Job Site Started Mobile: How United Rentals is Leading the Heavy Equipment Industry

United Rentals founded in 1997 by Bradley S. Jacobs in Greenwich, Connecticut, is the equipment rental business that offers rent to construction and industrial companies, manufacturers, utilities, municipalities, homeowners, and government entities. There are two business segments that the company is working on: General Rentals; and Trench, power, and fluid solutions.

Currently, United Rentals is the world’s largest equipment rental company. Its network consists of 1,169 rental locations in North America and 11 in Europe. It is said that the company operates in 49 states of North America and every Canadian province. Besides, the number of employees serving construction and industrial customers goes up to 18,900. The company also offers nearly 4,000 classes of rental equipment with a total original cost of $14,13 billion.

According to the company, Rental equipment takes up more than two-thirds of the company’s revenues. It also sells second-hand equipment, supplies and is considered as an authorized dealer for plenty of leading tool and equipment manufacturers. The company took the number one spot in e-commerce in February 2000 when launching its new business-to-business website. From the website, the customers can rent or buy equipment on a 24-hour basis, seven days a week. Going public in 1997, United Rentals never lost, it has only met or exceeded the financial analysts’ estimates for every quarter of each fiscal year.

How the Story Began

In the 1980s, the studies about the consequences of global warming and growing awareness of the pollution pushed the emergence of lots of small and privately owned garbage-collection companies throughout the U.S. In 1989, Bradley Jacobs founded the United Waste Systems, Inc. to combine all the small solid-waste companies into an efficient and profitable organization. Soon, his organization quickly bypassed the major competitors at that time such a Waste Management and Browning-Ferris.

What should be mentioned is that Jacobs was such an experienced administrator when he served as the CEO of AmerexOil – an oil brokerage firm that he cofounded from 1979 to 1983. From 1984 to 1989, he was also the chairman as well as COO of Hamilton Resources Ltd. This excellent profile explained his early success with United Waste.

By 1997, United Waste offered service to over 700,000 commercial, industrial, and residential customers in 16 states. Yet it was later sold to USA Waste Services for $2.2 billion.

After selling the company, Jacobs enlisted Merrill Lynch to help figure out the new opportunities. It is believed that when the economies of scale were such a tremendous advantage, equipment rental rose as a booming business and grew up to 15 percent a year.

Only a few weeks after the sale of United Waste, Jacobs created United Rentals. Most of the senior management team of United Waste then joined with Jacobs. They together invested $46.5 million of their wealth and raised another $8 million. At the time, the little public record of family-owned rental companies made it hard for suitable acquisitions. Thus, what Jacobs did was to read five years’ worth of trade magazine, he also downloaded the websites of hundreds of rental stores and hired a private investigating firm with the aim of identifying potential targets.

Acquisitions – How United Rentals Became the Biggest Player

The company’s goal was to create a rental company with diversified equipment in the U.S. and Canada. Later, United Rentals acquired six smaller leasing companies. The analysts believed that the success of the company was based on its growth strategy, which was to focus on expansion through acquisition program, the opening of new rental locations. In December 1997, the company went public and the stock was traded at $13.50 per share.

Initially, most of its revenues were made from renting equipment to the construction industry and the sales of second-hand equipment. The company gradually received more attention when more and more large industrial companies decided to go for renting options rather than purchasing. By June 1998, 38 rental companies had been acquired by the United Rentals, which means that they got 109 stores, appearing in 20 states. As the fifth-largest player, its stock increased dramatically to nearly $37 per share.

Regardless of their size, United Rentals kept on finding and purchasing the potential smaller companies. Then, U.S. Rentals, Inc. – the second largest equipment rental company was purchased by United Rentals. This made the company become the largest and most geographically diverse equipment rental company in North America.

By the end of 1998, the company owned 103 companies which located 439 locations, spreading across 39 states and five Canadian provinces, and Mexico. There was already a variety of equipment at a time when they owned more than 600 different equipment and served over 900,000 customers. The total revenue in 1998 was estimated to be $1.22 billion, which was 149.1 percent over that in 1997 with $489.84 million.

According to the United Rentals’ data, the U.S. equipment rental industry experienced steady growth from $600 million in annual revenues in 1982 to over $25 billion in 2000, which was a 15 percent increase. In terms of United Rentals, in February 2000, the company released the opening of its E-Rental Store where people could rent and buy used equipment online.

At the end of the year 2000, the company managed to acquire additional 17 equipment rental companies which increased its location numbers by 32 locations. Most of these acquisitions were focusing on sectors like traffic control, trench safety, and special-event segments. Undeniably, these acquisitions are the reason for United Rentals’ huge size, it even became the largest provider of rental equipment for traffic control.

The Way That United Rentals Is Redefining the Rental Business Model

However, concentrating on acquisitions solely was not the only strategy that United Rentals used for its success. Instead, it is the combination of constant investment in digital solutions or more innovative technology and many more. Let us discover some of the ways that this multi-billion-dollar organization is utilizing and the reasons behind them.

#1. Ongoing investment in digital solutions

In the 2019 conference, the executive vice president and chief commercial officer, Paul McDonnell, shared that the industrial customers are having to face up with the changing environments of the organization’s construction. He believed that as the projects are getting bigger and more complicated, it is even harder to manage their growth.

He stated that: “This major challenge which is managing the complexity of the modern worksite can indeed give us the chance to provide with a better-improved performance for the customers,” he added. “With our digital solutions and innovation, our customers can capture the untapped opportunity and perform better in the field as well as in the back office.”

Currently, United Rentals is focusing to invest in areas like the digital ecosystem (telematics, online self-service tools, benchmarking services, etc.) that offer solutions that can put actionable data into customers’ hands.

McDonnell also assumed that this investment might go ahead of the adoption curve. By contrast, he added, “No matter how quickly the industry is going to adapt to change as we would like it to, we believe that we are responsible for leading the industry to make the investment in case the next generation of our customers might step up and digitize their business, we are ready.”

#2. Taking Equipment Management Mobile

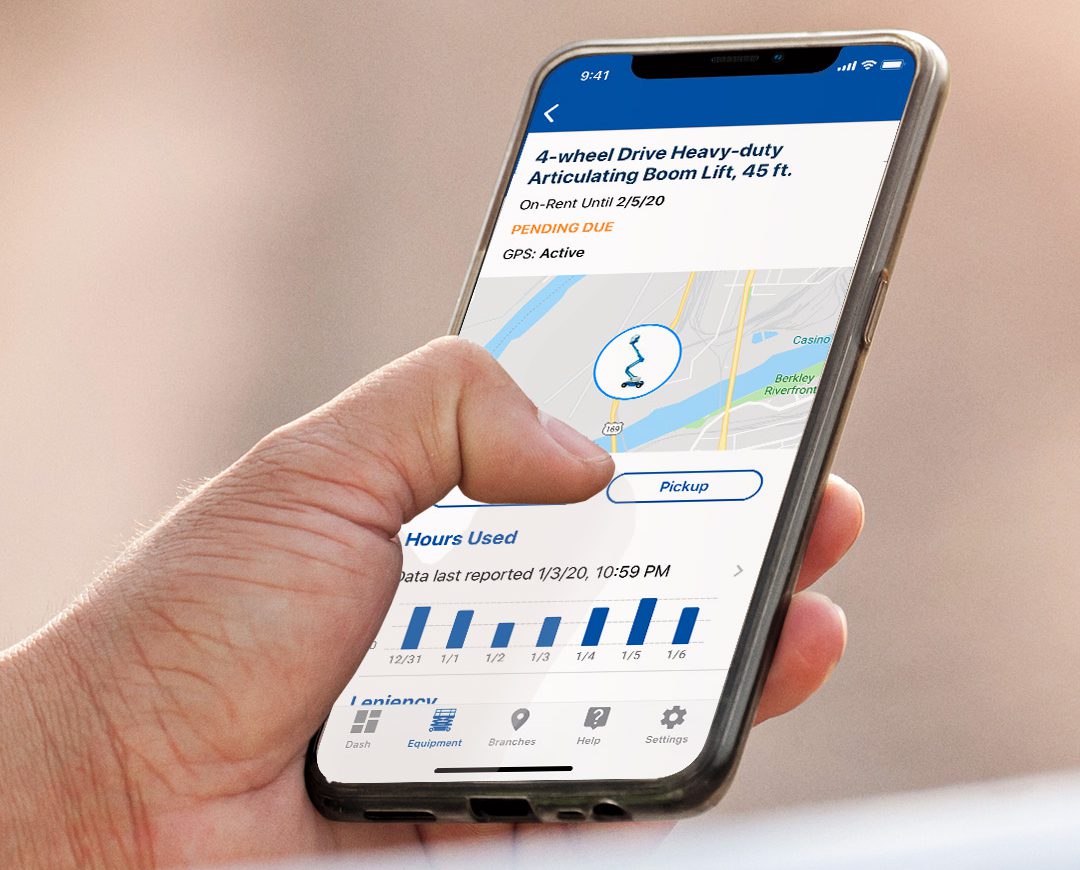

United Rentals’ digital investment also includes the constant evolution of Total Control, which is a cloud-based worksite performance solution enabling the users to manage both rented and owned equipment. The 20th year has come, and this Total Control is still being enhanced as the customer needs change.

The senior vice president of services and advanced solutions, Norty Turner, told the conference attendees that, “Today, everything on the worksite has been connected through telematics, which makes data become the new currency of the work site,”. He also added, “telematics can bring visibility not only just equipment but also the people and we all know the intersection of those two plays such an important part of the worksite.”

“Total Control has always been about helping provide data back to people so that they could be equipped with the insights to find productivity,” said Chris Hummel – a senior vice president and chief marketing officer. And the next step is to deliver that actionable data in a way that is easy for the customers to access. To fulfill this requirement, United Rentals came up with a new mobile app that has a connection with Total Control to provide users with 24/7 access aiming to manage equipment from the field.

Hummel stated, “The United Rentals Mobile App helps to place the power of our digital tools directly with workers on the worksite. The app is such an effective way to help the field get a handle on what equipment they have, its location, price, or how frequently it is being used or when they need to return it.”

The app can offer visibility into users’ equipment across numerous projects, and they can also browse or order anytime from the United Rentals equipment inventory. The app also has the features allowing them to track orders and deliveries, monitor its utility, identify the location, as well as off-rent and increase the equipment rentals if needed.

#3. Benchmarking and Beyond

United Rentals also has a plan to leverage its own experience and data. McDonnell pointed out that, “we currently possess the fleet size worth more than $14 billion, additionally, most of them are equipped with GPS – based telematics. This could give us an incredible amount of data, which we could leverage them and help the customers gain the insights to drive productivity and efficiency in their business.”

With its benchmarking tool that the company launched three years ago, it is able to utilize its own fleet’s data as well as customer data to gain a deeper understanding of not only how equipment is being utilized but also how that utilization compares to comparable equipment under like conditions.

Hummel said that, “We know the customers want to find a way to take all the data from different connected work sites together so that their whole equipment fleet could be well-managed. United Rentals is playing an important role here when we are offering the solutions for this problem.”

According to Turner, nearly half of the time, the customers would bring their own equipment to the working site. He shared, “That’s a lot of money, the fleet could be worth up to billions and billions of dollars. And if your business is possessing any equipment, you will need to care for lots of aspects. You need to make sure that you are maintaining compliance, that you are repairing it, and that you are getting parts for it. Then you also need to consider the right time for selling it off and replacing it with the right equipment. That is a lot of work or other words, the burdens to them.”

“Our customers are really good at building things,” he added. “But United Rentals, with so much experience from learning how to manage the world’s largest construction equipment fleet, would want to take on those aspects of the business to reduce those burdens for the customers.”

When the network keeps on expanding, the Customer Equipment Solutions divisions has a plan to expand into other different industries. In detail, they will look for opportunities not only on industrial sites but also on commercial contractors, who are operating equipment on multiple worksites,” Tuner stated. “Eventually, it is about trying to apply our understanding and expertise to help out the customers to get the best performance from their fleet.”

Should You Follow the Trend?

It can be said that to be successful in this digital era, United Rentals know to follow the trends, or they are even the trendsetters of the industry. With the huge resources and cash flow, there is no wonder that they have an advantage over other competitors in terms of taking the leaps and risks required to set the pace.

Undoubtedly, few rental businesses can realistically follow where United Rentals is heading. Yet it should be also mentioned that the steps that United Rentals is taking can be a window opening to new opportunities as well as the influences behind them.

Thus, it would be a smart move to literally understand the services that United Rentals is providing. By this, you will know if its approach to meeting customer needs or the reasons behind its digital investments bears any similarity to your own operation and customer base. If they do, then let them fuel you with ideas for steps that you can take to adjust your current business model to fit and thrive in this data-driven market in the years ahead.