How Quest Diagnostics Becomes the ‘Elephant Company’ in the Clinical Laboratory Services

The global COVID-19 diagnostics market size is projected to reach USD 11.40 billion by 2027, exhibiting a CAGR of 7.9% during the forecast period. Uncontrolled spread of the coronavirus worldwide will be the major factor propelling the growth of this market.

The United States is one of the worst-hit countries in the world by the coronavirus pandemic, with the number of cases as of June 2020 standing at 2.68 million and 129,000 deaths. In response, the US government is injecting more funds into medical research facilities to accelerate development of COVID-19 diagnostics and widen the testing net in the country. The region’s market size in 2019 stood at USD 2.17 billion.

Soaring Demand for COVID-19 Testing Makes the Opportunities for the Rise of Quest Diagnostics

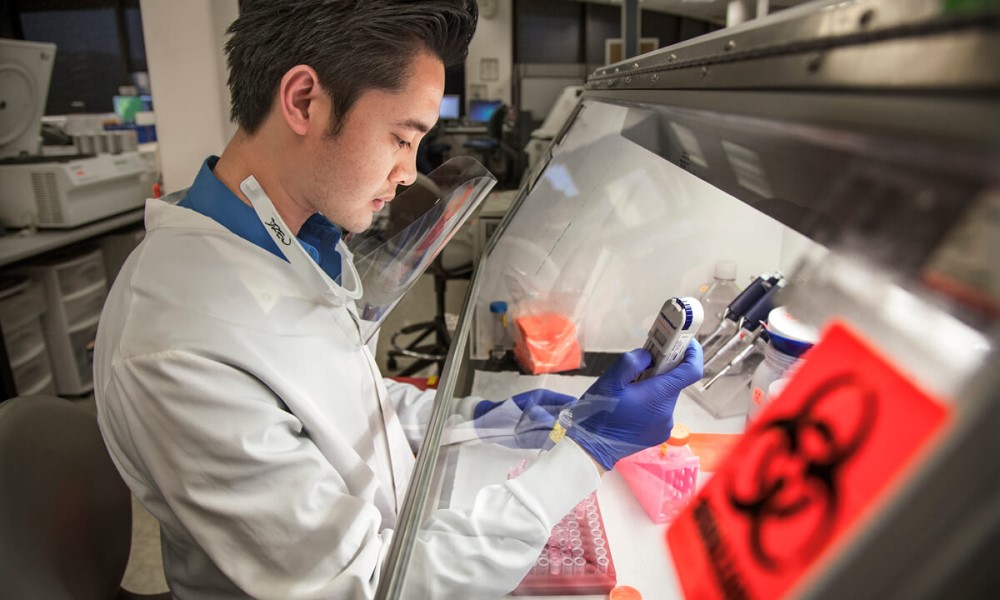

Quest Diagnostics is an American clinical laboratory company, collaborative agreements with various hospitals and clinics across the globe. Quest provides testing services for healthcare, helping doctors make evidence-based decisions on treatment for patients. It offers an extensive menu of diagnostics tests. The company is in the Fortune 500, has some 47,000 employees around the US, and generated $7.6 billion in revenue in 2018. From a marketing perspective, Quest engages a wide range of customer segments, spanning both B2C and B2B spaces.

Even in the face of its recent furloughs, layoffs, and pay cuts prompted by the COVID-19 pandemic, it still be a resilient healthcare company.

As the one of the nation’s two largest commercial laboratories, Quest have scaled up molecular diagnostic testing to meet the unrelenting U.S. demand for COVID-19 tests. at the beginning of July, Quest had daily testing capacity of 120,000 tests and ended the month performing approximately 135,000 molecular diagnostic tests a day.

“We have a large presence in the four largest states” by population, a Quest spokesperson said, referring to California, Texas, Florida and New York. In the first three states on that list, which are the most populous in the U.S., coronavirus cases began to rise in June and by mid-July emerged as COVID-19 hotspots that collectively accounted for almost 20% of the world’s new cases, according to an analysis by NBC News.

Quest is very big in Florida and its presence in the state is as deep or as broad. Obviously, Florida is a hotspot of COVID-19 pandemic. There is a geographic component to the fact that Quest is getting a lot of demand in the market where they are heavily exposed.

Demand is likely to increase further in the autumn and winter when millions of Americans with common colds and the flu are expected to line up for tests to eliminate the possibility, they have the virus.

The surge in demand in states in the south and west has been exacerbated by attempts to expand access to testing in places that have managed to tame the virus, but which see mass surveillance as an essential tool to prevent the virus from resurging. In New York everyone is eligible for testing regardless of whether they have symptoms.

About those markets, all the way up to New York, is that those cities have already gone through the big COVID waves. It is more of Quest’s markets that saw the COVID uptick.

Quest acknowledged that rising demand in July for molecular diagnostics outpaced its ability to quickly process the tests, leading to backlogs and delays. It was not until Aug. 3 that Quest reported growing capacity coupled with plateauing demand had started to translate into faster turnaround times of five days versus seven days the prior week. In its public statements, Quest would often point out that “turnaround time can fluctuate with demand and vary by region.”

Amidst COVID-19 Pandemic, Quest Diagnostics Broaden Its Market Penetration

Quest’s wide reach has been a boon to the company’s high-profile participation in COVID-19 diagnostic testing efforts. But careful investors should recognize that Quest’s recent stint in the spotlight is unrelated to its sound strategy and effective growth-oriented business model.

Quest routinely acquires small firms in part or in whole to fortify its regional networks, making deals to purchase laboratory testing companies like Boyce & Bynum Pathology in 2019 and Cape Cod Healthcare in 2018, sometimes for as little as $35 million. With each acquisition, Quest deepens its integration with healthcare providers, paving the way for future selling opportunities within its newly expanded network.

Quest also has an appetite for acquisitions that contribute to its portfolio of diagnostics. In January, Quest ambitiously purchased Blueprint Genetics, a genome diagnostics company. Soon, Quest will be able to offer the diagnostic tests developed at Blueprint to all of its customers as new products. In the same vein, after acquiring Oxford Immunotec in late 2018, Quest onboarded two entirely new infectious disease diagnostic products to its already-impressive collection. These product-driven acquisitions enable Quest to bring new offerings to its customers in healthcare without incurring high in-house research and development expenditures.

Because of the nature of its diagnostic testing business and relatively fixed demand in its major markets, Quest is unlikely to become a major growth stock as a result of expanding its COVID-19 testing capabilities. Doctors are unlikely to need significantly more diagnostic tests processed by Quest in the short term outside of those associated with COVID-19 testing because the incidence of typical medical disorders hasn’t changed overnight.

On a longer timescale, however, the market for medical laboratories will grow in keeping with the ever-increasing number of new diagnostic metrics discovered by basic medical science. To Quest’s leadership, this paradigm of trickling new opportunities for growth is business as usual.

Since the company’s founding in 1967, its product offerings have expanded from a basic set of common diagnostic tests to a massive array of clinical tools, many of which are cutting-edge or designed for rare diseases. Thus, on the basis of its proven ability to consistently adopt new diagnostic products and deploy them at an ever-increasing scale, Quest’s competitive position is extremely strong, meaning that it will capture a significant share of new testing markets as they develop. In the meantime, Quest will continue to seek growth by expanding the reach and capabilities of its laboratories.

It is important to keep Quest’s projected long-term growth in context. While investors can reasonably expect Quest’s stock to gain in value over the next five to 10 years, it’s unclear whether the company’s strategy of acquisitions will make its stock appreciate more rapidly than smaller and more specialized competitors. Likewise, while Quest is a reliable pick for investors seeking dividends, the company appears loath to take on large-scale new initiatives to penetrate new markets or explore new business models. Its 2.09% dividend yield is in line with the average S&P 500 stock, which also yields 2%.

Current holders of Quest stock should not give in to the urge to sell it if the shares take a beating after a poor earnings report or chaos ensues elsewhere in the healthcare sector or the broader market. For buyers looking to open a new position, look for market exuberance regarding Quest’s role in COVID-19 testing to fade, but know that there is not any guarantee of a major bargain anytime soon.

Quest Diagnostics Re-defines Customer Engagement During a COVID-19 Crisis by Pivoting Marketing

Quest knew they needed to pivot their messaging and tactics because of COVID-19. They broke their “re-defined” strategy down into four core components: content, segmentation, offers, and data enhancement.

What Quest delivered as it pivoted its marketing and Eloqua to address COVID-19 was timely value to audiences who wanted it urgently.

They created a huge cross-functional, multi-channel experience for our customers and involved lots of teams at Quest, and a lot of those touch points were directly involved with Eloqua. “All the components were fed through Eloqua and driven by our new strategy”, said by Christopher Crowe, Senior Manager of Marketing Automation. It took a team effort across the company to redefine how Quest engaged its audiences during COVID-19, a process involving people, teams, and technology working together.

Quest identified four core customer segments to engage during the COVID-19 crisis: Healthcare providers (primary care providers), medical specialists, office staff, and the different medical professionals who would need information from Quest. Each segment would receive content tailored to their specific needs and preferred communication styles/channels. Messaging to the medical professionals, for example, was targeted around issues like test availability, turnaround times, test processing, and acceptance criteria. Quest also had health systems and payers as a targeted audience (hospitals and insurers) and communicated differently to address their particular concerns. “Whatever was relevant to each of these segments, we made sure the messaging was targeted and focused on that.”

Over the last four weeks (from about mid-March to mid-April 2020), Quest launched some 15 unique campaigns targeted at different audiences with different messaging needs.

They sent a little over 20 million messages, and that just keeps growing. They have a high volume of sends that are going out and continuing to go out with approximately 10,000 form submissions. Quest’s unsubscribe rate is below the industry average, a clear indicator of the relevancy and continued interest in its content. “We are seeing our unique open rates growing about 50% from when we started this campaign to the point where we are today. So, we are seeing that interest just continue to grow,” explains Crowe.

By re-defining its messaging following the 4-part pivoting strategy, Quest Diagnostics drove great success in how it engaged its audiences during a crisis. As Christopher Crowe sums it up: “These pandemics and other crises really put our marketing and communication strategies to the test. The best path is to focus on the best practices of marketing, especially customer-centricity, while executing deliberately.” Quest Diagnostics pulled it off with great success, as the burgeoning level of its audience engagement proves.