Governmental Aggressive Efforts to Spur Growth of Made-in-US Chips

Semiconductors are used in a wide range of products for a variety of functions, such as the operation of software programs, the temporary storage of documents, and the provision of data storage and communication capabilities in countless gadgets like mobile phones, gaming systems, aircraft avionics, industrial machinery, and various kinds of military gear and weapons.

Currently, the leading countries in the semiconductor global supply chains are the US, Taiwan, Japan, and South Korea.

Most everyone is aware of chips from US-based companies like Intel, AMD, Nvidia, Qualcomm, Apple and others power the devices we all are familiar with, but very few people bother to think about where they all come from.

As the hit of the pandemic and the US-China fight going, the demand of US domestic made semiconductors is rising drastically. There has been much talk about how to make US-based supply chains more viable. The United States is encouraging chips makers to shift back to the nation, as a goal to remain the leading position in the market.

Chip Shortage: Notable Example of Escalating US-China Tech War

Today, computer chips, also known as semiconductors, are used in millions of items, including cars, washing machines, smartphones, and more. And currently, there just aren’t enough of them to satisfy market demand. As a result, there is a shortage of several in-demand goods.

When the pandemic hit in 2020, it exaggerated the issue. The demand for information and communication technology – and the semiconductors that enable it – then skyrocketed as people started working from home.

Chip shortage forced car companies to halt operations because they were unable to get chips. This was a big factor in the severe inflation that Americans were experiencing in 2021, which contributed to the increasing prices of new and used cars, according to the Bureau of Labor Statistics.

Given the harsh current geopolitical environment and the fights between the US and China on tech-based evolutions, these problems have quickly been identified as crucial across all political party lines.

A part of the problem is that only about 12% of the world’s silicon chips are currently made in the US, down from 37% in 1990, and the Chinese government is currently making threatening subsidized investments in building over 60 semiconductor manufacturing plants.

Despite China’s rapid progress toward semiconductor self-sufficiency, which may not threaten US dominance in the industry for some time, it has caused the Trump and Biden administrations to apply sanctions and take other steps to gradually reduce US reliance on the global semiconductor market.

The Biden administration primarily carried on the Trump administration’s policy of sanctions on China, with the U.S. putting hundreds of Chinese firms and individuals to its “Entity List,” the list of countries with trade restrictions published by the Bureau of Industry and Security (BIS) of the U.S. Department of Commerce, and China responding in kind.

Governmental Bold Moves in the Fight to Bring Chip-Makers Back

The American government is exerting every effort to increase local semiconductor production, pouring billions of dollars into the struggling industry and using all of its regulatory options to give it an advantage over competition from Asia.

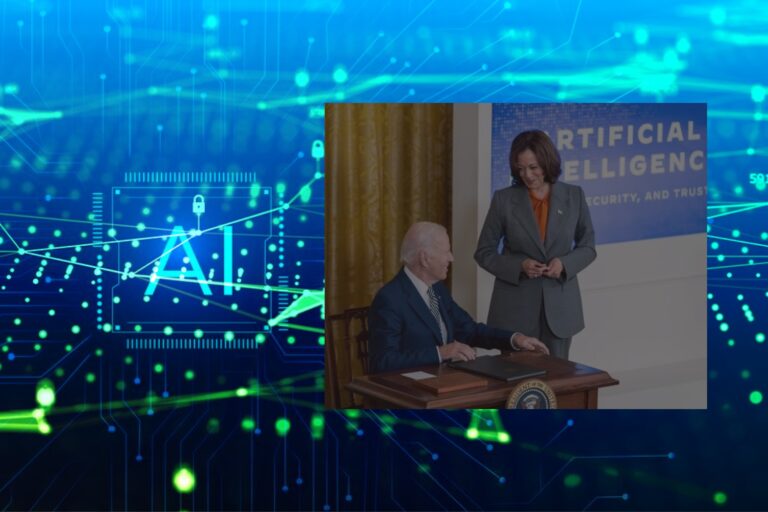

As a result, the CHIPS and Science Act was enacted into law in August by the Biden administration and senators. $52 billion of the legislation will be used to improve American semiconductor production.

$39 billion will be used as manufacturing incentives, $13.2 billion will be used for workforce training and research and development, and $500 million will be used for semiconductor supply chain operations and international information communications technology security.

In a flurry of tweets earlier this month President Joe Biden pledged: “America is going to lead the way in microchip manufacturing.”

About three-quarters of the CHIPS funding to be allocated over the next five years ($39 billion) is earmarked for the building projects of chip manufacturing plants, or “fabs,” including $2 billion specially identified for mature semiconductors essential to the military as well as the automotive and manufacturing industries.

The remaining funding will support a more developed domestic semiconductor production environment, including workforce development and research and development.

These subsidies may provide semiconductor companies with the support they need to not just close the enormous talent gap they currently confront but also to upskill and diversify their workforce.

The law offers a chance to make significant improvements in digital manufacturing and necessary personnel capabilities. This strategy may be essential for staying competitive in the race to lower chip size and power while boosting performance.

What “Big Elephants” in the Arena Do to Catch the Hype

In the growing desire for Made-in-US Chips, there can’t be lacking the participations of leading names in the semiconductor industry. Apple, Intel, NVIDIA, AMD and other entities are taking steps to fulfill the need of the ongoing demand and contribute to reduce the reliance on chips produced in Asia.

Apple to Join National Push for Made-in-America Chips

A couple of days back, there had been rumors that Apple will source its microchips from within the US. These chips would have been produced by TSMC in Arizona at its brand-new semiconductor factory. Now, the company has confirmed this news.

The relocation to Arizona is also piece of the company’s general efforts over the last few years to move manufacturing out of China, from moving Apple Watch manufacturing to Vietnam and iPhone making to India, according to The Verge.

The CEO of the Cupertino-based company, Tim Cook, stated during a speech in Arizona that Apple intends to purchase chips made in the US by TSMC, the largest contract chipmaker in the world. For those who don’t know, the Taiwan Semiconductor Manufacturing Company just built a multi-billion-dollar semiconductor plant in Arizona and plans to start producing by 2024.

The iPhone maker is already one of the biggest clients of the chipmaking giant. This step to source from within the US also benefits Apple despite the ongoing tensions between Taiwan and China. The military situations will make it more difficult for the business to acquire its chips from the area. Sourcing it domestically will help safeguard the supply chain for its chips.

According to Tim Cook, “And now, thanks to the hard work of so many people, these chips can be proudly stamped Made in America. This is an incredibly significant moment.”

Other Giants Not to Be Outside of the Club

In order to produce chips in the United States, Micron recently declared that it would invest $40 billion between now and 2030. The investment is supported by grants and credits from the CHIPS and Science Act.

Up to 40,000 jobs, including 5,000 highly compensated technical and operational positions, will be created in the US, according to Micron. The extra capacity will increase market share for memory chip production in the United States from 2% to 10%. Micron expects to begin production in the second half of the decade.

Texas Instruments is one of the companies that benefits from the CHIPS Act. However, the company said it was investing in more chip production in North Texas with or without the funding.

Intel, along with firms like Texas Instruments and Micron Technology, designs and manufactures its own chips. The company in January announced plans to invest up to $100 billion to build a new chip complex in Ohio, starting with an initial $20 billion commitment. The full scope of the project also relies heavily on funding from the CHIPS Act.

To lessen their reliance on international supply chains that have shown to be susceptible to disruptions like the pandemic, American manufacturers are moving production back to the US in greater numbers.

In January, General Motors declared that it would invest $7 billion in four plants in Michigan. It spent roughly $40 billion last year purchasing parts from 5,600 US vendors.

The company that makes Chevrolet, GMC, Cadillac, and Hummer made its largest investment to boost battery cell production in order to realize its goal of being the leading producer of electric vehicles in North America.

GE Appliances is also investing on broadening US production to make products closer to customers and create more American jobs. Since 2016, the manufacturer of appliances like refrigerators, dishwashers, and hot water heaters has put more than $2 billion into its US manufacturing and distribution facilities.

In the past five years, it has boosted its spending on US suppliers by two thirds and constructed a water heater plant in Camden, South Carolina, in May.

US Steel is investing in a $3 billion steelmaking factory in Osceola, Arkansas. Similar to this, Nucor is investing close to $2.7 billion in a steel plate plant in Brandberg, Kentucky, with construction scheduled to begin later this year.

Generac Power Systems relocated some production from China to the US after the pandemic. It announced intentions to build a new plant in Trenton, South Carolina, last year.

In Huntsville, Alabama, Lockheed Martin is investing $16.5 million in a new Missile System Integration Lab facility. The defense contractor currently has 25 locations in Alabama, where it plans to add 200 employees.

After a trade dispute with China led to hefty tariffs on Chinese imports, US businesses began to reevaluate having their supply chains abroad.

As the trade war started in 2018, the Trump administration promoted “America First” trade and advocated for the return of US employment.

What Will It Take to Build Back This Industry?

Even with the urgent efforts made, the US has a long way to go to. Today, East Asia is home to around 75% of the world’s current chip manufacturing. And even with these urgent action, the United States does not currently possess the same talent and distribution network pipeline as some Asian markets do to support a robust homegrown industry.

To further complicate matters, as worries about the global chip supply deficit have subsided, the increase in public and private investments comes at an uncertain time. Pandemic-related supply chain blockages are letting up somewhat and a worsening economic outlook has hampered demand.

Promoting semiconductor production in the US at this time runs the danger of creating oversupply and overcapacity. Additionally, it’s not yet apparent whether government subsidies will be sufficient to get around other challenges the nation confronts in becoming a competitive chip manufacturing cluster given the diminishing demand.

The process of creating new semiconductor fabs is expensive and time-consuming. According to Reuters, “a cutting-edge chip plant needs 9–18 of these devices.” An extreme ultraviolet lithography machine costs about $150 million and is needed to map out the circuitry of chips.

Additionally, a variety of specialized inputs are needed for the production of semiconductors, including chip etching machinery, etching gas, and pure chemicals like fluorinated polyimide.

In the United States, there is both a shortage of new graduates and experienced employees with the engineering and technical knowledge necessary to manufacture silicon wafers. Many of those who might have the requisite experience instead prefer to work in trendier industries.

Intel has tried to set up cordial links with Arizona State University to recruit engineers, but it is uncertain whether it and other companies building fabs in America will be able to recruit enough skilled engineers and technicians. If not, reshoring semiconductor manufacturing may not be possible despite the billions of dollars invested by the public and commercial sectors.

What’s in the Throne for the Nation When We Win This Plan?

Along with the obvious economic benefits of establishing new manufacturing facilities or investing in new research initiatives, there are also practical benefits to reducing our reliance on foreign chip producers.

One of the best things about the proposed initiatives is that US-based semiconductor companies of all sizes could reap the rewards, including the well-known companies mentioned earlier as well as lesser-known firms like Marvell, Xilinx, or Texas Instruments, as well as even smaller players like Lattice Semiconductor, Silicon Labs, or NI (formerly known as National Instruments).

This shifting can remain the position of the US in the technologies that go into the chips at the heart of not only computing devices but also medical equipment, wireless networks, cars, manufacturing equipment, and nearly every industry that’s now in existence.

It only makes sense, and thus, to increase the amount of research and manufacturing support that the market demands in order to preserve that lead and grow its global share of manufacturing, particularly as we navigate our way into a technology-driven future. Let’s hope our national leaders continue to move these efforts forward.