Is the Global-Renowned Technology Hub Celebrating Its Last Moment?

Disruption is the term that entrepreneurs, VCs, and all related to the economy want to reach. Over the last few decades, we’ve been experiencing myriad advances and innovations that dramatically transformed how mankind lives. Along with the new technologies that played an important role in the throne of businesses, people started to gather as groups to support one another. These groups referred to as the hubs that all the top players choose to locate their offices.

In the list of powerful technologies’ centers in the world, Silicon Valey seems to sit on the front row since its inception.

The term Silicon Valley refers to a region in the south San Francisco Bay Area. The name was first embraced in the early 1970s because of the region’s connection with the silicon transistor, which is used in all modern microprocessors.

It now houses the headquarters of many of the biggest high-tech companies in the world, including more than thirty Fortune 1000 companies and thousands of exciting startups. Furthermore, one-third of all venture capital investments in the country are made in Silicon Valley.

Silicon Valley has profited over the past 20 years from a once-in-a-lifetime convergence of favorable circumstances. The emergence of the smartphone (among other widely adopted technological advancements), American primacy, the availability of cheap finance, and, probably most importantly, a tolerant regulatory environment has all combined to produce a historic concentration of wealth and power. The titans of the Valley and their descendants have been free to roam far ahead of legislators, watchdogs, and tax codes.

As its reputation dominates the press, this hub start to get many criticisms from public and the entrepreneurs that are not satisfied with how the Silicon Valey is. Many individuals have been raising concerns on the future of this innovation Centre of the world. Many research and big powerhouses in the game have shown the shortcomings of the hub and reasons for its no longer worth position. Let’s read on.

When the Gods Pulled Back Down to Earth

The first quarter of 2022 marked the impressive milestones for the big titans in the tech hub. The iPhone maker became the first publicly traded company to hit a $3 trillion market cap, with Microsoft and Google not far behind.

By the beginning of 2022, the already dominant tech industry only looked destined to get greater. But the way the year ended was very unexpected. A perfect storm of aspects has pushed a dizzying reality check for the once high-flying software industry, making it one of the biggest losers of 2022.

The sell-off started in winter 2021 and extended through the first half of 2022 amid concerns of the omicron variant of Covid and a more aggressive tone from the Federal Reserve.

Since then, the Ukraine war, rising oil costs, and increased inflation have all worked together to destroy markets. The end of April 2022 saw one of the toughest hits to the tech industry as Amazon revealed worse than anticipated results and a pessimistic outlook for the rest of the year.

Over the course of the year, consumer and advertiser spending, which makes up the core business of many major names in tech, was affected by shifting demand for various tech products from the epidemic era, rising inflation, rising interest rates, and fears of a potential recession.

The outcome was a massacre beyond anything the tech sector has experienced in the previous ten years.

In the past few months, tens of thousands of tech workers have lost their jobs; even internet giants like Amazon have reduced employees. The traditional villains’ laundry list includes inflation, a hawkish Fed, weak consumer demand, and reduced advertising spending. Of course, there is also the potential for a 2023 recession.

Yet, the figures are startling for a sector that has experienced a decade of growth: 11,000 positions cut at Facebook parent Meta, 10,000 at Amazon, and perhaps 7,500 at Twitter thus far. Moreover, Stripe, Salesforce, Lyft, DoorDash, and Carvana have all experienced layoffs.

Last year 2022, the market has completely destroyed tech equities. Alphabet, Amazon, Apple, Meta, and Microsoft were all down, correspondingly by 19%, 31%, 13%, 38%, and 17%. They are all performing worse than the S&P 500, which makes them lucky. In 2022, Netflix has decreased by 65%, Shopify by 70%, and Lyft by about a third by June 2022.

These huge layoffs, sharp decreases in valuation, and hiring freezes at other Big Tech companies have given new fuel to the issue that is becoming more and more popular: Is Silicon Valley’s glory coming to an end?

This question has been asked since the Silicon Valley cannot improve all the shortcomings that’s killing this tech hub softly. Over the last few years, many warning signs have popped up and threaten the position of this innovation center.

The term “innovation center” is the honor stage name for the Silicon Valley, but to look at the reality, is it really innovative? That’s the big misgiving of the public since this center cried off all the vows.

The False Promise of the Global Innovative Center

The hype machine in Silicon Valley has long been charged with preempting reality. But in recent years, the IT sector’s detractors have observed that its most ambitious plans — the concepts that actually have the power to alter the world — appear to be getting further and further away. The great profits produced by the industry in recent years has generally been thanks to concepts, like the iPhone and mobile apps, that showed up years ago.

Silicon Valley will claim that everything is operating as it should in public. They note that because services like Facebook are free, the benefits aren’t represented in the productivity figures. The Founders Fund general partner Keith Rabois claimed in a recent CNBC interview that the Washington drive to break up Big Tech was nothing more than a political invention.

He claimed that everyone outside of the capital city enjoys technology exactly as it is.

Yet, tech executives are aware of a problem in private. The incentives surrounding who receives cash for which idea are misaligned, and funding is being allocated in ways that harm the economy.

Some entrepreneurs recognize Silicon Valley’s guarantee to save the world was always a piece of manipulation — a way to get employees to buy in to long working hours and to get consumers to completely disregard growing monopolization.

One veteran entrepreneur informed that venture capitalists would be penalized for missing a hype cycle more than for failing to invest in cutting-edge, practical technologies.

VCs who ride the most recent hype cycle are more likely to receive markups, which are subsequent investments from other VCs made at a higher price. Markups allow VCs to put more money into their funds. Wall Street has never met a hype cycle it didn’t love, and while Silicon Valley hoodies may not love Wall Street suits, they do adore Wall Street money.

This means that companies outside of the industries that produce hype cycles are cash-strapped. According to PwC, businesses involved in the life sciences or information and communication technologies received 83% of all venture capital investments made between 1995 and 2019. That excludes important industries like energy from the discussion.

Thanks to this perverse incentive system, a lot of entrepreneurs invent (or reinvent) with an eye toward the exits. And at the moment, those exit alternatives are being purchased or going public in our already irrationally buoyant stock market (assuming a company has managed to escape entering the death zone, when bigger tech corporations either clone or kill their product).

Facebook attempted to buy Snap for $3 billion before it went public. When that failed, it merely duplicated its features. After purchasing the competing navigation provider Waze, Google began gradually incorporating its navigational functions into Google Maps.

Since the stock market is currently experiencing a SPAC boom (special-purpose acquisition company) boom, going public has never been simpler for software companies.

Businesses that go public through a SPAC are expected to provide investors with forward-looking estimates rather than the comprehensive prospectus needed for an IPO. This benefits the SPAC sponsors, who get more fees than IPO underwriters, but also forces companies to go public before they are truly ready.

The Silicon Valley promises a lot but do a few. Entrepreneurs come to the hub with enthusiasm until the reality tears them down. This leads to the leaving of many startups and entrepreneurs to better places.

Future Makers Branching Out into New Places

As one of the richest areas in the world, Silicon Valley has many advantages that give aspiring entrepreneurs an advantage over those in many other places. Moreover, the region has a significant amount of investment funding, with more than $25 billion of the $69 billion invested by US-based venture funds landing in Silicon Valley and the Bay Area

Notwithstanding this outstanding performance, California is seen by CEOs as unsafe for business.

The rent was really expensive. Taxes were expensive. The people around you didn’t like you. You might have traveled an hour to your job at Apple, Google, or Facebook if you resided in San Francisco. However, if you worked in a metropolis, perhaps the area where you worked had too much street crime, open drug usage, and $5 coffee.

Together with the coronavirus outbreak, which fundamentally altered how people work, huge offices in SOMA (South of Market) becoming vacant, and tech workers fleeing San Francisco for states like Texas, where there is greener grass, lower rent, and no state income taxes.

According to a survey conducted by Chief Executive magazine in 2021, these CEOs place the greatest priority on tax policy, regulatory environment, and talent availability.

California was rated as the worst of the 50 states for business due to its excessive tax rates. Taxes have a significant impact on company decisions, the creation and maintenance of jobs, and the location of manufacturing facilities.

Because higher taxes result in lower profits and slower economic growth, they will make a state less appealing for company investment. A ranking by the Small Business & Entrepreneurship Council placed California 49th out of the 50 states for being the most entrepreneur friendly (SBE Council). Texas, on the other hand, came out on top in both of these polls.

California, with 395,608 regulatory restrictions in 2020 as opposed to the 135,000 in the rest of the nation, is the state with the most regulations. As a result, firms have a harder time adhering to all of the regulations and have less economic flexibility.

Economic freedom enables businesses to expand and thrive by enabling them to hold protected property, make decisions on their own terms, and take part in markets that are free from restrictions. California is placed 47th in terms of economic freedom in a survey published by the Fraser Institute, whereas the top states are New Hampshire, Florida, Virginia, and Texas.

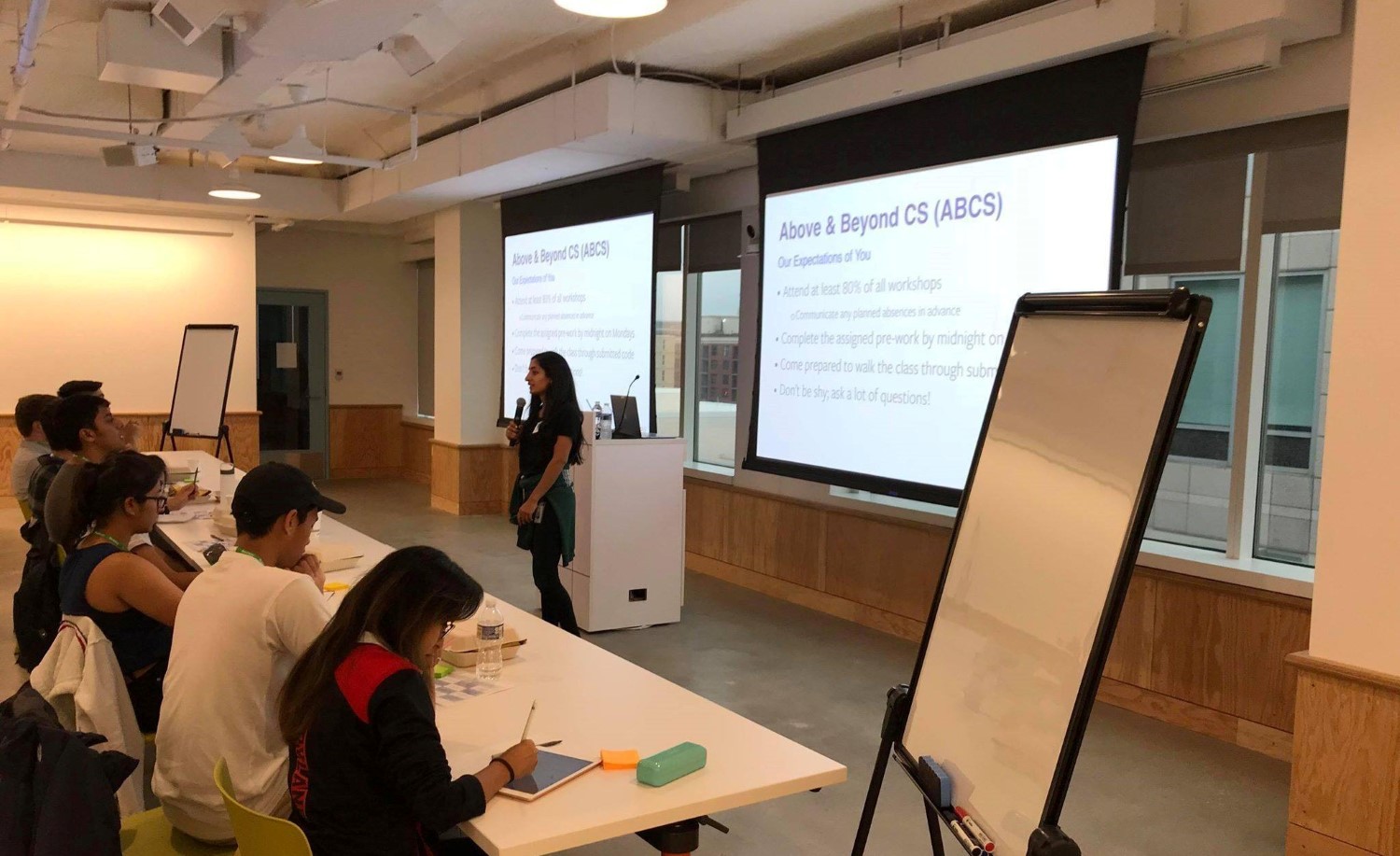

In the first half of 2021, more businesses are moving their headquarters from California to other states than they did in the same period in 2020. Texas is developing its own tech hub, with Austin serving as a “Silicon Hills” substitute thanks to its abundant labor force, high standard of living, capital, tax climate, and cheaper operating expenses.

Leaders in the industry including Dell, Oracle, Uber, Airbnb, and Yelp have already relocated or established new offices in Austin. In addition, businesses are looking at Florida as a potential new base of operations. Florida is a state that is developing into a tech and startup powerhouse thanks to its year-round sunlight, affordable real estate, and low tax rates.

Alexis Ohanian, the co-founder of Reddit, relocated from San Francisco to Florida a number of years ago, and the New York Times reports that New York-based Goldman Sachs is thinking about shifting some of its offices to Miami.

All these challenges seem to block the hub’s way to expand its power. We are all waiting for the response from the Silicon Valley, but they seem to be keeping their optimistic culture.

The Silicon Valley is in Front of the Severe Storm

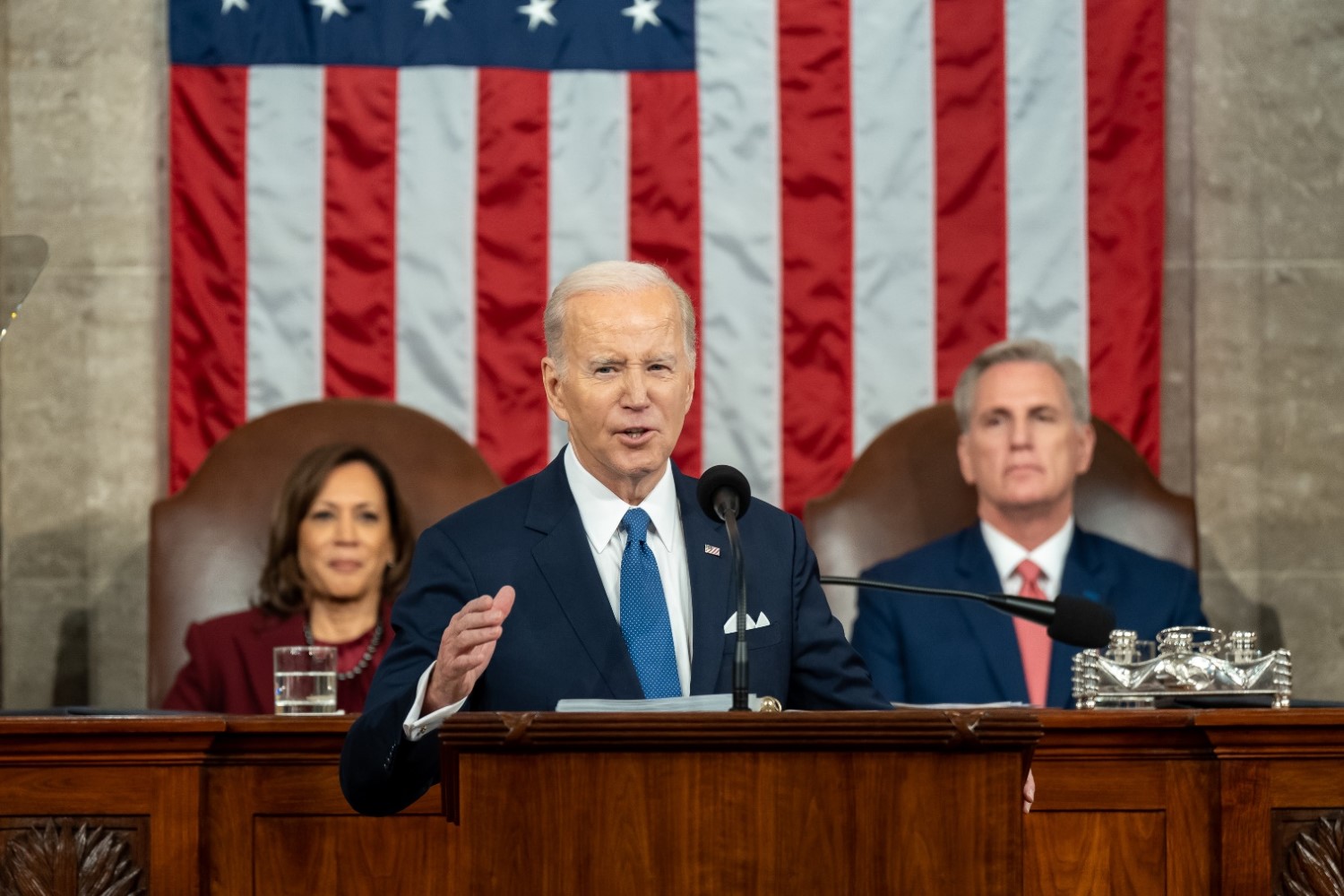

In a recent Wall Street Journal op-ed, President Biden accused Silicon Valley of “collecting, sharing and exploiting our most personal data, deepening extremism and polarization in our country, tilting the playing field in our economy, violating the civil rights of women and minorities, and even putting our children at risk.”

The President outlined three main objectives for his administration’s approach to major internet companies, such as Google, Twitter, and Facebook: restricting the collection and use of personal data, increasing their responsibility for third-party content posted on their websites, and reducing their size and power through increased antitrust law enforcement.

In the op-ed, he also demanded that both major parties draft new legislation to safeguard privacy, eliminate prejudice, and foster competitiveness.

Despite the exposure from the government and widening reports of tech and biotech layoffs in the Bay Area, the Silicon Valley region, defined as Santa Clara County, San Mateo County and the Fremont area, is still adding jobs, according to the new report from Joint Venture Silicon Valley, a San Jose-based think tank.

According to the “gloom and doom” surrounding tech layoffs, “you could think there is a crisis in Silicon Valley,” said Russell Hancock, president of Joint Venture Silicon Valley.

Hancock, though, disputes the idea that Silicon Valley has a grim future. Tech is going through a difficult time, according to Hancock. There is no way to characterize what is taking place as a catastrophe for the tech industry, he continued.

During the coronavirus pandemic, when many people started doing their work, shopping, and learning from home or other remote sites rather to their places of employment and retail centers, Silicon Valley tech companies as well as those in San Francisco had a hiring boom.

The Silicon Valley Index report indicated that “the region recovered from pandemic job losses by April 2022” and that “unemployment touched a historic low.”

Tech companies have started to cut employment and personnel numbers as the demand for the sector’s products and services has fallen. That is a readjustment, in Hancock’s opinion.

According to the Silicon Valley Index study, Silicon Valley added 88,000 jobs overall throughout the course of the year that concluded in June 2022. IT companies boosted their employment by 16,000 individuals during the course of that year.

However, after the time period covered by the paper, in 2023, the tech and biotech layoffs started to experience their worst periods. Tech and biotech companies have announced plans to cut at least 19,500 employees in the Bay Area since July 1, 2022. Some of the reductions have already taken place, and others will soon.

The study discovered that it is evident that a small number of tech giants are clearly providing substantial portions of jobs in Silicon Valley as the economy changes. 42% of the tech workers in Silicon Valley and San Francisco are reportedly employed by 30 tech companies, according to the Silicon Valley Index analysts.

According to the survey, only three companies—Google, Apple, and Facebook owner Meta—account for 19% of the tech jobs in that region.

Hancock referred to the region’s renowned Big Three automakers from a bygone age of American industrial supremacy by saying, “We look a lot more like Detroit.”

Is Silicon Valley Losing Its Crown?

Yet, it is clear that Silicon Valley continues to draw a lot of would-be business owners because of the substantial financial and skill pools it provides. But so far, that dominance may become less significant as individuals have unprecedented access to technology and resources from almost anywhere in the world.

What’s unclear is how Silicon Valley will try to adapt as the global technological competition of the twenty-first century heats up. Ultimate challenges are waiting for the tech center to test its ability in maintaining its track record as the world’s most famous technology hub.