s Price Matcher for hotels and airline tickets let consumers name their own price. Besides, Expedia got involved in another lawsuit filed by Reed Elsevier in November on behalf of its subsidiary, Cahners Travel Group, which claimed that Expedia breached a contract regarding the use of Cahners’ worldwide hotel directory database.

At the beginning of 2000, Expedia and Travelocity were locked in a battle for no. #1 amongst online travel services. Following its IPO, Expedia experienced more traffic at its site than Travelocity during the 1999 holiday season. Nevertheless, Travelocity’s planned takeover of Preview Travel and an alliance with Priceline.com granted it added strength in its competition with Expedia. When it comes to Expedia, the company launched a $50 million multimedia advertising campaign designed to position Expedia as a travel advisor. The campaign’s taglines were, “Don’t just travel. Travel right,” and “Where do you want to go today?”

The new millennium saw Expedia fall into a habit it’s maintained ever since. In February 2000, it made its first acquisitions, snapping up a pair of travel websites. Particularly, it paid $82 million in stock for VacationSpot.com Inc. of Seattle, a reservation network for vacation homes, condo rentals, and bed-and-breakfasts. In addition, Expedia closed its acquisition deal with Travelscape.com, Inc., a Las Vegas-based company specializing in discounted hotel rooms for approximately $95 million in stock. The acquisition of these two online lodging leaders gave Expedia listings for 65,000 properties worldwide, guaranteed the lowest hotel rates in 240 cities, and some two million room nights per year.

Notably, 2000 marked the first year that Expedia shifted its business model from one of primarily selling airline tickets to one that included more profitable lodging and package transactions. At the end of that fiscal year, the online travel giant received additional financing of $10 million from Microsoft and a capital infusion of $50 million from venture capital firm Technology Crossover Ventures. Hence, Technology Crossover gained a 7% interest in Expedia, with Microsoft retaining a 70% share of Expedia.

The year 2001 was also a good year financially for Expedia. Whilst the company failed to yield profit, its revenue more than doubled to $222.2 million, and its net loss was reduced to $77.1 million. Bolstered Expedia’s revenue could be partly attributed to the increased wholesale sales of inventory from lodging and travel package suppliers, which generated merchant income in addition to its traditional commission income stream from airline ticket sales.

By August 2000, Expedia committed further to its merchant model by acquiring TravelScape, which continued to maintain its format and operate independently. Additionally, Expedia did establish a marketing alliance with eGulliver.com, a lead generation service for travel agents, that added links between each company’s websites. In late 2000, Expedia and Ziff-Davis Publishing jointly launched Expedia Travel, a bi-monthly travel magazine that began with a circulation of 200,000. Around that time, the Bellevue-based travel behemoth also enhanced its service for business travelers by embedding a feature that allowed one person in a company to book travel for a group.

In regard to the lawsuit between Expedia and Priceline.com, they managed to settle their patent disputes when Expedia agreed to a royalty arrangement with Priceline.com. That settlement allowed Expedia to continue to offer its Price Matcher services. In March 2001, Expedia came up against a different challenge when Northwest Airlines and KLM Royal Dutch Airlines stopped paying commissions on ticket sales to Internet-based travel agents. Whereas competing site Travelocity promptly added a $10 surcharge on all Northwest and KLM tickets, Expedia reached an agreement with the two airlines to avoid having to add such a surcharge, whose terms of the agreement were not disclosed.

Earlier in 2001, anticipating the launch of the airlines-backed online travel site Orbitz, Expedia launched a new flight search platform, Expert Searching and Pricing (ESP), after four years of development. Designed to integrate several existing site features into one single user-friendly platform, ESP granted Expedia’s consumers more choices and more control over their travel planning. Additionally, Expedia introduced another program called Bargain Fares, which empowered consumers to purchase blind tickets at a discount.

Remarkably, whereas Expedia had predicted that it would not become profitable until mid-2002, the company reported a surprising profit in its third-quarter ending March 31, 2001. The company’s reported profit of $4.4 million, though, was before noncash expenses such as stock options and amortization. With those charges included, the company’s quarterly loss was $17.6 million, compared with a quarterly loss of $66.5 million the previous year.

New Growth Pages for Expedia

In the following years, Expedia started expanding internationally, launching sites in Holland and Italy. Besides, the company entered into a joint venture in France with railway operator SNCF, leading to a co-branded site launched at the end of 2001. Through an alliance with online retailer Amazom.com, the two companies opened a travel store at the Amazon.com site.

Beyond any doubt, all online travel services were negatively affected by the events of September 11, 2001, when terrorists flew hijacked airliners into New York’s World Trade Center and the Pentagon. Travel bookings and stock prices dropped dramatically, with Expedia reaching a 52-week low of $19.64 after stocks resumed trading. Notwithstanding that, the company had been growing when the disaster occurred with gross bookings up 78% compared to the previous year. By early October, its stock rebounded to more than $30, and online travel bookings reached previous levels within a month after the 9/11 event.

For the quarter ending December 31, 2001, Expedia reported its first “real” bottom-line profit of $5.2 million on revenue of $81.8 million. The company’s pro forma profit excluding noncash and nonrecurring charges reached $18.9 million for the quarter. Such a high figure of revenue was boosted by strong activity in hotel and vacation packages, which offered higher margins than airline ticket commissions. It was in the first quarter that Expedia surpassed its rival Travelocity.com in gross travel bookings, with $704 million compared to Travelocity’s $630.2 million. For the same quarter, Travelocity posted a $25 million loss. At the end of 2001, Expedia changed its fiscal year to match the calendar year and reported six-month revenue of $161.2 million and net income of $2.1 million.

In July 2002, Expedia continued to acquire Seattle-based Metropolitan Travel – one with around 230 corporate customers – in a move that positioned the company to compete within the corporate travel landscape. Following the acquisition, the company launched a corporate travel site, Expedia Corporate Travel Services, which gave clients access to both call-center reservation agents and online booking tools. Expedia Corporate Travel, a full-service travel management company, was formally launched in November 2002.

As regards its revenue streams, the figure did climb dramatically in 2002, reaching $590.6 million, while its net income jumped to $70 million. Expedia’s strong financial results could be attributable to a significant and early investment in technology and diversification into wholesale accommodations, where the company could set prices and control margins. Indeed, up to 60% of Expedia’s 2002 revenue came from the sale of wholesale accommodations, which the company called its merchant business.

The Acquirer Ending Up the Acquired

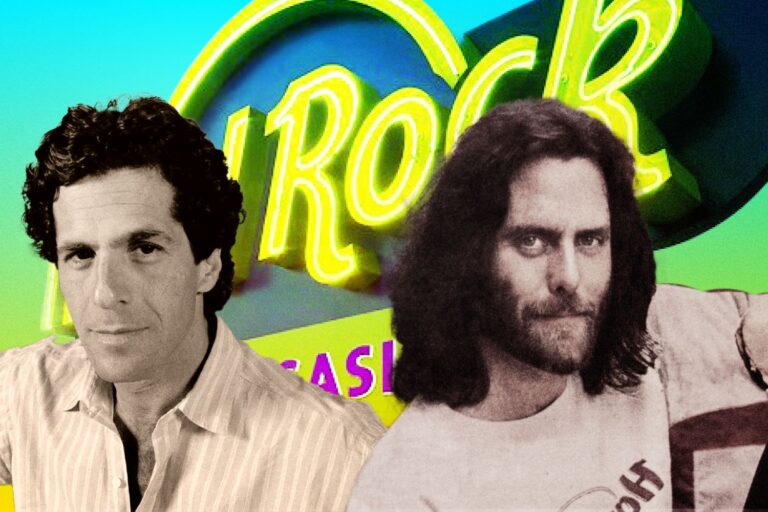

In 2003, the acquirer became acquired when a majority stake in Expedia was bought by the company that would later be known as IAC, Interactive Corp., a leading Internet and media company led by Barry Diller. That brought upper-level management changes as IAC consolidated its ownership of Expedia. CEO Richard Barton announced in February 2003 that he was resigning as CEO to take a year off with his family. He became a director of IAC and also consultant to Expedia’s new CEO, Erik Blachford, who was formerly president of Expedia North America. Another executive, Senior Vice-President of corporate travel Byron Bishop, also left Expedia around this time.

Despite all changes, Expedia continued to outperform expectations in the first quarter of 2003, with net income quadrupling to $26.9 million on revenue of $198.8 million. The company achieved outstanding growth in its travel-package business, which accounted for 30% of quarterly revenue. Expedia also planned to bolster its corporate travel offerings in the coming year by going after accounts of large corporations.

The Birth of Expedia, Inc & Its Growth Onward

In 2005, IAC celebrated their travel businesses’ success by creating and spinning off one public company, Expedia, Inc. Under the leadership of Dara Khosrowshahi, Expedia, Inc. embarked upon its independent journey – capitalizing upon the momentum from the past 10 years to build and form a Fortune 500 company.

During these early years, Expedia, Inc. began to grow its portfolio and ignite its online presence. After the successful IPO, the company was officially added to the S&P 500. New lines of businesses including activities and technology solutions such as Media Solutions and Partner Solutions were born. Since then, the company has stood out as a forerunner in the industry, providing innovative offerings that leverage technology to connect partners to travelers in novel and meaningful ways.

As the decade wore on, Expedia returned to its old acquiring ways, opening its wallet for assets such as European hotel reservation company Venere, and the self-explanatory CarRentals.com. In 2011, the focus on the Asia Pacific region was to build joint ventures and expand partnerships with Air Aisa, Tencent and eLong. By 2012, the company maintained its solid growth pace within the Europe region with Via Egencia and Spun off TripAdvisor to the public market.

The financial crisis of the late 2000s hit Expedia’s business performance hard, driving its stock down to a new low in early 2009. The bad times did not last long, though. Once the world crawled out of the economic murk, online travel booking grew exponentially, and Expedia’s fundamentals and the stock price started to improve accordingly.

So far, the 2010s had been a time of expansion and consolidation for Expedia and the occasional divestment. At the end of 2011, Expedia spun off TripAdvisor into a separate, publicly-traded company. Later, TripAdvisor turned out to be an energetic and ambitious rival although because of a handful of adjustments, its share price was well down from the peaks it hit in 2014. The story of hotel search specialist Trivago was quite similar to that of TripAdvisor, yet with a different ending. Expedia gained a controlling stake in TripAdvisor in 2013 and held on to it even through the company’s 2016 IPO. Since then, Trivago’s stock price has risen more or less steadily and is up by almost 87% across its lifetime.

Nonetheless, TripAdvisor and Trivago were hardly Expedia’s only revenue-producing units. The company continued to pack new strategic assets into its suitcase, acquiring familiar names such as Travelocity, HomeAway, and Orbitz Worldwide in the busy year of 2015. Since then, it has slowed the pace of “shopping” yet has still kept an eye out for attractive buys-out.

From A Humble Expedia.Com to Finally A Glorious Expedia Group

The year 2018 witnessed the shift from Expedia, Inc to Expedia Group, which recognized the 20+ year journey to a vast two-sided platform, home to a multitude of travel brands and technology solutions. The focus of the “group” turns towards working better together, bringing brilliant minds across countries, teams and brands together and turning away from siloed work.

Whereas the “black swan” COVID-19 pandemic has disrupted the world, it does rally Expedians like never before. Though, the online travel behemoth has acted fast, launching a plethora of recovery initiatives designed to support the business, their partners, destinations and industry.

The Bottom Line

From a humble Microsoft subsidiary, Expedia has undoubtedly been on phenomenal growth, growing to be a standalone powerhouse and riding the crest of a wave within the travel landscape. Whilst the future remains unseen, such dynamic top-line growth can be projected to continue for Expedia – since, after all, the broader travel market still has legs.