U.S. Commercial Service Northern New Jersey | U.S. Department of Commerce | International Trade Administration: Cross Border eCommerce Solutions - Duties & Taxes

U.S. Commercial Service Northern New Jersey | U.S. Department of Commerce | International Trade Administration

Discover the Key to Global eCommerce Success!

Have a U.S. product sold domestically through your website but haven’t made the plunge into international sales because duties & taxes are too confusing?

Join our exclusive, free webinar on understanding duties & taxes in cross border eCommerce. Designed for U.S. businesses, this session will demystify the subject and enable you to confidently extend your online business internationally.

In this session, you will learn:

- The difference between taxes, duties and tariffs

- How duties and taxes impact a shipment

- What prepaid duty and taxes are

- Best practices

As Part 2 of our “Cross Border eCommerce Solutions” Series, in this session you will also hear about the U.S. Commercial Service’s Website Globalization Review Gap Analysis(Link is external) for international SEO.

Don’t miss this opportunity to unlock new markets and streamline your international sales process! Register now and take your eCommerce business to the next level of global success!

Speakers (3)

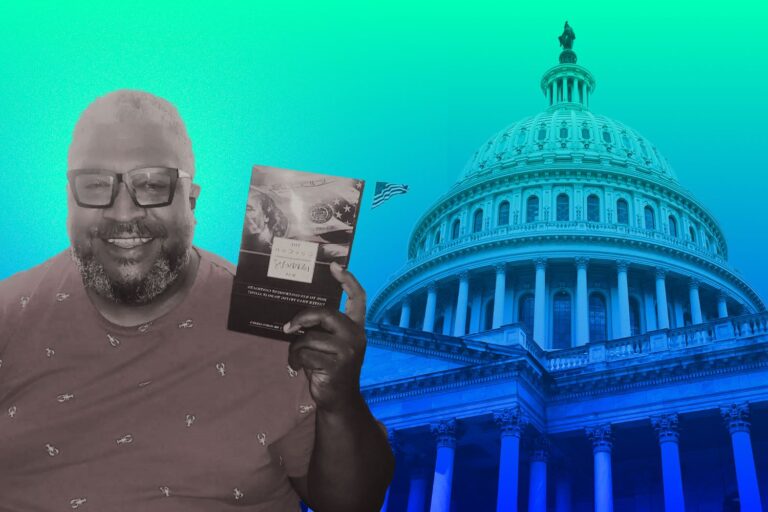

Daniel Bruner (Federal)International Trade Specialist

Adam Shanks (Federal)Director

Jane Collison