Can the Aviation Industry Bounce Back or Die down through the Rest of the Year?

The world’s commercial airlines and other aviation businesses face significant financial stress and perhaps bankruptcy in the coming months from the unprecedented, unexpected, and broad shutdown of travel due to the rapid spread of Covid-19. According to IATA, airlines in most regions only have two to three months of cash to cover their operation, however, this hides huge variation in the financial strength of individual carriers. The best airlines generate more profits and have stronger balance sheets, but most airlines remain financial walking wounded.

Aviation Industry Will Take Time to Replenish by The Havoc of Coronavirus

Within this backdrop, the industry faces massive pressure on cash flow from extraordinary travel restrictions and a tremendous drop in passenger demand. For example, according to the privately maintained COVID Airline Tracker, roughly 117 airlines had grounded 90% or more of their capacity and over 167 had grounded at least 40%. On March 24, TSA counted a more than 87% decline in travelers in the USA at the same period last year.

Where the airlines go, the value chain will follow. For instance, according to data from Rotabull, aircraft parts transaction volumes fell 7% for each of the first two weeks in March. Internet travel agencies and global distribution system bookings will also decline. Although aircraft order books have not changed for now, orders and deliveries will certainly slow dramatically in the coming months as airlines find themselves awash in unused capacity.

In addition, cash reserves are running down quickly as fleets are grounded and what flights there are operate much less than half full. Forward bookings are far outweighed by cancellations and each time there is a new government recommendation it is to discourage flying. Demand is drying up in ways that are completely unprecedented. Normality is not yet on the horizon.

In post COVID-19 pandemic, most airlines in the world will be bankrupt. Coordinated government and industry action is needed – now – if catastrophe is to be mitigated. As the impact of the coronavirus and multiple government travel reactions sweep through the world, many airlines have probably already been driven into technical bankruptcy or are at least substantially in breach of debt covenants.

Amid the pandemic, it is undoubted that there is little instinct to act cooperatively from the governments whilst they have grappled with the health challenges to impede the spread of coronavirus. Messages were mixed and frequently quite different. Each nation has adopted the solution that appears best suited to it, right or wrong, without consideration of its neighbors or trading partners.

When, for example President Trump peremptorily announced the effective cancellation of airline access to most Europeans, he did not even advise his European government counterparts in advance, let alone consult with them. Other governments have performed little better.

On the other sides, governments have unleashed rescue packages for the industry to prevent a catastrophic disruption to aviation. The industry got largely what they wanted via the $2 trillion stimulus package just signed into law. Nevertheless, the industry will need an immense amount of capital to recover and many weaker airlines will not make it as independents. A smaller set of well-capitalized airlines makes sense for an industry with enormous exposure to external shocks, but it would be a mistake to assume the post-2020 industry will look the same as the one prior to the Covid-19 crisis.

How Aviation Businesses Pivot Their Operations to Avoid the Bankruptcy

Global aviation industry is concerned with the manufacturing and operations of all types of aircraft and related services during transportation. According to the World Bank Organization, in 2018, around 4.2 billion passengers were carried around around the globe. Factors that were driving the aviation industry before the COVID-19 pandemic include increasing disposable income across the globe, the introduction of low-fare airlines, increasing global economic activities, new travel trends, and many more. Moreover, replacement of aging commercial aircraft has also contributed significantly to the market growth.

The global aviation industry report is segmented into passenger airlines, cargo airlines, aircraft manufacturing companies, airports managing companies, and catering and other service providing companies. Out of which, passenger airline segment is expected to get affected most along with catering & other service providing companies. Cancellation of airplane order would be witnessed by the airline companies affecting the airplane manufacturing companies.

The key factors affecting the aviation industry after the pandemic include the decline in tours and travels as a large number of international as well as domestic flights are getting cancelled all across the globe to curb the transmission of the virus. The governments across the globe are cancelling the visa of foreign people and locking down affected area which is also one of the major reasons behind the slowing down of the aviation industry.

Key companies of the aviation industry that are getting affected globally include Qatar Airways, Emirates, Lufthansa, Boeing, Airbus, American Airlines Group Inc., and Delta Air Lines. For example, Qatar Airways suspended all of its flights to and from Italy that was one of the worst-hit countries by the pandemic of COVID-19. In addition, the company has also decided to scale back its operation which includes cutting flights and removing less economical aircraft.

Furthermore, Emirates has halted most of its passenger operation as a result of the pandemic. Now, airlines and airport managing companies are seeking bailout packages from the government. For instance, airport managing companies in Europe are expected to incur a loss of $15.4 billion due to pandemic. It is estimated that airports in Europe will receive 700 million fewer passengers which are 28% less as expected earlier.

Will the Airplane Maker Emperors Boeing and Airbus Be Plunged into Insolvency?

As the coronavirus pandemic rocks the aviation industry, two industry giants are fighting to protect their legacies – Boeing and Airbus. They are doing to survive this unprecedented crisis by outlining survival plans that include order cancellations and furloughed or laid off staff to cut down on operation costs and raising fresh funds as their airline customers reeled from the coronavirus pandemic and the near-collapse of global passenger air travel.

On March 23, Airbus’ CEO Guillaume Faury announced the withdrawal of the company’s 2020 financial guidance and deliveries forecast due to COVID-19. Airbus continues to evaluate its production flow and maintains a strong focus on financial stability and backlog management, and on supporting customers, and securing business continuity even in a protracted crisis. Airbus is following WHO and local health authority guidelines and has updated its workplace safety and travel recommendations to employees, customers and visitors. Rules are being implemented on day-to-day behaviors concerning hygiene, social interaction and distancing, illness reporting, and travel to and from Airbus sites. The company is restricting travel to business-critical activities, and all travel to high-risk regions has ceased. The same goes for visits to Airbus from high-risk regions, and employees having returned from such areas must self-quarantine for two weeks.

Airbus is to furlough 3,200 staff at its north Wales site and roughly half of the staff at its Broughton site would be placed on the UK government’s job retention scheme, which pays 80% of wages. The company is expected to top up salaries by a further 5-10%. It comes hours after Chief Executive Guillaume Faury warned the company was bleeding cash at an unprecedented speed.

The remaining staff will stay on site, including 500 who are currently working at the AMRC Cymru facility, building parts for ventilators as part of the Ventilator Challenge UK consortium.

Desperately, Airbus has warned remaining 135,00 staff to brace for potentially deep job cuts and said that its survival was at stake without immediate action.

Meanwhile, Airbus’ main rival Boeing is battling another major crisis due to the year-long grounding of its 737 Max passenger jet, which had been its best-selling plane. The US aviation giant scrapped a $4.2B (£3.4B) tie-up with Brazil’s Embraer. Some industry analysts saw the move as being triggered by the crises, although the company cited contractual reasons for the decision.

The 16,000 jobs to be eliminated are equal to about 10% of Boeing’s global staff, almost all of whom work in the United States. Almost all the job cuts are coming from the commercial aircraft unit, rather than its defense or space operations.

“We have come to the unfortunate moment of having to start involuntary layoffs,” CEO Dave Calhoun said in a message to employees. “We will have to adjust our business plans constantly until the global pandemic stops whipsawing our markets in ways that are still hard to predict.”

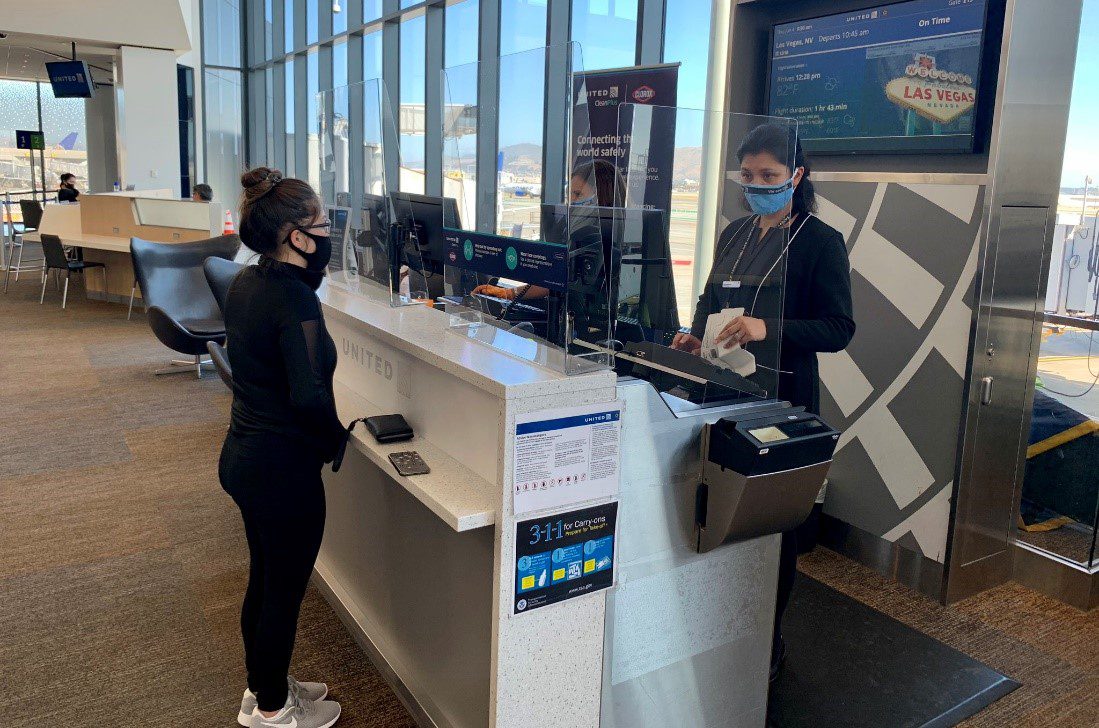

Airlines around the world are also cutting jobs or making plans to do so. But US airlines are prohibited from making involuntary job cuts until October under terms of a US government bailout for the industry. However, the cash flow has been running down quickly, and major airlines companies try to minimize the operating costs to stay alive. Just in July, United Airlines sends a warning of 36,000 layoffs. According to CBS report, the furlough warning of nearly half of its US staff can cut the livings of 15,000 flight attendants, 11,000 customer service and gate agents, 5,500 maintenance workers and 2,250 pilots. After a week from United Airlines’ furlough warning, American Airlines also warned to cut about 25,000 employees, nearly 29% of its workforce in the coming Fall. Many executives across the industry have warned their employees they will have much smaller operations in the future. But some, such as United (UAL) CEO Scott Kirby, have expressed hope that it will not need involuntary layoffs.

What Happens as Aviation Industry Comes Back Post COVID-19 Pandemic?

The long-term outlook for aviation and travel continues to be desperate. The underlying global separation, economic downturn and decreasing consumer incomes and increasing leisure time that has impaired demand for these services faster for decades should continue to do so as the world recovers from the Covid-19 shock.

#1. Air Travel Volumes Will Not Regain Its Peak

In the Covid-19 situation, an exogenous event triggered a recession and increased consumer anxiety about flying that decreased demand. There is no precedent for the pandemic’s impact on long-haul traffic. Many nations have closed their borders to restrain the spread of the disease and will probably continue to regard foreign travel with far more suspicion than domestic travel. Governments also will find it harder to restrict domestic travel volumes than international volumes. For similar reasons, customer confidence in international flying will return more slowly than for domestic flights. Finally, bigger planes have higher trip costs and create more economic risk when demand is depressed. Expect volume to return slowest in international long-haul, especially segments that extra-long-range narrow bodies cannot handle.

#2. Business Travel Will Be Changed by Leisure Travel

Expect a rapid snapback for business travel due to pent-up demand created by the shelter in place orders, but also expect the level of business travel to settle at a structurally lower level. With the evolution of improved tools like Zoom and more distributed teams, travel substitution trends were well underway prior to the crisis. The Covid-19 crisis represents the largest trial-by-use period for creating remote workspaces and virtual teamwork in the history of business. Does anyone really think there will not be a material, permanent substitution of online meetings for business travel?

Leisure may snapback more slowly as consumers take time to gain confidence in flying again. It will take time for the memories of the risk of contagion and of being stranded far from home to fade. However, the trends that have made travel one of the world’s favorite leisure activities remain and will likely enable leisure travel levels to continue to grow. The airlines can help accelerate the recovery by addressing consumer concerns about contagion on aircraft.

#3. Long-Haul Narrow Body Aircraft Will Reshape Airplane Makers Industry

A great deal of long-haul flying has disappeared for the moment, especially in countries with a smaller geographic footprint. This will leave many routes up for grabs when the industry returns. The range of narrow-body aircraft has steadily increased over the years and has recently taken another step change. For example, the A321 XLR has a range of 4,600 miles – 25% higher than the standard A321. This will allow more point-to-point flying for many long-haul routes further undermining the connectivity advantages of hubs, cutting the cost of trips, stimulating leisure demand and building volume at secondary airports.

This change in long-haul trends will put additional pressure on Boeing. The demand for wide-body aircraft will fall and the economic case for new wide-bodies like the 777X will become more tenuous. Narrow-bodies will replace many wide bodies on long-haul routes. Even after the 737 MAX returns to the skies, Boeing will feel the loss of aircraft orders and the reputational damage for years to come. Boeing will need to launch a 737 MAX replacement to stay relevant.

The Bottom Line

Cumulatively, these changes will undermine traditional hub and spoke models operated by Delta, American, United, British Airways and others like them. Today these models depend on premium revenues from business passengers to support a lot of infrastructure that will have less value in the future.

In addition, the value of frequent flyer programs, a major profit spinner for more traditional airline models will decline. As business traffic becomes less important, mid-range, long-haul traffic becomes more point-to-point and regional traffic diverts to tertiary airports, the importance of the connectivity through hubs will also decline. There will always be a place for these carriers but expect major restructuring of their business models.