How Apex Space Resolves the New Bottleneck of Spacecraft Manufacturing Industry?

A satellite bus, also referred to as a spacecraft bus or satellite platform, is the standardized, modular structure or framework that forms the core of a satellite. It carries and supports the primary systems and subsystems required for the satellite’s operation, while the payload, which varies depending on the satellite’s purpose and mission, is attached to the bus.

For decades, satellite buses have catered to an infrequent and expensive launch market. They were typically custom-designed, requiring new non-recurring engineering (NRE) to meet specific payload and rocket needs. This led to long lead times (2-4 years), wide pricing variability ($3 million to $30 million), and lower reliability due to constant new engineering challenges.

This is somehow the new bottleneck that Apex Space wants to cure. They want to productize satellites and make it more accessible with low price. The CEO of the company – Ian Cinnamon, has been fostering the passion with space since he was a little kid.

Ian Cinnamon – From Childhood Dream to Emerging Startup

Ian Cinnamon grew up in Los Angeles, specifically in the San Fernando Valley, with a deep passion for space from an early age. His fascination with rockets and everything space-related led him to spend weekends with his dad in the desert, launching model rockets. He was so obsessed that he even begged his parents to take him to gun stores—not to buy guns, but to get black powder to try building his own rocket engines.

The love for space led him to attend MIT, where he was introduced to the world of dual-use technology—innovations that could be used both in commercial applications and government sectors.

“I worked in a research lab that was funded by the Department of Homeland Security and got to work extensively in that space. But while I was there, frankly, I shifted a little bit away from aerospace, and the reason for that was during my years in undergrad, it really felt like if I were to study aerospace, the path for me was to either go work for one of these big defense prime contractors, or, if I happened to be a billionaire, it would be to start my own space company, like Elon had done,” Ian recalled.

However, because of lacking the resources of a billionaire and craving more flexibility, Ian decided aerospace wasn’t suitable for him at the time. This reason had pushed him to look beyond aerospace. Instead, Ian moved to the Bay Area, immersing himself in the Silicon Valley startup culture.

About a decade ago, Ian applied his knowledge of artificial intelligence to start a dual-use technology company. This company developed edge compute AI products for both commercial and government applications. They raised venture funding and built hardware and software solutions, but three years ago, Ian sold the company to Palantir.

At Palantir, Ian had a major breakthrough. He and his team applied their AI platform to satellite data, and Ian realized that the data was coming from commercial companies run by founders just like him—entrepreneurs who raised venture capital and managed to get something into space without needing to be billionaires or work for defense contractors. This revelation reignited his obsession with space.

Ian shared, “Three years ago, I sold that company to Palantir, and at Palantir, they had us take the AI platform that we had developed and apply it entirely to downstream satellite data. For me, this was the biggest “aha” moment of my entire career because the satellite data I was working with was coming from all of these commercial companies.”

He added, “Not only had I heard of many of these commercial companies, but I realized I knew some of these founders, and these founders were just like me. They had a great idea, they raised venture capital money—a bit more than I had raised in my prior company—but with that money, they were able to get something up into space. They were not billionaires, they weren’t working on a prime, but they were able to do this. That got me incredibly obsessed with this industry.”

He and his co-founder – Max Benassi observed that the cost of launching satellites had dropped significantly, while the potential to build payloads and sell satellite data had grown. The space industry was rapidly changing, with entry barriers lowering, offering new opportunities for innovation.

After speaking with more than 100 potential customers, Ian identified a common challenge around satellite buses, which many companies were struggling with. This widespread issue inspired Ian to create Apex, a company aimed at solving this critical problem in the space industry.

“The same bottleneck around these satellite buses was hitting everybody, just in slightly different ways. That’s really where the idea for Apex was born. It came out of feeling the pull from the market—this was a massive problem they were all facing firsthand,” he said.

Apex Space – The Mission to Productize Satellites

At Apex, they build the core components of satellites, known as satellite buses or platforms. Apex manufactures small satellite bus models from 100 to 500kg (Aries, Nova, Comet), each of which is available in a base model or with easily-swappable configuration packages.

Apex manufactures its satellites at Factory One, a 46,000-square-foot facility in California. The factory will scale up to produce 50 satellite platforms per year. Apex CEO Ian Cinnamon stated the facility is “essential for meeting customer demand.”

According to Ian Cinnamon, the satellite buses that exist today were designed based on the needs of a launch market from 20 to 30 years ago, when launches into space were rare and extremely costly.

Because of these constraints, companies would build highly customized (bespoke) satellite buses, each designed from scratch with new non-recurring engineering (NRE) to meet the specific requirements of the payload (the part of the satellite that performs the mission) and the rocket used for launch.

This customization made sense when launches were so expensive and infrequent, but it also meant that each satellite bus took a long time to build and was costly. Essentially, the satellite industry developed around a model of low-frequency, high-cost launches, leading to individualized, tailor-made satellite buses.

He elaborated on his point, “As a result, if you wanted to buy a satellite bus, you were looking at a lead time of two to four years and huge variability in price—anywhere from $3 to $30 million for very similar platforms. Additionally, these custom buses came with low reliability, and that’s simply because if you’re doing new engineering work for every bus, bugs and problems are inevitable.”

Ian added, “This system worked when launches weren’t frequent and were expensive. There was no rush to build these satellite buses. However, today, thanks to companies like SpaceX, Rocket Lab, and other amazing launch providers, the launch system has proliferated, and the cost has dropped massively. Now there’s a huge demand to get things into space quickly. If it still takes years to build a satellite bus, the business model doesn’t work anymore.”

The demand for spacecraft has skyrocketed, but the current providers, while great and having done an amazing job over the decades, are still very good at doing things their way—taking several years to custom design each satellite bus. There’s no concept of productization, no approach of saying, “We’re going to take this, turn it into a standardized product, stop iterating on it, and just mass-produce it.” That idea is very foreign in this industry, and that’s exactly what we’re doing.

Ian explains that while the demand for spacecraft has increased rapidly, the companies that have traditionally built satellite buses are still following old methods. These providers excel at custom-designing each satellite bus for specific needs, which can take several years.

However, they lack the concept of productization—turning the satellite bus into a standardized, mass-produced product that can be built efficiently and quickly.

This is why Apex is taking a new approach by focusing on productizing satellite buses, creating a scalable, repeatable process that’s unfamiliar to the traditional space industry. Rather than changing the core structure of a satellite, Apex aims to address two key pain points in the industry: high prices and infrequent production.

Supply Chain Challenges and Supplier Dual Sourcing – Reliability, Cost and Lead Time

As shared by Ian Cinnamon, the industry that he is trying to conquer has a big problem on supply chain. To tackle this problem, Apex has their own philosophy.

He highlighted, “What it really comes down to is our customers need the bus to work right; the bus has to deliver for them. So really what we do is it means we work with our supply chain to who’ve already created these rad-hardened components that will work. Instead of us saying, “Let’s go build our own,” what we do is we try to enable our supply chain.”

Ian added to his point, “So, whether that’s helping them understand how to scale production, which is one thing that we are very, very good at—taking some of our engineers going onsite there, showing them how they could speed up processes—or things like does it make sense to potentially invest in some of our suppliers and really help them kind of ramp up. So, we’ve been looking at it from both of those perspectives.”

Apex has a clear and straightforward approach to managing their supply chain and integration strategies. They prefer to purchase parts from external suppliers rather than manufacturing them in-house. For a supplier to be chosen, they must meet three key criteria: reliability, with a proven track record of performance; timely delivery, with acceptable lead times; and cost-effectiveness.

“If we purchase parts, we have very important requirements: the supplier must meet our reliability criteria, so we have to know what works as a TL9, but TL9 doesn’t mean it’s just flown; it’s like how many have flown, what’s the failure rate, where has it gone wrong—like really digging in,” Ian emphasized.

“We need to know how quickly you can get us the parts, what is the lead time. On the lead time, that’s where we may help those suppliers get better; we may be able to help invest or share some resources, etc. And then finally, it’s to hit our cost targets.” he continued.

If a supplier meets these criteria, Apex then seeks a second supplier to ensure redundancy and avoid dependency on a single source. This dual-sourcing strategy helps them manage risks and maintain flexibility. If they can’t find suitable suppliers, they may consider vertical integration as a last resort. However, their goal is always to work with multiple suppliers to maintain optimal supply chain efficiency and resilience.

Ian insisted, “Our preference is to always be able to dual source and work with suppliers if possible.”

Apex Space is an Emerging Startup

Ideas will keep remain ideas when there isn’t any executions. Apex doesn’t want to be someone who can’t deliver their promises. As an emerging startup in the field, Apex has proven their capabilities to go further in the spacecraft industry.

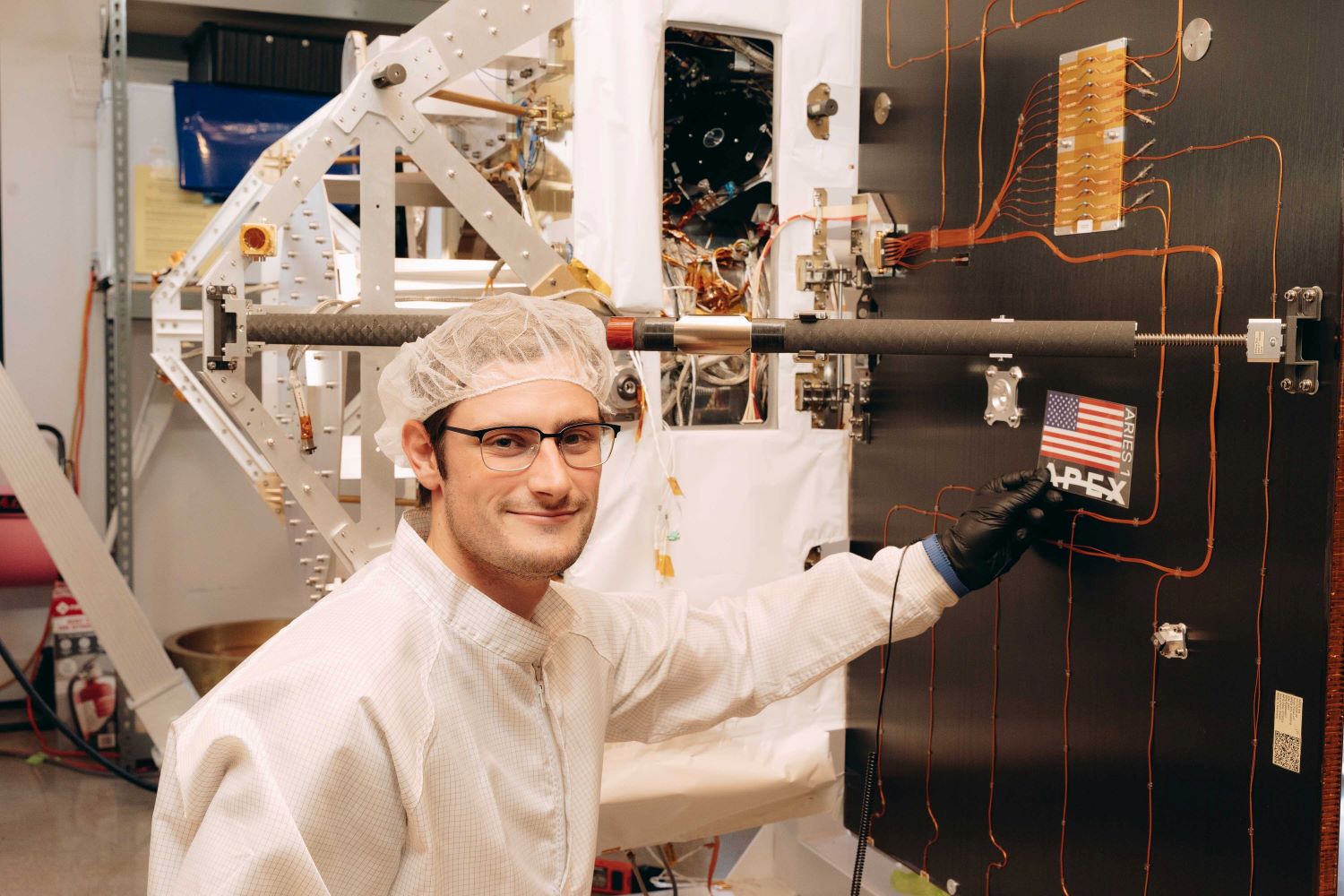

Apex Aries Has Made It to Space

One thing to note is that there is no information claiming any satellite has successfully made it into space on its first production launch, but Apex might be the one to set that record.

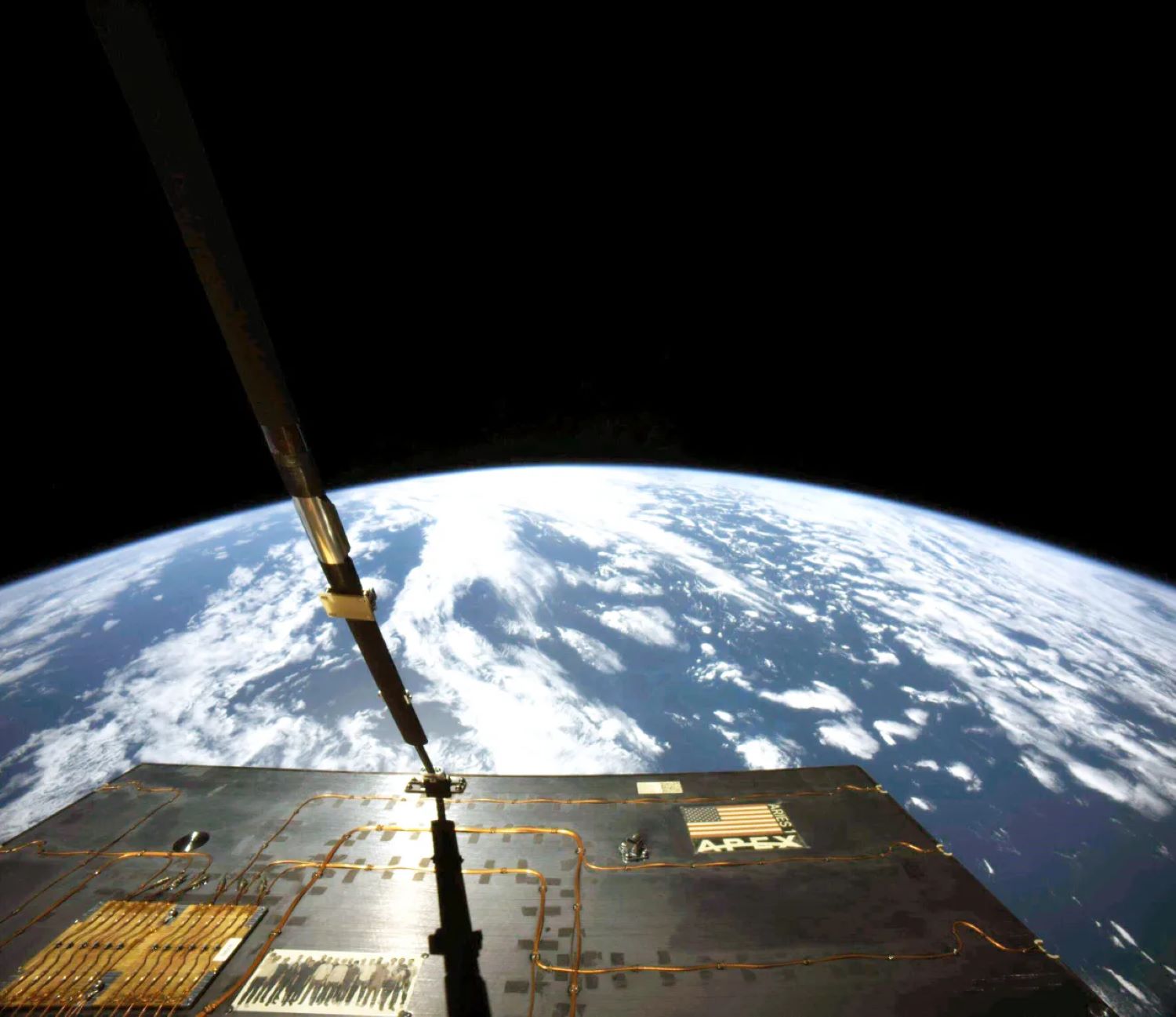

On March, the Los Angeles based startup, announced the successful deployment of Aries SN1, their first production model of a productized ESPA-class satellite bus. The satellite was launched on SpaceX’s Falcon-9 on March 4.

After 7 days in orbit, Aries continues to operate on schedule, with commissioning proceeding according to plan.

Aries remains in good health with nominal communications across both S band and UHF. As part of our planned commissioning sequence, the Apex team has successfully demonstrated its ability to perform over the air software updates.

This massive milestone has been making headlines since March which draw investors’ interest to join the game with Apex.

95 Million Dollars Series B to Expand into New Orbits

Following the success of its first mission, satellite manufacturer Apex has secured $95 million in new funding to expand its operations.

As revealed by Ian Cinnamon, the $95 million Series B funding round has been crucial for Apex’s expansion and development, primarily focusing on two key areas.

Before this funding, Apex had been concentrating on their Aries product line, which is their ESPA-class vehicle designed for smaller satellite missions. Aries has already been successful, with units in orbit and more under construction. However, as the company grows, the focus is shifting from serving customers who need just one or a few demonstration satellites to those who require constellations for operational capabilities.

To meet this demand, Apex is now focusing on developing a larger satellite bus platform called Nova, their “ESPA Grande” model, which is essentially a larger, more robust version of Aries, designed for operational rather than demonstration purposes. This will allow Apex to cater to clients who need a more substantial, operational satellite system, moving from 100 kg buses to 300 kg buses.

In simple terms, Apex is scaling up. The Series B funding is being used to accelerate the development and production of Nova, allowing Apex to ramp up its resources and focus on providing larger, more capable satellite systems.

The second major use of the funds is for expanding into new orbits. While Aries and Nova were initially designed for low Earth orbit (LEO), customer interest has driven Apex to explore missions beyond LEO, including geostationary orbit (GEO), medium Earth orbit (MEO), and even deep space.

With this funding, Apex is now working on creating a GEO version of Aries, using rad-hardened components and enhanced systems to operate in more extreme space environments. This parallel development allows Apex to diversify its offerings and meet the growing demand for advanced satellite missions in different orbits.