How Ramp Has Grown into The New York-Based Fastest-Growing Unicorn Ever?

Should you be in the financial landscape for a while, you must hear about Ramp – the first AI-empowered corporate card startup designed to help businesses spend less, “challenging business practices and assumptions that have existed for nearly 50 years.” Just around two years after its launch in 2019, the New York-based startup has grown into fintech’s latest unicorn, amassing an eye-popping $1.6 billion valuation and claiming to be the fastest-growing startup ever to come out of “The Big Apple”.

“Ramp has become the card of choice for high-growth companies that want to remove any operational barriers that could get in the way of their ambitious goals,” stated Eric Glyman, co-founder & CEO, Ramp. “Mission-driven companies choose Ramp because they don’t have time to waste with inefficient processes, filing expense reports, or optimizing points. We feel lucky to go to work for our customers and deliver software that helps companies operate higher-performing businesses.”

Given how awesome it is, let’s read to uncover how the fintech unicorn was conceptualized and has disrupted the financial services ecosystem ever since.

The Growth Trajectory of Ramp As New York’s Fastest-Growing Startup

Ramp was founded in March of 2019 with a vision to design a “corporate card and spend management platform” that has emerged as a solid Fintech success. Before delving into its handsome prominence, it’s critical to first cast a glimpse over the earlier days when three outstanding Harvard graduates – Eric Glyman, Gene Lee and Karim Atiyeh – collaborated and discovered a potential market gap for their awesome startup.

Actually, their very first business is Paribus, which was established in May 2015, “with a mission to save consumers time and money by automating the price adjustment refund process.” One year later, after saving more than 700,000 consumers millions of dollars, they came into the partnership with Capital One’s credit card division (and eventually sold the company to them).

As shared by Eric Glyman, “Our time at Capital One opened our eyes to the innovation barriers that exist in the corporate card industry and sparked a new idea inspired by our desire to put customers first. With our new startup, we would build software that was aligned with—and protective of—businesses.”

Later on, they quit their jobs at Capital One and started interviewing hundreds of startup founders to establish a hypothesis as they did identify three main problems with incumbent corporate cards:

Misaligned incentives

The “products” card those companies designed and optimized were complex rewards programs aiming to encourage wasteful spending.

Bloated expense management software

More often than not, businesses were forced to adopt legacy expense tracking software that slowed everybody down.

Lack of spending oversight

Since payments were usually scattered across multiple systems, businesses hardly gained a single view of how their employees were generally spending.

“I think one of the biggest issues in the credit card industry, which is, so many funds go into sponsoring points programs, not into helping automate and help people get more out of each dollar,” shared Eric.

Motivated by Ramp’s several potential ways of turning data into savings for customers, the company launched its ground-breaking corporate card and spend management platform. Ramp came into place in March 2019, aiming to increase the lifespan of businesses with intelligence and automation, empower them to break through the bottlenecks – expense, spend and vendor management roadblocks – that stand in the way of saving thousands of dollars.

“Our vision was to design a corporate card and spend management platform that actually helped businesses spend less.” And there exist a handful of “golden” guiding principles to realize such a mission.

Ease of use

Instead of complex rewards, Ramp designs corporate cards with simple cash back, integrated with software that’s easy to set up and easier to use.

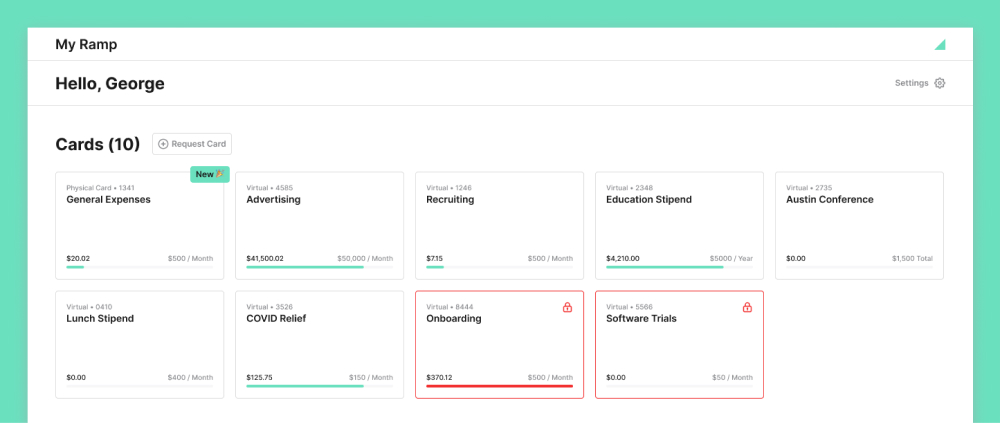

Control at scale

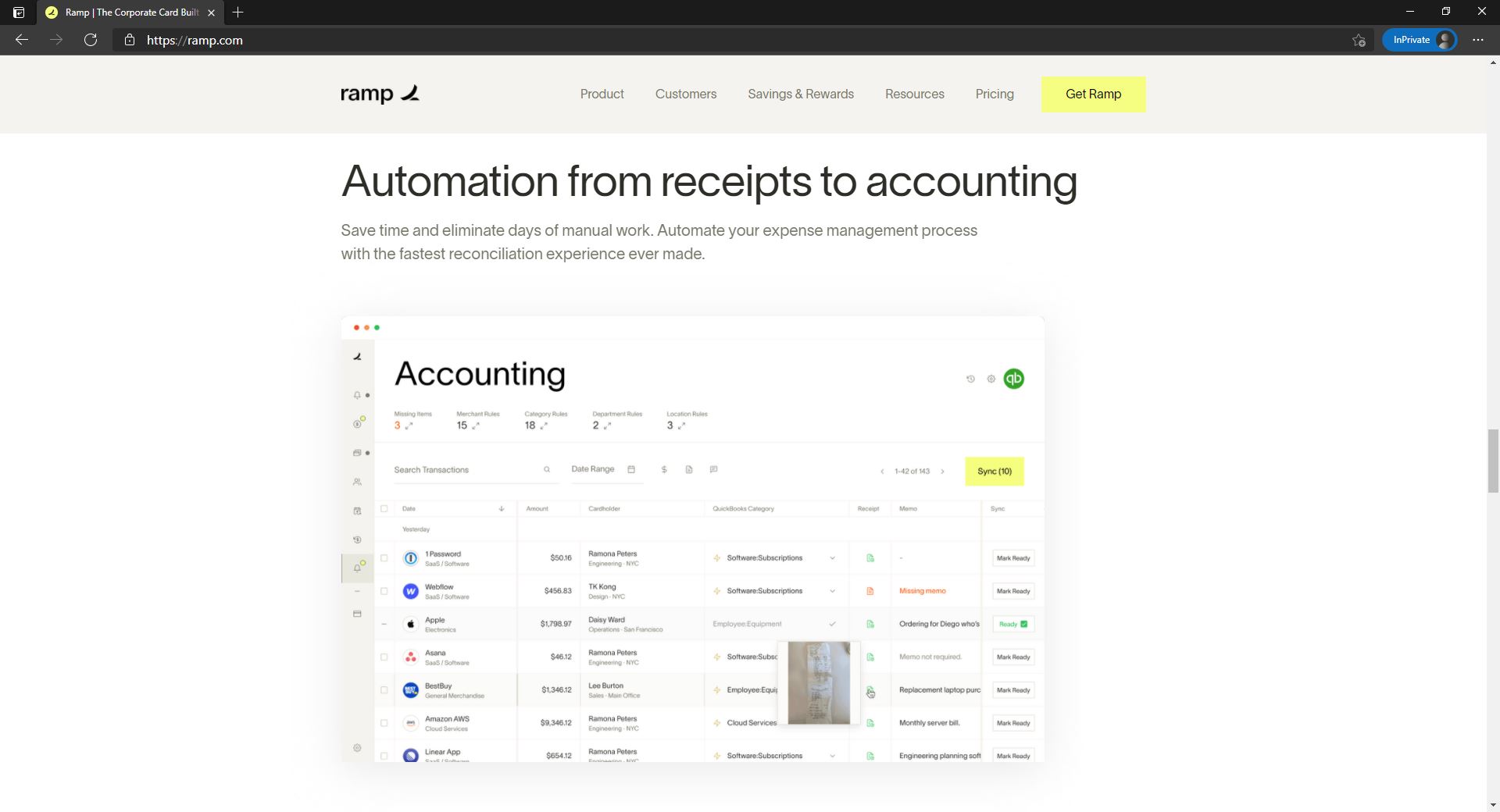

The platform offers various functionalities of controls, limits, and automation that allow businesses to manage their employees’ expenditure as the company grows. “Automation is Ramp’s ultimate weapon. I was skeptical at first but when I started using it, I realized it was as beautiful as it sounds,” shared Jose, Staff Accountant at WayUp.

Real-time intelligence

Businesses are empowered with an overall view of company spending, which is paired with intelligence that automatically identifies waste and cuts costs to optimize every dollar spent.

“Ramp found over $250,000 in savings right out of the gate. That, plus Ramp’s 1.5% cashback is far more valuable than any points program,” stated Nick, CEO at Candid.

“From day one, we’ve vowed to put the customer first and drive cohesion, automation, transparency, and efficiency for finance teams so companies can save time and money. Our core offering was an unlimited 1.5% cash back corporate card integrated with spend management software designed to help businesses spend less,” Eric said.

Instantly Stunning Success from The Early Days

A few months after its launch – August 2019, to be exact, Ramp welcomed their very first customer. Then, by February 2020, the corporate card startup was publicly introduced and have been amazed at the response from the market, especially from some of the most innovative companies in the world.

Whether at such fast-scaling unicorns as Ro, Better, ClickUp, Applied Intuition and more, or at more traditional businesses seeking higher financial efficiency, Ramp has quickly become the spend management platform of choice. A plethora of businesses depend on Ramp to manage their finances during hypergrowth and inflection points within their company trajectories—when things can get especially messy and complicated for finance teams.

“Ramp is taking a novel approach to corporate cards and spend management. We’ve been impressed by their product velocity and user focus,” stated Karim Temsamani, head of Stripe’s banking and financial products. “With this investment, we’re excited to partner with Ramp, and to further expand access to the corporate cards and expense management tools that businesses need.”

Plus, according to Nick, Candid’s CEO, “Unlike other credit card companies which are constantly pushing us to put more money on our card, Ramp is trying to help us spend less and save more. It feels like finally there’s alignment.”

Remarkably, a third of Ramp customers switched over from American Express, and more than 90% of customers adopted Ramp as a comprehensive spend management platform, replacing Expensify, Concur or manual solutions, according to the company report. Notably, the New York-based corporate card startup has saved its customers over $10 million through its proprietary software that identifies ways for businesses to spend less on purchases and an additional 5.4 days a month in administrative work for finance function.

“Our transition to Ramp was memorable because it felt like upgrading from a flip phone to an iPhone. Ramp brings corporate cards into the future,” Aron Susman, CFO of Ro, shared his team’s experience when adopting Ramp. “Within minutes of signing up, we were able to issue cards to employees and take full control of our spending. Thanks to Ramp’s superior product, we no longer have to manage a separate expense management software, we have full visibility into spend, and we are achieving efficiencies we never expected.”

Artificial Intelligence (AI): Ramp’s Core Weapon to Drive Customers’ Values & Foster Its Phenomenal Success

Leveraging AI and machine learning to personalize savings strategies for business customer – including how to trim unneeded subscriptions – has proved to be a compelling value proposition – which all sizes of businesses acted on. And the corporate card startup Ramp is definitely not an exception.

As Eric observed, “We started getting involved with businesses and saw a bit of a sad rule that the bigger businesses got, the less efficient, the more wasteful they got with their money.” Beyond any doubt, keeping track of receipts and submitting them with expense reports turns out to be the greatest time-waster any corporate cardholder has today. From purchasing software subscriptions, services and supplies to paying contractors, tracking receipts to reconcile a corporate card does waste time. Especially, when it comes to small businesses – where people “put on multiple hats”, keeping track of receipts can get chaotic.

Ramp did capitalize on this opportunity via leveraging AI and machine learning to bring order out of the receipt chaos so that a large number of businesses routinely go through. Since the corporate card startup relies on the Visa network and Visa Zero Liability Guarantee, they do process every single transaction as well as provide clients with the flexibility to define algorithms that approve or deny every purchase.

“Because we’re processing the transactions, we can approve or deny each one. We can text or email the cardholder, depending on if it was in person or online. When you still might have a receipt in your hand, you can text a photo of the receipt back and we automatically match that to the right receipt”, explained Eric, stressing how the company can smartly automate the most time-consuming aspect of having a corporate card – providing readable, auditable receipts.

What should be noted is that Ramp’s spend management platform can accept receipts from various e-channels that employees are most comfortable using. “We automate the process behind where customers can email receipts. We auto-match it and can help close the books automatically. I think, at the start, people think about this as this a modern credit card so it must be T&E [Travel and Expense], but in many of our businesses, it’s replaced that PO [Purchase Order] infrastructure,” Eric continued.

That alone saves hundreds of hours a month across businesses of all scales, as employees – who previously had to wait for a purchase order to get service – could now be charged with a corporate card within seconds. This likely does wonders when the pandemic is over: such convenience will promote business travel’s efficiency, resulting in more significant cost savings on travel and entertainment expense.

Furthermore, Eric Glyman, together with his teams, has proved why AI and machine learning are the future of spend management by how they’re adopting these technologies to tailor personalized spend management strategies for clients in real-time. Early on, the decision was made to design their spend management platform leveraging the power of AI and machine learning designed in from the very start. Indeed, Eric and the Ramp team initially wished to take on the challenge of working with an immense amount of data since these opened new ways to optimize clients’ spend management. “Our early team has members who were formerly part of Facebook AI research and our engineers hail from Google research as well,” Eric explained.

Having integrated with AI and machine learning from the very first start, Ramp’s spend management platform “boasts” the flexibility to tailoring specific workflows to specific customers, matching the nuances of their business. Deploying machine learning algorithms to learn from and tailor spending policies to each workflow also fosters accuracy and scale gains since the platform continually looks for and learns what’s best for every client.

More importantly, business clients can put in rules that further refine the platform’s performance for individual workflows. “You can put further rules too, to say, “Look, I, as a business, want to know anytime that someone spends above $100,” and you can get alerted. There’s a number of safeguards, both in terms of advanced controls that haven’t been possible on other cards and workflows, notifications based on activities that businesses can be set,” added Eric.

Ramp: The Latest Fintech Unicorn with An Eye-Popping $1.6 Billion Valuation

In this April, the corporate card company reports to receive $115M in new funding from D1 Capital Partners and Stripe, with support from Goldman Sachs, Founders Fund, Coatue Management, Thrive Capital, Redpoint Ventures, Box Group, Neo, and Contrary Capital. The round does bring total venture and debt financing raised by Ramp to staggeringly $320M. With a valuation of $1.6B, Ramp has become the fastest growing New York-based startup in history, and also the first to surpass a $1B valuation in under two years from incorporation.

“We’ve been energized by the innovation that has come out of our city in recent years and are proud to play a leading role in the NYC ecosystem.”

Headquartered less than two blocks south of Manhattan’s Union Square, Ramp has already picked up approximately 1,000 clients, including buzzy social app Clubhouse, mortgage fintech Better and nonprofit Planned Parenthood. “This new fundraising reflects the stellar growth Ramp has experienced—transactions have grown by approximately 400% over the past 6 months, and we’re nearing annualized transaction volume of $1 billion,” wrote Eric Glyman on the company website. “Co-founding a fintech unicorn was never my plan, and almost feels crazy given my job 12 years ago was selling t-shirts and jeans,” he added.

“Ramp has quickly become a key player in the financial services ecosystem by challenging business practices and assumptions that have existed for nearly 50 years,” stated Dan Sundheim, Founder and Chief Investment Officer of D1 Capital Partners. “The company attracts new customers by providing value and savings, and empowers CFOs and finance teams to operate at a higher level of efficiency. We look forward to supporting Ramp during its next phase of growth.”

Sharing the same standpoint, Keith Rabois, Partner at Founders Fund, noted, “Like Square, Paypal, and Stripe, Ramp is rapidly emerging as a generational fintech company. Though it launched publicly just one year ago, Ramp is already viewed as the obvious choice for efficient spend management at the fastest-scaling, highest-performing startups. We are pleased to welcome Stripe, an innovative company that we deeply admire, to the Ramp team.”

“It turned out to be just an incredible year for Ramp,” commented Eric.

“When March, April and May came around, this suddenly started to mean the difference between making it through the next month and helping keep more and more folks on payroll,” he recalled the early days during the pandemic in 2020. The company launched its services on February 12, 2020—just one month before dozens of states started mandating lockdowns that dealt a crippling blow to the revenues of small businesses—Ramp’s main market. The new funding comes at a time of massive growth in value for the promising fintech.

This fresh capital will be utilized for product development as well as supporting its swelling employee headcount, which is up five-fold during the pandemic to about 100. According to Eric, Ramp is planning to “add novel features and new payments capabilities that have not been seen in the corporate card or expense management space before, like sophisticated card controls, automated savings, and accounting automation. With the recent hire of former Stripe and Goldman Sachs executive Colin Kennedy as Chief Business Officer, the company will also grow its partnerships, sales, and marketing efforts.”

The Bottom Line

Leveraging AI and machine learning, the New York-based corporate card company has sidestepped the trap that so many fintech fall into pursuing a point-based value proposition that isn’t going to cut it during economically challenging times. Empowering business clients to alleviate the chaotic nature of tracking receipts and own better financial management, Ramp has become “the card of choice” and grown into the fastest-growing unicorn ever to come out of “The Big Apple”.