The U.S. Public Debt Dilemma: Facing the Risks and Realities Ahead

National public debt is a growing concern for many countries around the world, as it reflects how governments manage their finances and set economic priorities. Countries like Japan and Greece have also faced challenges with high public debt, which can affect their financial stability and future growth.

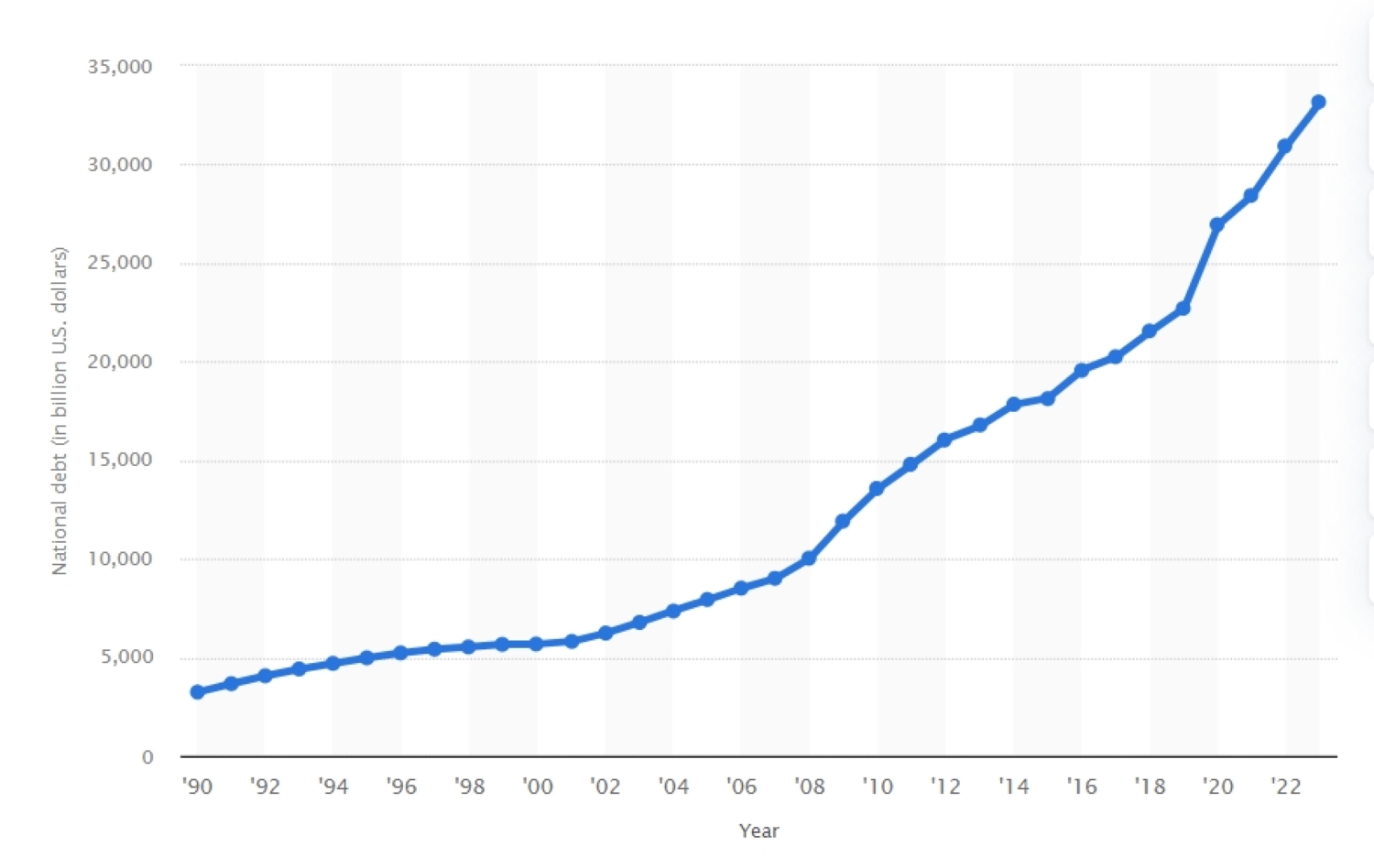

The U.S. is no exception to this trend. As of 2024, the country’s national debt has reached a record high of over $34 trillion, with each American now shouldering around $93,500 of the debt.

First, it is necessary to understand the basics of the U.S. debt problem.

Understanding U.S. Debt: How Serious Is It?

The U.S. government depends on the country’s economic activity to meet its financial obligations. Citizens and businesses earn money and pay taxes, which fund government programs like the military, public services, Social Security, and interest on the national debt.

Think of the government like a person with a credit card. If that person spends more than they earn, they’ll use their credit card to cover the difference. Eventually, they have to pay back that money with interest.

Similarly, the U.S. government spends more than it collects in taxes, so it borrows money to make up the shortfall, which increases the national debt. To keep running and making payments on this “credit card,” the U.S. has to borrow even more.

The problem becomes a crisis when debt repayments become too high for the country’s economy (GDP) to handle.

Right now, U.S. government spending is much higher than the money it collects from taxes. The debt-to-GDP ratio is at 120%, which means the government owes more than it produces in a year. This is the highest ratio in U.S. history, even surpassing the levels seen during World War II when the country was financing a large-scale war.

In 1981, the U.S. debt hit $1 trillion, a big milestone that took 205 years to reach, from the country’s founding in 1776 to 1981. Now, in 2024, the cost of just paying the interest on the debt is already $1 trillion each year.

“The debt puts an unbelievable burden on future generations of Americans. Congress cannot wait! We must take action now to get America’s fiscal house in order,” said Rep. Lloyd Smucker of Pennsylvania.

The world is paying attention. In June 2024, the IMF warned that the rising U.S. debt “creates a growing risk to the U.S. and global economy.”

The real challenge is the rapidly increasing interest payments combined with lower tax revenues in the future.

The Pros and Cons of the U.S. Debt Situation: What Lies Ahead?

The U.S. debt situation is complicated and has important effects on both the national and global economy. As the debt keeps growing, it’s essential to understand the potential upsides and downsides.

Potential Advantages and Gains

First, let’s consider the potential positive outcomes if the U.S. government can’t pay its interest on the debt but investors still see America as a stable and innovative economy, rather than a financial basket case.

Despite a U.S. default, U.S. assets might still be seen as relatively safe compared to other options, potentially attracting investment if the world and investors continue to believe in America’s innovation and economic resilience. This influx of investment could help stabilize the economy and provide the government with much-needed funds.

In response to a crisis, the government might introduce fiscal stimulus to support the economy. This could sharply reduce the value of the dollar, possibly leading to a crash.

While a much weaker dollar would hurt Americans in the short term by lowering their purchasing power and raising the cost of imports, the negative effects might not last long if other positive factors come into play.

For example, a weaker dollar could make U.S. exports more competitive globally, increasing demand for American goods and helping the economy grow.

If American businesses continue to produce quality products that people want, this growth could lead to a strong recovery over time. As a result, tax revenues for the government could increase, allowing it to start paying down the debt.

Additionally, in response to higher interest rates, domestic investors might shift their investments from riskier assets back into government bonds. This shift could provide the government with a more stable source of funding.

If the American government stays functional and prioritizes smart spending in areas that promote growth, it could create a healthier economic environment. This responsible spending could involve investing in infrastructure, education, and technology. These investments would not only help with immediate recovery but also set the stage for long-term growth.

Challenges and Risks of the U.S. Debt Situation

However, if America doesn’t address its debt situation and is seen as a financial disaster, the negative outcomes could be serious.

First, if the U.S. defaults on its debt, it could hurt confidence in the American economy. Investors might lose trust in government bonds, which could lead to higher interest rates. However, even with these higher rates, there may not be enough buyers willing to invest.

This situation could be similar to what happened in Argentina, where high bond yields indicated a weak economy instead of a strong one. A collapse of U.S. bonds could cause market volatility, less investment, and much slower economic growth.

Furthermore, higher interest rates would make borrowing more expensive for both businesses and consumers in the U.S. This could lead to less spending, lower investment, and reduced tax revenue, putting more pressure on the economy.

A U.S. debt default could also create chaos in global markets, disrupting trade and financial systems, which could harm not only the U.S. economy but also economies around the world. Since the U.S. dollar is an important currency for international trade, any instability could have far-reaching economic consequences.

Finally, if interest rates and bond yields were to soar, the Federal Reserve might feel forced to take drastic actions. To try to lower yields, they could print a huge amount of money and buy government debt, aiming to stabilize bond prices and boost the domestic economy through lower interest rates.

However, printing so much money would likely cause inflation, which could further weaken investor confidence in U.S. bonds.

Global Impact of a U.S. Debt Crisis: How Other Countries Would Be Affected

So, what would happen to the rest of the world if the U.S. can’t pay off its debt? If U.S. bonds were to crash and bond interest rates began to skyrocket, the global repercussions would be profound.

The initial shock of a U.S. bond crash would likely send global markets into a panic. If the largest economy in the world is viewed as unable to repay its investors, headlines would worsen the crisis.

Many investors would pull their money out of riskier assets and move it into safer options like commodities, gold, or bonds from other countries. This shift would cause those safer assets to rise in value, while other markets would fall sharply due to the uncertainty.

But it’s not just markets that would be affected. Rising U.S. interest rates could create a ripple effect across the global economy. Investors often view U.S. assets as a benchmark for safety and returns.

When U.S. rates go up, American investments become more attractive, prompting other countries to raise their own interest rates to compete for investment. If they don’t, they risk facing inflation.

This situation could lead to a kind of currency war. If a country doesn’t raise its interest rates in response to rising U.S. rates, investors might move their money to the U.S. to take advantage of better returns.

This shift would lower the value of the local currency and lead to inflation. In short, higher U.S. rates could cause interest rates to rise globally, resulting in inflation in other countries. It would mean higher costs for mortgages and loans for businesses and individuals everywhere.

Now, what happens to those who bought U.S. bonds expecting a return? The U.S. government owes money to various investors, including countries like Japan, China, and the U.K., as well as central banks, commercial banks, wealth funds, and other financial institutions.

Some American citizens also hold these bonds, and interestingly, the U.S. government owns some of its own debt as well. If there were a bond failure, all these parties would face significant losses, leading to chaotic fallout that would be unprecedented.

The IMF suggests that it’s not the size of the debt itself that matters, but its long-term sustainability.

Since the U.S. dollar is the global reserve currency, any troubles in the bond market could lead to a crash of the dollar and destabilize the global economy.

Finding a Way Forward: Addressing the U.S. Debt Situation

So, how can the U.S. get out of this debt situation?

After World War II, the U.S. saw economic growth even with high debt-to-GDP levels. However, there are important differences today. Back then, the country had strong manufacturing capabilities that could easily be turned into civilian production.

Today, that flexibility isn’t as strong. Still, if there were economic pain from a debt crisis and a weaker dollar, the U.S. could become more competitive in trade, which could lead to growth. The success of this potential boom would depend a lot on how the Federal Reserve and the government handle the situation at that time.

Firstly, printing money might look like an easy solution because it could wipe out debt. However, the downside is that it would likely make the currency worthless. The U.S. dollar is used in 60% of international trade because it’s the world’s reserve currency.

But if the government printed a lot of money to get out of a crisis, it could lead to hyperinflation. This would quickly reduce the dollar’s value and create major problems in global markets.

While raising taxes might seem like a sensible option, it’s politically unpopular, especially in a weak economy where consumers are already struggling. Politicians would face backlash for such a move, making this option unlikely.

On the other hand, cutting spending appears to be the most practical approach. If the U.S. government took a closer look at its spending, it could save between $250 billion and nearly a trillion dollars each year, which would help reduce the debt.

Previous efforts, like the Budget Control Act of 2011, showed that strong political support is necessary for real change. There’s also the unusual idea of minting a trillion-dollar coin to pay off the debt.

How Presidential Decisions Have Influenced the U.S. Debt

The path of the U.S. national debt has been shaped by the fiscal policies and economic conditions under recent presidents.

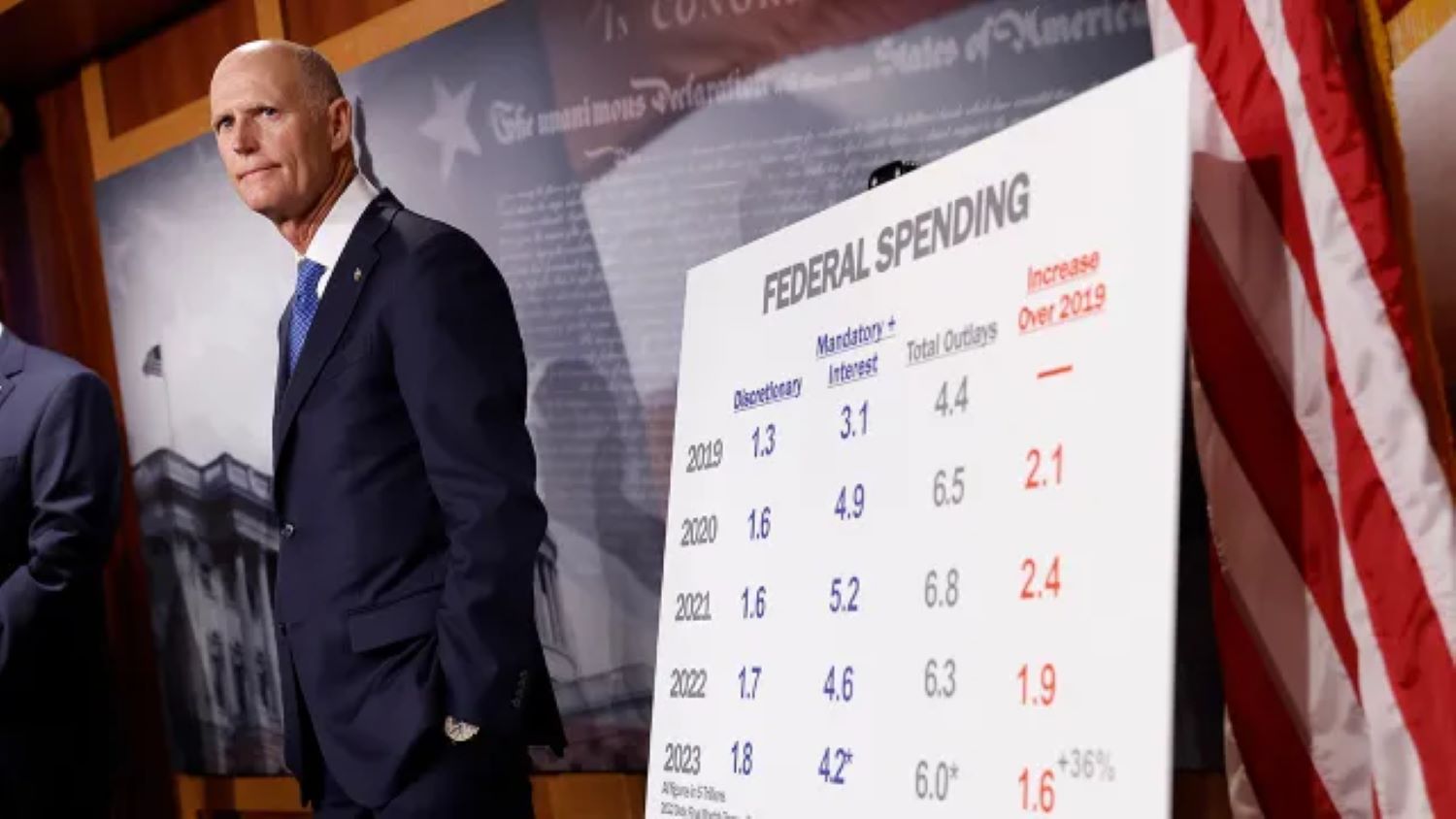

President George W. Bush’s administration saw a substantial increase in the national debt, primarily due to tax cuts and military spending.

The Bush tax cuts, implemented in 2001 and 2003, reduced federal revenue, while the costs of the wars in Iraq and Afghanistan added trillions to the national debt. By the end of his presidency, the debt had increased by approximately $6 trillion.

President Barack Obama took office during the Great Recession, facing a struggling economy. To address this downturn, his administration introduced the American Recovery and Reinvestment Act of 2009, a stimulus package that significantly increased the national debt.

Additionally, ongoing military expenditures and the implementation of the Affordable Care Act (ACA) contributed to the debt increase. By the end of Obama’s two terms, the national debt had grown by about $9 trillion.

President Donald Trump’s tenure saw further increases in the national debt, driven by a combination of tax cuts, increased military spending, and the economic impact of the COVID-19 pandemic.

The Tax Cuts and Jobs Act of 2017 lowered federal revenue, even as defense spending continued to grow. Additionally, the pandemic required substantial government spending on relief measures, such as stimulus checks, unemployment benefits, and support for businesses.

As a result, approximately $7.8 trillion was added to the national debt during President Trump’s time in office.

President Joe Biden’s administration has continued to grapple with the economic fallout from the COVID-19 pandemic. The American Rescue Plan, a $1.9 trillion stimulus package, was one of the first major legislative actions of his presidency.

Additionally, proposed infrastructure investments and social spending plans aim to address long-term economic challenges but also add to the national debt.

As of now, the debt has increased by about $5 trillion under Biden’s administration, with ongoing debates about further spending and fiscal policy.

Solutions Initiative 2024: Comprehensive Plans to Tackle U.S. Debt and Fiscal Challenges

The Solutions Initiative 2024, led by the Peter G. Peterson Foundation, brings together seven prominent think tanks to tackle the U.S. national debt and fiscal challenges with over 200 policy recommendations.

These organizations cover a range of political and ideological views and include the American Action Forum, American Enterprise Institute, Bipartisan Policy Center, Center for American Progress, Economic Policy Institute, Manhattan Institute, and Progressive Policy Institute.

Each think tank has created a detailed plan that focuses on both spending and revenue, aiming to reduce America’s debt-to-GDP ratio by at least one-third in the long run and lower 30-year interest costs by at least $13 trillion.

Key recommendations include addressing the debt ceiling deadline in January 2025, reforming the U.S. tax code to ensure it remains revenue neutral, preventing automatic cuts to Social Security and Medicare, funding investments in infrastructure, education, and climate initiatives, and continuing support for expanded Affordable Care Act subsidies that are set to expire in 2025.

“The Solutions Initiative 2024 shows that there is widespread agreement that America’s fiscal challenges are both unsustainable and solvable, and we have many good options to chart a brighter future for our country,” said Michael A. Peterson, CEO of the Peterson Foundation.

“As Election Day approaches and we face a series of critical fiscal deadlines in 2025, these seven comprehensive plans all put our debt on a sustainable path, offering a deep playbook of policy options to help voters and elected leaders prioritize solutions. The Solutions Initiative shows that strengthening America’s fiscal and economic future is entirely within our control — all we need is leadership.” he added.

This initiative is especially timely, given the rapidly worsening fiscal outlook. At the end of fiscal year 2023, public debt stood at 97% of GDP, with the Congressional Budget Office projecting it will surpass the previous record high of 106% within three years.

If current laws remain unchanged, by 2054, debt could soar to 166% of GDP, well above the 50-year historical average of 47%. Each plan under the Solutions Initiative aims to significantly reduce and stabilize this troubling debt trajectory.

As part of the Solutions Initiative 2024, each organization involved wrote a memo for candidates and policymakers, highlighting its top three priorities. These priorities cover a variety of reforms and investments based on their unique viewpoints.

For instance, the American Action Forum focuses on reforming entitlement programs, addressing global threats, and tax reform. In contrast, the Center for American Progress prioritizes increasing nondefense spending, investing in people, and ensuring that wealthy individuals and large corporations contribute their fair share.