Addepar: From a Temporary Initiative Amid Recession to Solid Auxiliary of Finance World

As the volume of available data and the pressure to remain relevant to younger generations increase, financial services companies are increasingly turning to digital wealth management solutions to either support their in-person service offering or to be able to give a clear-sighted view of the business’s prospects.

A key factor in the financial security of an ever-wider spectrum of customers, wealth management is still a field with strong growth potential. People now have the chance to “own” financial advice and take on a central role in the lives of their clients by providing service that is upgraded digitally and is more individualized.

In 2009, a startup was founded as an aspirin that soothes the headache of data explosion which is known as Silicon-based wealth management platform aggregating portfolio, market and client data all in one place.

An Existing “Savior” of Financial Decision Among The Surge of Social Uncertainty

Addepar headquartered in Silicon Valley and has offices in New York City and Salt Lake City is a wealth management platform that specializes in data aggregation, analytics and reporting for even the most complex investment portfolios. The goal of Addepar is to increase the good effects of global capital.

Americans of all ages and socioeconomic backgrounds have been impacted by the financial uncertainty brought on by the global pandemic. Too many Americans remain unemployed despite the economy beginning to show signs of recovery, and the future of the economy remains uncertain. For some people, this translates into uncertainty about whether they will be able to retire comfortably. Others are becoming anxious about their capacity to accomplish fundamental financial objectives like buying a new house or sending a child to college.

By tackling community’s concerns, Addepar acquires its reputation on the marketplace by improving financial world in terms of speed, clarity and foresight. More than 700 of the top financial services companies in the world rely on Addepar to unleash the potential and power of data-driven, informed investment and guidance.

The services are used by these family offices, wealth managers, banks, and institutions to provide value to their clients in a contemporary, scalable, and secure manner. It is stated that the adoption of Addepar by businesses is simpler than ever. Addepar claims to have a solution to fit each customer’s demand, regardless of whether you have little resources or a wide variety of adviser teams.

Well-Rounded Solution That “Clicks”!

Talking about the company’s product will be impressive as the startup has shifted their focus on customer-centric, systematic and user-friendly financial solutions for RIAs (registered investment advisors). The platform from Addepar gives RIAs a comprehensive perspective that is advantageous to both financial planners and investment advisers.

They work with solutions in an open ecosystem in addition to integrating with financial planning tools that run scenarios and sync data with eMoney. Custodial portals gather all the most important data, which not only makes it easier to access data but also strengthens reporting. This implies that people won’t need to use a new system because they’ll have access to all the information and resources that they require in a single location.

Nicole Sager, reconciliation and reporting manager at FitzRoy, has integrated Addepar into work and showed how much it meant to her. Her perception of procedures and processes has really been influenced by how she utilizes Addepar.

She is constantly seeking ways to improve. What is the best way for her to present this data in a report? How can she combine Addepar with something else to improve the effectiveness and efficiency of the procedure? Nicole Sager simply accepted the procedure prior to Addepar. She is now always searching for ways to make processes better.

Making That Leap from The Early stage To Expansion Phase

Over a decade passing by, the company has overcome ups and downs, along that way, Addepar has reaped some remarkable rewards placing its position on the marketplace. Addepar won the Morgan Stanley Fintech Award in 2018 for having a substantial influence on the company’s continuous innovation mission, and in 2020 it was nominated to the Forbes Fintech 50 for the fifth consecutive year and an honored member of the CB Insights Fintech 250.

With clients in more than 25 nations, Addepar’s business is currently being expanded internationally. Their commitment to tech- and data-driven innovation is ongoing, their platform and product roadmap is considered to be more ambitious than ever. The company is also well-known as customer-centric that they put their clients first in everything they do and the services they offer.

It is not exaggerating to say that the second decade of Addepar is even much more exciting than the first. “Addepar will continue to grow at a high rate for a long time, and will be a much more impactful platform than people yet realize, as a key part of the global financial infrastructure,” Addepar founder and chairman Lonsdale once stated in a release.

Addepar has raised a total of $491.4M in funding over 6 rounds by 18 investors. Their latest funding of $166.3M was raised in Jun 2021 from a Series F round. Addepar also announces the expansion of their European presence following significant development in their clientele and product line. Their Edinburgh office was expanded last year, and now they have a location in London. They currently have more than 30 clients and six offices spread across three nations.

Looking for Silver Linings and Seeking Meaning in The Madness Create Innovations

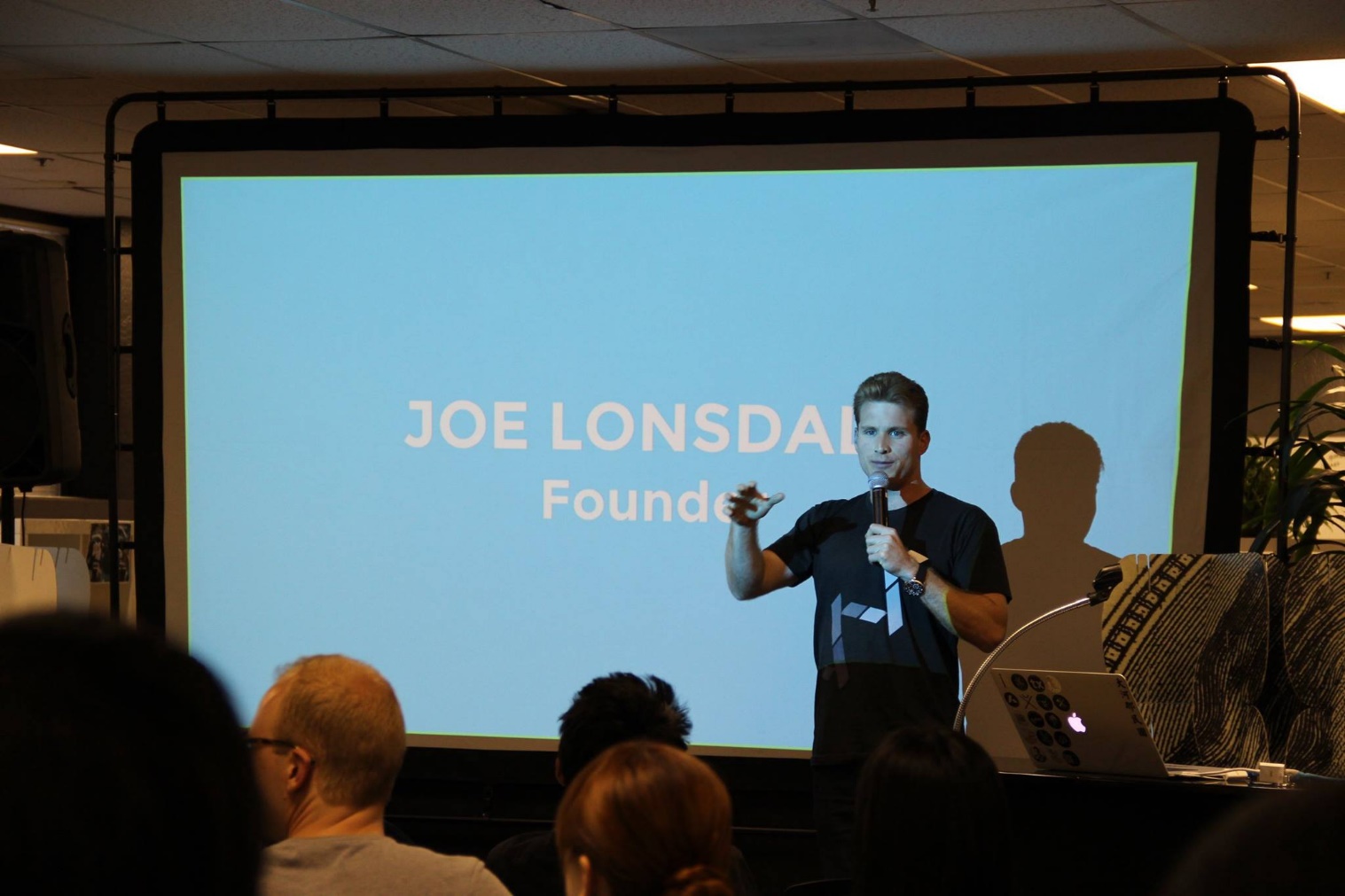

The character that stands behind all Addepar unwavering drive forward is serial entrepreneur, startups investor and philanthropist Joe Lonsdale. Lonsdale, 40, made history in 2016 and 2017 by becoming the list’s youngest member and ranking among the top 100 venture capitalists worldwide.

Beside serving as chairman of Addepar, a wealth management technology platform with a $4 trillion market cap, recently, he launched a number of mission-driven technology companies including Epirus, Affinity, National Resilience Bio, LIT, and others.

What’s more, Joe Lonsdale also have a knack for investment when being early backer of many companies like Anduril Industries, Oculus, Guardant Health, Oscar, Illumio, Wish, JoyTunes, Blend, Flexport, Joby Aviation, Orca Bio, Qualia, Synthego, RelateIQ, Yugabyte and others.

Since Joe Lonsdale was in college, he has shown his interest in the finance world. While studying at Standford College, Joe Lonsdale also worked with the financial arm of PayPal. He is a typical example for other businesses about innovation and optimalism.

Lonsdale urges investors and business owners to maintain optimism despite the murky economic forecast. Crises often give rise to the best innovations. Following the 2008 financial crisis, Lonsdale established Addepar to aid advisors in navigating choppy market situations. “Venture investment requires being bold and being able to have an opinion on what is possible. You have to think: “What’s possible now that wasn’t five years ago?”, Joe Lonsdale once said.

Lonsdale anticipates that businesspeople will seize the opportunity presented by this and innovate to develop products and services that will aid in our collective adjustment to the new normal. He is upbeat about the likelihood that these high-impact firms will develop into significant participants in the tech industry.

A Suspicious Psychological Manipulation Trick Hidden Behind People-oriented Culture

Besides being one of the competitive startups in the market, Addepar is also well-known for being people-oriented by continuously showing their gratitude towards “Addepeeps”. The company always has exceptional gifts for their community on special days.

In pride month, affinity groups champion their members’ work and celebrate diversity. Everyone has a right to respect and decency in their daily interactions with one another. The goal of AddePride is to build an accepting atmosphere at Addepar, in their communities, and with their clients by offering an inclusive workplace that inspires Addepeeps to bring their genuine authentic self to work. Additionally, they are committed to opposing systemic racism with the Black community and fighting for justice, equality, and, ultimately, reform.

On top of that, at the end of last year, Addepar joined in celebrating for their “AddeParents” with appreciation for all parents who are working at the company while balancing their family’s time. Don Nilsson, Chief product officer of Addepar stated:” Family is the most important thing in life and it has been wonderful to watch the AddeParents in our extended Addepar family support and learn from each other, particularly as we’ve navigated some challenging circumstances over the past 18 months.”

The startup was put to the extreme test by the epidemic and unknowns that emerged over the past years. As a tech firm, Addepar was able to quickly switch to home-based work and encouraged parents to take whatever time they needed to care for their family.

Nevertheless, everything has two sides. One thing that should be taken into consideration is that Addepar has decided to subsidize employee housing if they live within a specific proximity to their headquarters. Yet, Addepar, Palantir, Facebook, and Salesforce.com have all faced criticism for this program as it is attributed to encourage employees to spend more time at work and in response to rising housing rents in the area. According to John Liotti, the CEO of the East Palo Alto community advocacy group Able Works, there is no agreement on whether or not this contributes to the gentrification of communities.

Key Take Away in Venture World: Think Out of The Box

Joe Lonsdale said that as Addepar works to achieve radical openness in the financial sector, he is anticipating ongoing innovation within the company. The next stage is creating a feeling of community so that clients can connect with and pick the brains of other wealth managers and financial advisors using Addepar.

The founder is reminded of the significance of their founding idea as global markets continue to fluctuate and unemployment rises to its greatest level in over a century. At Addepar, they think that advisers ought to have access to information and chances to make quicker and more knowledgeable financial judgments. Their most recent step in achieving that goal is Marketplace.

Joe Lonsdale also shares his own strong belief as to startup’s orientation and vision. He claims that rushing to invest in the newest technical advancement is a critical mistake made in the venture business. Focus on businesses that are developing goods and services that weren’t even feasible five or 10 years ago rather than joining a bandwagon.

Bottom Lines

Addepar has made an impressive milestone that leverages wealth management solutions in the financial world. This also gives inspiration to other firms to learn from the company’s stories and take advantage of them to shape their own business or startup ideas. I personally believe that Addepar can do even better than that just as the next decade is said to be more interesting than its past time.