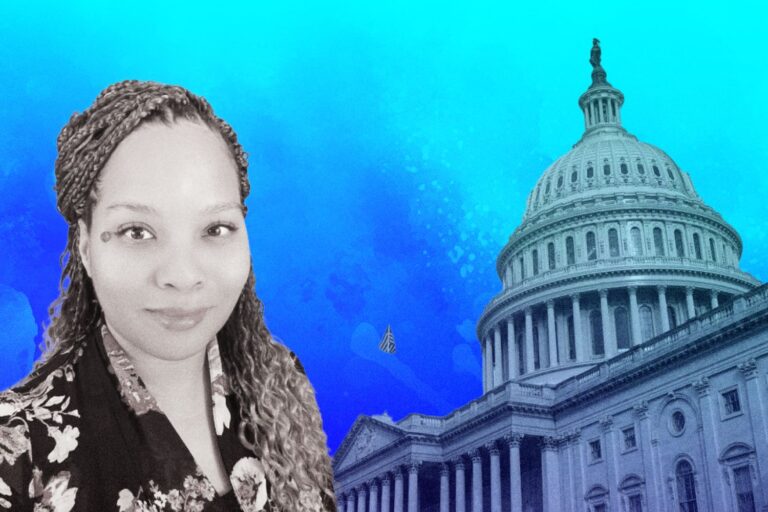

SBA Administrator Isabella Guzman: The Biggest Voice for America’s Main Streets

Amidst a challenging and critical time for Main Street, Isabella Guzman has taken the reins of Small Business Administration (SBA), which has become synonymous with federal policy toward small business and entrepreneurship. It’s definitely not a straightforward job especially when the SBA found itself in the public spotlight more in the past two years than in probably any year during its nearly seven-decade existence.

So, how would the new administrator lead this agency and “shepherd” small business communities through this socio-economic crisis? Let’s read on to uncover!

Isabella Guzman: Who Is She?

Before delving into the new administrator’s strategic plans during her second tenure at the agency, it’s critical to take a closer look into Isabel Guzman’s inspirational story.

Her Entrepreneurial Foundation

“Growing up in an entrepreneurial family, I learned firsthand the ins and outs of managing a business from my father and gained an appreciation for the challenges small business owners face every day.” – Isabella Guzman, Administrator of the U.S. Small Business Administration

Whilst Isabella Guzman has been well proclaimed for her public service career, fewer people know that initially, she was an entrepreneur herself and had grown up within an entrepreneurial family.

“I grew up in a small business family. My father owned and operated multiple veterinary hospitals in California, and, as a kid, I loved being at his clinic, watching him interact with his clients and seeing how much he and all the other small business owners meant to the neighborhood,” shared Guzman, recalling her childhood.

“As I grew older and began working with him after school and on weekends, I started to understand how much work he put in to his business—how challenging it was to have his workday 100% focused on his clients and treating their animals, and then shifting hats during lunch and into the evening to keep up on the books, compliance, ordering, payroll, and workforce issues.”

Having a hands-on understanding of unique challenges small businesses encounter as well as their indispensable role as “the fabric of our neighborhoods”, Isabel Guzman has set her heart on empowering these businesses to hit the ground running. Before pursuing public service career, she has started her own business and become an advisor to fellow founders in terms of accelerating technology commercialization and guiding small business contractors to leverage the federal marketplace.

Her Dedication to Empowering SMBs

On March 17, Isabella Guzman has been confirmed as the 27th Administrator of the Small Business Administration (SBA). President Joe Biden’s nominee with broad bipartisan support in the Senate, passing by a vote of 81-17.

This is not new territory for Guzman, given her first tenure at SBA during the Obama Administration as Deputy Chief of Staff and Senior Advisor, where she oversaw the agency’s adoption of enhanced policies, technology, and program initiatives to make SBA more accessible to entrepreneurs of all backgrounds.

Most recently, as the Director of California’s Office of the Small Business Advocate – the largest state SMB network across the country, Isabel Guzman served 4 million small businesses, together with 7.1 million employees, raising her voice for small businesses and promising startups while advocating for numerous initiatives to shepherd an influx of federal cash to secure their financial health.

Besides, Guzman and her team made tremendous efforts to connect entrepreneurs in every community with the resources needed. In fact, when it comes to the nation’s economic recovery from the COVID-19 pandemic outbreak, Guzman has arguably one of the most important Cabinet roles in President Joe Biden’s administration – who has worked diligently and relentlessly to help small businesses gain financial relief amidst the economic crisis.

“Having successfully navigated a high volume and sophisticated business environment in California, I am confident that Isabella Guzman understands the urgent and complex needs of this moment,” affirmed Senator Alex Padilla (D, Calif.). “Her expertise is critical to our nation’s economic recovery. She’s ready to hit the ground running and will assure the SBA helps small businesses across America not only to survive the pandemic, but to build back better than before.”

“SBA must continue to be a lifeline for small businesses in the months ahead, and I am confident that Isabel Guzman is the best person to lead the agency out of the pandemic and through the economic recovery to follow,” said Senate Committee on Small Business & Entrepreneurship Chair Ben Cardin (D-MD). “Mrs. Guzman’s commitment to equity and her deep knowledge of the needs of small businesses will make her a strong advocate for all small businesses in the Biden Administration. I am looking forward to working with Mrs. Guzman as we in Congress work to fine-tune SBA to better meet the needs of small businesses in Black, Latino, Native, and other underserved communities.”

“I bring all those experiences with me to my position today, but most of all, I bring a passion and deep respect for small businesses and innovative startups and the impact they have on our communities, our nation, and the world. They define our Main Streets, deliver the products and services we depend on every day, and innovate to solve global problems,” stated the new SBA Administrator.

“Throughout my public and private sector career, I have been dedicated to helping small businesses grow and succeed. Now more than ever, our impacted small businesses need our support, and the SBA stands ready to help them reopen and thrive.”

– Isabella Guzman, Administrator at SBA

Isabel Guzman’s Top Priorities as The Next SBA Administrator

#1. Delivering Pandemic Relief to Recovery

Beyond any doubt, the country remains in the depths of economic pain with small businesses hit harder by the pandemic. Whereas new business creation spike has been observed, many incumbent SMBs still struggle to stay afloat. Actually, it’s too early to tell whether that spike is a blip or a reversal of secular downward trends in entrepreneurship that existed prior to the pandemic.

“This pandemic and the resulting economic crisis have gone on longer than anyone anticipated. Right now, millions of small business owners are wondering how much longer they can hold on—the struggle is unrelenting,” noted Isabel Guzman. “I witnessed this firsthand in California. At the SBA, we are here to help.”

Confronting the complexity of COVID-19-related impacts, especially in terms of cash flow, she affirmed, “Immediate relief is really critical. Because businesses have been devastated. The cash flows have disappeared or shrunk completely. Their markets have been impacted, and so focusing on providing access to capital, whether it’s relief grants or loans or assistance on the fundraising side, that’s really important.”

Upon Guzman’s first days taking the office, she did nearly triple the amount of funding businesses could receive from the SBA’s Economic Injury Disaster Loans (EIDL), which have worked as a critical lifeline for so many impacted businesses. “Beginning the week of April 6, EIDL maximum loan amounts increased to $500,000 from the previous cap imposed of $150,000. And our team is busily reaching out to those eligible who applied under the old cap.”

In addition to EIDL, more financial incentives have been fostered to weather small businesses through financial instability. “Through the American Rescue Plan Act, which was signed into law on March 11, by President Biden, we’re working diligently to release billions more in much-needed aid—with $15 billion in flexible disaster program grants for the smallest and most severely impacted businesses, a $28.6 billion Restaurant Revitalization Fund grant program, a $16.2 billion Shuttered Venue Operators Grant program, and more than $7 billion more for Paycheck Protection Program loans.”

After all, she did stress, “We intend to be as entrepreneurial as the small businesses we serve. And, with every loan, every investment, every grant, and every connection we make with our small businesses and innovative startups, we will work to be sure that we’re delivering our services equitably, recognizing the changing face of entrepreneurship.”

#2. Advocating For Inclusive & Equitable Entrepreneurial Ecosystems

“Women- and minority-owned businesses were already facing historic barriers limiting their growth, and that opportunity gaps have only widened during the pandemic. That is why it is imperative that we review every program in the SBA portfolio to ensure equity is a top priority.” – Isabella Guzman, Administrator of the U.S. Small Business Administration

The hard truth is that, despite significant equality-driven initiatives, systemic racism remains a persistent roadblock for women and minority SMBs owners. Unfortunately, this reality has got worse now since they were disproportionately impacted by the pandemic. Actually, according to the report by Progressive Policy Institute in 2020 on the demographics of business ownership and performance, the Blacks and Latinos own businesses at a rate vastly disproportional to their population shares. Furthermore, businesses owned by men are, on average, larger in revenue and employment than those owned by women.

Acknowledging that, “together with President Biden and Vice President Harris, I’m intent on making inclusion and equity top priorities. At the SBA, that often means making sure we’re reaching the smallest of the small businesses—particularly the businesses that do not have in-house lawyers, accountants, or special connections that give them an edge,” affirmed Guzman.

She further explained, “We are laser-focused on both design and implementation of our programs because we know it’s not just about access, but also about connection. We need to meet all of our small businesses where they are.”

Up to now, the SBA has offered an array of resources as well as launched various programs to empower minority and underserved businesses to “reset and retool” during these uncertain periods. Given that, “we’re looking at doing more through policy and process to remove those historic impediments, and partnerships and outreach to more equitably reach and distribute our services to business owners of color and women-owned businesses.”

Amongst major steps to support the most vulnerable SMBs is the Restaurant Revitalization Fund, which prioritizes women, veterans, and socially and economically disadvantaged businesses in its first 21 days, as well as designate set-aside funding for the smallest businesses.

Besides, the SBA has plans for Community Navigators Pilot program, ensuring that small business resources are more accessible than ever to entrepreneurs with disabilities, veterans, women, immigrants, minority small business owners, and those from rural and other underserved communities across the country.

“This $100 million grant program will utilize a ‘hub and spoke’ model to enlist trusted, culturally-knowledgeable community navigators to conduct targeted outreach to small business owners that lack access to critical resources, services, capital and/or networks. The local navigators will include private nonprofit organizations, SBA resource partners – including Small Business Development Centers (SBDCs), Women’s Business Centers, and SCORE – Tribes, states, and local governments with demonstrated excellence in outreach and service/resource delivery to small businesses in underserved communities,” she explained. “This is a critical step to help ensure SBA’s great resources reach all our aspiring and established entrepreneurs for greater equity and access to opportunity to reopen, startup, grow, and be resilient.”

After all, the new Administrator did note that, “This is just the tip of the iceberg. We know much more work needs to be done to level the playing field.”

#3. Exposing the SBA to the Public

In addition to these two urgent pandemic-related concerns, Isabella Guzman also focuses on another chief and long-term plan to raise public awareness of this agency. “The SBA has always been the best kept secret in government, and we don’t want to be that,” commented the new Administrator. “We want to be known.”

“We know that government can be hard to navigate, and we’re trying to simplify our processes. Our customers are small business owners who have to wear so many hats and have so many responsibilities and need a team behind them.”

In fact, a large number of small businesses are only aware of the SBA due to the media attention received by being the middleman for various stimulus programs although this agency has offered numerous services targeted at small businesses well and beyond dolling out loans and grants. Indeed, the SBA has struggled to get the word out about its services for ages.

This could be attributable to low level of “public awareness”. Yet, things could improve as the SBA has an opportunity to leverage the enormous PR it received during the pandemic to get itself exposed to the entrepreneurial world.

“We’re going to be looking at all of our programs completely and trying to apply a customer-first and technology forward approach as well as an equitable approach,” Isabel Guzman stated. “We intend to make sure that we’re meeting businesses where they’re at in their current situations and providing products and services that can best help them grow.”

In particular, some courses of action include recruiting brighter talents for the agency, increasing their partnering outreach to government departments, local organizations and chambers of commerce while focusing on issues that are top of mind for several SMB owners, such as exit strategies.

“Our small business development centers, in particular, are training up on ESOPs (Employee Stock Ownership Plans) and other types of alternatives for exit strategies,” she added. “We know that it’s a big challenge to sell or hand down a business and we don’t want those businesses to disappear.”

Whilst solutions for upgrading public awareness had been implemented in the past with saddeningly mediocre outcomes, Isabel Guzman stands a high chance of successfully addressing this long-term concern by leveraging the SBA’s notoriety from the pandemic into a message that enables more small business owners to take advantage of all the resources it offers.

The Bottom Line

“I want small businesses to be recognized and feel like the giants they are in our economy. I will act as their voice every day and work hard to ensure that happens.” Undoubtedly, Isabel Guzman has become the nation’s biggest advocate and voice of small businesses in America, given her new role as the SBA Administrator and her pivotal dedication to empowering Main Streets for years.