The Mistreatment and Discrimination against the Black-Owned Businesses during the Pandemic

More black entrepreneurs are going into business which is showing a good sign. Their businesses grew by more than 400% from 2017 to 2018. However, their development has to go through a number of obstacles. But the main one should be access to funds. While their white counterparts can easily gain funds from the banks, they are not that lucky, most of the funds to start their businesses belong to them or to their friends, families. The discrimination is the U.S. is still high and alarming. Below we include some facts and data to illustrate how pathetic the black-owned businesses are currently.

Daunting Picture of Black-Owned Businesses in the U.S.

Recent numbers indicate that $2.5 million black-owned businesses in the US could generate only $150 million in revenue. Unluckily, this represents negligible ownership and control over the nation’s productive capacity. For example, in 2017, the top 100 black-owned businesses companies received a total revenue of $27 million and employed 79.216 workers. These numbers could see the positive increase which was better than the previous years. However, if we look at the numbers of Walmart alone, this giant grossed more than twenty times as much in revenue and employed 2.2 million more workers. The numbers of Walmart solely are huge compared to the entire top 100 black-owned businesses combined.

The data is clear and transparent, it gives us a daunting glance at African American entrepreneurship and small business. According to the U.S. Census Bureau’s Survey of Business Owners (SBO), which is conducted every five years, over 90% of Latino and black firms do not employ any employees other than their owners. This trend with only one owner is increasing and nearly reaching its peak of 98% for the sub-group of African American female-led businesses. Thus, even though the blacks own the business, their profit cannot be compared to the whites, which leads to the fact that it will take even longer to close the racial wealth gap.

Another report from Small Business Administration shows that 19 million businesses which mean 70.9% of all the U.S. businesses belong the white ownership. While the blacks own 2.6 million businesses (9.5% of all the U.S. businesses), the Latinos have slightly more positive numbers, they own 3.3 million businesses or 12.2 of all the U.S. businesses.

These numbers are already telling a sad story about the market for the black. However, when it comes to sales and revenues, it is even worse. The 19 million businesses owned by the white have a proportion of 88% in the overall sales, and 86.5% of U.S. employment is controlled by these Whites. In contrast, the sales of black businesses only contribute to 1.3% of American total sales, 1.7% of the nation’s employees.

It is believed that businesses with paid employees have better performance as well as create a greater impact on the economy. The sales per year of a business without the employees is just a tiny fraction compared to the sales of the business with the employees. It might be true that some firms without the employees are successful financially, but this is a tiny number; the majority are not. 67.3% of firms without employees had annual sales of less than $25,000. Thus, if these firms make any profits, then it should be a small number of that $25,000. This also implies that most black-owned businesses without the employees do not make enough to keep their owners and their owners’ families out of poverty if the firm is the owner’s sole source of income.

How the COVID Pandemic Has Financially Affected the Black-Owned Business

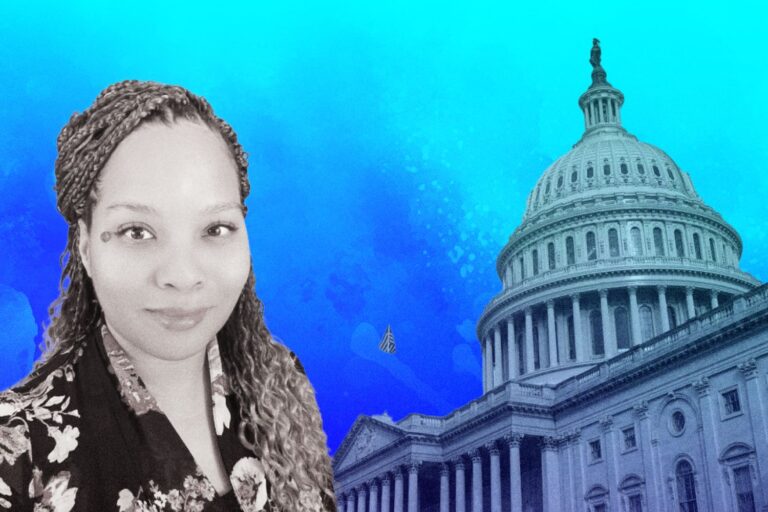

Story of a black female businesswoman in the COVID pandemic.

Tara Williams-Harrington-a female black owner rushed to apply for her application as soon as the federal Paycheck Protection Program opened in April. Once the coronavirus stopped her in-person classes, she calculated that she needed $33,000 to pay her rents and her nine-part time employees. However, when she applied for a PPP loan at M&T bank, they told her there have been other customers that they were prioritizing.

In the end, Williams-Harrington believed she was luckier than black fellows. Thanks to the help of the African American Chamber of Commerce, she was able to secure a loan through a different bank. But in April, while everything was in process, her husband died due to COVID, and she also tested positive for the virus. “Most people who are colored here are heavily impacted, most of them are dying,” Williams-Harrington says. “As a business owner of color, we’re hit 3 ways around.”

President Donald Trump said Thursday was “a great day for everybody” since, in line with the newest job report, 2.5 million U.S. jobs were added in May. Yet there was a rise in unemployment for the African Americans, it’s reached a decade high. Across the country, both the coronavirus and its economic fallout are the explanations for the African Americans’ disproportionately suffering, causing them to struggle with getting access to the federal aid programs designed to mitigate the damage. Data and interviews with small business owners and advocates say that of all the businesses that have struggled to access relief from the Paycheck Protection Program, minority-owned businesses have taken the most important hit.

With the set of conditions, the larger businesses are more favored. Moreover, several banks only approved loans for the prevailing customers and slowed down the applying of sole proprietorships. As a result, many of these small minority-owned businesses had to shut down. For those that could secure the loans with the conditions, the advocates worry that those conditions might make it hard for several to qualify for their forgiveness, potentially saddling them with years of debt.

Efforts are underway to help, but may it be enough?

Recently, there has been an encouraging push for customers to assist black-owned businesses. Besides, new legislation has been passed with the aim of eliminating some of the program’s baked-in inequities. But the experts doubt if these new measures are strong enough to tackle the inequality issues that have been happening for years.

Jessica Fulton- a vice president at the Joint Center for Political and Economic Studies, at public policy think tank in Washington, DC believed that there is a transparent reminder of the systemic racial inequality brought to the fore in the past week due to the way that the programs have disadvantaged minority-owned businesses. Besides, this also triggered and thus, tens of thousands have taken to the streets across the country. She also mentioned that this is unavoidable when you are not including black communities meaningfully in policy conversations around issues that matter. Moreover, PPP’s failures could have been corrected from the beginning if there were folks in the room who were acquainted with the troubles that black businesses might deal with.

Congress planned the Paycheck Protection Program, which was incorporated as a part of $2.2 trillion coronavirus alleviation package President Trump signed into law more than two months ago, to help small businesses who were abruptly on the edge of closing during stay-at-home requests. The program, which is run under the Small Business Administration, makes use of banks and other loaning institutions to manage governmentally backed loans to organizations with up to 500 workers. So long as most of the assets are utilized to pay workers and keep operations afloat, they can transform into grants, and be forgiven. Altogether, Congress has dispensed $649 billion toward the program; as of May 30th, about 80% of that had been spent, according to the information from the SBA. (After the program came up short on its first 349 billion within fourteen days, Congress distributed another $310 billion).

The reasons for the difficulty in raising funds for the minority-owned businesses

The SBA has not discharged a rundown of organizations that have got the credits; whatever data there is has been gathered from either voluntary disclosures, or in the case of public companies filings with the protections and trade commission. What data has appeared, however, paints a hopeless picture for minority-owned organizations. A national online survey of 500 African-American and Latinx-owned small businesses run by the Global Strategy Group discharged May 13 – after the second round of subsidizing for the program was assigned – found that simply 12% got the full help they mentioned, with 66% revealing that they didn’t get any. A different survey from the Small Business Majority, a small business advocacy organization, demonstrated that 63% of Black and Latino entrepreneurs attempted to find and got financing, however, 3 of every 10 did not get the amount they demanded.

Congress included language in the law asking lenders to put female, minority-owned, and rural organizations on priority, yet since the loans to these organizations were managed through banks and not the government, there was clearly no requirement system for the solicitation. A May 8 report by the SBA Inspector General found that the SBA did not consent to this piece of law’s direction. Accordingly, the Inspector General concluded that “The underserved and rural borrowers probably can’t receive the credits as expected.”

In fact, that conclusion was not really a disclosure. “The premise of the program itself, a Paycheck Protection Program that depends on budgetary organizations, has major auxiliary detriments for organizations owned by non-white individuals from the earliest starting point,” says Ashley Harrington, the Federal Advocacy Director, and a Senior Counsel at the nonprofit Center for Responsible Lending (CRL).

Small business advocates have argued from the first days of the program that the option to utilize banks as intermediaries implied that bigger, and more established organizations would get priority over smaller businesses. This expectation was compounded by a provision embedded in the bill, relating just to the food and hospitality parts, where organizations with “individual location” under 500 individuals could in any case be qualified – which means restaurant chains like Shake Shack and Ruth’s Chris Steakhouse could apply. Since the funds were initially limited, and demand far surpassed the supply. Thus, lenders who preferred to minimize their risk often offered funds to the clients with whom they had preexisting relationships.

Experts believed this lending based on the relationships adversely affected minority-owned organizations that often did not have those connections. The information from the Center for Responsible Lending informed that 46% of white-owned organizations could get credit from a bank in the last 5 years-double that of African American owned organizations.

The program also specified that, when it opened the first round, independent contractors and sole proprietors needed to hold up seven days before applying, with the view of prioritizing firms that might be preparing to lay employees off. Since minority-owned organizations are less likely than their white partners to fall into that class, this showed another disadvantage for these black-owned businesses. In a report by CRL, it illustrated that ninety-five percent of organizations possessed by African Americans have no workers, compared to 91% of Latinx-owned organizations and 78% of white-owned organizations.

The improved movement from the government to tackle the issue

Acknowledging these issues, the government found a way to lighten the issue instead of just allocating more subsidizing. On May 28th, the SBA and Treasury reported they would set aside $10 billion for Community Development Financial Institutions, which its function is to offer loans for the underserved and rural organizations. Later, President Trump signed a bill into law with a purpose to lessen the criteria for businesses to transfer their loans into grants. Previously, organizations had to spend the loans within about two months after receiving them, and 75% must be spent on payroll. Under the improved measures, organizations have up to 24 weeks to spend the money, and just need to use 60% of it on the payroll. Williams-Harrington says these new requirements will be tremendously valuable for her since she was stressed about utilizing the money in the allotted time.

In any case, Ashley Harrington, the counsel at the Center for Responsive Lending, is worried that similar issues, like the lack of employees, that prevented the minority-owned organizations from getting access to the funds could impose another impediment when it comes to turning them into grants. The 11-page application, she claims, is so complicated that probably the smallest organizations might be constrained to hire accountants or consultants to navigate it, further straining resources that have already been pushed to the brink.

“This program is a huge lifeline however part of what makes it a lifesaver is the capacity to transfer this loan into a grant. Or paying huge debts will make these businesses suffer” she says. “We don’t need these small organizations to come out of this crisis with debt they can’t manage.”

The Bottom Lines

In the end, in the pandemic situation, where all the people need help from the government, we can see the transparent inequality treatment to the black-owned businesses. Before they had to struggle with the employee recruitment so much that as mentioned, most of the black-owned businesses are sole proprietorship, plus the difficulty in raising funds has made them vulnerable compared to other white businesses. Now in the coronavirus pandemic, with the help of different programs, there is still not enough for what they had to bear. For entrepreneurs like William-Harrington, as if she had received the financial support from the PPP in the first time, then things could have been much better for her and her family. Due to these deep-rooted prejudices or just plain ignorance, these black-owned businesses are pushed to the edge of extinction. But there are also advocates and supporters for these minority groups, and we can see how people reacted aggressively after George Floyd’s death, which has made thousands of protestors come down the street. Soon, we all hope the discrimination will disappear and leave a fair and great America again.