Crack to Subscription-Based Business with Lessons from Netflix & MasterClass

There are umpteen instances worldwide of companies failing to strategically pivot themselves while cosmetically dressing themselves up till they become irrelevant with their legacy models. BlackBerry, the original smartphone which lost out to Apple and Samsung, and Sun Microsystems are a few examples.

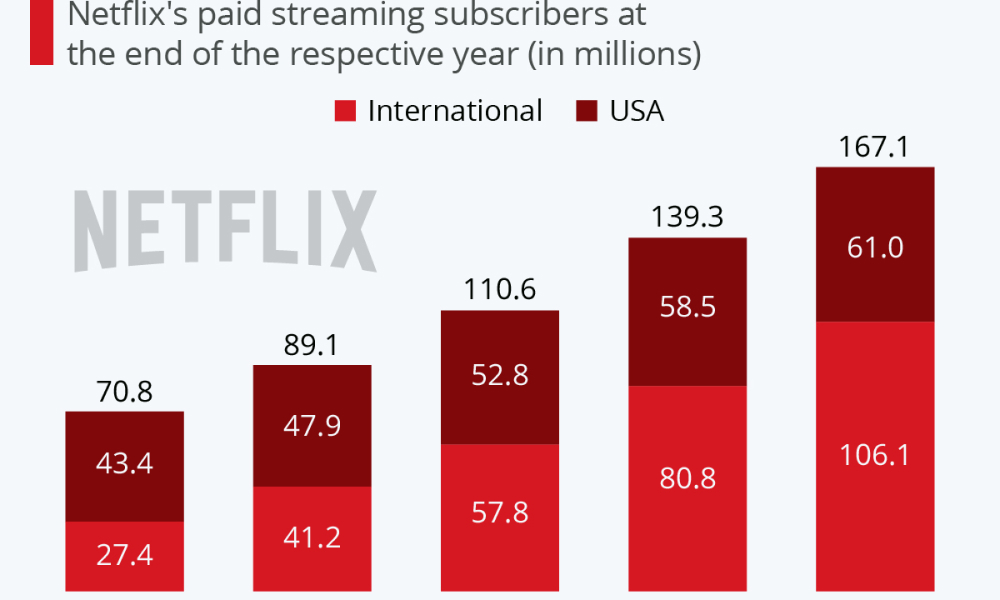

Gauging the Triumph of Netflix on Subscription-Based Business Strategy

Netflix is the exception to this. When Reed Hastings and Marc Randolph founded Netflix (formerly known as Kibble) in 1997, the company appeared to be little more than an upstart DVD rental business whose only real value proposition was the mail-order element of its operation. Fast forward two decades and Netflix has become one of the biggest TV and movie studios in the world, with more subscribers than all the cable TV channels in America combined. How did Netflix go from renting movies to making them in just 20 years?

Netflix’s glory lies in institutionalizing pivoting-on-the-go: Originally as a humble alternative to the video store as a DVD-by-mail service, then pivoting to subscription model (throwing brick-and-mortar king ‘Blockbuster’ out of business – a company to whom the now $150-billion Netflix offered itself for acquisition for $50 million in 2000).

The year 2013 marks an important milestone for Netflix; it is the year it released House of Cards, its first original content. The rest is history.

Just before the release of House of Cards, in Dec 2012, Ted Sarandos, the chief content officer of Netflix, asserted: “The goal is to become HBO faster than HBO can become us”. No one took Netflix seriously, because HBO was HBO and then Game of Thrones happened

Yet, Netflix would surpass HBO in subscribers, content budgets, and Emmy-award nominations in the years to follow.

Outsider of Media Industry: Stepping Out of Temporary Trend to Make Subscription-as-a-Service

Renting software’ became a way of life for companies after Mark Benioff of Salesforce revolutionized the IT industry by pioneering and making ubiquitous SaaS (Software as a Service). That Salesforce achieved it in a B2B industry is a testimony to Benioff’s genius and vision.

It is as if Netflix was waiting for inspiration to take a leaf out of this development. Netflix became a challenger in the media industry by offering content without advertising, in the process, shaking the industry out of slumber and in the process, unleashed ‘unbundling’.

Just as SaaS removed the hurdle of managing software installation – what historically accounted for building Microsoft’s dominance in enterprise software – is how Netflix cracked the disruption of distribution in the media industry.

The on-demand model combined with a subscription business model by using Internet technologies enabled Netflix to digitally deliver content to multi-platform consumers across an ever-expanding range of devices.

Pivoting on Subscription-Based Business Model: Simple but Impactful

A business model is more than just a monetization strategy – it is about how consumers access your product or service and how you create an ecosystem for value creation for several stakeholders. It is also about consumer ownership and engagement through understanding their inclinations and matching viewers and content.

Technology does not disrupt, business models do. Yes and no.

The viability of old business models to new industries with technology enablement created the Netflix juggernaut. Not to forget that the on-demand business model works, first owing to the Internet, then the speed of the Internet, then data and more. The tuberization of services economy then leads with options of flexibility on time and place to watch for the subscriber.

The age-old subscription business model has got no innovation–it is the successful application of it in a different context that carries the day for Netflix.

GE, one of the 12% survivors from 1955 Fortune 500 list generates its bulk revenues today from digital subscriptions such as data services as different from its original avatar of being a manufacturer of light bulbs and fixtures. IBM at the 34th rank today from 61st in Fortune list in 1955 has transformed itself to offering IT and business subscription services from selling commercial scales and measuring equipment back then.

Back home, Tata Power has recently announced its intent to transform from a utility play to a customer-focused business with its ‘power-as-a-service’ foray. Almost simultaneously, M&M has announced its passenger vehicles on a subscription model in Sept 2019 targeting users preferring an asset-light lifestyle and wanting to rent for a shorter duration.

The tech industry is completely transformed with the subscription-as-a-service model. The next holy grail is going to be for manufacturing companies to become the ultimate as-a-service business with IoT (Internet-Of-Things) enablement for continuous monitoring and updating of products in real-time. Everyone realizes the power of owning the consumer as the new established mechanism to extract value.

Netflix successfully modularized content, allowing it to integrate production with subscription and distribution. All the modern-day success stories of platform ecosystems do the same – modularization of production/ delivery of services to allow them to move closer to the customer.

This new value is created through customer data: Airbnb commoditizes trust for travelers, Uber commoditizes dispatch and modularizes cars for commuters and Netflix commoditizes time and distribution for content-seekers enabling it to integrate production and customer management.

Smart companies are increasingly realizing the power of subscription as a recurring revenue model to survive and to grow. Valuations are a direct function of increase in earnings. Subscription earnings are higher quality earnings for they are stable, safer, often contractual, recurring and ride out any market turbulence. These higher-quality earnings result in better valuation metrics such as price-to-earnings and price-to-book ratios which reflect the potential for future performance as a consequence of intangible assets (for example, customers, brands and market insights and expertise) rather than retained earnings from the past. Growth of these high-quality recurring earnings, coupled with an increase in higher price-earnings multiples, often results in quadratic growth in stock price.

Yet basic value is created with the fundamental core strengths of a business. In the case of media companies, that competitive differentiator seems to be content, content and more content – lethal, cutting-edge, state-of-the-art, differentiated, and engaging. That it does not stop Netflix from today burning a near $15 billion hole when Amazon Prime and Apple TV+ intend spending around $6 billion each, points to this basic understanding.

Netflix, Amazon, Spotify, Uber and several others are spot-on in realizing that consumers are service-hungry and no longer want the hassles of ownership. They want the ride, not the car; the music, not the CD; the milk, not the cow. Access and service remain two stand-out points that endear customers to the new way of life. The net results. Higher utilizations of assets – be it hard assets (cars) or soft (music).

The Bright Diamond in Subscription-Based Education: MasterClass

Professional survival depends on education in today’s world of rapidly accelerating transformation. At the same time, for organizations to stay competitive, they must have a way to measure the success of that education.

Instructional training is typically delivered as a transactional service, limited to occasions when individuals need to acquire new skills. But the pace of change today, especially in technical disciplines, has become so rapid that employees now need continuous education. This need for ongoing education has driven the growth of subscription-based training. That is why many subscription-based businesses have been investing on educational training landscape for recent years. One of these subscription-based triumphant models is MasterClass.

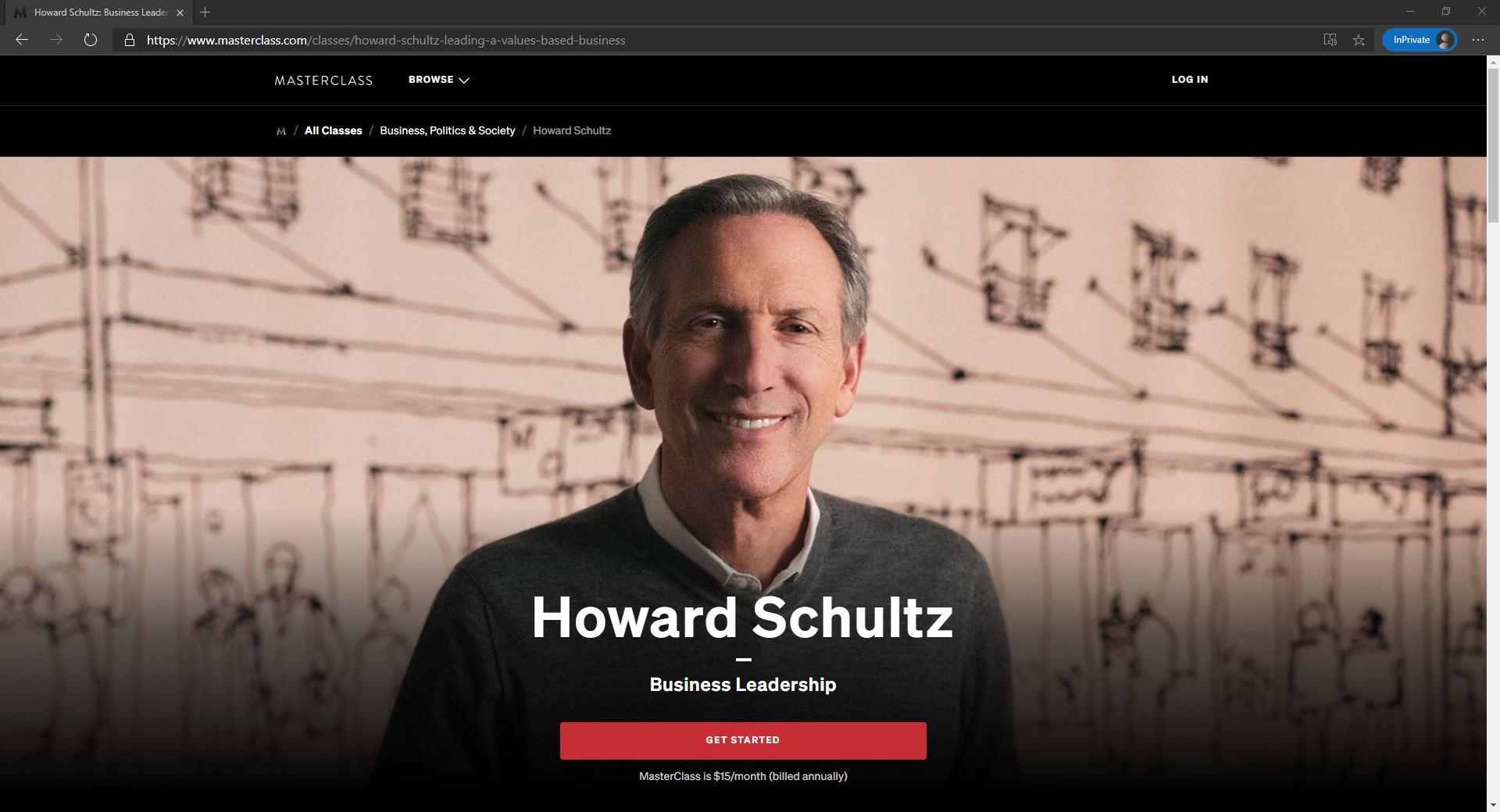

MasterClass is an original content producer and streaming platform that provides online courses led by celebrities in a variety of fields. Courses each contain between 20 – 30 video lessons that are around 10 – 20 minutes long and are produced to Hollywood-level video production quality.

There are currently 83 courses on the platform, with names ranging from “Malcolm Gladwell Teaches Writing” to “Serena Williams Teaches Tennis”, across 9 different categories ranging from “Music & Entertainment” to “Design, Photography & Fashion” to “Business, Politics & Society.”

Most lessons are structured as intimate, one-on-one conversations with celebrities who share insights into their craft, while other lessons (such as cooking or various sports) involve demonstrations. Most courses are accompanied by a downloadable workbook and a community section allowing users to engage through reviews, questions and comments.

The business model of MasterClass is based on charging customers a yearly subscription in exchange for accessing the more than 80 courses available on its platform. Alternatively, consumers can pay $90 to access a single course.

Founded in 2014 by two American entrepreneurs, the company has seen tremendous success with students across the globe. It has raised over $230 million in six years of operation while amassing a valuation of $800 million.

MasterClass’ sales more than doubled from 2016 to 2017 and are on track to do the same this year. That puts the company on pace to match Udacity and Coursera — a pair of EdTech heavyweights — in revenue, according to Rogier, who would not disclose MasterClass’ financials but made the comparison. Udacity has said publicly that its increased revenue to $70 million last year, up from $29 million in 2016. Coursera, for its part, is reportedly “within striking distance of $100 million dollars in annual revenue.

Udacity was founded in 2011 and garnered a $1 billion valuation in 2015. Coursera, founded in 2012, was valued at $800 million last year. Three-year-old MasterClass declined to disclose a valuation.

To thrust itself ahead of its competitors, MasterClass also recently rolled out a new subscription model that allows customers to pay an annual fee of $180 for access to all MasterClass lessons, which are otherwise $90 each. It is been a huge success so far, counting for 80 percent of the company’s revenue.

Lesson from Method That MasterClass Makes Money

MasterClass makes money by charging students a subscription fee for the ability to gain unlimited access to their courses.

The package is called All Access Pass and comes in at $180 a year (or $15 per month). Separately, customers can also pay a one-time fee of $90 to access one single class.

This steep price point stems from the focus on production quality as well as the deals made with instructors. According to a report by Hollywood Reporter, instructors receive an upfront payment of $100,000 plus royalty fees of 30 percent. The company’s thesis stands in stark contrast to its competitors. While platforms like Udemy count thousands upon thousands of instructors, MasterClass focuses on selecting only the best in their field.

This drives word-of-mouth for MasterClass (“This dish was inspired by the class I took from Gordon Ramsey”), which is accelerated by the large social media followings of instructors as well as the news publications covering their courses.

Moreover, MasterClass does not make any promises of career acceleration. Rather, it is aimed at more casual learner, who may want to get to know an instructor’s mindset as opposed to hands-on advice. After all, a 2-hour course by Serena Williams will not make anyone substantially better at playing tennis.

Premium Subscription: Venture or Cunning Business Strategy?

Describing MasterClass as merely “celebrity courses” misses the point. By anchoring in big-budget, carefully produced video series – which includes only partnering with the biggest names in a field – they are building consumer confidence that their future offerings will all meet the same standard – the sort of trust Pixar built by starting slowly with a steady stream of high-quality, big budget animated films.

With a direct-to-consumer streaming platform, this trust for the underlying brand opens the door to a payment model that reflects it: a premium subscription. MasterClass is already moving beyond selling access to individual courses: 80% of revenue now comes from users paying a $180/year all-access subscription. The company looks ever less like a MOOC and more like a Netflix-style SVOD (subscription video on demand) platform for educational video series.

MasterClass launched with just three courses, and still has only 39, but the financial impact of each course is substantial. CEO David Rogier told TechCrunch’s Kate Clark last week that the company’s revenues were just shy of the leading MOOCs, Udacity and Coursera, which are understood to be in the $70-100M range. The MasterClass video library will have a longer shelf-life than educational videos from unknown names as well: people two decades from now will still care how Werner Herzog thought about film directing techniques and how Marc Jacobs thought about fashion design even if technology and culture have changed dramatically.

It is worth noting by comparison that while Netflix is spending more than ever on content – a whopping $13 billion this year – its library is shrinking substantially, not expanding. It too is anchoring itself in better content – expensive, must-have original shows instead of licensed re-runs from other networks – because it is the exclusive, must-see shows that make consumers consider it the must-have subscription.

Collaboration Between the Subscribers and The Stronger of MasterClass

The more subscribers who sign up for must-see content by the celebrities they look up to, the more MasterClass can invest in the next slate of courses to ensure more hits, and the more data it collects on user engagement to improve their productions. This dynamic can give direct-to-consumer streaming services network effects, each additional user’s data marginally enhances the experience of every user, and the more active they are, the more personalized their experience can become.

The data MasterClass, Netflix, and other SVOD services collect from users informs their understanding of the elements that constitute a hit show and enable them to more wisely allocate resources, tripling down on what works best while cutting investment in what does not. This feedback loop empowers them to grow faster than competitors can keep up.