COVID-19 Aftermath: Burden Falls Mainly on Small Businesses

While the discussion on reducing the economic consequences of the COVID-19 pandemic response often focuses on macroeconomics, a decades-old observation by renowned economist Paul Krugman comes to mind: “Countries do not buy or sell goods overseas, companies do.” The pandemic-induced slowdown first and foremost affects the real economy – made up of businesses and the people who work for them.

Within this business world, small companies are likely to suffer more than larger ones because they tend to be more vulnerable with fewer resources to adapt to a rapidly changing context. Even when the short-term effects end, the long-term economic impact will ripple for years.

Small Businesses Are Most Vulnerable to COVID-19 Impacts

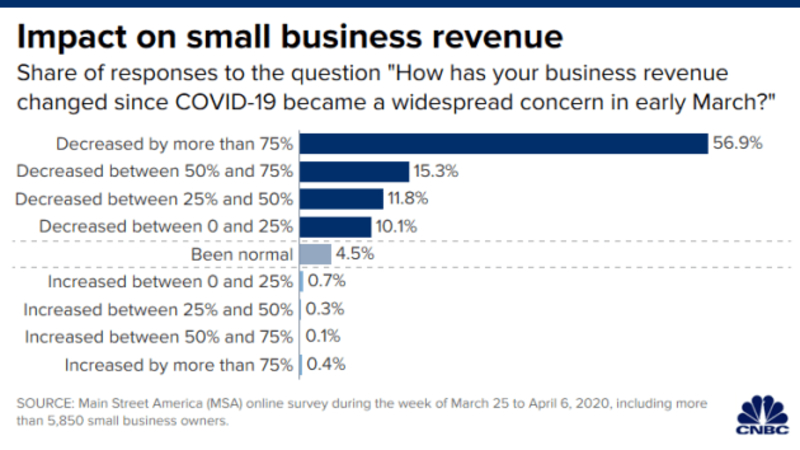

Record Revenue Loss

Small businesses cover 99% of all businesses and employ 50% of the US workforce. The pros of running a small firm is that you’re able to stay agile and pivot almost on demand as the market changes. However, on the flip side of things, since so many small businesses are lean and bootstrapped, it does not take much disruption for normal day-to-day operations to feel that squeeze — especially their bank accounts.

Measures to contain the virus, such as lockdowns and quarantines, caused devastating ripples to business operations and disrupted international supply chains. Sales decreased significantly and inputs were difficult to reach. In other words, small businesses got hindered both in demand and supply.

After surveying 1,500 of its small business owners throughout the US, Goldman Sachs reported that approximately 75% said they might not be able to exist in 3 months because of the drop off in sales. Nearly two-thirds of micro and small firms said their business operations were strongly affected by the crisis, compared with about 40% for large companies.

Hospitality and travel are two of the biggest industries impacted by COVID-19 thanks to travel cancellations, restaurant and bar closures, and low consumer confidence. Manufacturing and construction have largely held off on layoff decisions, but these industries could suffer the strain as consumer demand drops.

Most small businesses lack the cash reserves to weather a month-long interruption, and forecasts indicate more than 2 million workers could lose their jobs in just one week as a result of the coronavirus pandemic. There is also possibility of a “startup depression,” wherein new companies don’t enter the job market because of the pandemic.

The effect on micro, small and medium-sized enterprises is especially severe, partly because they are overrepresented in sectors most strongly hit by the crisis, such as accommodation and food services, or wholesale and retail services. Indeed, small businesses are particularly vulnerable: they tend to have fewer assets and limited cash reserves to cushion the lockdown-induced liquidity shortages.

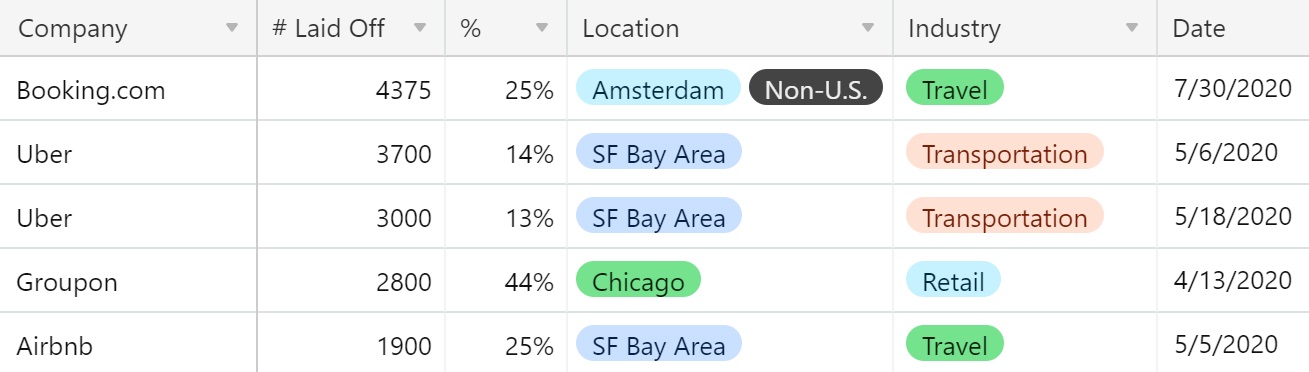

Highest Layoffs in Several Years

A precipitous surge in unemployment continues to shake the US workforce in the wake of COVID-19. Total claims have reached 35.7 million until April 6, according to Main Street America.

The challenge is especially acute for small businesses (those with 500 or fewer employees), which account for a disproportionate share of the vulnerable jobs. Before COVID-19, they provided nearly half of all US private-sector jobs, yet they account for 54 percent (30 million) of the jobs most vulnerable during COVID-19.

Given the distribution of industries and occupations in each of the states, 42 of the 50 states will have a larger share of their vulnerable jobs in small businesses than in large ones. In California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas the number of vulnerable small-business jobs ranges from 1.0 million to 3.5 million per state.

Even though initial steps are underway to ease lockdowns, up to a third of all US jobs remain vulnerable. One of the challenges for policy makers and executives is figuring out how to get these employees back to work. Yet because they employ so many people, the associated job loss would aggravate the economic downturn created by the pandemic.

On the Verge of Shutdown & Bankruptcy

Small businesses face more severe resource constraints than larger firms and thus find it harder to survive when negatively affected by the COVID-19 crisis. Not surprisingly, one-fifth (21%) of small businesses reported that they risked shutting down permanently within three months.

Youth-led firms were also at higher risk of permanently closing their business. Even after taking into account that youth-led firms tend to be smaller, it appears they find it harder to adapt to turmoil. Possible reasons include lack of diversification, social networks, experience, and access to resources.

Data also indicates that young entrepreneurs have a somewhat different attitude to government support measures during the COVID-19 crisis. Young entrepreneurs found it easier, on average, to access information and benefits from COVID-related government assistance programs compared with older respondents. When asked what the government could do to help, young entrepreneurs emphasized support in the short term to reduce costs. They were significantly more likely to view rent subsidies as most helpful, for example. Employment programs and support to self-employed people were also popular among young people.

How Small Businesses are Coping With COVID-19 Crisis

#1: Utilize remote collaboration tools

Shifting to remote work is not that easy. Fortunately, there are several tools for facilitating team interaction: from video-conferencing to project management, and time-tracking. In the wake of COVID-19, remote collaboration tools serve as great assets to your business. Most of them come in free light versions as well as more complex paid versions packed with additional features.

#2: Adapt your services to ‘a new normal’ in consumer behavior

The outbreak has caused a massive influence on what and how people purchase. With more than one-third of the world’s population being under some form of lockdown, consumer behaviors are changing dramatically. Small businesses that have ability to adapt to changes quickly are facing unprecedented demand for products and services that can guide people through life under quarantine.

Some businesses were able to adapt to the outbreak fast, forcing the ongoing evolution of their products further, faster and in more fascinating ways than ever before:

- LifePoints, an app to reward users for time spent at the gym, has released a new version of its fitness app to reward users who are staying at home.

- Boxcar, New Jersey-based parking application transforms into food delivery app.

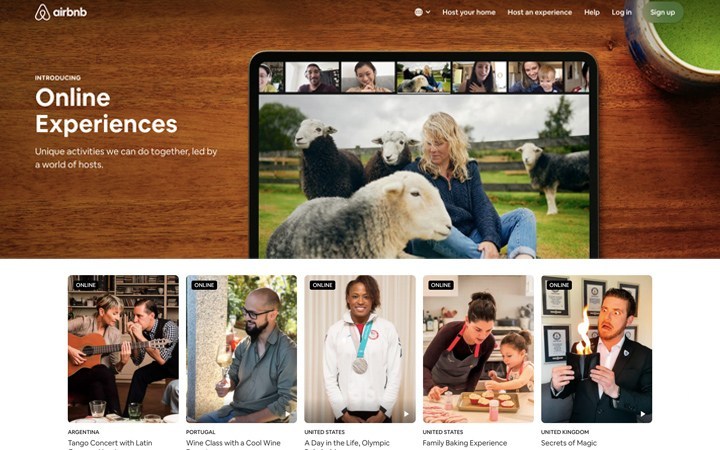

- Airbnb launches ‘Online Experiences’ that include virtual hangouts with goats and cooking classes.

#3: Choose a strategy for communicating with your customers

As part of your strategy to survive the coronavirus, planning for effective business communication during the lockdown is your #1 objective. If you rarely used the internet for business previously, it’s time to increase your social network presence.

Update your website to let your clients know that you are working remotely during the quarantine. This will not only enable you to keep some of your leads but also instill a sense of reassurance into your customers. Transparent communication will ensure that they come back to you after the lockdown.

#4: Change your marketing and sales strategy

Change is surely the most adequate coronavirus business response. You will have to adapt your business processes to physical and financial limitations. Here are some ideas you could start with:

- Offer online deals: discounts, certificates, pricing changes, etc.

- Focus on serving your customers through digital channels. Offer consultations and advice through messengers, face-to-face video conferences, online broadcasts, etc.

- Conduct online marathons, questions & answers, and video product demos.

- Offer additional services that are in demand during the quarantine, such as pick up services of a wrapped/sealed order without entering the store, “non-contact” food delivery, etc.

In the wake of coronavirus, business continuity is your primary goal. These steps will help you retain customers. Show them that your company is socially responsible and well-equipped to survive COVID-19.

#5: Consider an online shift

This will not apply to all businesses, but for some entrepreneurs, a complete online shift will be a viable strategy. Most citizens of countries with developed economies own smartphones and mobile devices, are ardent Internet users and will look for products and entertainment online. Offline businesses can quickly switch to working online by utilizing bespoke app development. For companies offering delivery, broadcasting, and event services an online shift may be highly relevant.

One way or the other, the COVID-19 outbreak will subside, and the global economy will embark on the long and painstaking journey of recovery. How well your business survives the crisis will depend not only on its inherent resilience but also on how well you prepare your company for the coronavirus lockdown and its limitations.

Post-COVID Phase: What to Learn for Small Businesses

Resilience

Pro-competitive approaches build the adaptive capacity of the business every time a shock hits, as employees learn how to adjust and start to take advantage of each new round of change. Resilient and agile approaches maintain competitiveness by ensuring that a business can weather the storm in as good shape as before, or even stronger. Resilient firms are getting through the pandemic with their basic form intact. They often have a deliberate strategy – sometimes concocted beforehand – that temporarily scales down the business in a manner that will allow it to resume fully later on. One way they do this is by moving to back-up-products, suppliers, or markets.

Resilient approaches use win-win options that pay off now and/or have added social, environmental, and economic benefits. This can lead to a virtuous cycle as a company strengthens its capacity to change and its alignment with new business realities. As a result, resilient firms emerge from the crisis in as good shape as before, if not better. Resiliency during the pandemic has entailed strategies such as shifting the sales mix towards online channels, sourcing from new suppliers or learning to telework. About 60% of the enterprises that responded to the ITC COVID-19 survey adopted this approach to cope with the coronavirus.

Agility

An even more constructive reaction to risk is to take advantage of it. Agile firms change form in response to the current situation, however new it is. This may include customizing or proposing new products or business models according to new market trends. Agile firms have created new products and services such as designer masks and rapid testing technologies during the pandemic. When lockdowns prevented them from opening, they lent their employees to other active businesses in essential industries. Roughly 21% of the companies that responded to the survey adopted this strategy to deal with the pandemic. Here is where it is good to be small, because it is easier for small firms to take swift decisions and develop new products quickly.

What SMEs may lack in productivity, they gain in agility. Indeed, the ITC COVID-19 survey reveals that small and medium-sized companies were far more likely to adopt agile responses to the crisis than larger firms. Large businesses, for their part, were significantly more likely to adopt a resilient approach than SMEs, underscoring their greater capacity to ride out the storm. The key take-away from this analysis is that while large companies can afford to stay put and be resilient, small companies must either adapt to the crisis in an agile manner or collapse.

Digitalization

Spurred by the need to accommodate remote working, we are living in an increasingly dematerialized world. Zoom calls and cloud computing make physical presence optional. The pandemic has forced companies to accelerate transformational digital investments. This has consequences for the third trend, jobs.

Job losses will be severe even at healthy companies. Some companies have paused restructurings, but a combination of weaker economic growth and new digital investments is going to hold down the need for employees. Physical sales forces will give way to digital marketers. Business re-engineering plans – which mean workforce restructurings – have new urgency. When survival is at stake, tough decisions can be made.

Digitalization and job losses have, of course, been with us for some time but emergencies like pandemics force action. COVID-19 is accelerating the pace of change. The outcome could be a world with greater opportunities for more people, a world of healthier people. Or it could be a dystopian future in which a small number of wealthy knowledge workers and their political allies use the tools of surveillance and digitalization to protect their privileges against a far larger number of have-nots. The decisions we make as the panic subsides will go a long way to answering these questions. This is not a time for rashness, for decisions that are made in times of crisis tend to get locked in and remain. This time is one that will test businesses and countries alike. Leadership at all levels will be put to the test.

The Bottom Lines

Small businesses are a recognized proving ground for entrepreneurs, a vibrant source of innovation and competition, and an essential source of employment. They are suppliers and customers to the broader economy and deeply embedded in local communities. Governments around the world realize that small businesses act as a lynchpin connecting the pandemic to broader economic recession. In addition to addressing the health crisis, they have scrambled to alleviate the impact of COVID-19 on small firms, introducing policies to help them cope with the short-term financial risks and long-term business implications. If these measures succeed, they will reduce layoffs, prevent bankruptcy, encourage investment, and help economies recover as soon as possible in the aftermath of the crisis.