Credit Karma: Is A Free Credit Score Really Worth It?

Should you be in search of an easy way to stay on top of your credit, Credit Karma shall be your perfect match. As one of the most popular “credit score” sites on the Internet, such a financial service not only offers its members free credit score updates, monitoring services, and personalized advice on how to improve your score, but it’s also absolutely FREE to use.

It seems too good to be true, isn’t it?

Still, there goes a popular saying that “you get what you pay for.” So … is a free credit score truly worth giving up your personal information, especially in an era when hackers are alarmingly successful at getting their hands on that personal data? Does the score hold up against what creditors would use to judge your credit-worthiness?

Let’s dug deep to figure out exactly what Credit Karma brings to the table and whether it’s worth taking your time to sign up!

Credit Karma: An Overview

Before diving into details, it is significant to first grasp the general picture as to Credit Karma, its major features as well as the inspiring story behind its founding.

1. Credit Karma: How It Works?

Founded on March 8, 2007, Credit Karma is best known as a free credit and financial management platform. Given that, its features also include free federal and state income tax preparation, credit monitoring (such as monitoring of unclaimed property databases), and credit card & loan recommendations. The final service mentioned above, credit card & loan recommendations, is how Credit Karma funds the operation.

Credit Karma pairs your credit score with credit cards that typically accept applicants with a similar score. If you apply through Credit Karma, it does receive a small commission. You don’t have to apply for a credit card to use Credit Karma. In fact, a large number of people sign up for the service just to access the free credit score and credit monitoring perks.

Now, let’s cast a look over its outstanding free services to check out how it actually works:

- A Free Credit Score

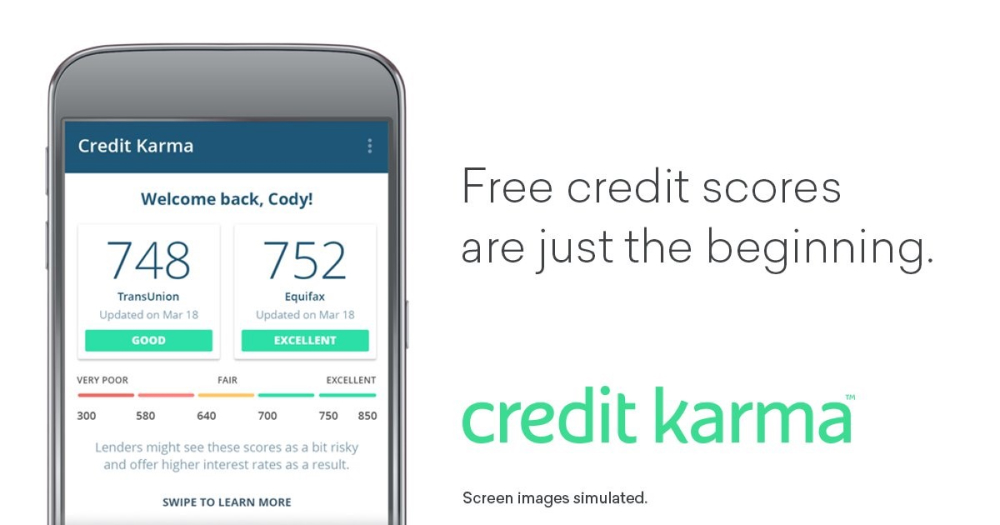

The main draw for Credit Karma is the ability to see your credit score for free. Actually, it was one of the first online services to offer this free perk – which explains why Credit Karma stands amongst the largest online platforms today. Plus, Credit Karma teams do a good job marketing through TV commercials.

To be more specific, Credit Karma offers you with the VantageScore 3.0 which was developed by the three credit bureaus – Equifax, Experian, and TransUnion – as an alternative to the FICO scoring model. Whereas most lenders still prefer the FICO credit score to the VantageScore, the VantageScore is still very similar and can give you a good idea of what your FICO score will be.

Furthermore, each time you log in to Credit Karma, your score from Experian and TransUnion will update.

- Free Credit Monitoring

Credit monitoring goes hand-in-hand with a free credit score.

As Credit Karma is already accessing your credit report to present your credit score, it will also send you alerts if it suspects any unusual activity. For instance, it will send a notification as soon as the credit bureaus report the hard inquiry when you apply for a new credit card or even a mortgage loan or car loan. If such application is approved, Credit Karma will send you a second notification stating a new credit account has been opened in your name. By this way, you can enjoy the ease of having Credit Karma monitor your credit report for potential fraud!

Additionally, since data breaches are repeatedly making news headlines, free credit monitoring that reports your information from two of the three credit bureaus is something everybody should truly consider!

- Free Tax Filing

Free tax preparation is Credit Karma’s most recent feature that was introduced for the Tax Year 2016 filing period in 2017. Staggeringly, over one million people have taken advantage of Credit Karma’s free federal and state income tax services!

Credit Karma will file almost any tax return for free – even if you “itemize” or have a complex Schedule C, D, or E form to file in case you have investment income or self-employment income to report.

Should you be dead tired of having to constantly decline your current tax programs numerous attempts to upsell, or the fact that you can file a federal return for free but have to spend a small fortune to complete your state tax return, Credit Karma Tax seems to a good option for you to consider this year. Although Credit Karma Tax may not be as user-friendly as your paid services such as TurboTax or H&R Block providing expert advice and automatic data imports, it’s FREE – which really matters.

Plus, if you never use the additional premium features anyhow, taking a few extra minutes to manually input all your information can be worth the savings. In fact, it’s still much quicker than doing it with pen and paper.

2. Credit Karma’s Story: Significant Momentums

As previously mentioned, Credit Karma was founded in 2017 by Kenneth Lin and cofounders Ryan Graciano and Nichole Mustard with the idea that people should have access to their credit and financial data for free.

“Everyone deserves to feel confident about their finances. Our job is to give you the tools, the education and the opportunities you need to make real, meaningful progress.”

Despite the economic turmoil, Credit Karma officially launched a beta program in March 2008, offering free credit scores and access to personalized offers to consumers for the first time. The goal was simple: to level the playing field for consumers by providing them with their credit information so they can make better informed financial decisions.

By 2009, the American economy began to “pick back up” and Credit Karma did receive its first round of venture capital funding. Later this year, it launched a Credit Report Card and Credit Score Simulator, enabling members to watch out changes to their credit score with added context.

In June 2010, Credit Karma hit one million members – and by the end of the year, half a million more join the growing community. As the first head of marketing, Greg Lull made huge efforts to shape a helpful and approachable brand as well as built out quantitatively-driven marketing, communications, and member support teams.

Credit Karma launched free daily credit monitoring and its first mobile app on iOS in 2012. For the first time ever, credit monitoring is now available for free -Consumers no longer need to pay $15 per month to stay on top of their credit, reports Fortune. In just three years, Credit Karma experienced revenue growth of more than 5,200%, making it one of 2012’s fastest-growing companies in the U.S.

In a whirlwind of 2014, Credit Karma partners with an additional credit bureau and provides full credit reports and credit scores from two of the three major credit bureaus in the U.S. for free. Credit Karma joins The Wall Street Journal’s “Billion-Dollar Startup Club.”

Its expansion goes on to this day, with a stronger international presence as well as more features and products added to make it become more of a financial assistant for members.

Security Concern: Is Credit Karma Safe?

Let’s go over some major questions to figure out your answer to the above security concern!

#1. What Security Measures Are in Place at Credit Karma?

Credit Karma makes its commitment to go the “extra mile” to protect your data, especially the sensitive ones. And when you evaluate its security practices, that certainly appears to be the case.

First of all, Credit Karma does adopt bank-level 128-bit encryption or higher encryption in all of its data transmissions. Secondly, this site has a dedicated security team that monitors and responds to concerns immediately. Furthermore, it submits to regular external security assessments and audits from third parties. Finally, Credit Karma maintains an external bug bounty program, in which the company will actually reward security researchers for finding and reporting security issues. This is a strategy that other top technology companies, like Apple and Google, have used for years and can be an effective way to keep itself informed of all the vulnerabilities and stay a step ahead of hackers.

It’s also noteworthy that Credit Karma says it regularly reviews its security program for compliance with ISO 27001, SOC Type I and II. Service Organization Controls (SOC) are rigid accounting standards for reporting financial information. Whilst SOC 1 deals with requirements for secure information security management, SOC II has to handle with the operational aspect of an organization’s information security. The latter mainly attests to security, process integrity, and other privacy barometers.

#2. What Personal Information Does Credit Karma Collect from Its Users?

In order for your Credit Karma account to work, it needs to match your identity with your TransUnion and Equifax credit files. To do that, you’ll need to give the site the following personal information as soon as you sign up:

- Full name

- Address

- Date of birth

- Last four digits of your Social Security Number

Being required to submit the last four digits of a Social Security Number is usually what gives many people pause. So why does Credit Karma need it?

The site uses your full name and the last four digits to your Social Security Number to match your identity to your Equifax and TransUnion credit files.

For most people these data will be enough but, in some cases, the site may need your full SSN (or Social Security Number, to be exact) to match it to the correct file.

#3. Does Credit Karma Share My Personal Information?

When it comes to the users’ doubt of personal data leakage, the site states that it does not sell any of your personal information and that “we do not disclose Social Security numbers to third parties except with your consent, or where such disclosure is required or permitted by law.”

As previously mentioned, there are times when it may share your information with other institutions and of course, with your permission. But how does it actually work? Let’s see!

Credit Karma makes money by recommending products and services to its members. For example, it may recommend a specific rewards card that you’d have a good chance of qualifying for. Should you decide to apply for the credit card, you would be giving Credit Karma permission to share your credit information with the card issuer.

Besides, it’s essential to point out that even though Credit Karma may be able to pre-populate some of your data on a bank or lender’s application, you’ll still need to submit the application yourself. Once you’ve submitted your information to a third party, it will be up to them to protect it in accordance with their own privacy standards.

#4. How Credit Karma Can Help to Protect Your Identity?

Whereas Credit Karma security standards are high, that’s, unfortunately not the case for every organization that has access to your data.

According to a recent analysis conducted by Credit Karma, over 105 million American adults have at least one password exposed on the dark web. That’s around 42% of the total U.S. population, and individuals with a credit score of 660 or higher are more likely to be at risk.

Thankfully, Credit Karma can help with this, too. In addition to providing free credit scores and reports to its members, it does offer free credit monitoring as well.

In practice, Credit Karma notifies members whenever a new hard inquiry shows up on their credit report. More than that, it will search over 13 billion public and dark web breach records to check if your personal information was involved.

#5. So, What’s The Catch With Credit Karma?

The question is: How does Credit Karma give you a TOTALLY FREE credit score when other services want to charge around $20 a month or even more?

Remember that it’s not entirely an altruistic effort – Credit Karma is a for-profit business. It is offering you something for free, but it is making money elsewhere. So, how does Credit Karma make money?

The answer is advertising – specifically, very targeted advertising based on your financial habits. To take an example, if you have excellent credit, banks are willing to pay big bucks to target you with their best loans and credit cards because it’s ultimately cheaper for them over running generic ads to millions of people who may never qualify for their products.

In the case of Credit Karma, it will recommend its partners’ products like credit cards and other loans to you based on your specific credit profile, credit score, and other personal data. As soon as you sign up for one of those products, Credit Karma is compensated for playing the middle man in that transaction.

If there’s a downside to Credit Karma, it’s the fact that, yes, it’s using your personal credit data to “advertise to you”. It’s no different than Facebook using your likes to serve ads based on your interests.

The Bottom Lines

With the prevalence of data breaches today, it’s understandable why people might be hesitant to trust a free site like Credit Karma. Nevertheless, such concern is largely unfounded. In fact, Credit Karma’s security is on par with other well-known financial entities in the United States, employing bank-level security, says cybersecurity expert Adam Levin, founder of cyber defense services firm CyberScout.

Undoubtedly, no privacy measures are perfect and no online business can 100% “guarantee” security. But Credit Karma users should be encouraged to know that the company makes huge efforts to protect members from both internal and external privacy threats.