Teledyne to Acquire Select Aerospace and Defense Electronics Businesses of Excelitas

THOUSAND OAKS, Calif. – Teledyne Technologies Incorporated (NYSE:TDY) (“Teledyne”) announced today that it has entered into an agreement to acquire select aerospace and defense electronics businesses from Excelitas Technologies Corp. (“Excelitas”) for $710 million in cash. The acquisition includes the Optical Systems (OS) business known under the Qioptiq® brand based in Northern Wales, UK, as well as the U.S.-based Advanced Electronic Systems (AES) business.

“We will be pleased to add these businesses to our aerospace and defense electronics segment, which has performed exceptionally well in recent years”

The UK-based OS business provides advanced optics for heads-up and helmet-mounted displays, dismounted tactical night vision systems and proprietary glass used in space and satellite applications. In the U.S., the AES business provides custom energetics, including electronic safe & arm devices, high-voltage semiconductor switches and rubidium frequency standards for defense and space applications.

“We are excited to announce this pending acquisition, which will bring us new technology in markets well-understood by Teledyne. Our respective products are highly complementary and not competitive, and we generally serve customers in complementary geographies,” said Robert Mehrabian, Executive Chairman. “We look forward to welcoming these businesses and their employees to Teledyne.”

“We will be pleased to add these businesses to our aerospace and defense electronics segment, which has performed exceptionally well in recent years,” said George Bobb, President and Chief Operating Officer. “Furthermore, we believe the businesses’ operations, personnel and culture are very compatible with our U.S. and UK defense electronics organizations.”

“We are excited about the new opportunities this acquisition will bring and look forward to a seamless integration that will benefit our customers, employees and Teledyne stakeholders,” said Doug Benner, EVP Excelitas and President Defense and Aerospace Segment. “Our journey providing electro-optical solutions designed to keep troops and high-value assets safe continues with an industry leader.”

The transaction is anticipated to be completed in early 2025 and is subject to customary closing conditions, including regulatory approvals. Teledyne management expects the transaction to be accretive to GAAP and non-GAAP earnings per share, excluding transaction costs.

Evercore and Harris Williams are acting as financial advisors, and Fried, Frank, Harris, Shriver & Jacobson LLP is acting as legal advisor to Excelitas in connection with the transaction. McGuireWoods LLP is acting as legal advisor to Teledyne.

About Teledyne

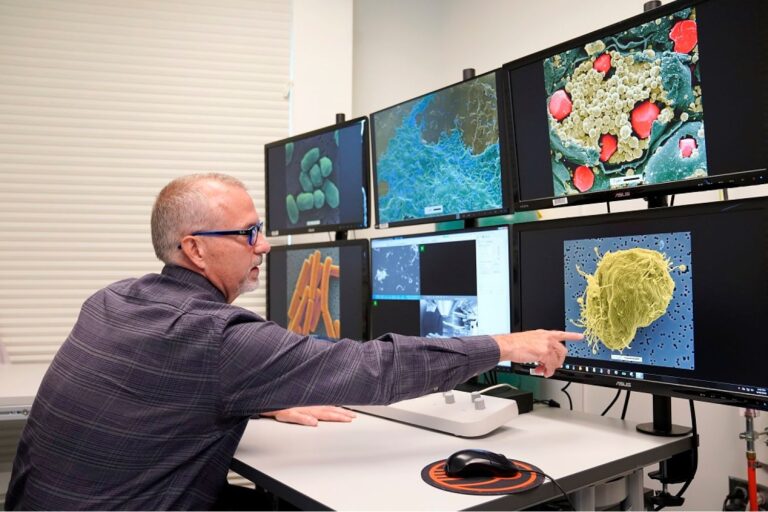

Teledyne is a leading provider of sophisticated instrumentation, digital imaging products and software, aerospace and defense electronics, and engineered systems. Teledyne’s operations are primarily located in the United States, Canada, the United Kingdom, and Western and Northern Europe. For more information, visit Teledyne’s website at www.teledyne.com.

About Excelitas

Excelitas is the leading provider of advanced, life-enriching technologies that make a difference, serving global market leaders in the life sciences, advanced industrial, next-generation semiconductor, aerospace, and defense end markets. Headquartered in Pittsburgh, Pennsylvania, Excelitas is an essential partner in the design, development, and manufacture of advanced technologies, offering leading-edge innovation in sensing, detection, imaging, optics, and specialty illumination for customers worldwide. Excelitas is at the forefront of addressing many of the relevant megatrends impacting the world today, including precision medicine, industrial automation, artificial intelligence, connected devices (IoT), and military modernization.

Forward-Looking Statements Cautionary Notice

This press release contains forward-looking statements, as defined in the Private Securities Litigation Reform Act of 1995, relating to a potential acquisition of a business. Actual results could differ materially from these forward-looking statements. Many factors, including the ability of Teledyne and the acquired businesses to achieve anticipated synergies and Teledyne’s ability to integrate the acquired businesses, the ability of the parties to satisfy closing conditions, as well as market and economic conditions beyond Teledyne’s control, could change anticipated results. There are additional risks associated with operating businesses internationally, including those arising from United States and foreign government policy and regulatory changes or actions and exchange rate fluctuations.