The Secrets and Lies of Once-Heralded Unicorn Startup Theranos

Theranos was a privately held health technology corporation. It was initially touted as a breakthrough technology company, with claims of having devised blood tests that needed only very small amounts of blood and could be performed very rapidly using small, automated devices the company had developed.

The Rise of Once-Heralded Revolutionary Testing-Blood Star from The Silicon Valley

Founded in 2003 by then-19-year-old Elizabeth Holes. While at Stanford University, Elizabeth Holmes had an idea to develop a wearable patch that could adjust the dosage of drug delivery and notify doctors of variables in patients’ blood. She started developing lab-on-a-chip technology for blood tests, with the idea to start a company that would make blood tests cheaper, more convenient and accessible to consumers. She has delivered her idea to Dr. Phyllis Gardner, a Stanford Medical School professor. However, Gardner tried to explain to her why that might not work.

Holmes was not deterred. “I got to a point where I was enrolled in all these courses, and my parents were spending all this money, and I was not going to any of them,” said by Holmes.

In the end, Holmes dropped out of Stanford in 2003 and used the education trust from her parents to find the company that would later be called Theranos, derived from a combination of therapy and diagnosis. The company’s original name was Real-Time Cures, which Holmes changed after deciding that too many people were dubious about the cure. She was inspired both by her grandfather’s medical career, and her summer 2003 internship at the Genome Institute of Singapore.

In the meantime, Shaunak Roy, a PhD student Holmes was assisting in Professor Channing Robertson’s lab, joined her at Theranos in May 2004 as its first employee. Additionally, She persuaded Robertson to spend one day a week as a technical adviser to the company and to serve as her first board member. Eventually, he retired from his tenured position, and began working at Theranos full time as an adviser. Theranos raised millions of dollars in its first years.

In order to raise initial funding, Holmes leveraged several family connections. The first two investors in Theranos were Tim Draper, the father of her childhood friend and former neighbor, and Victor Palmieri, one of her father’s long-time friends. In 2004, Theranos was based in a rented basement near the Stanford campus. By December 2004 the company had raised more than $6 million from investors at a valuation of $30 million.

The initial design for the Theranos device in 2005 was a cartridge-and-reader system that was dependent on microfluidics and biochemistry. This prototype was dubbed the Theranos 1.0, and the company had plans to license the technology out to pharmaceutical firms to help them catch side effects during drug trials.

The company had about $45 million total fundraising after Series B and Series C funding in 2006. In November 2006, Theranos Chief Financial Officer Henry Mosley was fired after questioning the reliability of its technology and the honesty of the company.

In August 2007, Holmes used the premature Theranos 1.0 in a patient study with terminal cancer patients in Nashville, Tennessee. Theranos also said that it would sue three former employees for stealing intellectual property. Theranos developed a new prototype in September 2007, named the Edison. The device was a modification of a glue-dispensing robot from New Jersey company Fisnar. By then, Holmes had poached some of Apple’s designers and put them in charge of architecting the overall look and feel of the Edison.

A key to the company’s growth was the hiring of Sunny Balwani, a software engineer, whom Holmes had met in the summer after her senior year of high school. He and Holmes spoke often, and they shared a belief that software, not just chemistry or biology, mattered. If Theranos was going to be able to analyze a few drops of blood, engineers would have to develop the software to do it. In 2009, Balwani joined as C.O.O. and president.

“We have automated the process from start to finish.” said Balwani.

Theranos has managed to keep its technology a secret for much of its decade of existence in part because it occupies a regulatory gray area. Most other diagnostic labs, including Quest and Laboratory Corporation of America, perform blood tests on equipment that they buy from outside manufacturers, like Siemens and Roche Diagnostics. Before those devices can be sold, they must be approved by the F.D.A., a process that makes their tests’ performances more visible to the public. Nevertheless, since Theranos manufactures its own testing equipment, the F.D.A. does not need to approve it, as long as the company does not sell it or move it out of its labs. Holmes said that the company has long resisted discussing how its technology works or how it makes money in order to avoid tipping off potential competitors.

The company employs seven hundred people and, in addition to its headquarters, has a two-hundred-and-sixty-five-thousand-square-foot facility, in Newark, California, that manufactures the blood-testing devices. Holmes says that Theranos has a positive cash flow; it is clearly expanding. For many years, it has earned income from large pharmaceutical companies, including Pfizer, which use its tests when they are conducting clinical trials on new drugs. It also earns revenue from the wellness centers that it has set up in Walgreens stores, its hospital work, and the U.S. military, although Holmes would not discuss the company’s arrangements with the latter.

By 2010, a startup had hit Silicon Valley. Theranos raised an additional $45 million in 2010 at a valuation of $1 billion.

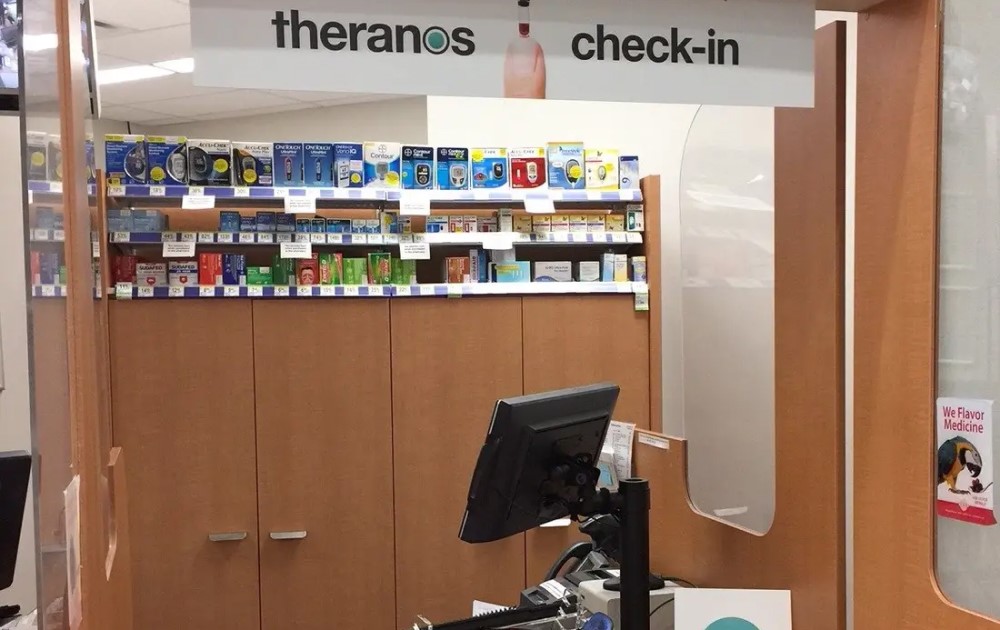

In early 2012, Theranos took over blood testing at a Safeway employee health clinic as a beta run. The chief medical officer of Safeway had concerns about discrepancies in the test results. Safeway’s CEO brushed it off and retired the following year. Theranos also signed a deal with Walgreens in 2012 to launch its devices in-store but continuously missed deadlines.

In 2013, Theranos announced a long-term partnership with Walgreens that will eventually establish its wellness centers in most of the eighty-two hundred Walgreens stores. The Walgreens in Palo Alto has one, as do forty Walgreens pharmacies in Phoenix. Holmes envisages wellness centers in most Walgreens and Duane Reade stores, which would put Theranos “within five miles of every American.” Theranos also could sign up the rival drugstore chain CVS, which has seventy-eight hundred outlets.

The new partnerships meant that Holmes had to create a new device that could perform more than just one class of blood tests. The miniLab was created in 2011 and was nicknamed the 4s after the iPhone model. In September 2013, Theranos launched its 4s model with a new website and an op-ed by Holmes in The Wall Street Journal, despite protests from several of the company’s scientists saying that the technology was not ready.

Theranos raised more than $700 million from venture capitalists and private investors, resulting in a $9 billion valuation at its peak in 2013 and 2014.

Theranos and Holmes started gaining media attention, gracing the cover of Fortune magazine in June 2014. She made claims about her blood test like that the company offered more than 200 tests and was ramping up to more than 1,000.Theranos was hyped to its investors and in the media as a breakthrough in the blood-testing market, where the U.S. diagnostic-lab industry posts annual sales of over $70 billion. Theranos claimed its technology was revolutionary and that its tests required only about 1/100 to 1/1,000 of the amount of blood that would ordinarily be needed and cost far less than existing tests.

In 2016, Forbes revised the estimated net worth of the company to $800 million taking into account the $724 million of capital raised.

The Downfall of The Blood-Testing Startup Theranos in Allegation of Frauding Maneuver

A series of Wall Street Journal articles in 2015 revealed that most of the tests Theranos claimed to be doing with its Edison machines were being carried out by traditional machines bought from other companies. When the company’s proprietary devices were used for testing, the results were found to be less reliable and accurate than those produced by traditional machines. After scrutiny from health regulators, Theranos retracted two years of blood tests and agreed to reimburse 76,000 Arizonans who used its services.

The indictment outlines these issues as well as alleged problems relating to the way Theranos presented its business to investors, including ambitious revenue projections of $1bn in 2015.

It also alleges that the pair defrauded doctors and patients by making false claims about the effectiveness of Theranos’s blood tests, including those for calcium, potassium, HIV and diabetes.

Theranos claimed that the allegations were factually and scientifically erroneous. At that time, the Cleveland Clinic announced that it would work to verify Theranos technology. Theranos fought back against the Journal’s investigation, sending lawyers after sources in the story, including Tyler Shultz, in an effort to stop them from providing information to the press. Former employees of reputation management firm Status Labs said that Theranos had hired the firm to discreetly erase mentions of the WSJ’s reporting.

In addition, medical research professors John Ioannidis and Eleftherios Diamandis, and investigative journalist John Carreyrou of The Wall Street Journal, questioned the validity of Theranos’ technology. The company faced a string of legal and commercial challenges from medical authorities, investors, the U.S. Securities and Exchange Commission (SEC), Centers for Medicare and Medicaid Services (CMS), state attorneys general, former business partners, patients, and others.

By June 2016, it was estimated that Holmes’s personal net worth had dropped from $4.5 billion to virtually nothing. The company was near bankruptcy until it received a $100 million loan from Fortress Investment Group in 2017 secured by its patents. In September 2018, the company ceased operations.

In July 2016, Theranos received sanctions from the CMS, including the revocation of its CLIA certificate and prohibition of Holmes and other company officials from owning or operating a laboratory for two years. Theranos announced it would close its laboratory operations and wellness centers to work on miniature medical testing machines.

In April 2017, Theranos said it had reached a settlement agreement with CMS. Following the CMS sanctions, the Walgreens pharmacy chain terminated its contract with Theranos and filed a lawsuit claiming continuous breaches of contract. The suit was settled out of court, with Theranos compensating Walgreens for a much smaller amount than the claimed $140 million, reported at about $30 million.

By the end of 2017, Theranos was in need of a cash infusion and made a deal with Fortress Investment Group for $100 million in secured debt financing to get it through 2018. The deal relied on Theranos hitting certain development milestones as it worked to get its Zika virus approved by the FDA.

Then in March, the SEC charged Holmes, Balwani, and the company with “massive fraud,” though Theranos and Holmes settled. As part of the resolution, Holmes paid a fine and cannot be a director or officer of a publicly traded company for 10 years. Facing setbacks in its Zika test development in the spring of 2018, Theranos laid off the majority of its remaining employees and appealed to investors for more funding.

On March 14, 2018, Theranos, Holmes, and former company president Ramesh Sunny Balwani were charged with massive fraud by the SEC. One section of the complaint says Holmes falsely claimed in 2014 that the company had annual revenues of $100 million, a thousand times more than the actual figure of $100,000. Theranos and Holmes agreed to resolve the charges against them, with Holmes paying a fine of $500,000, returning the remaining 18.9 million shares that she held, relinquishing her control of the company, and being barred from being an officer or director of any public company for ten years.

According to the agreement, if Theranos were acquired or otherwise liquidated, Holmes would not profit from her ownership until more than $750 million was returned to investors and other preferred shareholders. Theranos and Holmes neither admitted nor denied the allegations in the SEC’s complaint. Balwani did not settle. On June 15, 2018, the U.S. Attorney for the Northern District of California announced the indictment of Holmes on wire fraud and conspiracy charges. Balwani was also indicted on the same charges. The jury selection for the trial is scheduled to begin on July 28, 2020, with the trial scheduled to commence in August 2020.